Money

Ranked: The World’s Wealthiest Cities, by Number of Millionaires

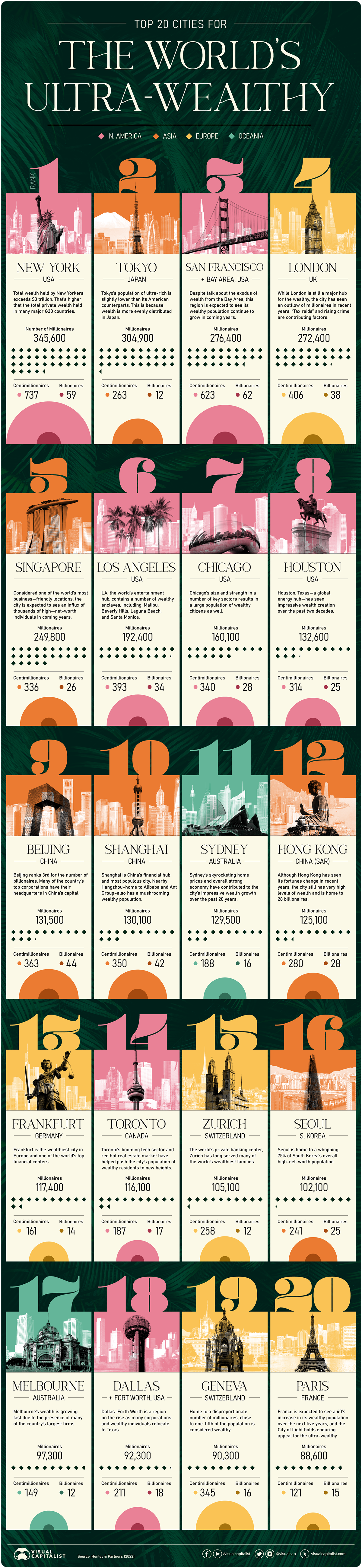

The Top 20 Cities for the World’s Ultra-Wealthy

How many millionaires, centimillionaires, and billionaires live in the world’s wealthiest cities?

While such metrics are not all encompassing, these measurements of private wealth do help put the financial health and economic activity of some of the world’s wealthiest cities in perspective.

This infographic uses information from the Henley Global Citizens Report, in partnership with New World Wealth, to rank the world’s wealthiest cities. It leverages a comprehensive data set that tracks the movements and spending habits of high-net-worth individuals in over 150 cities around the world.

Which cities and regions have the biggest concentrations of millionaires around the world, each with a net worth greater than $1 million (USD)?

Millionaires and Billionaires in the Wealthiest Cities

In the latest edition of the ranking, North America has a strong showing with seven of the wealthiest cities, by number of millionaires.

In particular, the United States claims five of the cities in the top 10, including the very top spot with New York City.

| Rank | City | Country | Millionaires | Billionaires |

|---|---|---|---|---|

| #1 | New York | 🇺🇸 United States | 345,600 | 59 |

| #2 | Tokyo | 🇯🇵 Japan | 304,900 | 12 |

| #3 | San Francisco | 🇺🇸 United States | 276,400 | 62 |

| #4 | London | 🇬🇧 United Kingdom | 272,400 | 38 |

| #5 | Singapore | 🇸🇬 Singapore | 249,800 | 26 |

| #6 | Los Angeles | 🇺🇸 United States | 192,400 | 34 |

| #7 | Chicago | 🇺🇸 United States | 160,100 | 28 |

| #8 | Houston | 🇺🇸 United States | 132,600 | 25 |

| #9 | Beijing | 🇨🇳 China | 131,500 | 44 |

| #10 | Shanghai | 🇨🇳 China | 130,100 | 42 |

| #11 | Sydney | 🇦🇺 Australia | 129,500 | 16 |

| #12 | Hong Kong | 🇭🇰 China (SAR) | 125,100 | 28 |

| #13 | Frankfurt | 🇩🇪 Germany | 117,400 | 14 |

| #14 | Toronto | 🇨🇦 Canada | 116,100 | 17 |

| #15 | Zurich | 🇨🇭 Switzerland | 105,100 | 12 |

| #16 | Seoul | 🇰🇷 South Korea | 102,100 | 25 |

| #17 | Melbourne | 🇦🇺 Australia | 97,300 | 12 |

| #18 | Dallas | 🇺🇸 United States | 92,300 | 18 |

| #19 | Geneva | 🇨🇭 Switzerland | 90,300 | 16 |

| #20 | Paris | 🇫🇷 France | 88,600 | 15 |

| Top 20 Cities | 3,259,600 | 543 | ||

Asia is the region with the second most millionaires with six cities in the mix. Not surprisingly, China is home to three of these cities, including Hong Kong (SAR).

Europe comes in third with five cities, though only London makes into the top 10 portion of the ranking. Finally, Oceania has two cities on the list, both located in Australia.

How Top Cities Stack Up

Let’s take a closer look at some of the top-ranking cities making the list.

#1: New York

New York is the wealthiest city in the world—home to 345,600 millionaires with a total private wealth that exceeds $3 trillion.

New York is home to many Fortune 500 companies and is the financial heart of the United States, with the New York Stock Exchange and NASDAQ located in the Big Apple. Additionally, the city’s real estate market is known for being expensive, with sky-high property values and rents.

#2: Tokyo

Tokyo is the economic hub of Japan and is one of the most important cities in the world for business and finance. It is home to 304,900 resident millionaires, making it the city with the second most millionaires in the world.

Japan’s largest city is home to the Tokyo Stock Exchange, which is one of the largest stock exchanges in Asia by market capitalization. Tokyo is also a major center for banking and insurance, and is home to many multinational companies like Honda and Sony.

#3: San Francisco Bay Area

The San Francisco Bay Area boasts 276,400 millionaires. It’s known as the mecca of tech innovation, and as a result, the region has a high concentration of wealthy individuals. San Francisco also has the highest median household income in the country.

The number of millionaires has been growing steadily over the last 10 years, and if the trends of recent years hold, San Francisco could become the number one millionaire hub by 2040.

#4: London

London has been the world’s wealthiest city for years, but over the past decade there has been an outflow of millionaires.

Today, with 272,400 millionaires, the city holds a more humble position. London is known for its financial and business sectors, and it attracts a significant number of high-earning professionals who contribute to its reputation as a hub of wealth and luxury.

#5: Singapore

Singapore is home to 249,800 millionaires making it the second richest city in Asia after Tokyo.

Singapore has one of the highest densities of millionaire households in Asia, with over 5% of households having at least $1 million USD in net financial assets. This is due in part to the country’s strong economic growth and favorable business environment, which has attracted many wealthy individuals and families to the country. In addition, Singapore’s political stability, low crime rate, and high standard of living have also contributed to its appeal as a place to live and work.

Fastest Growing Cities for the Rich

The cities shown in our visualization are already well-established locations for high-net-worth individuals. Some of them have topped the rankings for decades, while some others are less well-known. But what are the fastest growing cities for the rich?

In 2022, cities with strong oil and gas industries like Riyadh, Sharjah, Dubai, Luanda, Abu Dhabi, Doha, and Lagos grew exceptionally. Cities in the UAE became millionaire magnets, attracting over 4,000 millionaires in 2022. In the U.S., a few tax-friendly states like Texas and Florida became home to American companies moving their head offices there.

Looking to the future, companies and high-net-worth individuals will inevitably move where they are treated best. Countries that want to attract wealthy individuals will have to apply tax-friendly policies along with other factors such as quality of life, safety, education, and access to amenities that ultra-wealthy residents value.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees