Datastream

U.S. Inflation: Which Categories Have Been Hit the Hardest?

The Briefing

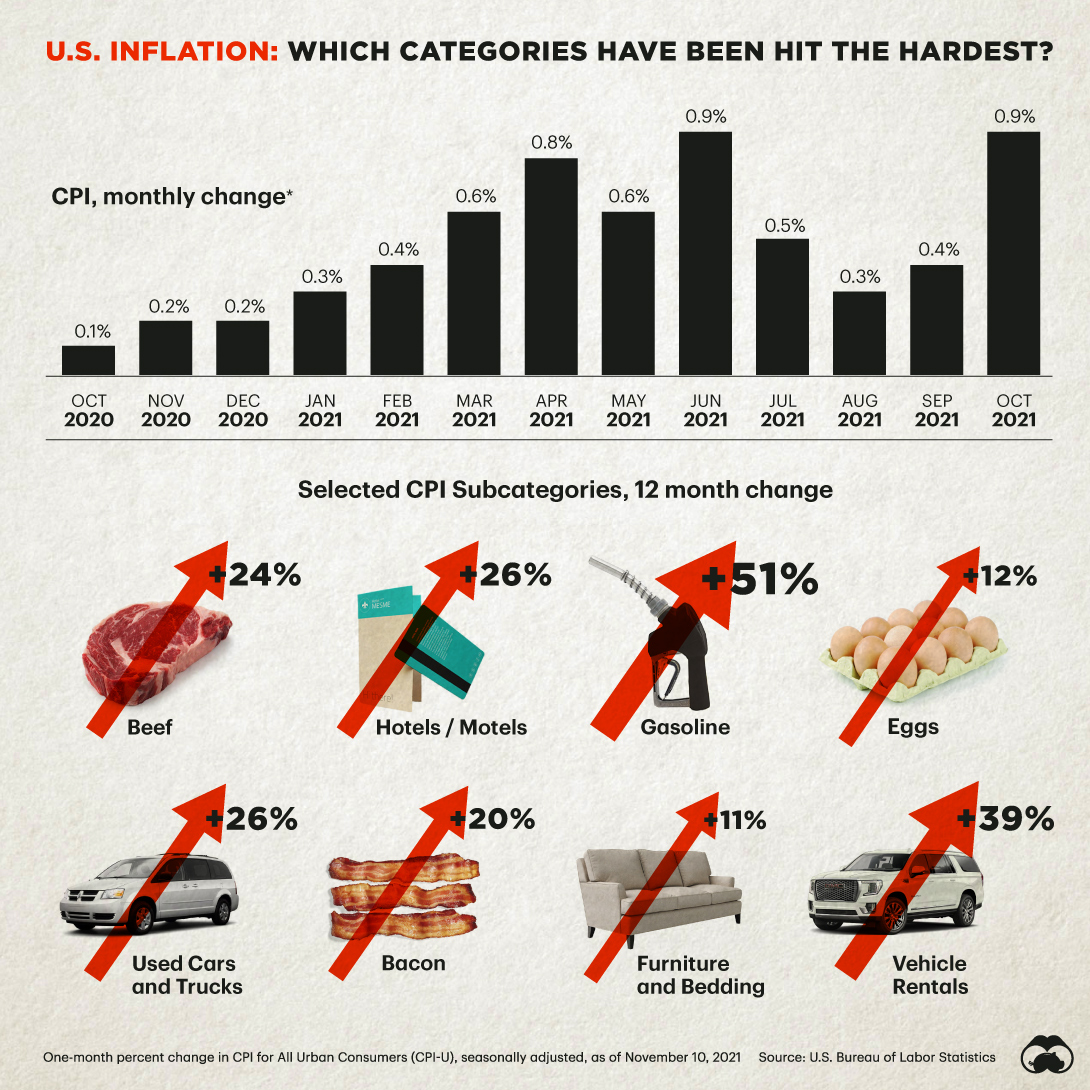

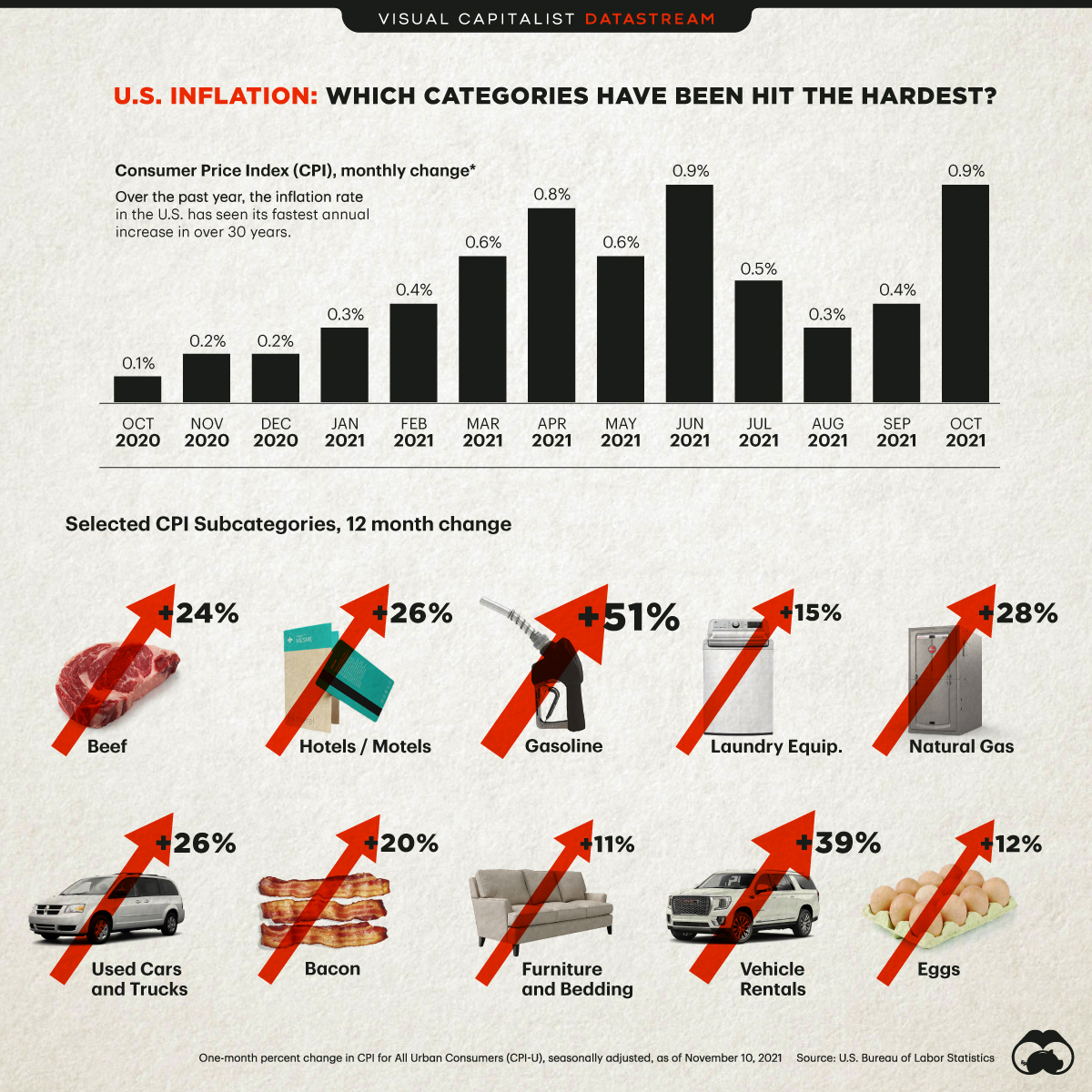

- The inflation rate in the U.S. has seen its fastest annual increase in over 30 years

- Fuel, transportation, and meat products are seeing some of the steepest increases

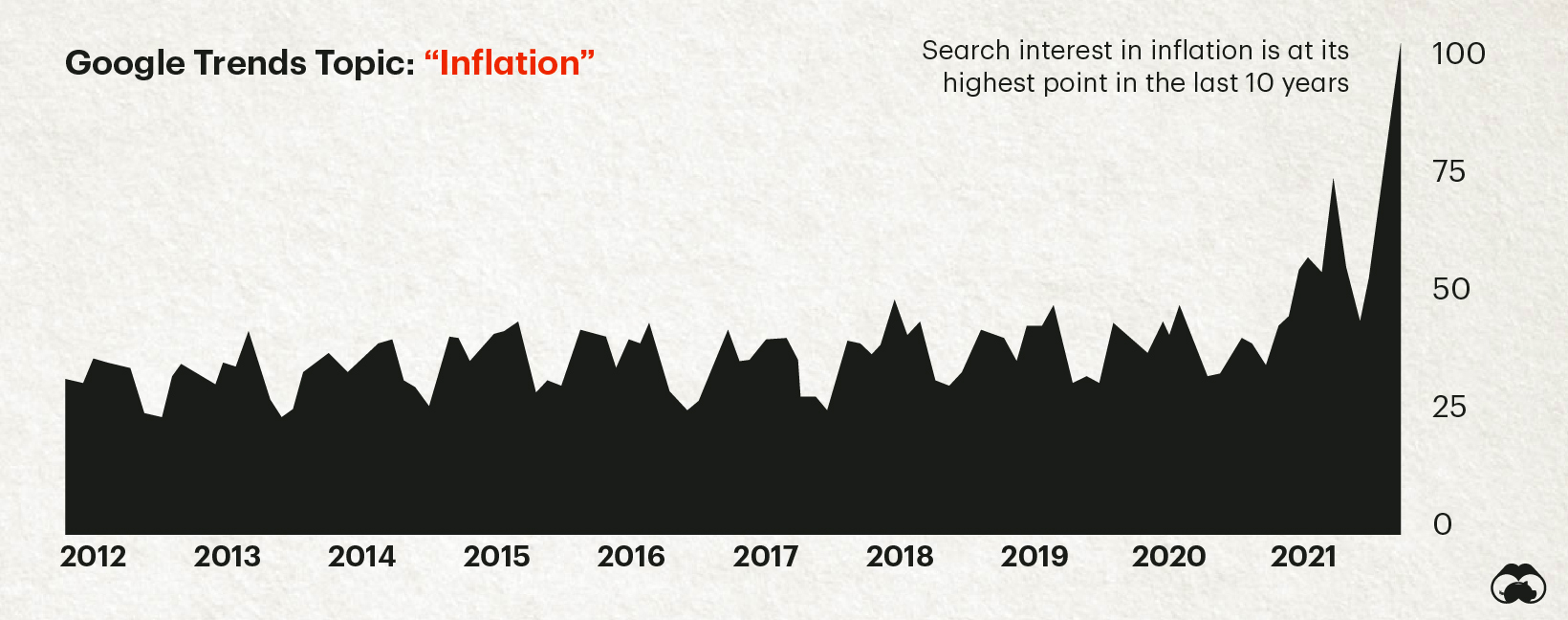

Prices have been going up in a number of segments of the economy in recent months, and the public is taking notice. One indicator of this is that search interest for the term “inflation” is higher than at any point in the past decade.

Recent data from the Bureau of Labor Statistics highlights rising costs across the board, and shows that specific sectors are experiencing rapid price increases this year.

Where is Inflation Hitting the Hardest?

Since 1996, the Federal Reserve has oriented its monetary policy around maintaining 2% inflation annually. For the most part, U.S. inflation over the past couple of decades has typically hovered within a percentage point or two of that target.

