Misc

Seven Man-Made Engineering Wonders of the Ancient World

Take a look around any major city today, and it’s evident that humans are pretty incredible builders.

We can create suspension bridges that span the widest rivers, or sleek skyscrapers that are over 1,000 m (3,300 ft) high. Even further, we can design these complex structures with extreme amounts of precision and consistency.

But while there is no shortage of modern engineering accomplishments to marvel at, it’s true that our ancestors also made impressive feats in the field of civil engineering. Ancient cultures were able to do things that still baffle people today, such as constructing majestic pyramids, erecting flawless walls out of huge boulders, or carving out multiple underground, monolithic churches from a rocky ridge.

Engineering Feats of the Ancient World

Today’s infographic comes to us from Norwich University, and it showcases details on seven civil engineering wonders from the Ancient world.

Note: Some ancient wonders, like the Great Pyramid of Giza, Roman aqueducts, and the Great Wall of China can be found on a previous infographic that counts them among the 10 Most Impressive Civil Engineering Projects of All Time

Ancient engineers and architects were able to pull off some pretty impressive feats.

Let’s take a detailed look at the seven listed here, including the aspects that continue to baffle modern engineers today.

Ancient Man-Made Wonders

1. Saksaywaman, Peru (16th century)

Imagine three giant stone walls made of giant boulders that all fit together perfectly, like puzzle pieces. The Incas managed to build these outside of Cusco, using boulders up to 120 tons in size. No one knows how they moved them from a quarry 3 km (2 miles) away to the site – and even more perplexing is how flawless they fit together.

2. Leshan Giant Buddha, China (803 CE)

This is the world’s largest carved stone Buddha statue in the world, and it stands 232 tall in China. The carved hair of the statue even has a hidden, built-in drainage system that displaces rainwater to protect it from damage.

3. Chand Baori, India (10th century)

This one of the world’s deepest stepwells, and it provides water to a hot, arid region before modern plumbing was possible. The stairs weave 3,500 steps, or about 13 stories, down into the depths where carved stones collect rainwater.

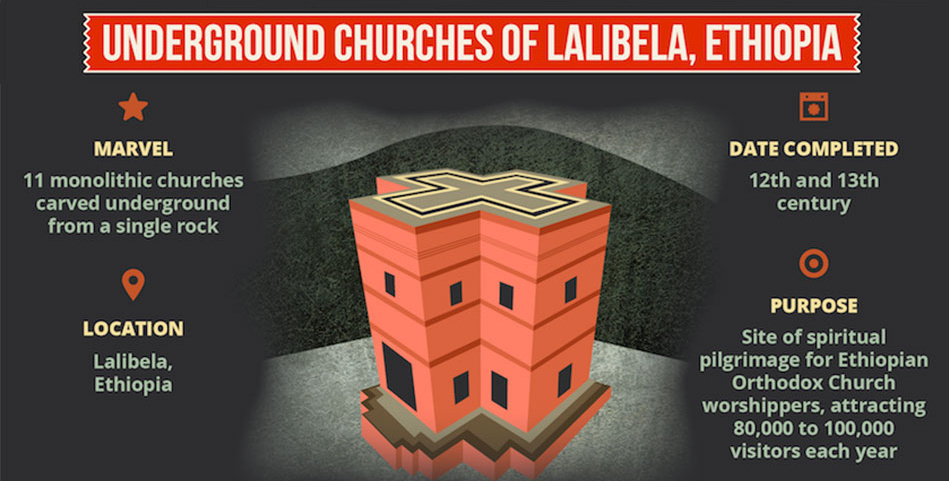

4. Underground Churches of Lalibela, Ethiopia (12th and 13th centuries)

These 11 underground churches were carved out of rock from the top-down. They are also connected, using a complex system of drainage ditches, tunnels, and subterranean passageways.

5. Teotihuacan, Mexico (450 CE peak)

At its peak, this ancient urban city sprawled 22 miles (35 km) with over 200,000 inhabitants. Not only does it have some of the largest pyramidal structures on the planet, but it also has many other unique traits, such as being aligned with celestial, geographic, and geodetic points of significance.

6. El Mirador, Guatemala (300 BCE)

This is the largest of five known Pre-Classical Mayan cities and it contains the world’s largest pyramid by volume. A total of 15 million man-days of labor were needed to create the iconic temple, named La Danta.

7. The Lost City of Mohenjo Daro, Pakistan (2500 BCE)

This city is over 4,500 years old, and it was unknown to modern people until 1921. It housed up to 35,000 people, and contained complex water and sewage system on a grid plan. Mohenjo Daro is regarded today as one of the most important archaeological finds, unveiling details on the Indus Valley people – one of the most widespread and mysterious civilizations of the early Ancient era.

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries