Datastream

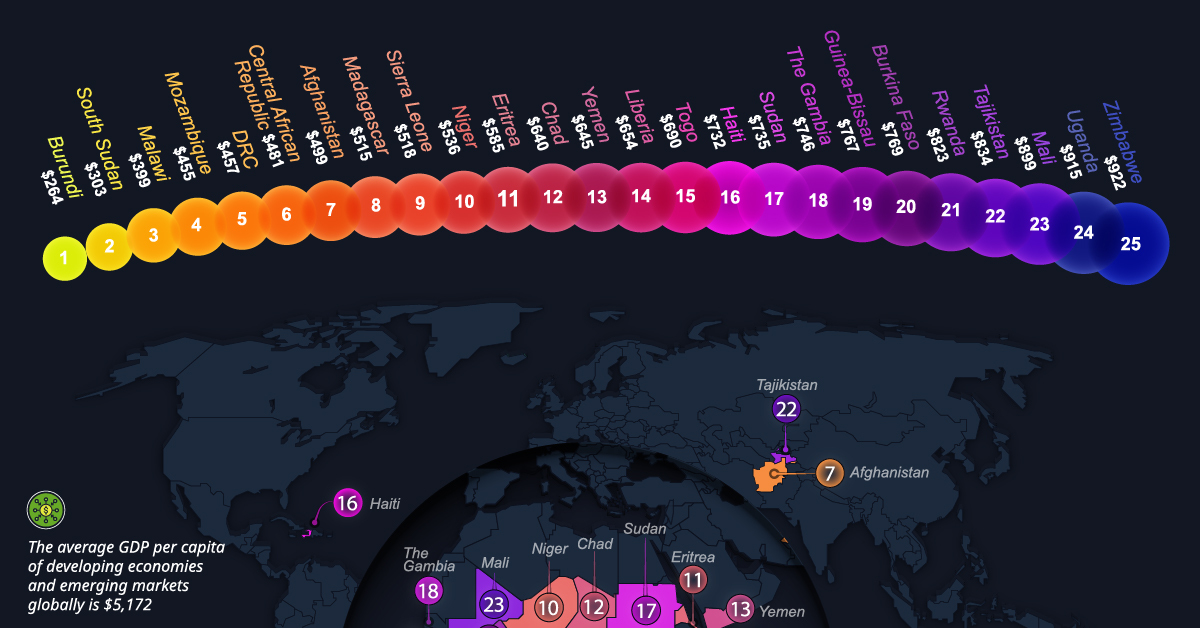

Mapped: The 25 Poorest Countries in the World

The Briefing

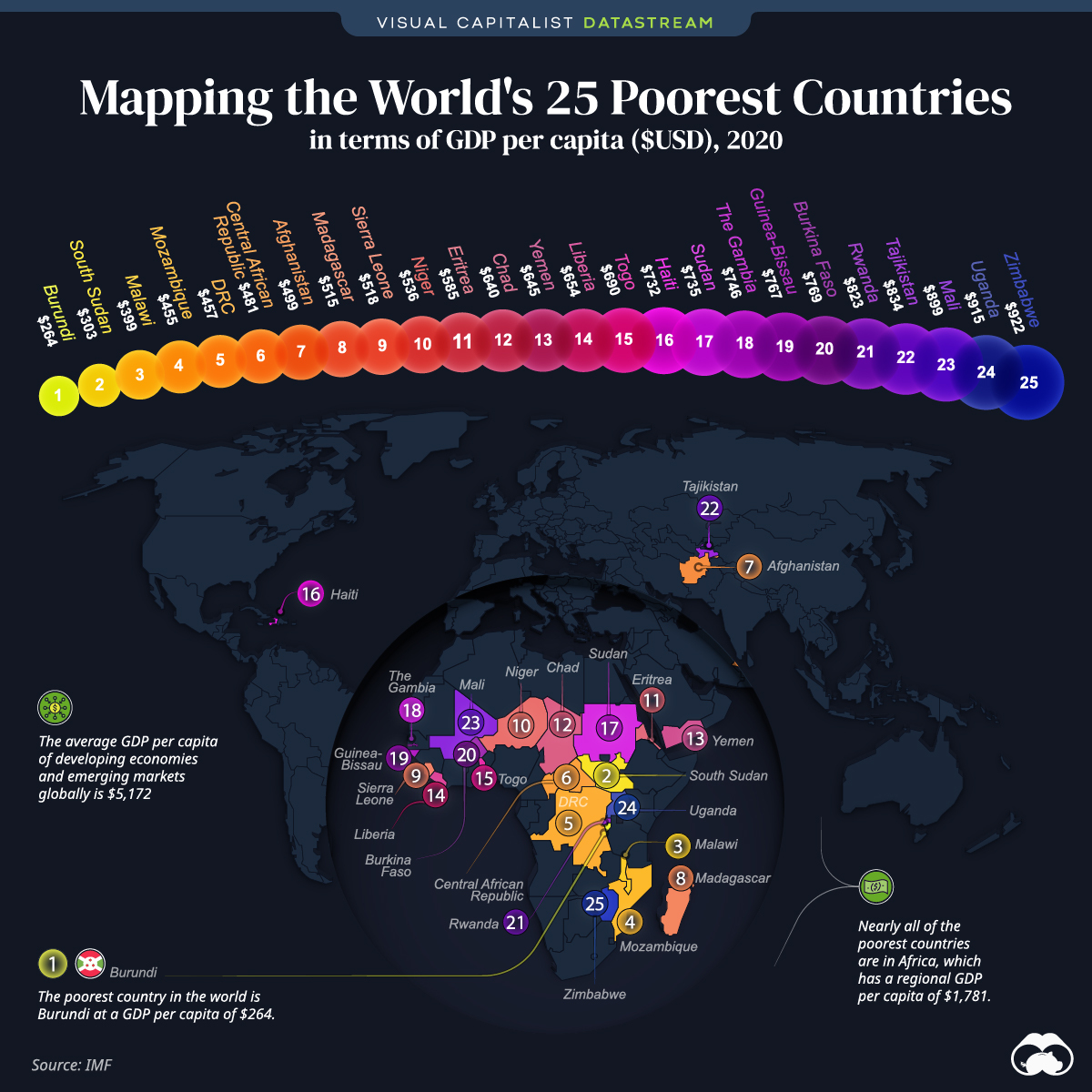

- The poorest country in the world is Burundi with a GDP per capita of $264

- Nearly all of the world’s poorest countries are in Africa, though Haiti, Tajikistan, Yemen, and Afghanistan are notable exceptions

Mapped: The 25 Poorest Countries in the World

Having looked at the richest countries in the world, which nations are at the bottom of the list in terms of GDP per capita, in nominal terms?

This map looks at the world’s 25 poorest countries by this metric.

| Country | GDP per capita (USD) |

|---|---|

| 🇧🇮 Burundi | $263.67 |

| 🇸🇸 South Sudan | $303.15 |

| 🇲🇼 Malawi | $399.10 |

| 🇲🇿 Mozambique | $455.01 |

| 🇨🇩 Democratic Republic of the Congo (DRC) | $456.89 |

| 🇨🇫 Central African Republic | $480.50 |

| 🇦🇫 Afghanistan | $499.44 |

| 🇲🇬 Madagascar | $514.85 |

| 🇸🇱 Sierra Leone | $518.47 |

| 🇳🇪 Niger | $535.83 |

| 🇪🇷 Eritrea | $585.16 |

| 🇹🇩 Chad | $639.85 |

| 🇾🇪 Yemen | $645.13 |

| 🇱🇷 Liberia | $653.60 |

| 🇹🇬 Togo | $690.28 |

| 🇭🇹 Haiti | $732.07 |

| 🇸🇩 Sudan | $734.60 |

| 🇬🇲 The Gambia | $746.33 |

| 🇬🇼 Guinea-Bissau | $766.75 |

| 🇧🇫 Burkina Faso | $768.83 |

| 🇷🇼 Rwanda | $823.40 |

| 🇹🇯 Tajikistan | $833.55 |

| 🇲🇱 Mali | $899.22 |

| 🇺🇬 Uganda | $915.35 |

| 🇿🇼 Zimbabwe | $921.85 |

All but four of these countries are located on the African continent.

Additionally, all of the 25 poorest countries, with the exception of Zimbabwe and Tajikistan, are considered Least Developed Countries (LDCs) by the UN. LDCs are categorized by criteria based on per capita income, human assets (such as education level), and economic vulnerability. Today, more than 75% of the population in LDCs live below the poverty line.

For added perspective, the average GDP per capita of all developing economies and emerging markets globally is $5,172.

Emerging Markets

Developing countries, while having much smaller economies, have one thing that the richest countries don’t have: immense room for economic growth.

Most of the poorest countries’ strongest industries are agriculture, mining, manufacturing, and so on, and the world is heavily reliant on the flow of raw materials and resources coming from developing nations.

Focusing on the African countries listed, the economic potential is significant. Africa’s infrastructure is currently improving at a rapid rate, opening the door for foreign direct investment and increased capacity for industrialization. In large part, this progress is thanks to China’s Belt and Road initiative and investment in multiple African countries.

Another signal of Africa’s potential is the extremely large share of young people on the continent. Here’s a look at the five countries in the world with the highest shares of their population aged younger than 15, all of which are in Africa:

- 🇳🇪 Niger: 49.8%

- 🇲🇱 Mali: 47.3%

- 🇹🇩 Chad: 46.8%

- 🇦🇴 Angola: 46.6%

- 🇺🇬 Uganda: 46.5%

In Niger, an astounding near half of the population is under the age of 15 years old. This could translate into a large future workforce, a growing domestic market, and potential for innovation and economic progress.

Overall, while today the poorest countries still have extremely low standards of living, the economic potential is there for future growth.

Where does this data come from?

Source: IMF

Details: GDP per capita is measured in $USD, 2020.

Datastream

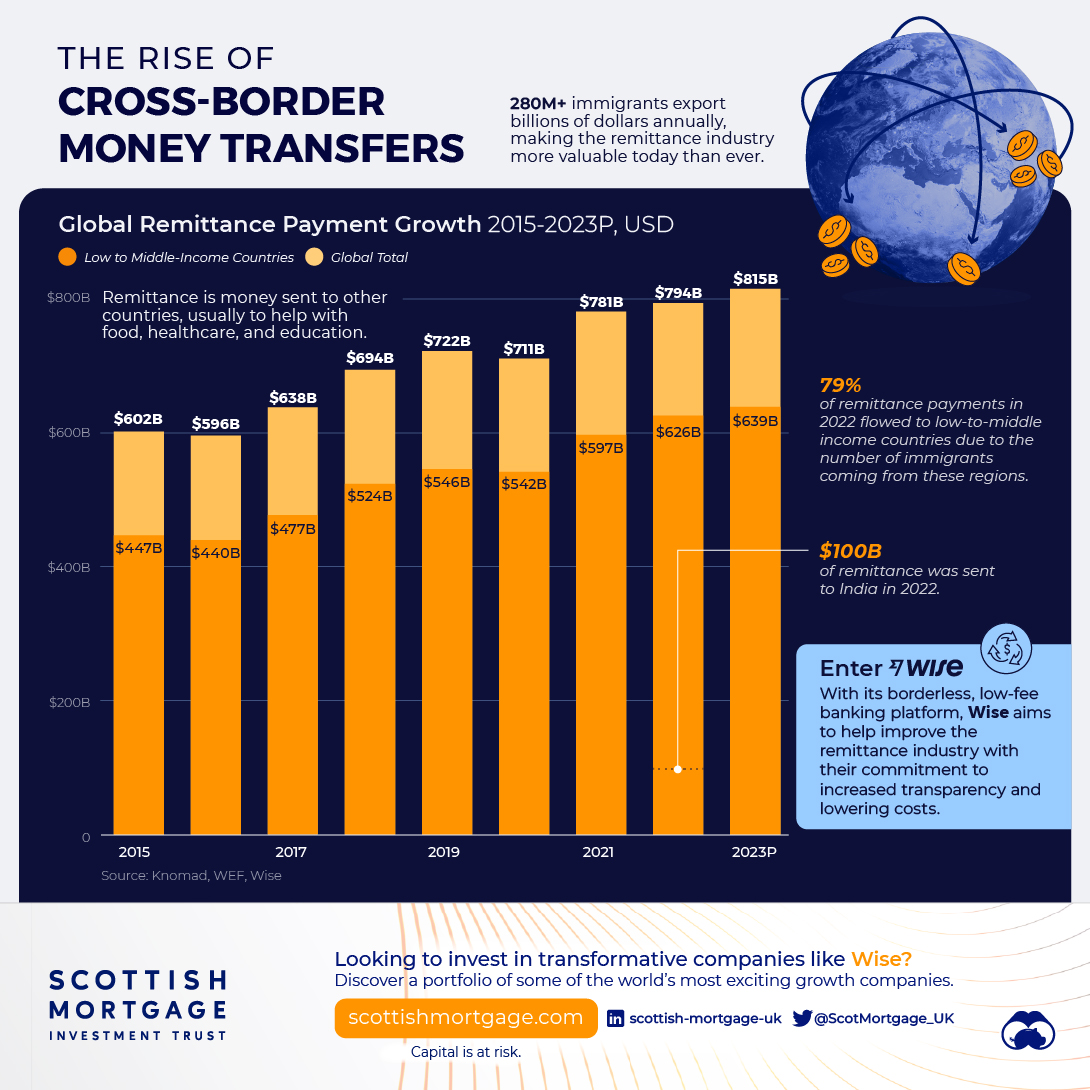

Charting the Rise of Cross-Border Money Transfers (2015-2023)

With over 280 million immigrants transferring billions of dollars annually, the remittance industry has become more valuable than ever.

The Briefing

- 79% of remittance payments in 2022 were made to low and middle-income countries.

- Borderless, low-cost money transfer services like those provided by Wise can help immigrants support their families.

The Rise of Cross-Border Money Transfers

The remittance industry has experienced consistent growth recently, solidifying its position as a key component of the global financial landscape. Defined as the transfer of money from one country to another, usually to support a dependent, remittances play a pivotal role in providing food, healthcare, and education.

In this graphic, sponsored by Scottish Mortgage, we delve into the growth of the remittance industry, and the key factors propelling its success.

Powered by Immigration

With over 280 million immigrants worldwide, the remittance industry has an important place in our global society.

By exporting billions of dollars annually back to their starting nations, immigrants can greatly improve the livelihoods of their families and communities.

This is particularly true for low and middle-income countries, who in 2022 received, on average, 79% of remittance payments, according to Knomad, an initiative of the World Bank.

| Year | Low/Middle Income (US$ Billion) | World Total (US$ Billion) |

|---|---|---|

| 2015 | $447B | $602B |

| 2016 | $440B | $596B |

| 2017 | $477B | $638B |

| 2018 | $524B | $694B |

| 2019 | $546B | $722B |

| 2020 | $542B | $711B |

| 2021 | $597B | $781B |

| 2022 | $626B | $794B |

| 2023 | $639B | $815B |

India is one of the global leaders in receiving remittance payments. In 2022 alone, over $100 billion in remittances were sent to India, supporting many families.

Enter Wise

As the global remittance industry continues to grow, it is important to acknowledge the role played by innovative money transfer operators like Wise.

With an inclusive, user-centric platform and competitive exchange rates, Wise makes it easy and cost-effective for millions of individuals to send money home, worldwide.

Connection Without Borders

But Wise doesn’t just offer remittance solutions, the company offers a host of account services and a payment infrastructure that has helped over 6.1 million active customers move over $30 billion in the first quarter of 2023 alone.

Want to invest in transformative companies like Wise?

Discover Scottish Mortgage Investment Trust, a portfolio of some of the world’s most exciting growth companies.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries