Technology

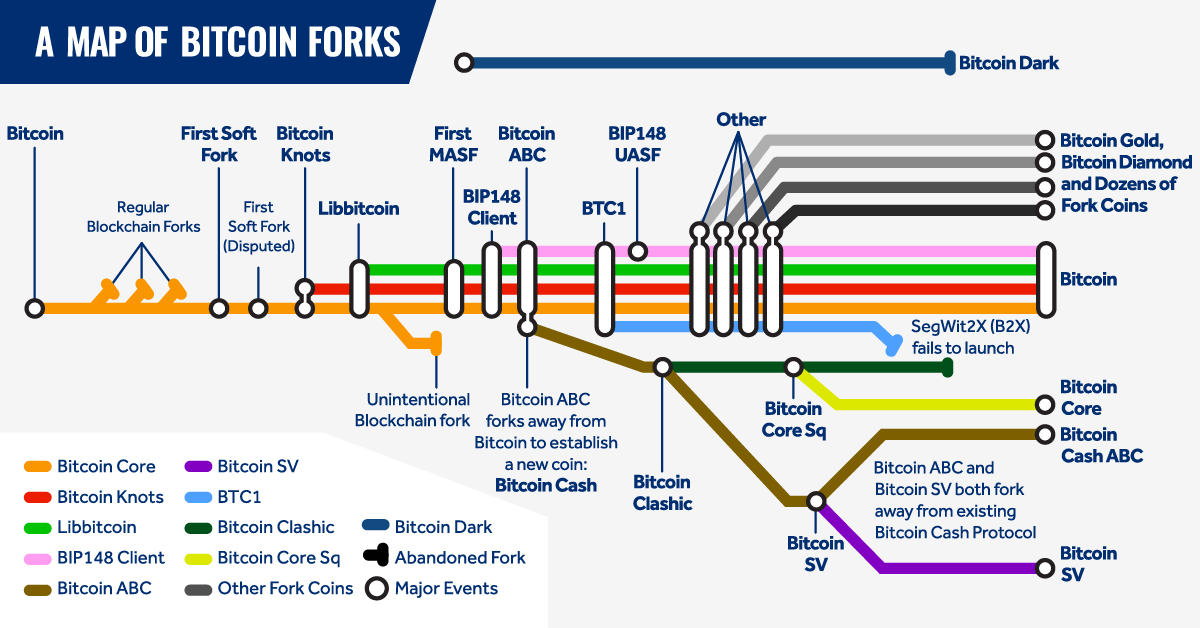

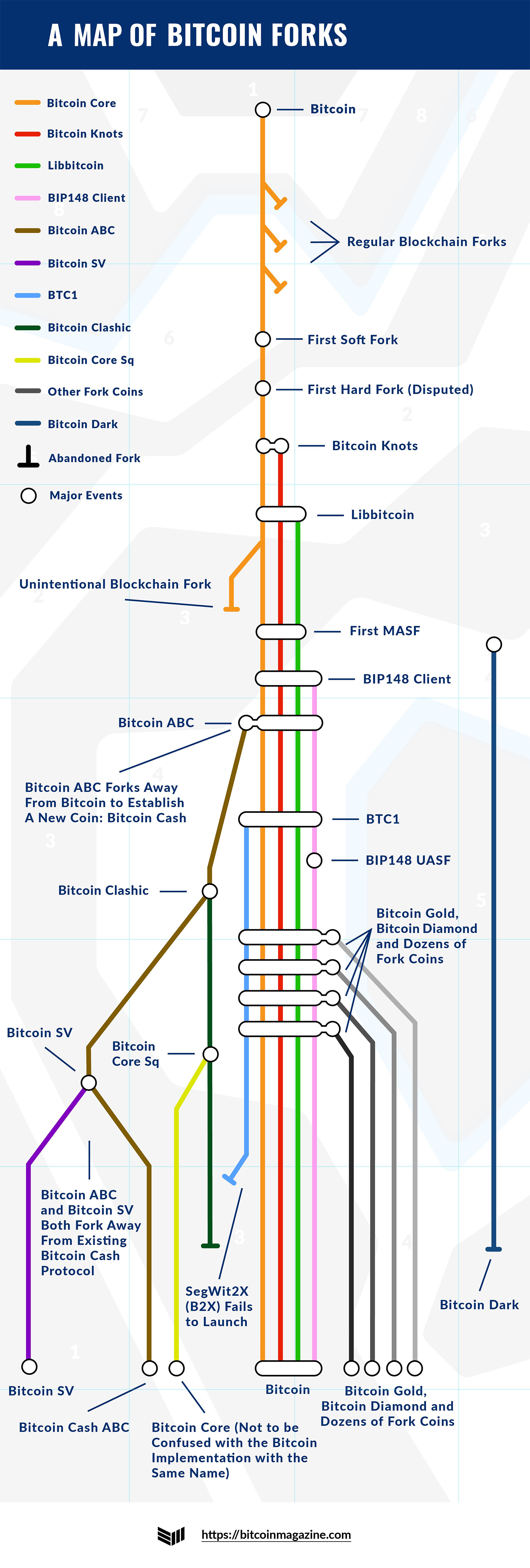

Mapping the Major Bitcoin Forks

Mapping the Major Bitcoin Forks

The emergence of Bitcoin took the world by storm through its simplicity and innovation. Yet, plenty of confusion remains around the term itself.

The Bitcoin blockchain—not to be confused with the bitcoin cryptocurrency—involves a vast global network of computers operating on the same distributed database to process massive volumes of data every second.

These transactions tell the network how to alter this distributed database in real-time, which makes it crucial for everyone to agree on how these changes should be applied. When the community can’t come to a mutual agreement on what changes, or when such rule changes should take effect, it results in a blockchain fork.

Today’s unique subway-style map by Bitcoin Magazine shows the dramatic and major forks that have occurred for Bitcoin. But what exactly is a Blockchain fork?

Types of Blockchain Forks

Forks are common practice in the software industry and happen for one of two reasons:

- Split consensus within the community

These forks are generally disregarded by the community because they are temporary, except in extreme cases. The longer of the two chains is used to continue building the blockchain. - Changes to the underlying rules of the blockchain

A permanent fork which requires an upgrade to the current software in order to continue participating in the network.

There are four major types of forks that can occur:

1. Soft Forks

Soft forks are like gradual software upgrades—bug fixes, security checks, and new features—for those that upgrade right away.

These forks are “backwards compatible” with the older software; users who haven’t upgraded still have access to the network but may not be able to use all functionality in the current version.

2. Hard Forks

Hard forks are like a new OS release—upgrading is mandatory to continue using the software. Because of this, hard forks aren’t compatible with older versions of the network.

Hard forks are a permanent division of the blockchain. As long as enough people support both chains, however, they will both continue to exist.

The three types of hard forks are:

- Planned

Scheduled upgrades to the network, giving users a chance to prepare. These forks typically involve abandoning the old chain. - Contentious

Caused by disagreements in the community, forming a new chain. This usually involves major changes to the code. - Spin-off Coins

Changes to Bitcoin’s code that create new coins. Litecoin is an example of this—key changes included reducing mining time from 10 minutes to 2.5 minutes, and increasing the coin supply from 21 million to 84 million.

3. Codebase Forks

Codebase forks copy the Bitcoin code, allowing developers to make minor tweaks without having to develop the entire blockchain code from scratch. Codebase forks can create a new cryptocurrency or cause unintentional blockchain forks.

4. Blockchain Forks

Blockchain forks involve branching or splitting a blockchain’s whole transaction history. Outcomes range from “orphan” blocks to new cryptocurrencies.

Splitting off the Bitcoin network to form a new currency is much like a religious schism—while most of the characteristics and history are preserved, a fork causes the new network to develop a distinct identity.

Summarizing Major Bitcoin Forks

Descriptions of major forks that have occurred in the Bitcoin blockchain:

- Bitcoin / Bitcoin Core

The first iteration of Bitcoin was launched by Satoshi Nakamoto in 2009. Future generations of Bitcoin (aka Bitcoin 0.1.0) were renamed Bitcoin Core, or Bitcore, as other blockchains and codebases formed. - BTC1

A codebase fork of Bitcoin. Developers released a hard fork protocol called Segwit2x, with the intention of having all Bitcoin users eventually migrate to the Segwit2x protocol. However, it failed to gain traction and is now considered defunct. - Bitcoin ABC

Also a codebase fork of Bitcoin, Bitcoin ABC was intentionally designed to be incompatible with all Bitcoin iterations at some point. ABC branched off to form Bitcoin Cash in 2017. - Bitcoin Gold, Bitcoin Diamond, Other Fork Coins

After the successful yet contentious launch of Bitcoin Cash, other fork coins began to emerge. Unlike the disagreement surrounding Bitcoin Cash, most were simply regarded as a way to create new coins.

Some of the above forks were largely driven by ideology (BTC1), some because of mixed consensus on which direction to take a hard fork (Bitcoin ABC), while others were mainly profit-driven (Bitcoin Clashic)—or a mix of all three.

Where’s the Next Fork in the Road?

Forks are considered an inevitability in the blockchain community. Many believe that forks help ensure that everyone involved—developers, miners, and investors—all have a say when disagreements occur.

Bitcoin has seen its fair share of ups and downs. Crypto investors should be aware that Bitcoin, as both a protocol and a currency, is complex and always evolving. Even among experts, there is disagreement on what constitutes a soft or hard fork, and how certain geopolitical events have played a role in Bitcoin’s evolution.

