Markets

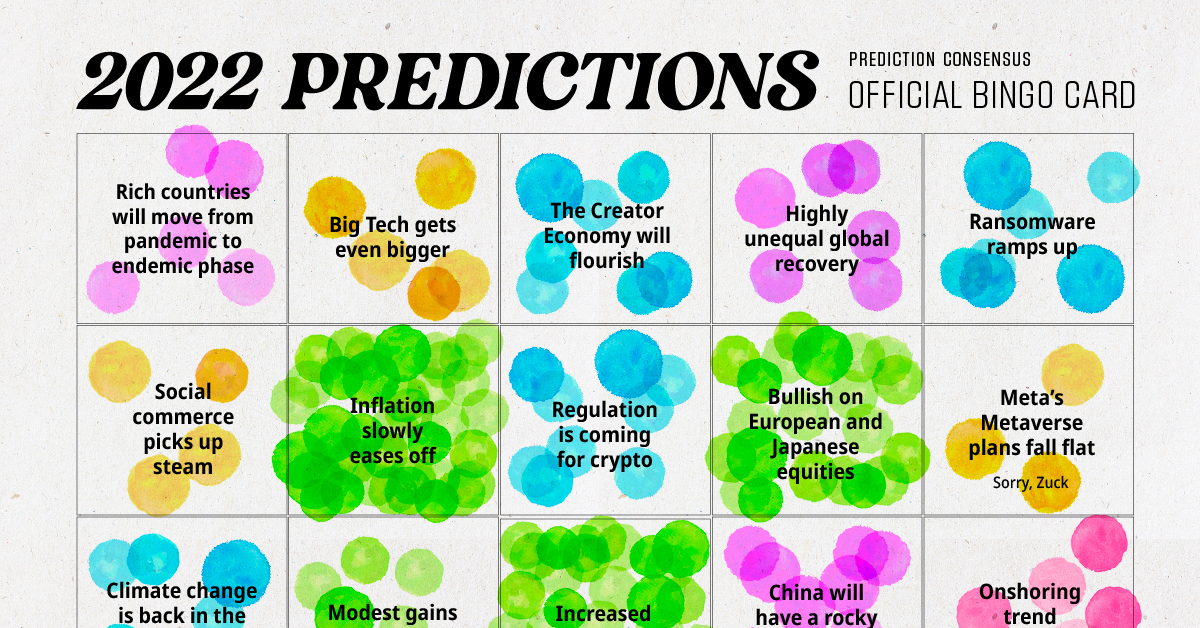

Prediction Consensus: What the Experts See Coming in 2022

What the Experts See Coming in 2022

Even at the best of times, it’s human nature to want to decode the future.

During times of uncertainty though, we’re even more eager to predict what’s to come. To satisfy this demand, thousands of prognosticators share their views publicly as one year closes and another begins. In hindsight, we see varying levels of success at predicting the future.

In truth, experts are merely guessing at what will happen over the coming year. In 2020, almost nobody had a pandemic on their bingo card. In 2021, NFTs completely flew under the radar of experts, and nobody saw a container ship get lodged in the Suez Canal in their crystal ball.

So, why should we pay any attention to predictions at all? Are they, as Barry Ritholtz says, “wrong, random, or worse”?

For one, these guesses are backed by expertise and experience, so the accompanying analysis is informative. Perhaps more importantly though, influential people and companies are in a position to shape the future with their predictions. In some cases, sentiment and actions can turn a prediction into a self-fulfilling prophecy.