Right now, most price categories are exceeding that, some quite dramatically. Here’s how various categories of consumer spending have fared over the past 12 months:

| CPI Category | One-Year Change |

|---|---|

| Energy commodities | 49.5% |

| Used cars and trucks | 26.4% |

| Energy services | 11.2% |

| New vehicles | 9.8% |

| Tobacco and smoking products | 8.5% |

| Food at home | 5.4% |

| Food away from home | 5.3% |

| Transportation services | 4.5% |

| Apparel | 4.3% |

| Shelter | 3.5% |

| Alcoholic beverages | 2.2% |

| Medical care services | 1.7% |

| Medical care commodities | -0.4% |

Of these top-level categories, fuel and transportation have clearly been the hardest hit.

Drilling further into the data reveals more nuanced stories as well. Below, we zoom in on five areas of consumer spending that are particularly hard-hit, how much prices have increased over the past year, and why prices are rising so fast:

1. Gasoline (+50%)

Consumers are reeling as prices at the gas pump are up more than a dollar per gallon over the previous year.

Simply put, rising demand and constrained global supply are resulting in higher prices. Even as prices have risen, U.S. oil production has seen a slow rebound from the pandemic, as American oil companies are wary of oversupplying the market.

Meanwhile, President Biden has identified inflation as a “top priority”, but there are limited tools at the government’s disposal to curb rising prices. For now, Biden has urged the Federal Trade Commission to examine what role energy companies are playing in rising gas prices.

2. Natural Gas (+28%)

Natural gas prices have risen for similar reasons as gasoline. Supply is slow to come back online, and oil and natural gas production in the Gulf of Mexico was adversely affected by Hurricane Ida in September.

Compared to the previous winter, households could see their heating bills jump as much as 54%. An estimated 60% of U.S. households heat their homes with fossil fuels, so rising prices will almost certainly have an effect on consumer spending during the holiday season.

3. Used Vehicles (+26%)

The global semiconductor crunch is causing chaos in a number of industries, but the automotive industry is uniquely impacted. Modern vehicles can contain well over a thousand chips, so constrained supply has hobbled production of nearly a million vehicles in the U.S. alone. This chip shortage is having a knock-on effect on the used vehicle market, which jumped by 26% in a single year. The rental car sector is also up by nearly 40% over the same period.

4. Meats (+15%)

Meat producers are facing a few headwinds, and the result is higher prices at the cash register for consumers. Transportation and fuel costs are factoring into rising prices. Constrained labor availability is also an issue for the industry, which was exacerbated by COVID-19 measures. As a top-level category, inflation is high, but in specific animal product categories, such as uncooked beef and bacon, inflation rates have reached double digits over the past 12 months.

5. Furniture and Bedding (+12%)

This category is being influenced by a few factors. The spike in lumber prices along with other raw materials earlier in the year has had obvious impacts. Materials aside, actually shipping these cumbersome goods has been a challenge due to global supply chain issues such a port back-ups.

How Inflation Could Influence Consumer Spending

Rising prices inevitably impact the economy as consumers adjust their buying habits.

According to a recent survey, 88% of Americans say they are concerned about U.S. inflation. Here are the top five areas where consumers plan to cut back on their spending:

| Money saving action | % of respondents |

|---|---|

| Cut back on restaurant / take-out meals | 48% |

| Keep my current technology (e.g. phone, tablet) instead of upgrading | 30% |

| Budget food and cut back on grocery buying | 29% |

| Purchase less clothing / accessories | 29% |

| Put off home repairs, renovations, or home upgrades | 23% |

Will Inflation Continue to Rise in 2022?

Many experts believe that U.S. inflation will decelerate going into 2022, though there’s no consensus on the matter.

Improved semiconductor supply and an easing of port congestion around the world could help slow inflation down if nothing goes seriously wrong. That said, if the last few years are any indication, unexpected events could shift the situation at any time.

For the near term, consumers will need to adjust to the sticker shock.

Where does this data come from?

Source: U.S. Bureau of Labor Statistics – Consumer Price Index (November 10, 2021)

Data Note: The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and

urban wage earners and clerical workers, which represent about 93% of the total U.S. population. CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001