Digital Transformation

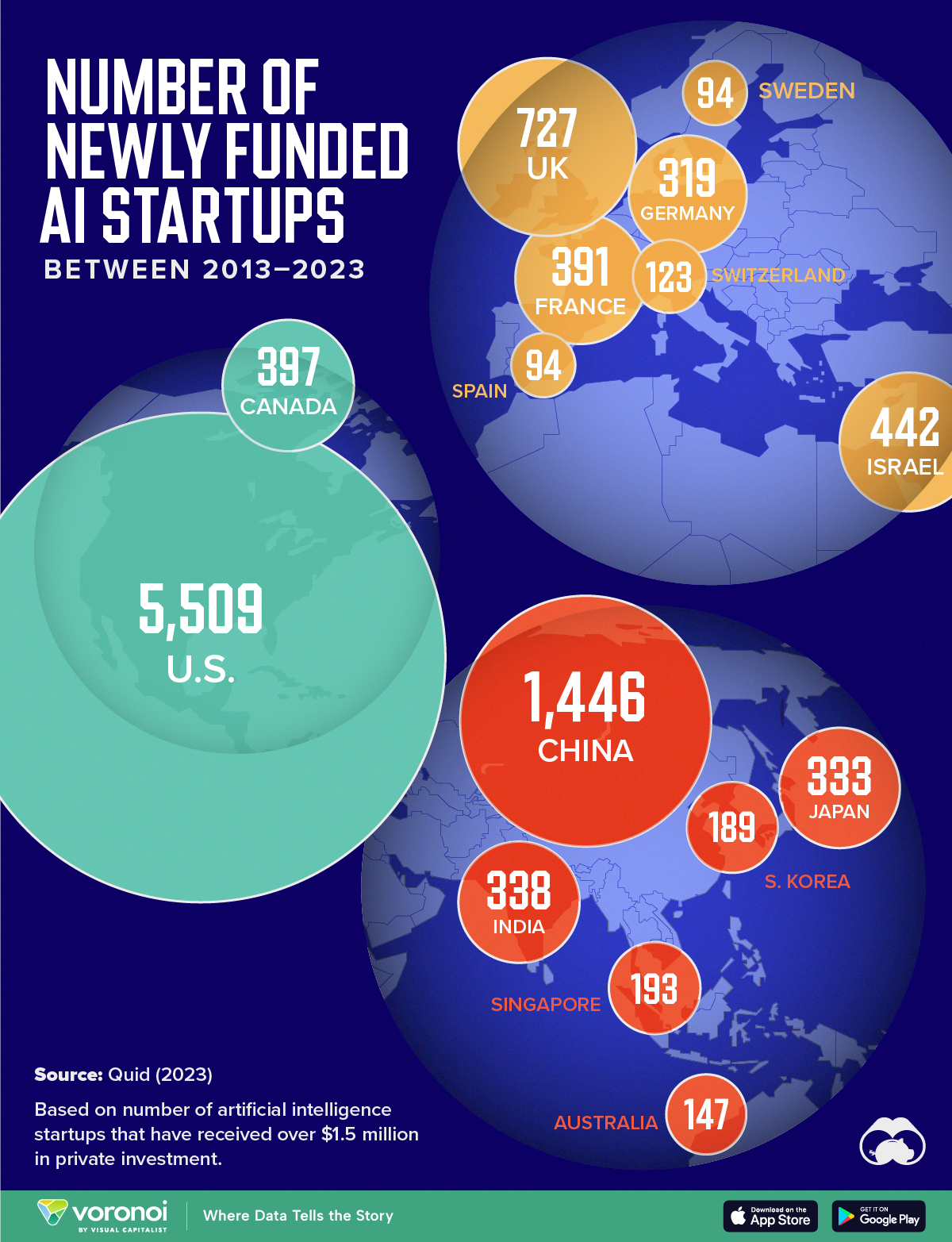

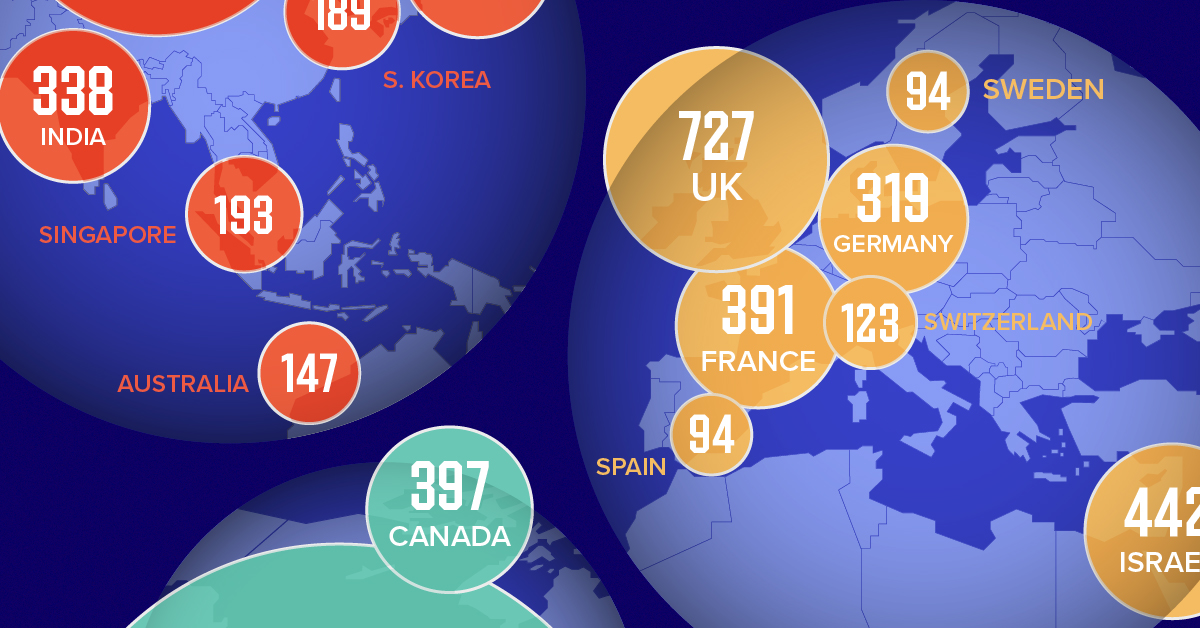

Mapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

Mapped: The Number of AI Startups By Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Amidst the recent expansion of artificial intelligence (AI), we’ve visualized data from Quid (accessed via Stanford’s 2024 AI Index Report) to highlight the top 15 countries which have seen the most AI startup activity over the past decade.

