Mining

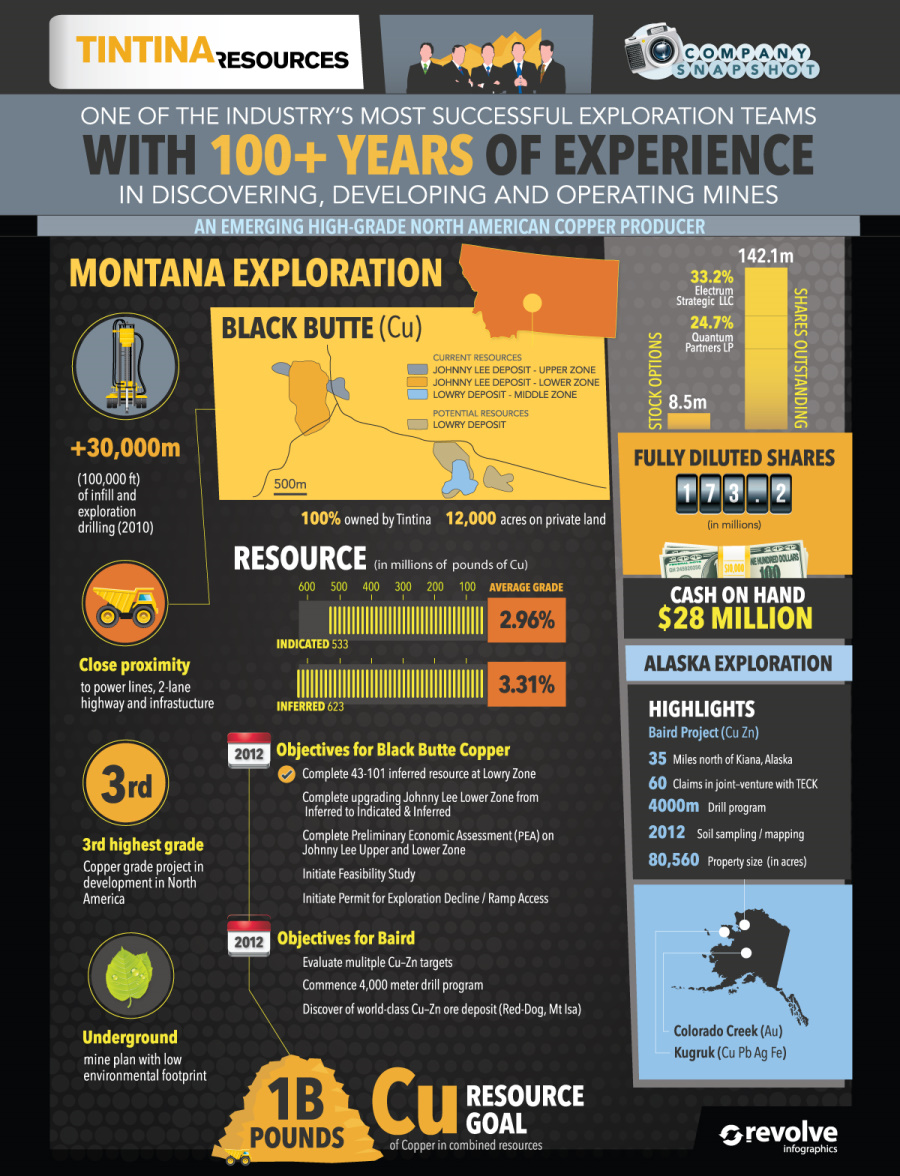

Tintina Resources (TSX-V:TAU)

Tintina Resources Inc. (“the Company”) is a growth company focused on the exploration and development of base and precious metal projects in North America. The Company’s experienced management team has assembled an impressive portfolio of base metal projects in Alaska, including the Baird copper-zinc project, located 100 kilometers southeast of Red Dog, the world’s largest zinc producing mine, and the Black Butte Copper a copper-cobalt-silver project located in central Montana. The Company is currently focusing on advancing it’s flagship property, the Black Butte Copper Project, towards production.

CAUTIONARY NOTE:

This presentation of Tintina Resources Inc. (the “Company”) includes certain disclosure, including statements regarding the Company’s plans for and intentions with respect to exploration of the Company’s properties and other information which constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities legislation. The Company’s forward looking statements reflect the beliefs, opinions and projections on the date the statements are made. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. In making the forward-looking statements, the Company has applied certain factors and assumptions that the Company believes are reasonable, including that the Company is able to obtain any required government or other regulatory approvals and any required financing to complete the Company’s planned exploration activities, that the Company is able to procure equipment and supplies in sufficient quantities and on a timely basis and that actual results of exploration activities are consistent with management’s expectations. However, the forward looking statements are subject to numerous risks, uncertainties and other important factors relating to the Company’s operation as a mineral exploration company that may cause future results to differ materially from those expressed or implied in such forward-looking statements. Such important factors, uncertainties and risks may cause and include, among others, actual results of the Company’s exploration activities being materially different than those expected by management, uncertainties involved in the interpretation of drilling results and geological tests, and the estimation of reserves and resources, the need for cooperation of government agencies and native groups in the development of the Company’s properties, the need to obtain permits and governmental approvals, risks of operations such as accidents, equipment breakdowns, bad weather, non-compliance with environmental and permit requirements, unanticipated variations in geological structures, ore grades or recovery rates, unexpected cost increases, fluctuations in metal prices and currency exchange rates, delays in obtaining required government or other regulatory approvals or availability of financing in the debt and/or capital markets, inability to procure equipment and supplies in sufficient quantities and on a timely basis. Further, all statements, other than statements of historical fact, included herein including, without limitation, statements regarding anticipated completion of engineering studies, potential results of drilling and assays, timing of permitting, construction and production and other milestones, and the Company’s future operating or financial performance are forward-looking statements. Estimates of reserves and resources are also forward-looking statements in that they involve estimates of the mineralization that would be encountered, based on interpretation of drilling results and certain assumptions, if a deposit were developed and mined. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. – See more at: https://www.visualcapitalist.com/portfolio/tintina-resources-company-snapshot#sthash.acAiBgze.dpuf

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001