Money

How Central Banks Think About Digital Currency

How Central Banks Think About Digital Currency

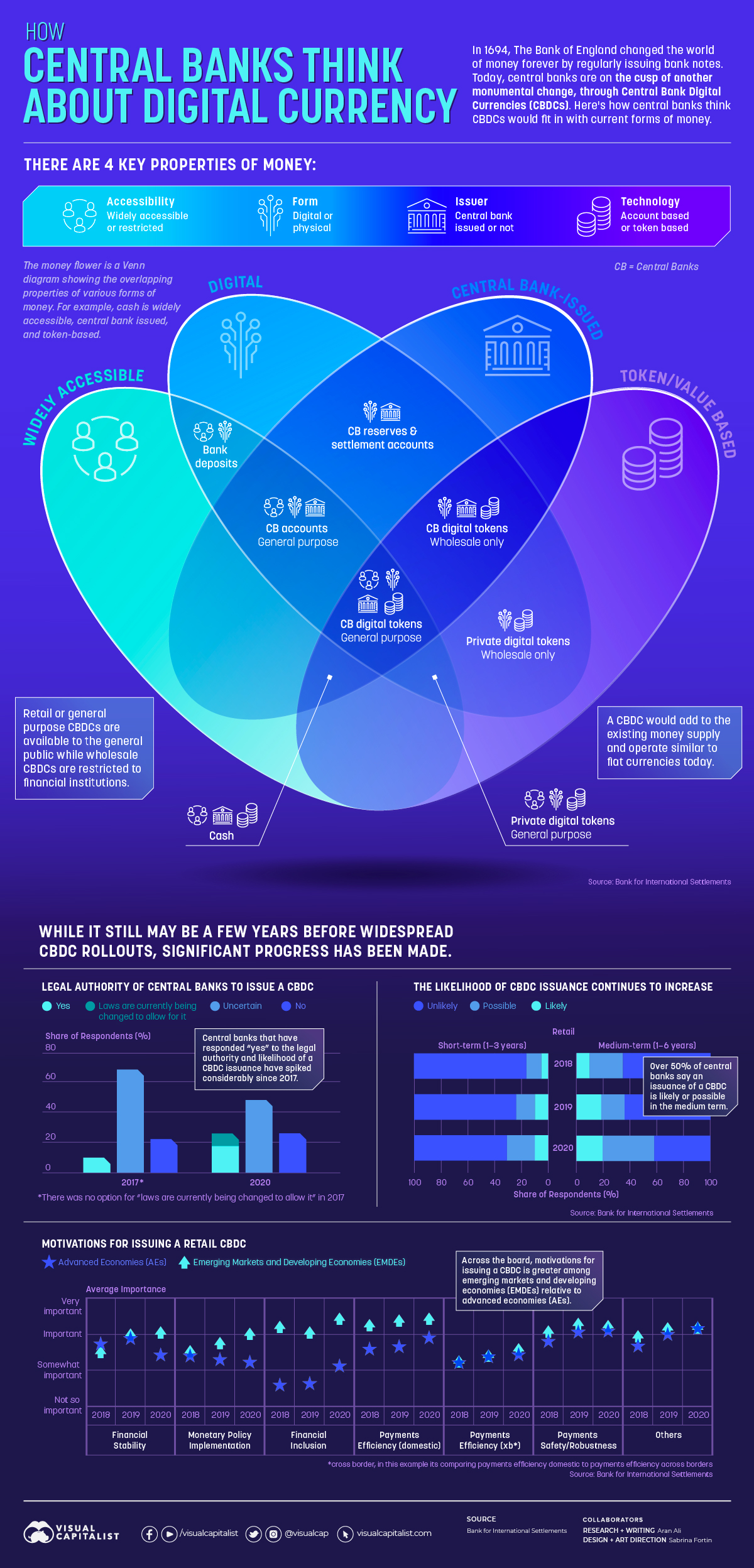

In the late 1600s, the introduction of bank notes changed the financial system forever. Fast forward to today, and another monumental change is expected to occur through central bank digital currencies (CBDC).

A CBDC adopts certain characteristics of everyday paper or coin currencies and cryptocurrency. It is expected to provide central banks and the monetary systems they govern a step towards modernizing.

But what exactly are CBDCs and how do they differ from money we use today?

The ABCs of CBDCs

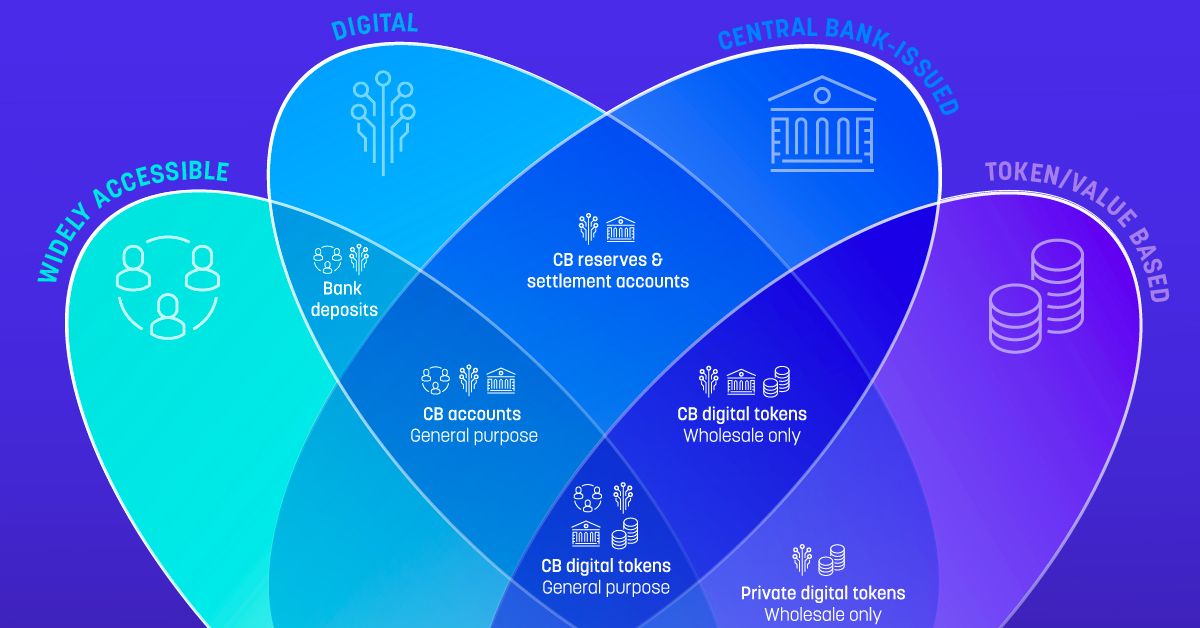

To better understand a CBDC, it helps to first understand the taxonomy of money and its overlapping properties.

For example, the properties of cash are that it’s accessible, physical and digital, central bank issued, and token-based. Here’s how the taxonomy of money breaks down:

- Accessibility: The accessibility of money is a big factor in determining its place within the taxonomy of money. For instance, cash and general purpose CBDCs are considered widely accessible.

- Form: Is the money physical or digital? The form of money determines distribution and the potential for dilution, and future CBDCs issued will be completely digital.

- Issuer: Where does the money come from? CBDCs are to be issued by the central bank and backed by their respective governments, which differs from cryptocurrencies which mostly have no government affiliations.

- Technology: How does the currency work? CBDCs break down into token-based and account-based approaches. A token-based CBDC operates like banknotes today, where your information is not known nor needed by a cashier when accepting your payment. An account-based system, however, requires authorization to partake on the network, akin to paying with a digital wallet or card.

Digital Currency vs Digital Coins

In essence, digital currency is the electronic form of banknotes that exists today. Therefore, it’s viewed by some as a modern and efficient version of the cash you hold in your wallet or purse.

On the other hand, cryptocurrencies like Bitcoin are a store of value like gold that is secured by encryption. Cryptocurrencies are privately owned and fueled by blockchain technology, compared to digital currencies which do not use decentralized ledgers or blockchain technology.

Digital Currency: Regulatory Authority and Stability

Digital currencies are issued by a central bank, and therefore, are backed by the full power of a government. According to the Bank for International Settlements, over 20% of central banks surveyed say they have legal authority in issuing a CBDC. Almost 10% more said laws are currently being changed to allow for it.

As more central banks issue digital currencies, there’s likely to be favorability between them. This is similar to how a few currencies like the U.S. dollar and Euro dominate the currency landscape.

The Benefits of Issuing a CBDC

There are several positives regarding the issuance of a CBDC over other currencies.

First, the cost of retail payments in the U.S. is estimated to be between 0.5% and 0.9% of the country’s $20 trillion in GDP. Digital currencies can flow much more effectively between parties, helping reduce these transaction fees.

Second, large chunks of the global population are still considered unbanked. In this case, a CBDC opens avenues for people to access the global financial system without a bank. Even today, 6% of Americans do not have a single bank account.

Other motivations for a CBDC include:

- Financial stability

- Monetary policy implementation

- Increased safety, efficiency, and robustness

- Limit on illicit activity

An example of payments efficiency can be seen during the onset of the COVID-19 pandemic, when some Americans failed to receive their stimulus check. Altogether, some $2 billion in funds have gone unclaimed. A functioning rollout of a CBDC and a more direct relationship with citizens would minimize such a problem.

Status of CBDCs

Although widespread adoption of CBDCs is still far away, research and experiments are making notable strides forward:

- 81 countries representing 90% of global GDP are exploring CBDCs.

- The share of central banks actively engaging in CBDC work grew to 86% in the last 4 years.

- 60% of central banks are conducting experiments on CBDCs (up from 42% in 2019) and 14% are moving forward to development and pilot arrangement.

- The Bahamas is one of five countries currently working with a CBDC – the Bahamian Sand Dollar.

- Sweden and Uruguay have shown interest in a digital currency. Sweden began testing an “e-krona” in 2020, and Uruguay announced tests to issue digital Uruguayan pesos as far back as 2017.

- The People’s Bank of China has been running CBDC tests since April 2020. In all, tens of thousands of citizens have participated, spending 2 billion yuan, and the country is poised to be the first to fully launch a CBDC.

The U.K. central bank is less optimistic about a rolling out a CBDC in the near future. The proposed digital currency—dubbed “Britcoin”—is unlikely to arrive until at least 2025.

Disrupting The World of Money

Wherever you look, technology is disrupting finance and upending the status quo.

This can be seen through the rising market value of fintech firms, which in some cases are trumping traditional financial institutions in value. It is also evident in the rapid rise of Bitcoin to a $1 trillion market cap, making it the fastest asset to do so.

With the rollout of central bank digital currencies on the horizon, the next disruption of financial systems is already beginning.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001