The figures in this graphic represent the number of newly funded AI startups within that country, in the time period of 2013 to 2023. Only companies that received over $1.5 million in private investment were considered.

Data and Highlights

The following table lists all of the numbers featured in the above graphic.

| Rank | Geographic area | Number of newly funded AI startups (2013-2023) |

|---|---|---|

| 1 | 🇺🇸 United States | 5,509 |

| 2 | 🇨🇳 China | 1,446 |

| 3 | 🇬🇧 United Kingdom | 727 |

| 4 | 🇮🇱 Israel | 442 |

| 5 | 🇨🇦 Canada | 397 |

| 6 | 🇫🇷 France | 391 |

| 7 | 🇮🇳 India | 338 |

| 8 | 🇯🇵 Japan | 333 |

| 9 | 🇩🇪 Germany | 319 |

| 10 | 🇸🇬 Singapore | 193 |

| 11 | 🇰🇷 South Korea | 189 |

| 12 | 🇦🇺 Australia | 147 |

| 13 | 🇨🇭 Switzerland | 123 |

| 14 | 🇸🇪 Sweden | 94 |

| 15 | 🇪🇸 Spain | 94 |

From this data, we can see that the U.S., China, and UK have established themselves as major hotbeds for AI innovation.

In terms of funding, the U.S. is massively ahead, with private AI investment totaling $335 billion between 2013 to 2023. AI startups in China raised $104 billion over the same timeframe, while those in the UK raised $22 billion.

Further analysis reveals that the U.S. is widening this gap even more. In 2023, for example, private investment in the U.S. grew by 22% from 2022 levels. Meanwhile, investment fell in China (-44%) and the UK (-14.1%) over the same time span.

Where is All This Money Flowing To?

Quid also breaks down total private AI investment by focus area, providing insight into which sectors are receiving the most funding.

| Focus Area | Global Investment in 2023 (USD billions) |

|---|---|

| 🤖 AI infrastructure, research, and governance | $18.3 |

| 🗣️ Natural language processing | $8.1 |

| 📊 Data management | $5.5 |

| ⚕️ Healthcare | $4.2 |

| 🚗 Autonomous vehicles | $2.7 |

| 💰 Fintech | $2.1 |

| ⚛️ Quantum computing | $2.0 |

| 🔌 Semiconductor | $1.7 |

| ⚡ Energy, oil, and gas | $1.5 |

| 🎨 Creative content | $1.3 |

| 📚 Education | $1.2 |

| 📈 Marketing | $1.1 |

| 🛸 Drones | $1.0 |

| 🔒 Cybersecurity | $0.9 |

| 🏭 Manufacturing | $0.9 |

| 🛒 Retail | $0.7 |

| 🕶️ AR/VR | $0.7 |

| 🛡️ Insurtech | $0.6 |

| 🎬 Entertainment | $0.5 |

| 💼 VC | $0.5 |

| 🌾 Agritech | $0.5 |

| ⚖️ Legal tech | $0.4 |

| 👤 Facial recognition | $0.3 |

| 🌐 Geospatial | $0.2 |

| 💪 Fitness and wellness | $0.2 |

Attracting the most money is AI infrastructure, research, and governance, which refers to startups that are building AI applications (like OpenAI’s ChatGPT).

The second biggest focus area is natural language processing (NLP), which is a type of AI that enables computers to understand and interpret human language. This technology has numerous use cases for businesses, particularly in financial services, where NLP can power customer support chatbots and automated wealth advisors.

With $8 billion invested into NLP-focused startups during 2023, investors appear keenly aware of this technology’s transformative potential.

Learn More About AI From Visual Capitalist

If you enjoyed this graphic, be sure to check out Visualizing AI Patents by Country.

-

Markets6 days ago

Markets6 days agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Markets2 weeks ago

Markets2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App