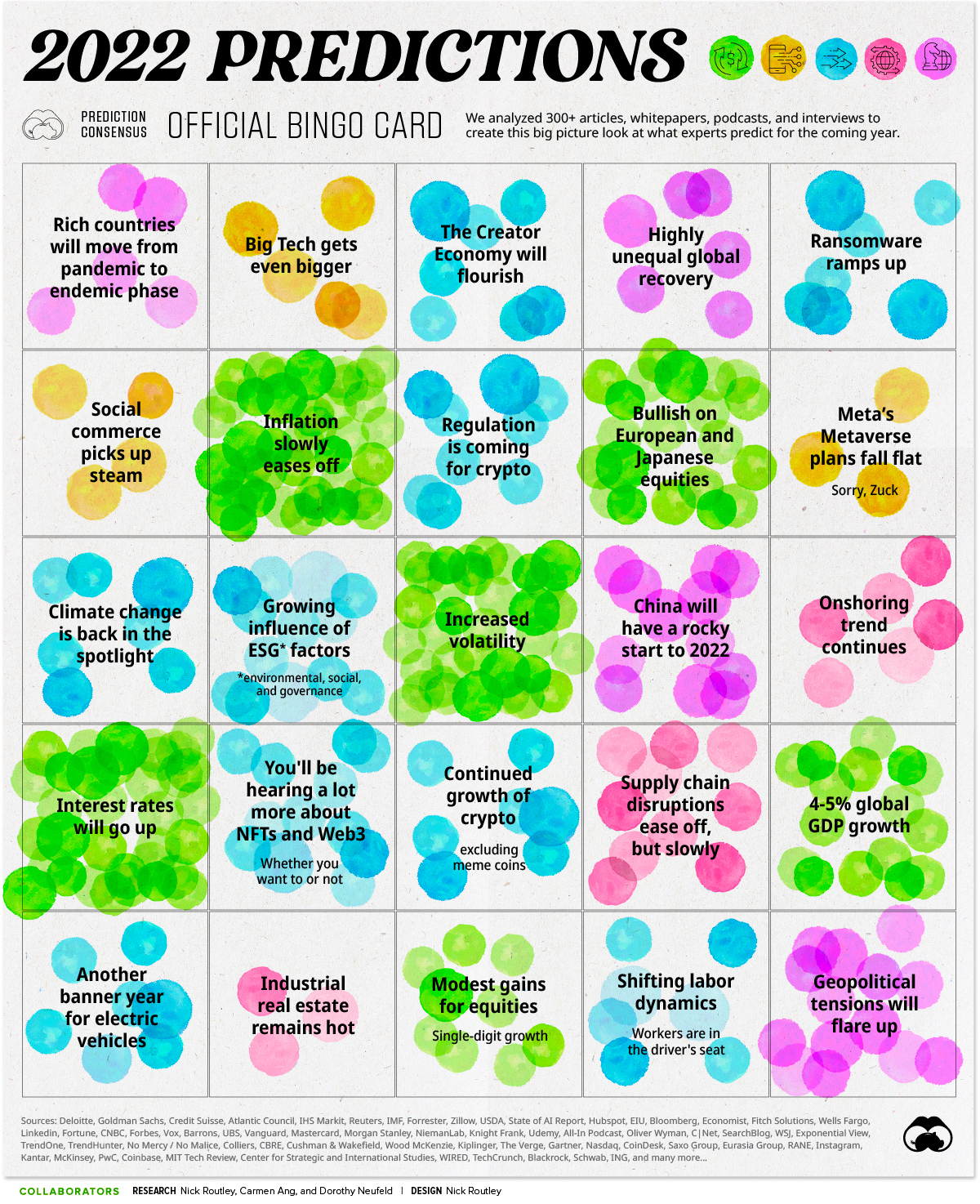

Regardless, whether for research or pure entertainment purposes, we’ve sifted through hundreds of reports, interviews, and articles to see which predictions are generally the most agreed upon. Where do experts see the ball moving over the next year? Our bingo card sums up the top 25, and below, we’ll dig into some of the trends that could shape 2022.

Join us for our interactive webinar on Jan 13th, 2022 by becoming a VC+ member:

Join VC+ Today

Vibe Check: What’s the General Outlook for 2022?

Based on the hundreds of predictions we analyzed, the general mood can be described as cautiously optimistic.

For starters, the global economy will likely keep growing, but not at the rate it did in 2021. We aggregated 40+ predictions from reputable sources such as the IMF and Goldman Sachs to determine median GDP estimates for the world, and select regions:

| Country / Region | Median GDP Estimate |

|---|---|

| World | 4.5% |

| United States | 4.0% |

| Eurozone | 4.3% |

| China | 5.3% |

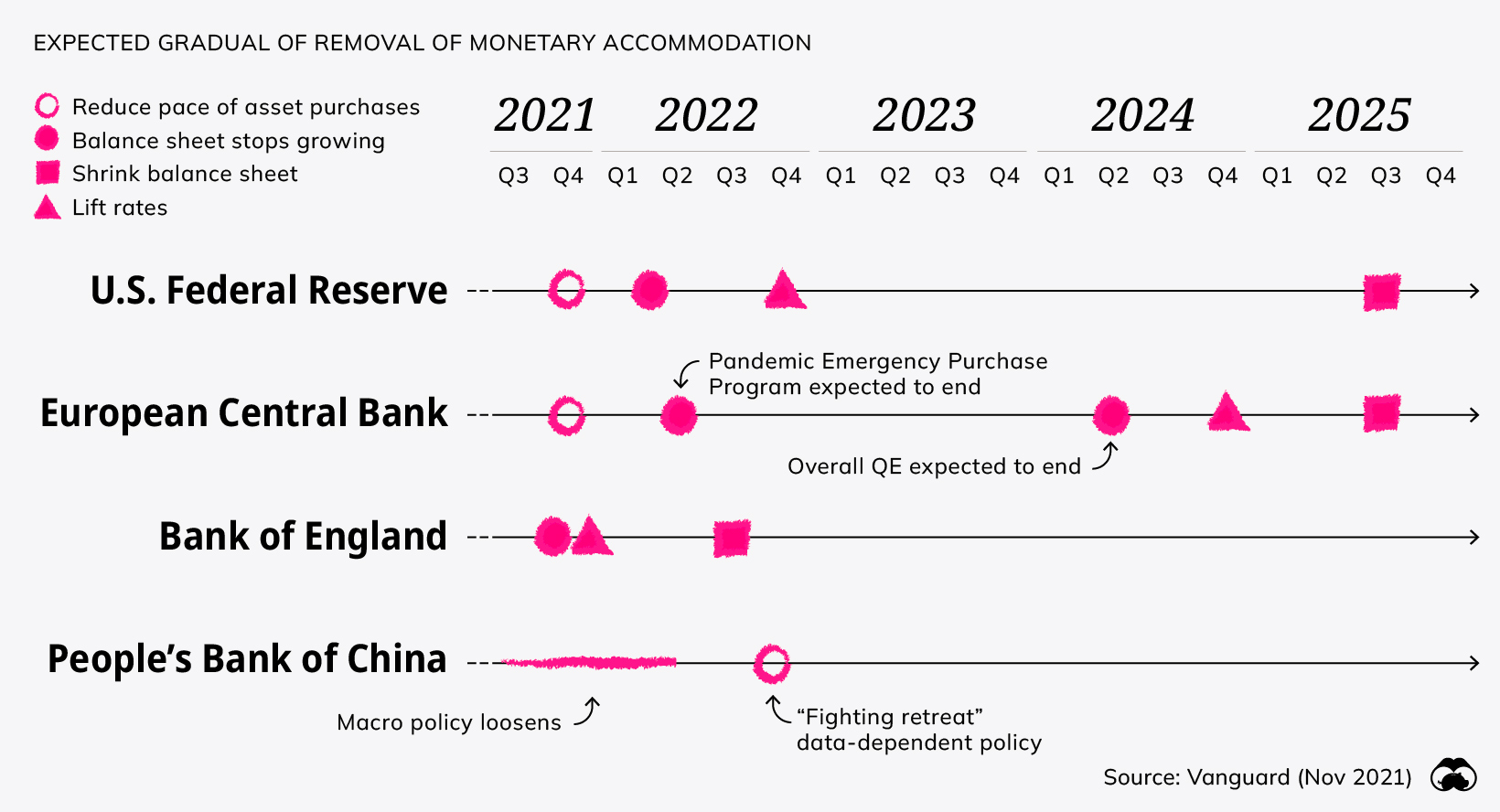

Next, there’s broad agreement that monetary policy will begin to tighten over the next 12 months. Here’s what major central banks are predicted to do:

Multiple experts described an era of lower equity returns and increased volatility. Many of the issues that plagued 2021 have carried over into 2022.

Technological disruption continues to reshape industries, and climate change and cybersecurity issues will be top of mind this year. Geopolitical tensions are heating up as well, now that countries have acclimated to the immediate challenges posed by the pandemic.

In short, nobody expects 2022 to be uneventful.

Trends that Will Shape 2022

Some of the predictions above are straightforward. GDP targets and explicit binary statements don’t require too much explanation.

Below are some of the predictions experts agreed on that are worth digging into in more detail:

1. Geopolitical Tensions Will Flare Up

There are a number of potential hotspots around the world, but here are a few that experts are watching in 2022.

Iran: Tensions ratcheted up between the U.S. and Iran after an attack on a U.S. military base in southern Syria in the fall of 2021. Further, the tension between Iran and Israel has the potential to escalate further in 2022, drawing in other nations in the region into a conflict.

Ukraine: This is a continuation of tensions that flared up after Russian annexation of Crimea in 2014. Europe’s dependence on Russian gas and Ukraine’s position as a key gas transit hub makes this a situation experts are watching very closely.

Taiwan: The risk that China will make a move on Taiwan has elevated in the minds of experts, though actions may contain “more bark than bite”.

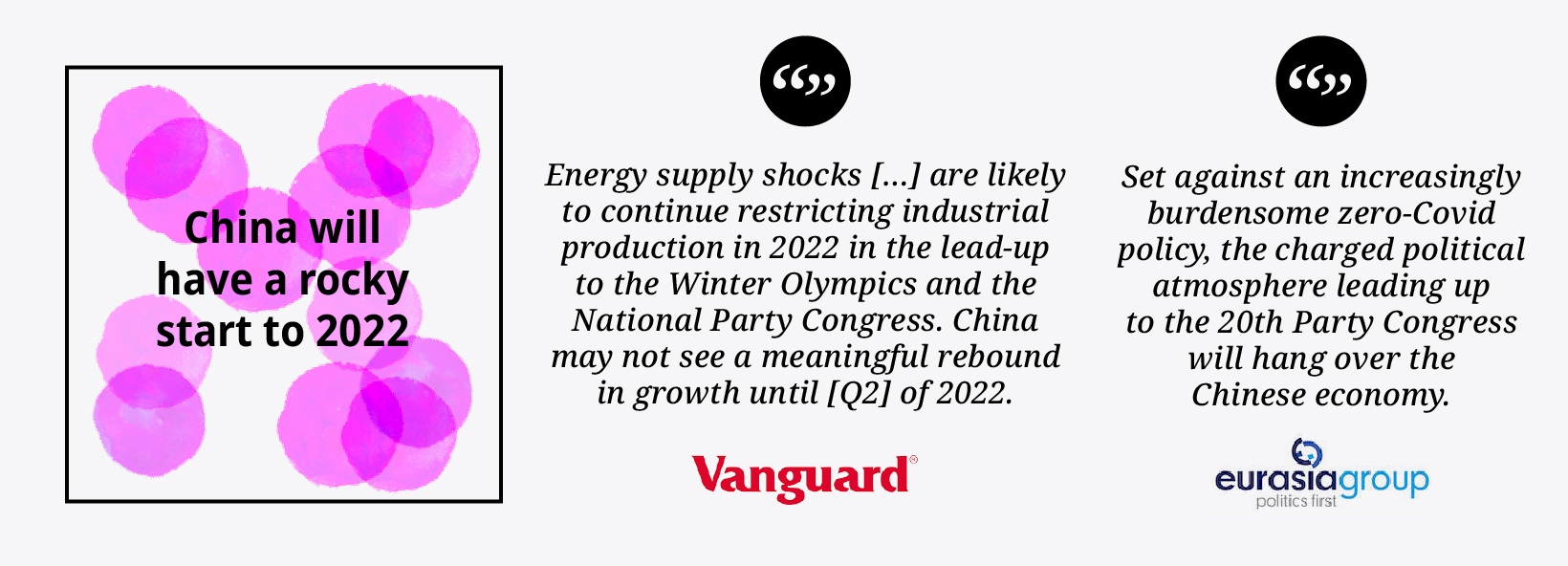

2. China’s Rocky Start to 2022

At the dawn of 2021, many of the predictions around China were largely optimistic as the country had entered a recovery phase sooner than the rest of the world.

Fast forward to 2022, and the predictions are the polar opposite as China faces challenges on a number of fronts. To begin with, there is pessimism around China’s zero-COVID strategy, which even today sees entire cities fall under strict lockdown orders. This strategy has unavoidable economic impacts.

Secondly, uncertainty around power shortages, a potential housing crisis, and regulatory crackdowns have dampened enthusiasm for the country’s near-term prospects.

Finally, Xi Jinping eliminated term limits on the presidency in 2018, potentially positioning himself to lead China indefinitely. As the Chinese Communist Party’s 20th National Party Congress approaches later in the year, if the country is still on uncertain footing, it could create a tense political atmosphere in Beijing.

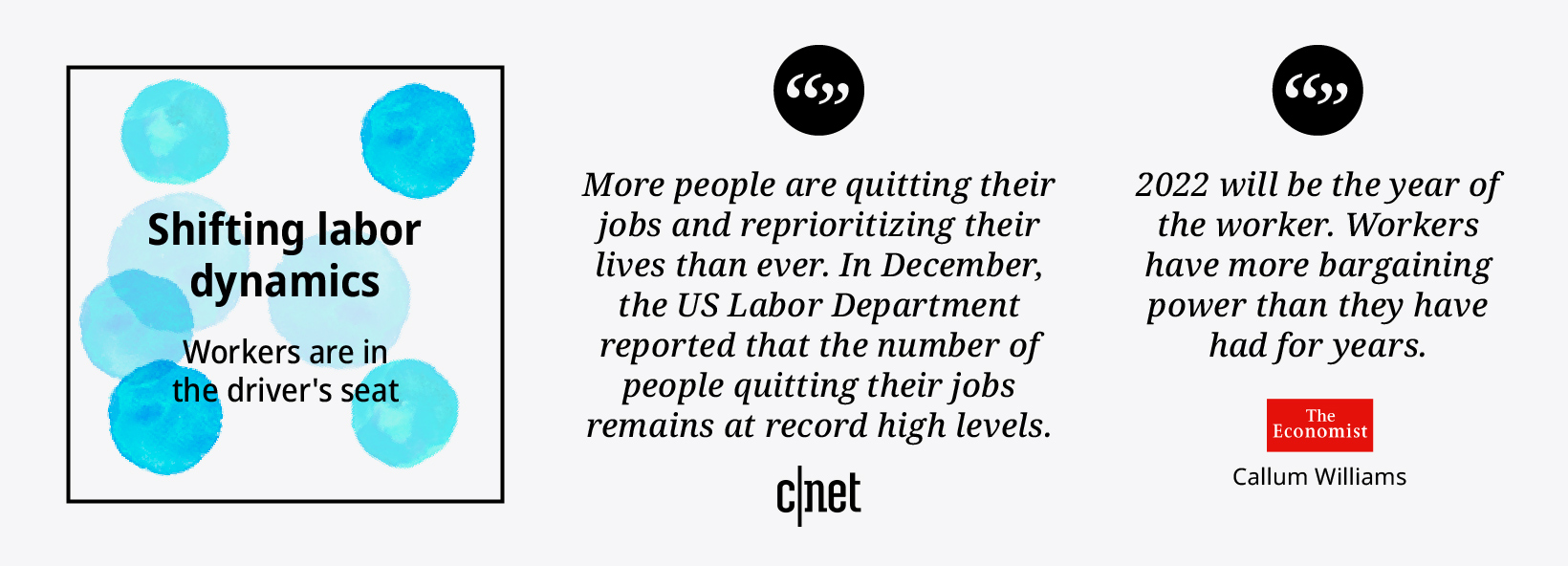

3. The Year of the Worker

Labor dynamics have stayed in the spotlight since the pandemic upended the world of work. There are a number of trends that emerge from this broader theme:

- The labor shortages that emerged during the pandemic will remain in place in 2022 and beyond. Certain sectors, such as cybersecurity, are facing acute shortages of skilled workers

- There is a broad consensus that the future of office work is “hybrid”. Companies that don’t offer flexibility will face a disadvantage in attracting talent

- The internet and social media have opened up a number of career pathways for individuals to earn an income beyond simply working for a company

- Work/life balance and burnout will be central points in discussions around workplace culture

4. The Changing Digital Ecosystem

If predictions are any indication, we’ll be hearing a lot more about NFTs and Web3. There are plenty of opinions on the former, and they run the spectrum from exuberant to outright bearish. Whether the hype surrounding profile picture NFTs dies down is anyone’s guess, but the technology has opened the door to a lot of experimentation for artists and creators.

On that note, experts are generally excited about the prospects of the burgeoning “Creator Economy”—a catch-all term describing the new technological ecosystem and growing infrastructure that is allowing individual content creators to monetize and flourish.

Another trend that is picking up steam is ecommerce centered around social media. The ability to purchase products straight from influencers is becoming more common on major social platforms, and ecommerce companies are creating more products to support influencers in their marketing endeavors.

By 2026, Gartner estimates that 60% of Millennial and Gen Z consumers will prefer making purchases on social platforms over traditional digital commerce platforms.

5. Inflation Slowly Eases Off

Worries about inflation have always cropped up here and there, but in countries like the U.S., truly damaging amounts of inflation haven’t been seen since the 1980s.

Last year, the narrative changed.

After trillions of dollars of pandemic stimulus and borrowing, inflation suddenly came back on the radar—and it was not “transitory” as early central bank statements hoped. Now, going into 2022, experts expect higher-than-normal inflation levels to continue.

While inflation is expected to have an impact going forward, experts also see it leveling off (relative to 2021) as supply chain disruptions work themselves out.

6. Another Banner Year of Electric Vehicles

As climate change dominates more of the spotlight in 2022, regulatory actions will force automakers to consider the future of their fossil-fuel models.

Even as incentives are slowly rolled back in a number of markets, EV sales are expected to set new records this year. As well, electrification of fleets will be a trend that gathers momentum.

Industrial and battery metals like lithium and cobalt surged by 477% and 208%, respectively, in 2021, a trend that many experts believe will stretch into 2022.

The Good Stuff

Of the hundreds of sources we looked at, here were a few that stood out as memorable and comprehensive:

- Bloomberg’s Outlook 2022: This article compiled over 500 predictions from Wall Street banks and investment firms.

- The All-In Podcast’s 2022 predictions: This lively podcast, featuring Chamath Palihapitiya, Jason Calacanis, David Sacks, and David Friedberg, is always entertaining and informative. In this predictions episode, biggest business winners and losers is great, as is best performing asset.

- Eurasia Group’s Top Risks for 2022: This comprehensive group of articles covers a lot of ground, and offers up some very credible predictions as to what might happen on the world stage this year.

- Wood Mackenzie’s Predictions for 2022: Wood Mackenzie analysts offer 10 predictions for key developments expected in the energy and natural resources industries in 2022.

Lastly, if you’ve found our Prediction Consensus useful, we’re going to be diving even deeper into this subject matter in the coming weeks.

Our VC+ members get access to the whole Global Forecast 2022 series, which features a webinar and additional articles that flesh out predictions for the coming year in even more detail. You can learn more about it here.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001