Money

Mapping the Migration of the World’s Millionaires

Mapping the Migration of the World’s Millionaires

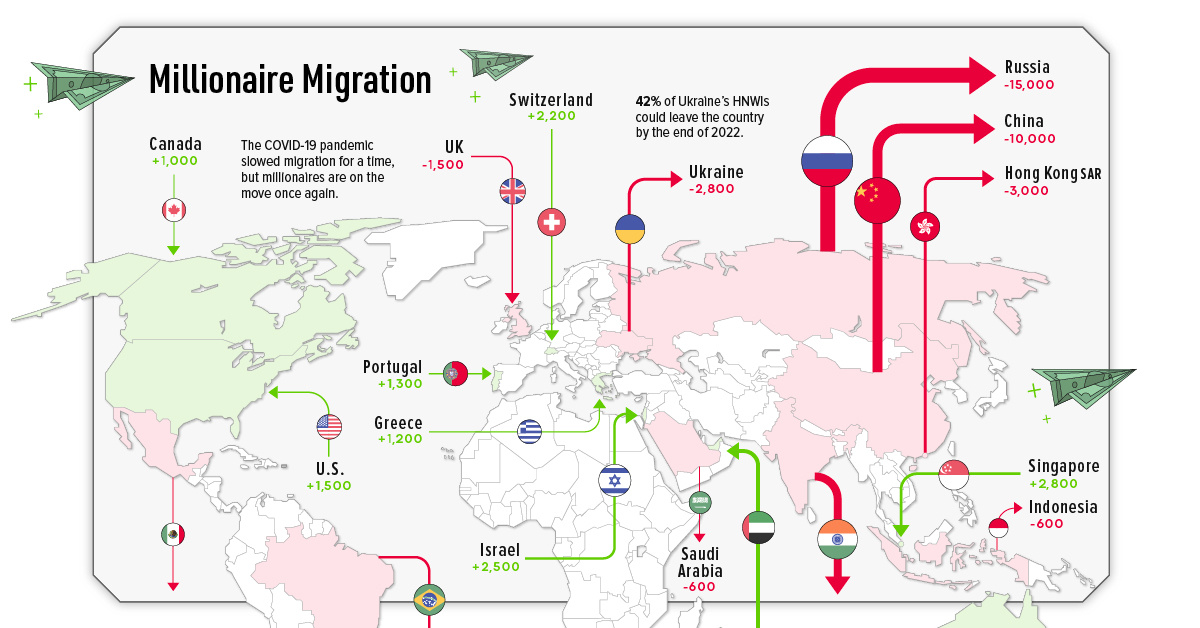

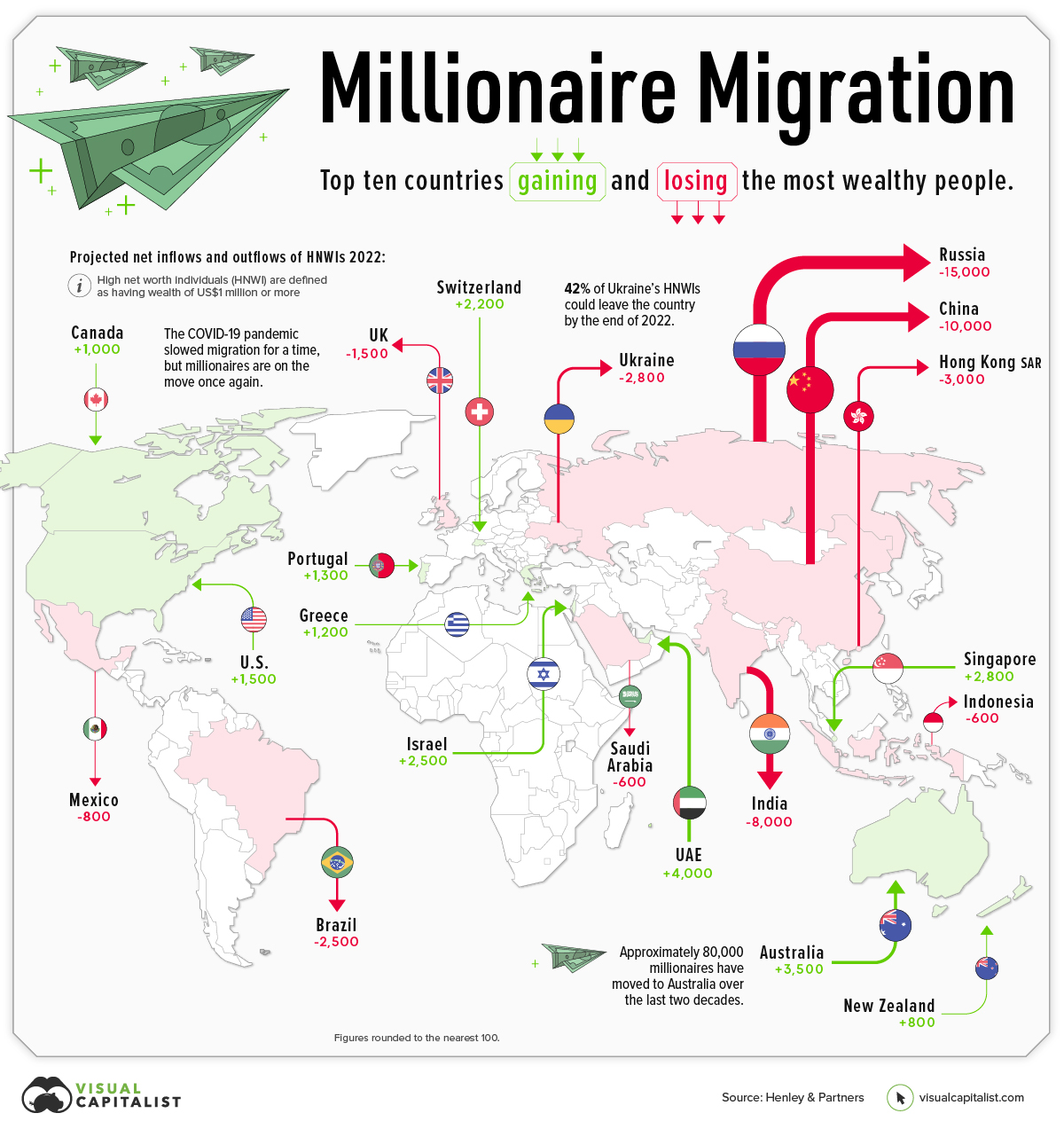

Throughout 2022, a projected 88,000 millionaires will move to a new country, according to the latest Henley Global Citizens Report.

Which countries are these millionaires moving to, and where in the world are they coming from?

This graphic maps the migration of high net worth individuals (HNWIs)—people with a net worth of over US$1 million—showing where rich people are flocking, and where they’re fleeing.

Migration of Millionaires is Back

Before diving into the country-specific data, it’s worth taking a step back to look at overall millionaire migration trends, and how things are changing this year.

2020 saw a drastic drop in the number of millionaire migrants, as pandemic-induced lockdowns kept people from leaving their home countries—and at times, their homes in general.

But as restrictions ease and countries begin to open up their borders again, the migration of millionaires is beginning to gather steam once again:

| Year | # of HNWIs that migrated | Y-o-y change |

|---|---|---|

| 2018 | 108,000 | 14% |

| 2019 | 110,000 | 2% |

| 2020 | 12,000 | -89% |

| 2021 | 25,000 | 108% |

| 2022P | 88,000 | 252% |

| 2023P | 125,000 | 42% |

Below, we’ll dive into which countries are seeing the highest number of HNWI migrants, and which ones are losing the most HNWIs.

Which Countries Are Millionaires Leaving?

There are a plethora of reasons why the ultra-rich move countries. Escaping conflict is one of them, which is why it’s no surprise to see Russia and Ukraine are projected to see some of the biggest emigration numbers by the end of 2022.

Here are the top 10 countries by millionaire outflows:

| Country | Projected net outflows of HNWIs (2022) | % of HNWIs lost |

|---|---|---|

| 🇷🇺 Russia | 15,000 | 15% |

| 🇨🇳 China | 10,000 | 1% |

| 🇮🇳 India | 8,000 | 2% |

| 🇭🇰 Hong Kong | 3,000 | 2% |

| 🇺🇦 Ukraine | 2,800 | 42% |

| 🇧🇷 Brazil | 2,500 | 2% |

| 🇬🇧 UK | 1,500 | 0% |

| 🇲🇽 Mexico | 800 | 0% |

| 🇸🇦 Saudi Arabia | 600 | 1% |

| 🇮🇩 Indonesia | 600 | 1% |

Figures rounded to the nearest 100.

While Russia is expected to see 15,000 millionaires leaving the country, Ukraine is projected to experience the highest loss in percentage terms—a whopping 42% of its HNWIs could leave the country by the end of 2022.

China could also see a big loss in its millionaire population, with a projected loss of 10,000.

According to Andrew Amoils, Head of Research at New World Wealth, this could be more damaging to the country than in previous years, since general wealth growth in China has declined recently.

Where Are The Ultra-Rich Moving?

The United Arab Emirates (UAE) has become a millionaire magnet, with a projected 4,000 HNWIs flowing into the country by the end of 2022. This influx of ultra-wealthy people is partly because of the country’s accommodating immigration policies that are specially tailored to attract private wealth and international talent.

Here are the top 10 countries that saw millionaire inflows:

| Country | Projected net inflows of HNWIs (2022) | % of HNWI Gained |

|---|---|---|

| 🇦🇪 UAE | 4,000 | 4% |

| 🇦🇺 Australia | 3,500 | 1% |

| 🇸🇬 Singapore | 2,800 | 1% |

| 🇮🇱 Israel | 2,500 | 2% |

| 🇺🇸 USA | 1,500 | 0% |

| 🇵🇹 Portugal | 1,300 | 2% |

| 🇬🇷 Greece | 1,200 | 3% |

| 🇨🇦 Canada | 1,000 | 0% |

| 🇳🇿 New Zealand | 800 | 1% |

Australia continues to attract HNWIs, coming in second behind the UAE. According to New World Wealth, approximately 80,000 millionaires have moved to the Land Down Under in the last two decades.

A few things that attract migrants to Australia are the country’s low costs of healthcare, its lack of inheritance tax, and its generally prosperous economy.

Where does this data come from?

Source: Henley Global Citizens Report 2022

Data notes: As countries reopen, and the invasion of Ukraine wears on, this will have ripple effects on where people choose to live. There are two main things to keep in mind when view the information above. 1) Individuals need to remain in a country for six months in order to be updated in the database. In many cases, it’s not yet clear where people leaving certain countries choosing to relocate. 2) In the graphic above, we’ve visualized the top 10 countries for inflows and outflows.

Update: This article and graphic have been updated to more clearly explain what’s being shown, and list the data source in a more prominent way. We appreciate your feedback.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees