Technology

Timeline: Looking Back at 10 Years of Snapchat

Looking Back at 10 Years of Snapchat

Over the years, many ideas have emerged from the dorm rooms at Stanford University, but not all of them evolve into billion dollar companies.

Snapchat, however, has beaten the odds. The company’s stock has recently shot up during the COVID-19 pandemic, a bright spot in a decade of highs and lows.

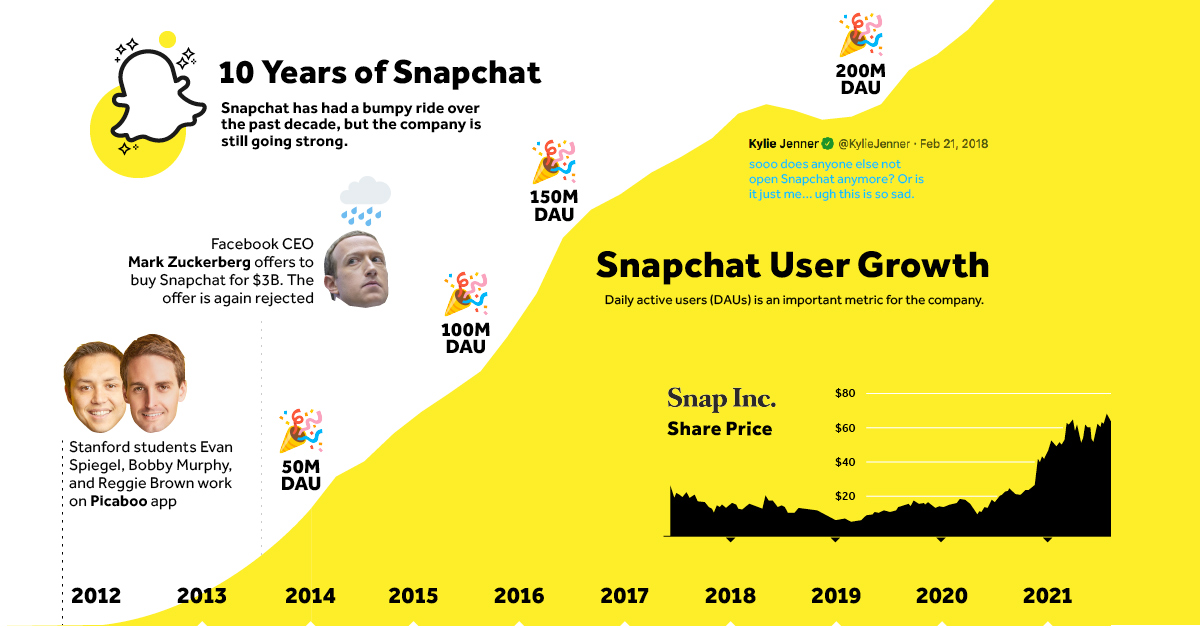

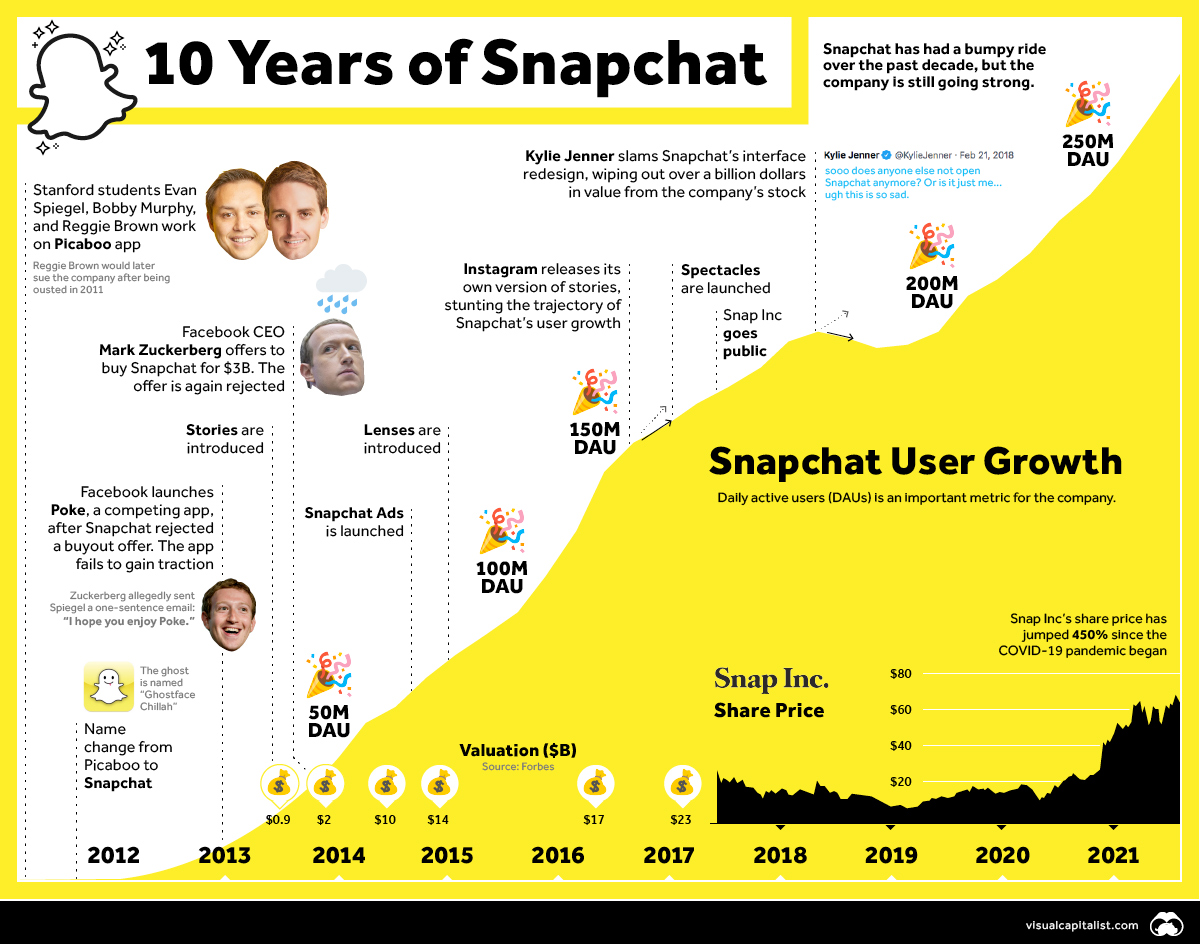

The graphic above is a high level look at Snapchat’s 10-year history, including user growth and financials. Snapchat’s wild ride from start-up to massive success is well documented, so we’ll focus on key elements of story—product design, the Facebook rivalry—and look at how the company is doing today now that the hype surrounding the app has died down.

But first, a quick history…

Setting the Scene

Snapchat originally began its life as a project called Picaboo in 2011.

Cofounders Evan Spiegel, Bobby Murphy, and Reggie Brown, who were attending Stanford, began building an app that could send photos that disappear after a certain amount of time.

Picaboo was renamed Snapchat in 2012, and by the end of that year, it was clear that the start-up was onto something big. A $13.5 million Series A financing in early 2013 helped fuel the company’s explosive growth.

Positive Momentum: Product Design

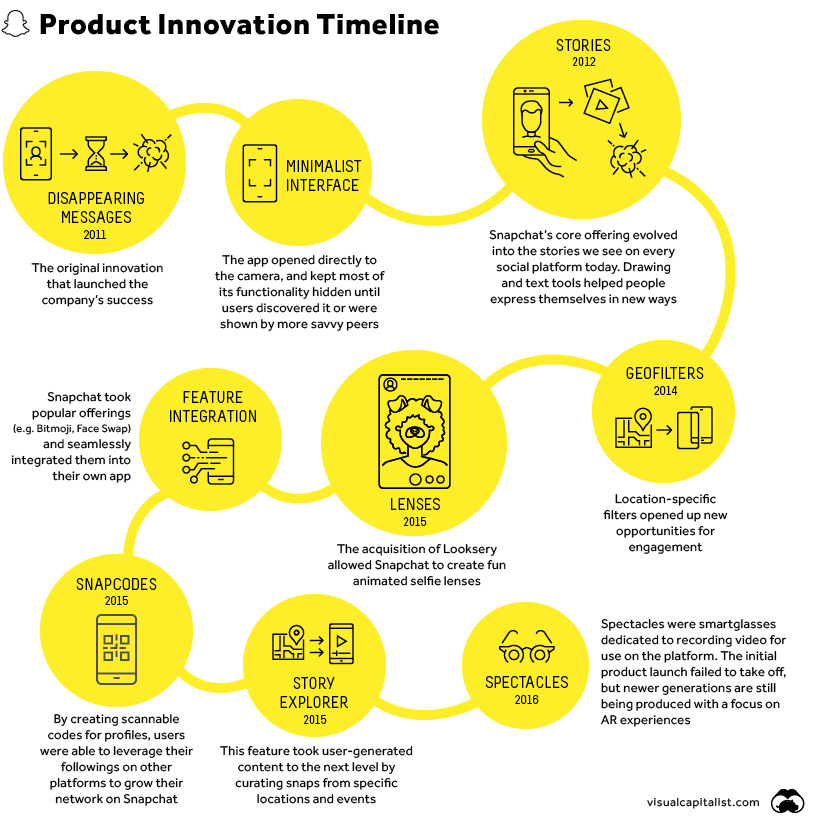

One of Snapchat’s biggest strengths over the years has been innovative product design. Many of the features we now see baked into every social app originated from Snapchat.

Here’s a quick rundown of Snapchat’s key feature and product development over the past decade.

Of all the features listed above, the concept of stories is perhaps the most significant contribution to the digital landscape. Disappearing short-form videos started off as a messaging tool, but ended up transforming the way people share their lives online.

As well, the forward-looking acquisition of Looksery in 2015, helped introduce millions of people to augmented reality (AR). AR continues to be a major growth driver for Snapchat today, as advertisers embrace the Lenses feature.

Negative Momentum: Facebook Rivalry

To Mark Zuckerberg’s credit, he realized the potential of Snapchat early.

When the company was only one year old, the Facebook CEO offered the Snapchat founders $60 million to buy the company. When they rejected the offer, Facebook almost immediately launched an app called Poke which was extremely similar to Snapchat’s offering. You’d be forgiven for not knowing what Poke is, as the app received a tepid reception and was quietly shut down in 2014.

“I hope you enjoy Poke.” – Mark Zuckerberg, in an email to Evan Spiegel

For Snapchat, Poke was a blessing in disguise as it brought even more attention to their growing app. Mark Zuckerberg, however, was not done trying to steal the company’s thunder. After offering $3 billion in cash to purchase Snapchat (the offer was once again rebuffed), Facebook copied a number of features from Snapchat and integrated them into Instagram.

Stories were a massive hit for Instagram, and Snapchat, which could not yet match Instagram’s scale, took a big hit. Growth began to slow noticeably after that Instagram update.

Snapchat Today

Snapchat hit rock bottom in 2018 after shares dropped below the $5 mark, and user growth had stalled out. As well, underwhelming sales of Snapchat’s Spectacles product garnered negative press and hurt the brand’s “cool factor”.

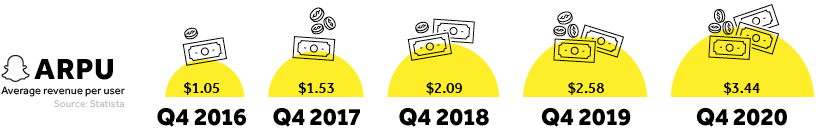

Today though, the situation looks much different. The app still has a strong market share with the younger demographic, and close to 300 million daily active users. Snapchat was one of the many digital companies to benefit from the COVID-19 pandemic (or, at least, the increase in digital content consumption), and the share price has rocketed to new highs. One other promising indicator is the company’s rising average revenue per user, or ARPU.

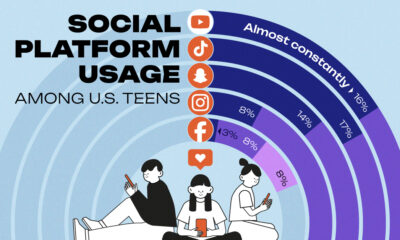

Of course, as the last 10 years have shown, success is not guaranteed. TikTok is still a significant competitor with a lot of momentum, and tastes can change quickly in the digital world. That said, there is a positive path forward for Snap Inc.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)