Money

Mapped: The 3 Billion People Who Can’t Afford a Healthy Diet

VC+ members get access to our World at 8 Billion Report.

Gain access to this exclusive new report and webinar by becoming a VC+ member.

The 3 Billion People Who Can’t Afford a Healthy Diet

While they aren’t often the focus of news media, hunger and undernourishment are problems plaguing millions of people every day.

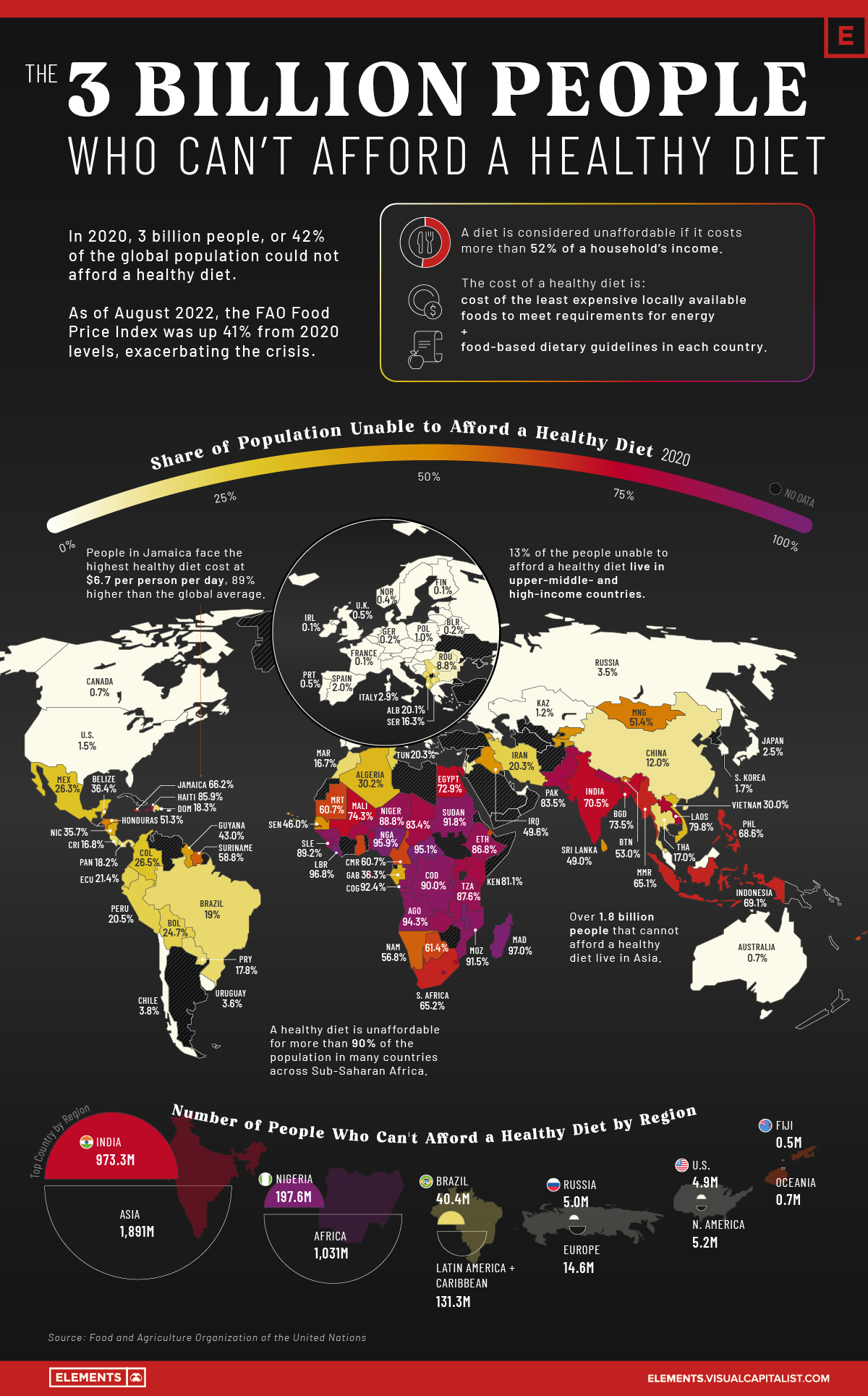

According to the UN Food and Agriculture Organization (FAO), more than 3 billion people could not afford a healthy diet in 2020, an additional 112 million more people than in 2019. The increase was partly because of rising food prices, with the average cost of a healthy diet rising by 3.3% from 2019 levels.

As of August 2022, the FAO food price index was up 40.6% from average 2020 levels. Unless income levels increased by a similar magnitude, the healthy diet crisis is likely to have worsened, especially in low-income countries experiencing rampant food inflation.

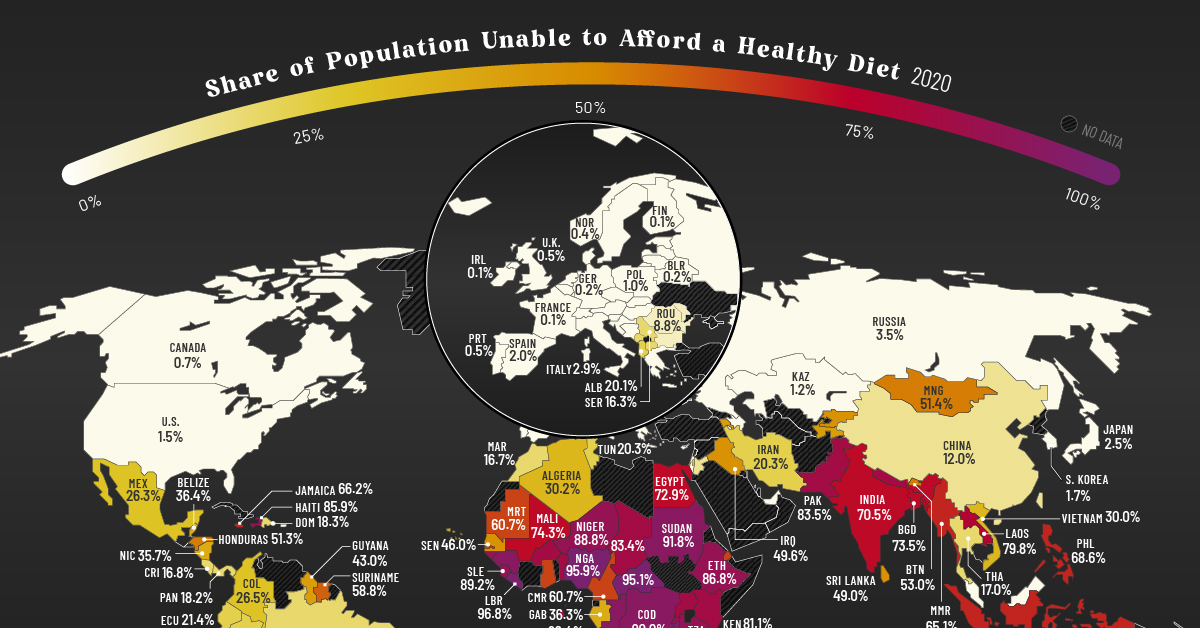

Using data from the FAO, the above infographic maps the share of people unable to afford a healthy diet in 138 different countries as of 2020 (latest available data).

The Cost and Affordability of a Healthy Diet

According to the FAO, a healthy diet is one that meets daily energy needs as well as requirements within the food and dietary guidelines created by the country.

The (un)affordability is measured by comparing the cost of a healthy diet to income levels in the country. If the cost exceeds 52% of an average household’s income, the diet is deemed unaffordable.

Here’s a look at the share of populations unable to afford a healthy diet, and the cost of such a diet around the world:

| Country | Percent of population unable to afford a healthy diet | Cost of Healthy Diet (USD per Person per Day) |

|---|---|---|

| Burundi 🇧🇮 | 97.2% | $2.9 |

| Madagascar 🇲🇬 | 97.0% | $3.2 |

| Liberia 🇱🇷 | 96.8% | $3.9 |

| Malawi 🇲🇼 | 96.6% | $3.1 |

| Nigeria 🇳🇬 | 95.9% | $4.1 |

| Central African Republic 🇨🇫 | 95.1% | $3.6 |

| Guinea 🇬🇳 | 94.9% | $4.1 |

| Angola 🇦🇴 | 94.3% | $4.5 |

| Congo 🇨🇬 | 92.4% | $3.4 |

| Sudan 🇸🇩 | 91.8% | $4.3 |

| Mozambique 🇲🇿 | 91.5% | $3.2 |

| Democratic Republic of Congo 🇨🇩 | 90.0% | $2.1 |

| Sierra Leone 🇸🇱 | 89.2% | $2.9 |

| Niger 🇳🇪 | 88.8% | $2.9 |

| Zambia 🇿🇲 | 88.0% | $3.3 |

| Tanzania 🇹🇿 | 87.6% | $2.7 |

| Guinea-Bissau 🇬🇼 | 87.2% | $3.5 |

| Ethiopia 🇪🇹 | 86.8% | $3.4 |

| Rwanda 🇷🇼 | 86.3% | $2.7 |

| Haiti 🇭🇹 | 85.9% | $4.5 |

| Sao Tome and Principe 🇸🇹 | 84.7% | $3.6 |

| Nepal 🇳🇵 | 84.0% | $4.4 |

| Lesotho 🇱🇸 | 83.5% | $4.3 |

| Pakistan 🇵🇰 | 83.5% | $3.7 |

| Chad 🇹🇩 | 83.4% | $2.8 |

| Benin 🇧🇯 | 82.9% | $3.7 |

| Uganda 🇺🇬 | 82.2% | $2.7 |

| Kenya 🇰🇪 | 81.1% | $3.0 |

| Burkina Faso 🇧🇫 | 80.1% | $3.3 |

| Laos 🇱🇦 | 79.8% | $4.1 |

| Mali 🇲🇱 | 74.3% | $3.1 |

| Bangladesh 🇧🇩 | 73.5% | $3.1 |

| Egypt 🇪🇬 | 72.9% | $3.4 |

| Eswatini 🇸🇿 | 71.8% | $3.4 |

| India 🇮🇳 | 70.5% | $3.0 |

| Indonesia 🇮🇩 | 69.1% | $4.5 |

| Philippines 🇵🇭 | 68.6% | $4.1 |

| Jamaica 🇯🇲 | 66.2% | $6.7 |

| South Africa 🇿🇦 | 65.2% | $4.3 |

| Myanmar 🇲🇲 | 65.1% | $4.2 |

| Gambia 🇬🇲 | 64.0% | $3.1 |

| Djibouti 🇩🇯 | 63.9% | $3.1 |

| Botswana 🇧🇼 | 61.4% | $3.7 |

| Ghana 🇬🇭 | 61.2% | $4.0 |

| Cameroon 🇨🇲 | 60.7% | $2.8 |

| Mauritania 🇲🇷 | 60.7% | $3.7 |

| Fiji 🇫🇯 | 60.4% | $3.9 |

| Suriname 🇸🇷 | 58.8% | $5.7 |

| Namibia 🇳🇦 | 56.8% | $3.5 |

| Bhutan 🇧🇹 | 53.0% | $5.0 |

| Mongolia 🇲🇳 | 51.4% | $5.1 |

| Honduras 🇭🇳 | 51.3% | $3.5 |

| Iraq 🇮🇶 | 49.6% | $3.5 |

| Kyrgyzstan 🇰🇬 | 49.6% | $3.2 |

| Sri Lanka 🇱🇰 | 49.0% | $3.9 |

| Senegal 🇸🇳 | 46.0% | $2.3 |

| Guyana 🇬🇾 | 43.0% | $4.9 |

| Armenia 🇦🇲 | 42.9% | $3.2 |

| Tajikistan 🇹🇯 | 42.1% | $3.5 |

| Cabo Verde 🇨🇻 | 38.1% | $3.6 |

| Belize 🇧🇿 | 36.4% | $2.1 |

| Gabon 🇬🇦 | 36.3% | $3.6 |

| Nicaragua 🇳🇮 | 35.7% | $3.3 |

| Algeria 🇩🇿 | 30.2% | $3.8 |

| Vietnam 🇻🇳 | 30.0% | $4.1 |

| Colombia 🇨🇴 | 26.5% | $3.1 |

| Mexico 🇲🇽 | 26.3% | $3.3 |

| Bolivia 🇧🇴 | 24.7% | $3.8 |

| Palestine 🇵🇸 | 23.1% | $3.4 |

| Ecuador 🇪🇨 | 21.4% | $2.9 |

| Saint Lucia 🇱🇨 | 20.6% | $3.6 |

| Peru 🇵🇪 | 20.5% | $3.3 |

| Iran 🇮🇷 | 20.3% | $3.6 |

| Tunisia 🇹🇳 | 20.3% | $3.6 |

| Albania 🇦🇱 | 20.1% | $4.2 |

| Brazil 🇧🇷 | 19.0% | $3.1 |

| Dominican Republic 🇩🇴 | 18.3% | $3.9 |

| Panama 🇵🇦 | 18.2% | $4.5 |

| North Macedonia 🇲🇰 | 18.0% | $3.4 |

| Paraguay 🇵🇾 | 17.8% | $3.5 |

| Montenegro 🇲🇪 | 17.5% | $3.5 |

| Thailand 🇹🇭 | 17.0% | $4.3 |

| Costa Rica 🇨🇷 | 16.8% | $4.1 |

| Morocco 🇲🇦 | 16.7% | $2.8 |

| Serbia 🇷🇸 | 16.3% | $4.2 |

| Jordan 🇯🇴 | 14.9% | $3.6 |

| Mauritius 🇲🇺 | 13.5% | $3.6 |

| China 🇨🇳 | 12.0% | $3.0 |

| Trinidad and Tobago 🇹🇹 | 11.6% | $4.2 |

| Romania 🇷🇴 | 8.8% | $3.2 |

| Bulgaria 🇧🇬 | 8.5% | $4.1 |

| Seychelles 🇸🇨 | 6.8% | $3.8 |

| Moldova 🇲🇩 | 6.7% | $2.8 |

| Chile 🇨🇱 | 3.8% | $3.4 |

| Croatia 🇭🇷 | 3.8% | $4.3 |

| Bosnia and Herzegovina 🇧🇦 | 3.7% | $4.0 |

| Uruguay 🇺🇾 | 3.6% | $3.4 |

| Russia 🇷🇺 | 3.5% | $3.4 |

| Greece 🇬🇷 | 3.2% | $3.1 |

| Italy 🇮🇹 | 2.9% | $3.1 |

| Japan 🇯🇵 | 2.5% | $5.8 |

| Hungary 🇭🇺 | 2.0% | $3.5 |

| Spain 🇪🇸 | 2.0% | $2.8 |

| Malaysia 🇲🇾 | 1.9% | $3.5 |

| Latvia 🇱🇻 | 1.8% | $3.2 |

| South Korea 🇰🇷 | 1.7% | $5.2 |

| United States 🇺🇸 | 1.5% | $3.4 |

| Maldives 🇲🇻 | 1.4% | $3.9 |

| Estonia 🇪🇪 | 1.3% | $3.3 |

| Kazakhstan 🇰🇿 | 1.2% | $2.7 |

| Lithuania 🇱🇹 | 1.2% | $3.1 |

| Slovakia 🇸🇰 | 1.2% | $3.2 |

| Israel 🇮🇱 | 1.0% | $2.5 |

| Poland 🇵🇱 | 1.0% | $3.2 |

| Austria 🇦🇹 | 0.8% | $3.0 |

| Australia 🇦🇺 | 0.7% | $2.6 |

| Canada 🇨🇦 | 0.7% | $3.0 |

| Malta 🇲🇹 | 0.7% | $3.8 |

| Sweden 🇸🇪 | 0.6% | $3.3 |

| Portugal 🇵🇹 | 0.5% | $2.7 |

| United Kingdom 🇬🇧 | 0.5% | $1.9 |

| Denmark 🇩🇰 | 0.4% | $2.5 |

| Norway 🇳🇴 | 0.4% | $3.5 |

| Cyprus 🇨🇾 | 0.3% | $3.0 |

| Belarus 🇧🇾 | 0.2% | $3.3 |

| Belgium 🇧🇪 | 0.2% | $3.1 |

| Czechia | 0.2% | $3.0 |

| Germany 🇩🇪 | 0.2% | $3.0 |

| Netherlands 🇳🇱 | 0.2% | $3.0 |

| Finland 🇫🇮 | 0.1% | $2.7 |

| France 🇫🇷 | 0.1% | $3.2 |

| Ireland 🇮🇪 | 0.1% | $2.2 |

| Luxembourg 🇱🇺 | 0.1% | $2.7 |

| Slovenia 🇸🇮 | 0.1% | $3.1 |

| Azerbaijan 🇦🇿 | 0.0% | $2.5 |

| Iceland 🇮🇸 | 0.0% | $2.4 |

| Switzerland 🇨🇭 | 0.0% | $2.7 |

| United Arab Emirates 🇦🇪 | 0.0% | $3.1 |

| World 🌎 | 42.0% | $3.5 |

In 52 countries, more than half of the population cannot afford a healthy diet. The majority of these are in Africa, with the rest located across Asia, Oceania, and the Americas.

By contrast, in four countries—Azerbaijan, Iceland, Switzerland, and the UAE—everyone is able to afford a healthy diet. The picture is similar for most European and developed high-income countries, where more than 95% of the population can afford a healthy diet.

When the percentages are translated into numbers, Asia contains the most number of people unable to afford a healthy diet at 1.89 billion, of which 973 million people are in India alone. Another 1 billion people are in Africa, with around 151 million people in the Americas and Oceania.

While hunger is a worldwide concern, it is particularly acute in African countries, which cover all of the top 20 spots in the above table.

Africa’s Deepening Food Crisis

In many countries across sub-Saharan Africa, more than 90% of the population cannot afford a healthy diet.

Sub-Saharan Africa is particularly susceptible to extreme climate events and the resulting volatility in food prices. Roughly one-third of the world’s droughts occur in the region, and some sub-Saharan countries are also heavily reliant on imports for food.

Russia’s invasion of Ukraine has deepened the crisis, with many African countries importing over 50% of their wheat from the two countries in conflict. The rising food prices from this supply chain disruption have resulted in double-digit food inflation in many African nations, which means that more people are likely to be unable to afford healthy diets.

The Horn of Africa region at the Eastern tip of Africa is particularly in turmoil. All the countries in the region are reliant on wheat from Russia and Ukraine, with Eritrea (100%) and Somalia (>90%) high up in the import dependency chart. Additionally, the region is facing its worst drought in 40 years alongside ongoing political conflicts. As a result, 22 million people are at risk of starvation.

Population Growth and Food Insecurity

In November of 2022, the global population is projected to surpass 8 billion people, and many of the fastest growing countries are also food-insecure.

By 2050, the global population is likely to increase by 35%, and to meet the growing demand for food, crop production will need to double. Given that agriculture is one of the biggest contributors to greenhouse gas emissions, this increase in crop production will also need to be environmentally sustainable.

As the impacts of climate change intensify and food demand increases, reducing food waste, building climate-resilient agricultural infrastructure, and improving agricultural productivity will all play a key role in reducing the levels of food insecurity sustainably.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024