Healthcare

Visualizing the Growth of COVID-19 in the U.S., Organized by State Peak Date

The exponential nature of viral spread means that pandemics are fast-moving and dynamic.

Combine this with the high interconnectedness of modern life—even when social distancing and lockdowns are applied—and pandemics can evolve quickly. In just a few weeks, previous hotspots can cool down, while new high risk areas can crop up seemingly out of nowhere.

In the United States, like many other places in the world, the virus is hitting regions differently, and this landscape is constantly changing over time.

COVID-19 Growth, by State

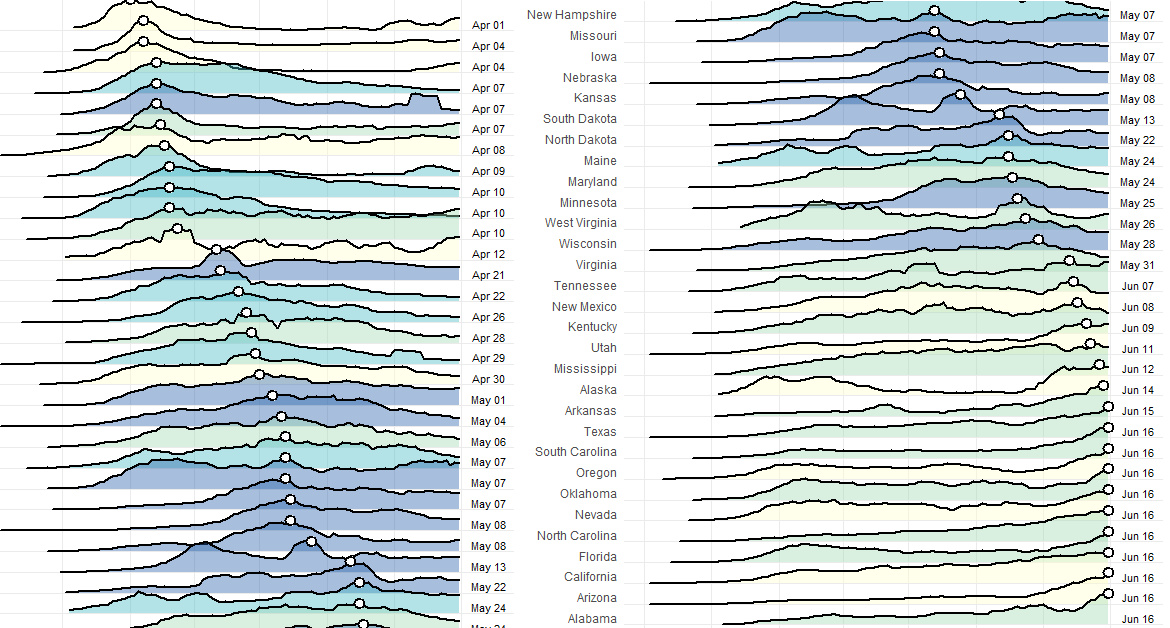

Today’s first visualization comes to us from Reddit user bgregory98, and it uses data from the New York Times to plot confirmed active COVID-19 cases by state.

States are organized by the date that weekly average cases peaked, from top to bottom. Data is normalized and is current until June 16th, and states are colored based on regional definitions (i.e. Northeast, Midwest, West, South) as defined by the U.S. Census Bureau.

As you can see, when looking purely at active cases, the situation has evolved considerably from a geographical perspective.

Early on, COVID-19 cases were more concentrated in coastal population centers, especially in the Northeast. New York, New Jersey, and Massachusetts, the three hardest hit states per capita so far, saw cases peak in April.

However, a look at the bottom half of the visualization shows that generally, states in the South and West are starting to heat up with cases. Recent daily numbers confirm this, with California, Texas, Florida, Arizona, and North Carolina all gaining more than 1,000 new cases on June 17th.

Growth by State, Part Deux

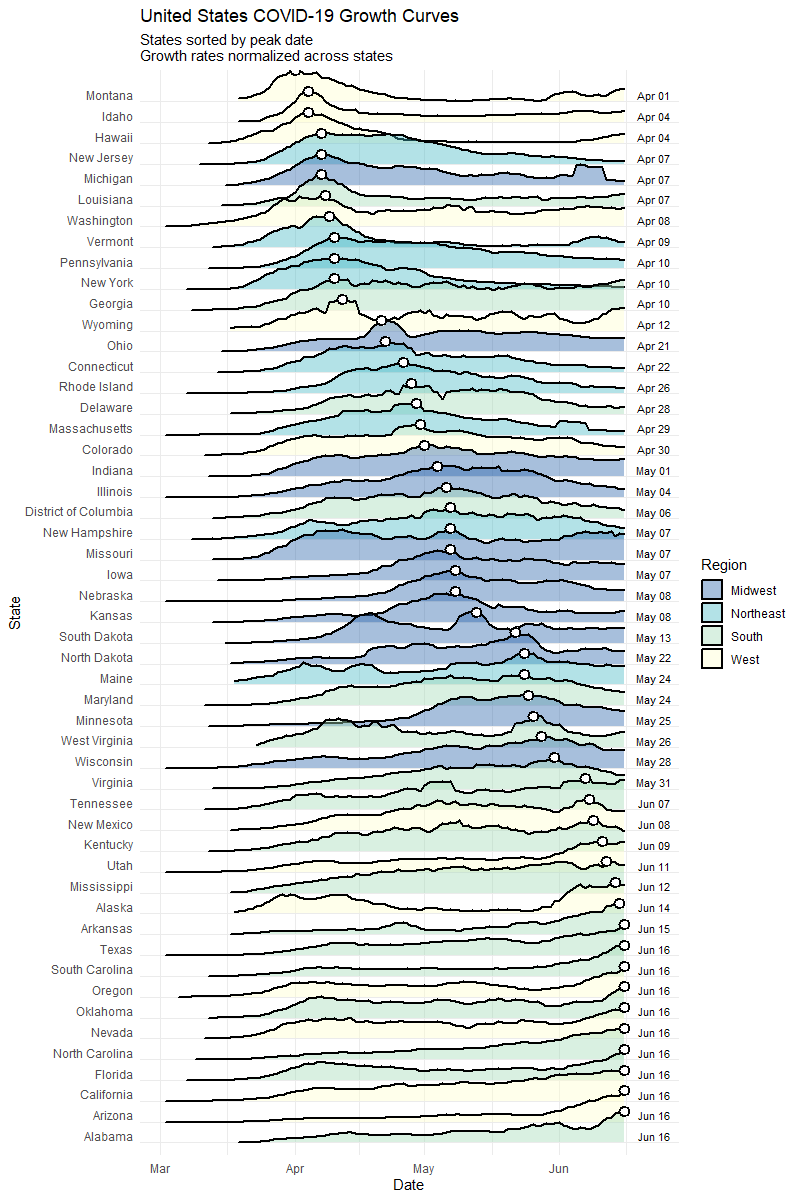

The following visualization by Reddit user jawsem17 is designed using a similar concept, and is current as of June 17th.

This version uses the same data set from the New York Times. However, it also includes deaths as a metric, showing a comparison of peak deaths to peak cases for each state.

Although one would expect peak deaths to follow peak cases, this is not always the case.

Peak deaths in Nevada, for example, occurred on April 24th, but peak cases have been in the last week. This same peculiar pattern can be seen in a variety of states, from California to Oklahoma.

Mapped: The Evolution of COVID-19 in the U.S.

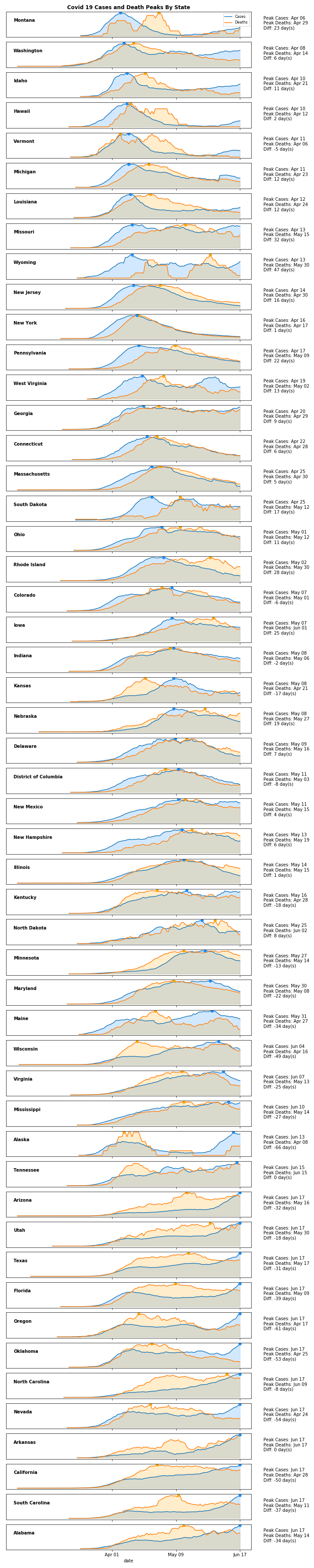

As the pandemic spreads and the situation has evolved, the mean center of weekly COVID-19 cases has been moving in a southwest direction.

The following map, which also comes from Reddit user bgregory98, averages the center coordinates of all counties weighted by how many new confirmed cases they have had over the past week:

Originating in Ohio, the mean center of cases was initially heavily skewed by cases in the New York metro area. Since then, the mean center of cases has shifted and has now journeyed slightly past the mean center of U.S. population, located in Missouri.

This is partially a regression to the mean, but it is also driven by growing case counts in aforementioned states in the southern and western parts of the country.

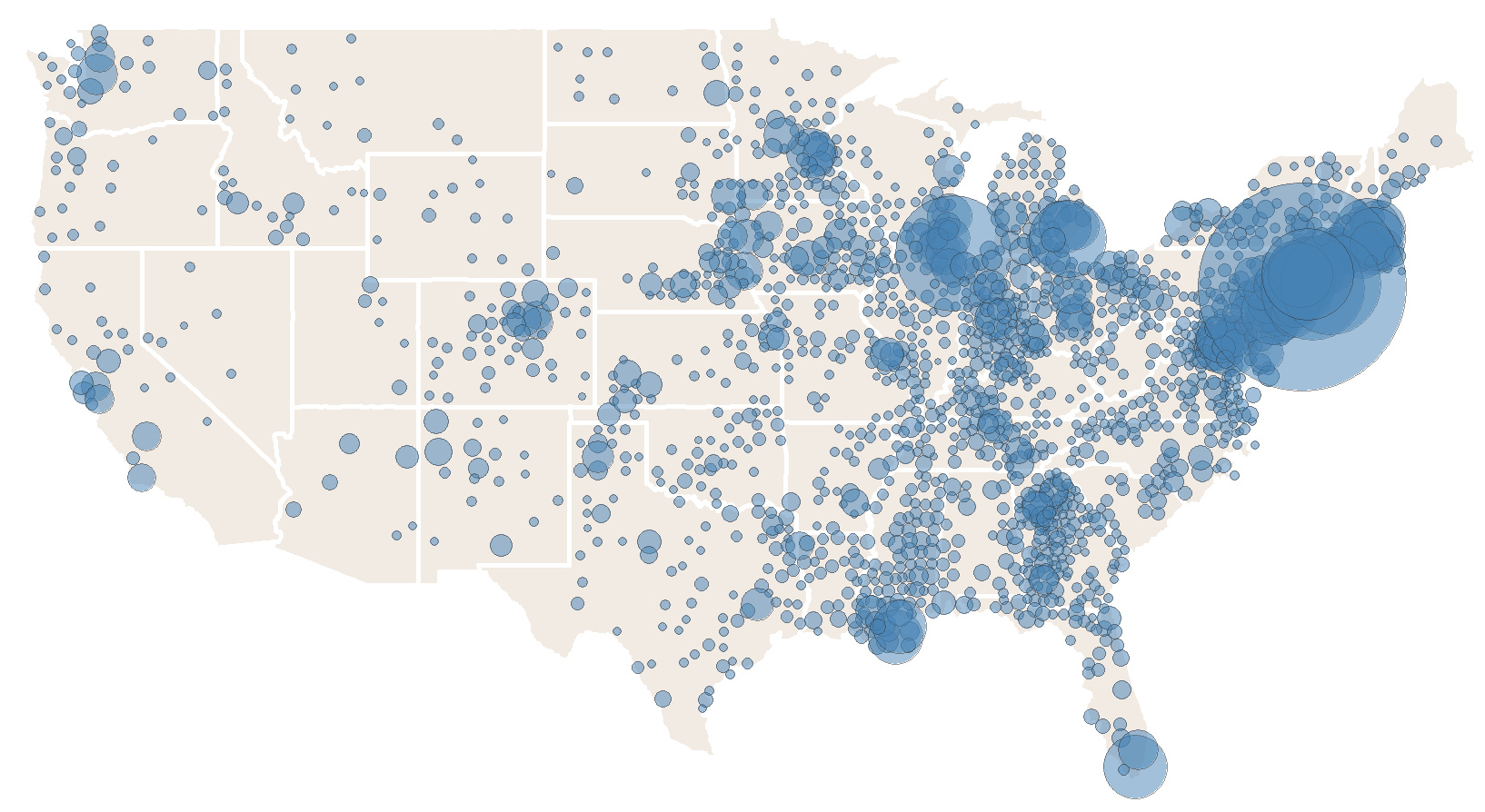

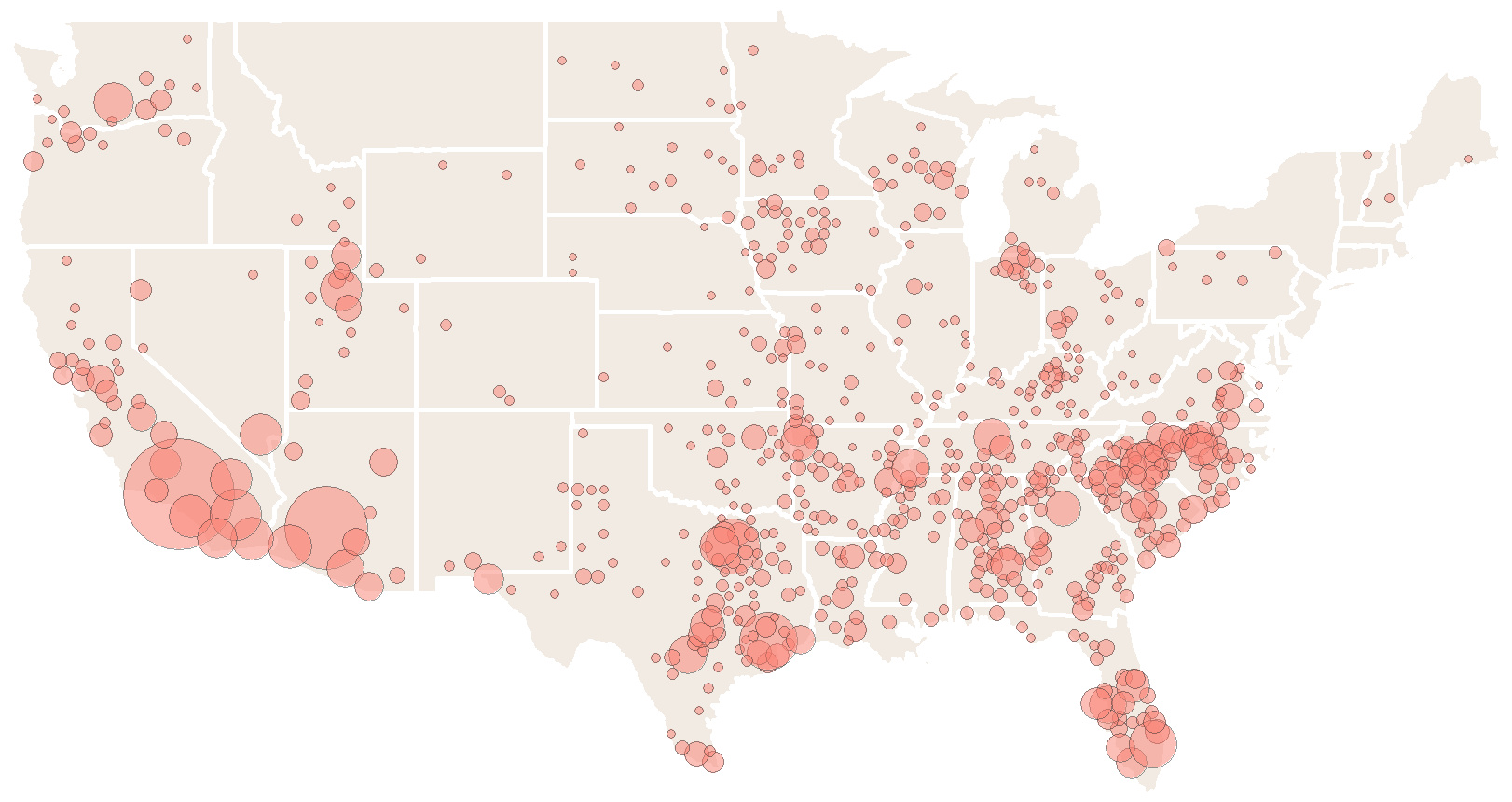

Mapped: Peak County Totals

Finally, the progression of COVID-19 within the U.S. can be mapped in another useful way, revealing a geographical perspective to the virus’ spread.

These maps from Winston Saunders show places where current disease levels are below their previous peaks (blue), and where current COVID-19 cases are at highs (red) as of June 18:

Cases Below Previous Peaks

Cases at Peak Levels

This again shows the shift from the Northeast and Midwest parts of the country towards the West and South regions.

As always, the path of the virus’ spread will continue to change and evolve, and the picture could again look quite different in just a few weeks time.

Healthcare

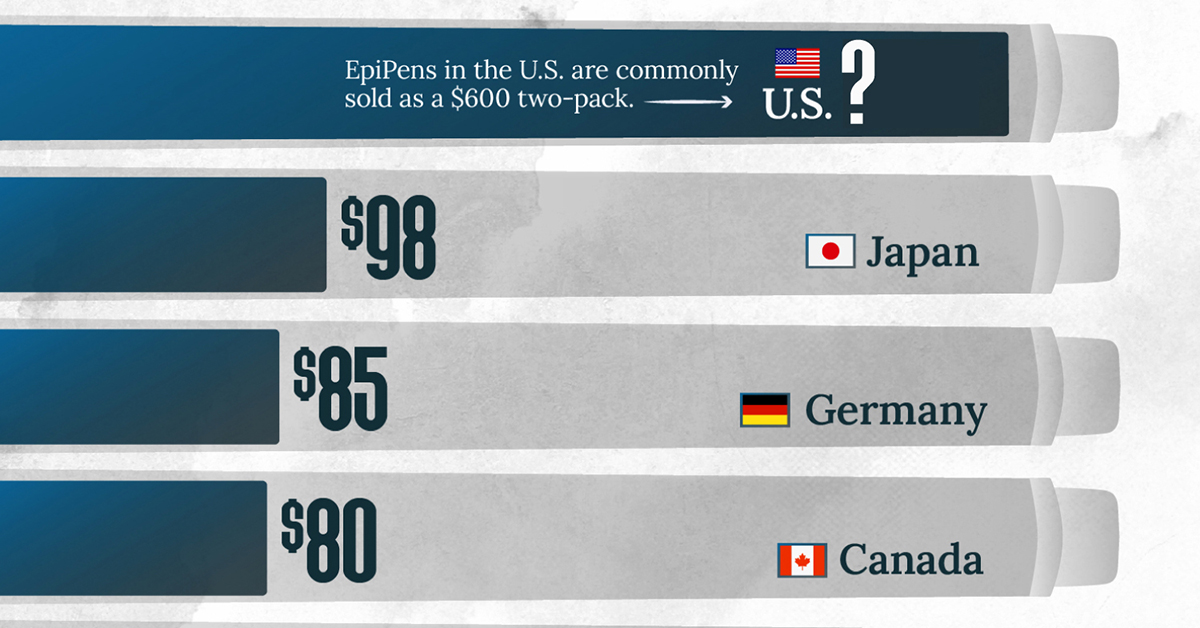

The Cost of an EpiPen in Major Markets

This visualization compares EpiPen prices around the world, with the U.S. having the highest prices by far.

The Cost of an EpiPen in Major Markets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

EpiPens are auto-injectors containing epinephrine, a drug that can treat or reverse severe allergic reactions, potentially preventing death.

The global epinephrine market was valued at $1.75 billion in 2022 and is projected to reach $4.08 billion by 2030. North America represents over 60% of the market.

EpiPens, however, can be prohibitively expensive in some regions.

In this graphic, we present estimated EpiPen prices in major global markets, compiled by World Population Review and converted to U.S. dollars as of August 2023.

Why are U.S. Prices so High?

The U.S. stands out as the most expensive market for EpiPens, despite over 1 million Americans having epinephrine prescriptions. After Mylan (now part of Pfizer) acquired the rights to produce EpiPens in the U.S. in 2007, the cost of a two-pack skyrocketed to $600, up from about $60.

| Country | Price (USD) |

|---|---|

| 🇺🇸 U.S. | 300* |

| 🇯🇵 Japan | 98 |

| 🇩🇪 Germany | 85 |

| 🇨🇦 Canada | 80 |

| 🇫🇷 France | 76 |

| 🇦🇺 Australia | 66 |

| 🇬🇧 UK | 61 |

| 🇮🇳 India | 30 |

*Per unit cost. Commonly sold as a two-pack, meaning total cost is equal to $600

Former Mylan CEO Heather Bresch defended the price hikes to Congress, citing minimal profit margins. Mylan eventually settled with the U.S. government for a nine-figure sum.

Notably, EpiPens are available at a fraction of the cost in other developed countries like Japan, Germany, and Canada.

Making EpiPens More Affordable

Efforts to improve EpiPen affordability are underway in several U.S. states. For instance, the Colorado House approved a $60 price cap on epinephrine, now under review by the state Senate.

Similar measures in Rhode Island, Delaware, Missouri, and Vermont aim to ensure insurance coverage for epinephrine, which is not currently mandatory, although most health plans cover it.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)