Markets

These Global Cities Show the Highest Real Estate Bubble Risk

These Global Cities Show the Highest Real Estate Bubble Risk

Housing bubbles are a tricky phenomenon. As a market gathers steam and prices increase, it remains a matter of debate whether that market is overvalued and flooded with speculation, or it’s simply experiencing robust demand.

Of course, once a bubble bursts, it’s all obvious in hindsight.

One common red flag is when prices decouple from local incomes and rents. As well, imbalances in the real economy, such as excessive construction activity and lending can signal a bubble in the making.

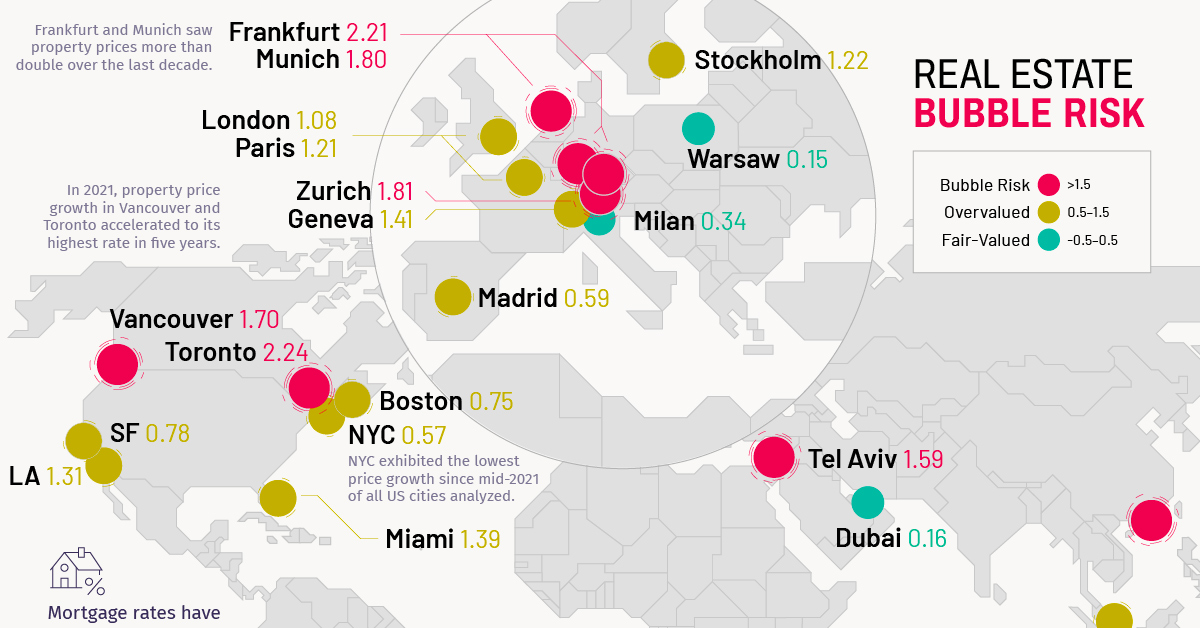

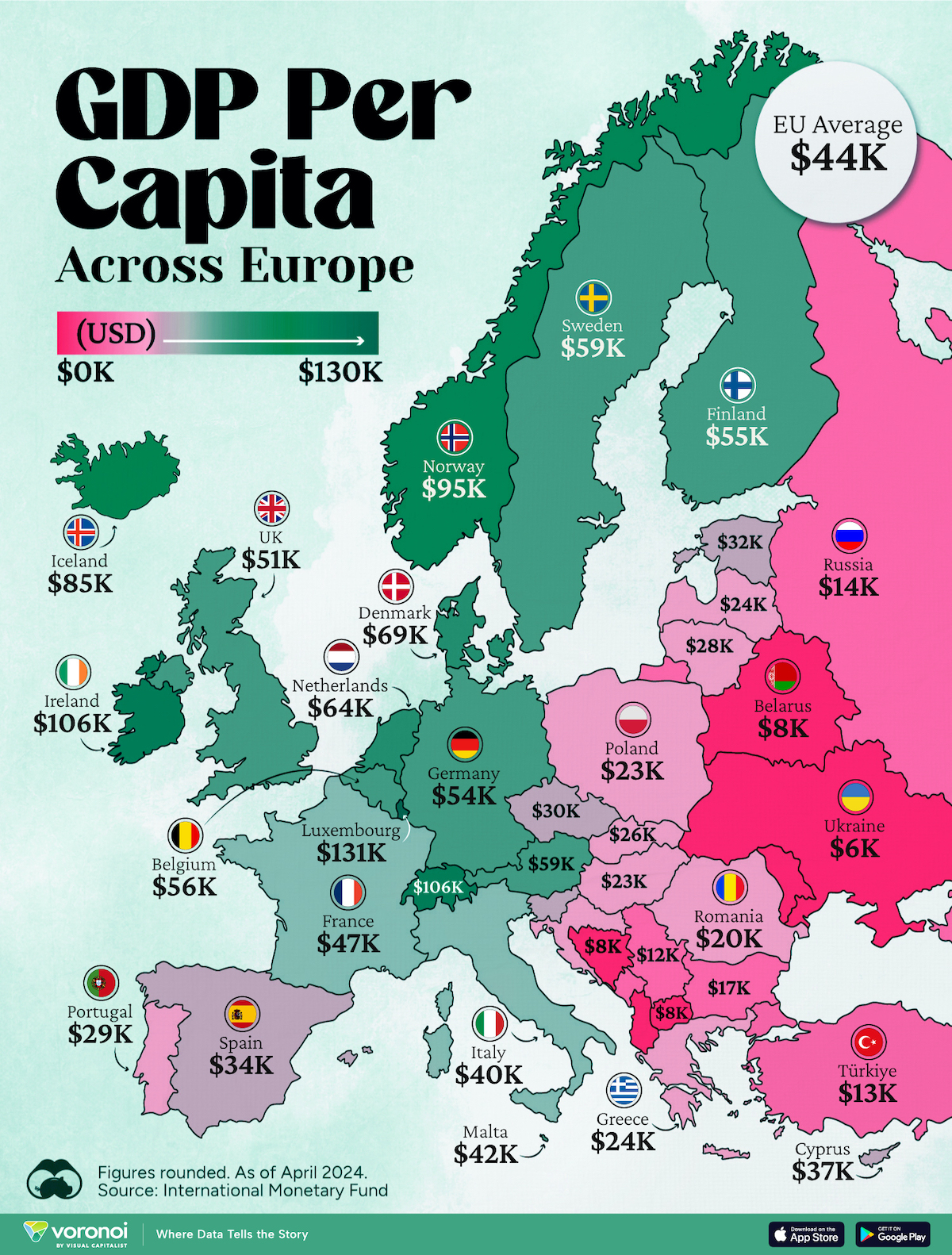

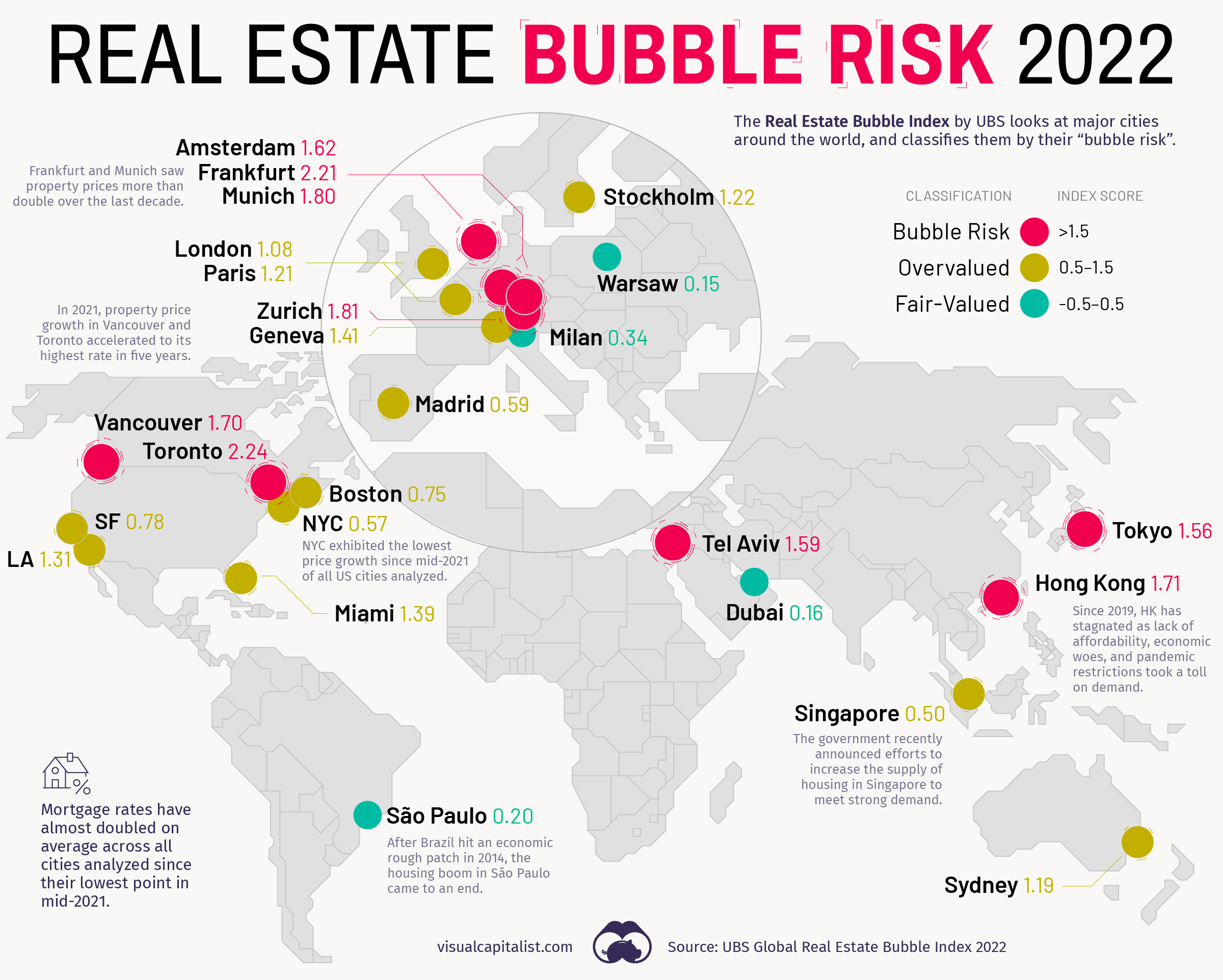

The map above, based on data from the Real Estate Bubble Index by UBS, examines 25 global cities, scoring them based on their bubble risk.

Overinflated Markets

In the 2022 edition of the Real Estate Bubble Index, nine of the cities covered were classified as having extreme bubble risk (1.5 or higher score).

| Rank | Risk Category | City | Bubble Index Score |

|---|---|---|---|

| #1 | 🔴 | 🇨🇦 Toronto | 2.24 |

| #2 | 🔴 | 🇩🇪 Frankfurt | 2.21 |

| #3 | 🔴 | 🇨🇭 Zurich | 1.81 |

| #4 | 🔴 | 🇩🇪 Munich | 1.80 |

| #5 | 🔴 | 🇭🇰 Hong Kong | 1.71 |

| #6 | 🔴 | 🇨🇦 Vancouver | 1.70 |

| #7 | 🔴 | 🇳🇱 Amsterdam | 1.62 |

| #8 | 🔴 | 🇮🇱 Tel Aviv | 1.59 |

| #9 | 🔴 | 🇯🇵 Tokyo | 1.56 |

| #10 | 🟠 | 🇺🇸 Miami | 1.39 |

| #11 | 🟠 | 🇺🇸 Los Angeles | 1.31 |

| #12 | 🟠 | 🇸🇪 Stockholm | 1.22 |

| #13 | 🟠 | 🇫🇷 Paris | 1.21 |

| #14 | 🟠 | 🇦🇺 Sydney | 1.19 |

| #15 | 🟠 | 🇨🇭 Geneva | 1.14 |

| #16 | 🟠 | 🇬🇧 London | 1.08 |

| #17 | 🟠 | 🇺🇸 San Francisco | 0.78 |

| #18 | 🟠 | 🇺🇸 Boston | 0.75 |

| #19 | 🟠 | 🇪🇸 Madrid | 0.59 |

| #20 | 🟠 | 🇺🇸 New York | 0.57 |

| #21 | 🟠 | 🇸🇬 Singapore | 0.50 |

| #22 | 🟢 | 🇮🇹 Milan | 0.34 |

| #23 | 🟢 | 🇧🇷 Sao Paulo | 0.20 |

| #24 | 🟢 | 🇦🇪 Dubai | 0.16 |

| #25 | 🟢 | 🇵🇱 Warsaw | 0.15 |

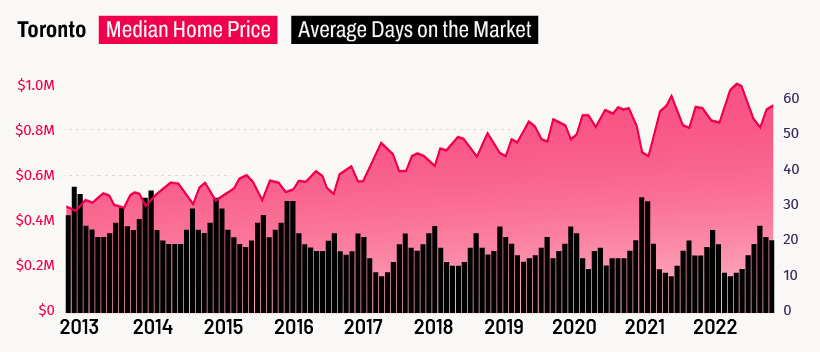

Canada’s largest city finds itself at the top of a ranking no city wants to end up on. Toronto’s home prices have been rising steadily for years now, and many, including UBS, believe that the city is now firmly in bubble territory.

Vancouver also finds itself in a similar position. Both Canadian cities have a high quality of life and have thriving tech industries.

Notably, none of the U.S. cities analyzed find themselves in the most extreme bubble risk category. The closest scoring U.S. city was Miami, which sits firmly in overvalued territory (0.5-1.5 range) with a score of 1.39.

Examining the Trends

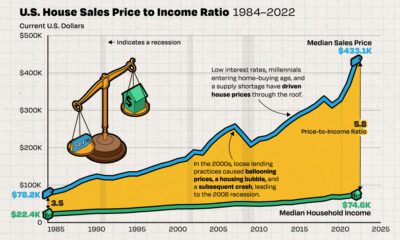

In recent years, low interest rates helped push home prices and incomes further apart.

For cities in the bubble risk zone, prices have climbed by an average of 60% in inflation-adjusted terms over the past decade, while rents and real incomes increased by just 12%. And, while COVID-19 briefly put a dent in urban demand, rents in the cities analyzed rose at around the same pace as pre-pandemic times.

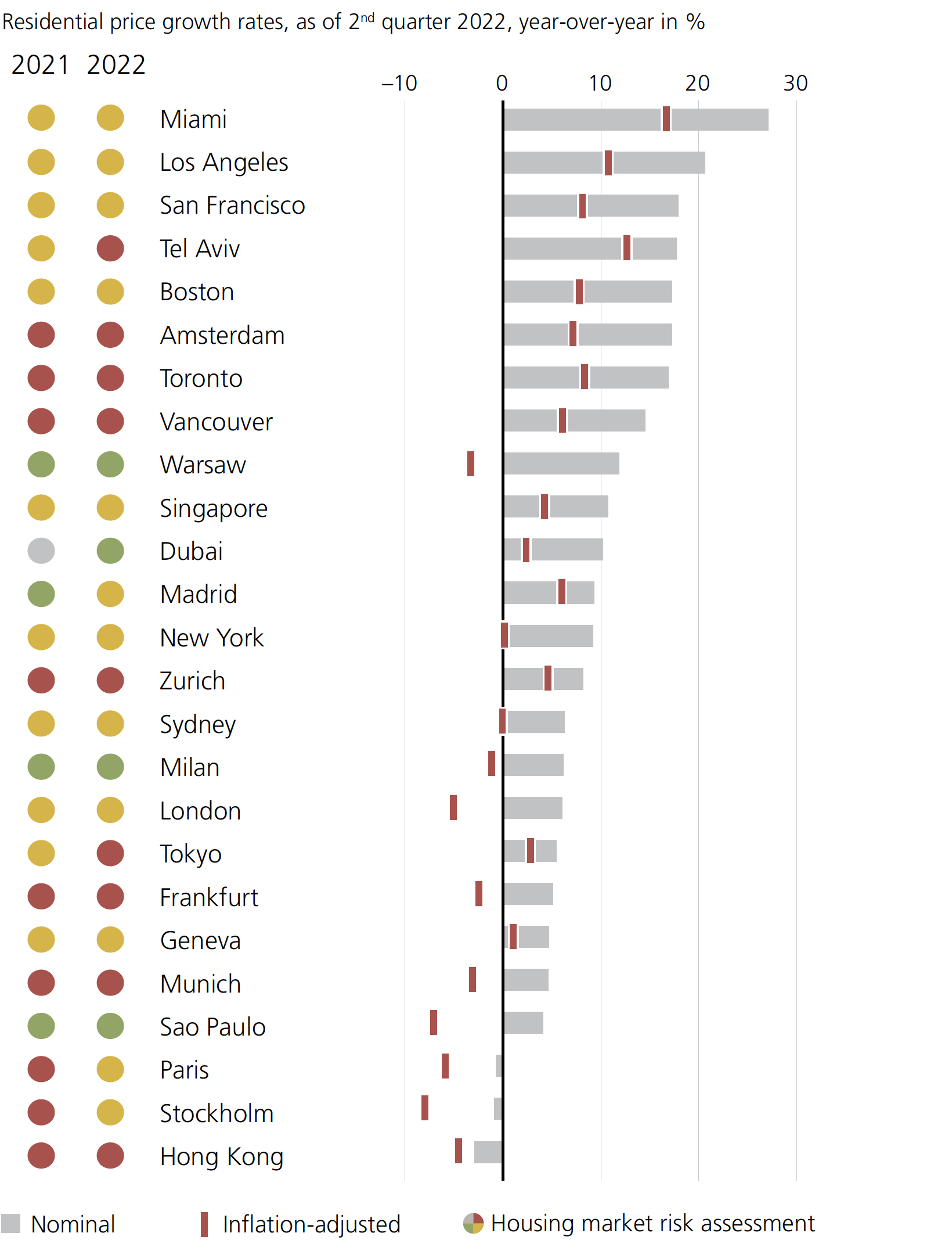

As a result, all but three of the cities saw positive price growth over the past year from a nominal price perspective:

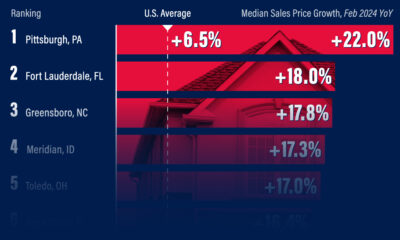

U.S. cities occupy a number of spots at the top of this chart. Miami, in particular, is seeing strong internal migration patterns, as well as renewed interest from foreign investors.

Hong Kong experienced the biggest one-year nominal drop of all the cities analyzed. The report notes that since around 2019 Hong Kong “has broadly stagnated as the lack of affordability, economic woes, and pandemic restrictions all took a major toll on demand.”

Prices can’t rise forever. According to UBS, most cities with high valuations, price corrections have already begun, or could be right around the corner.

Markets

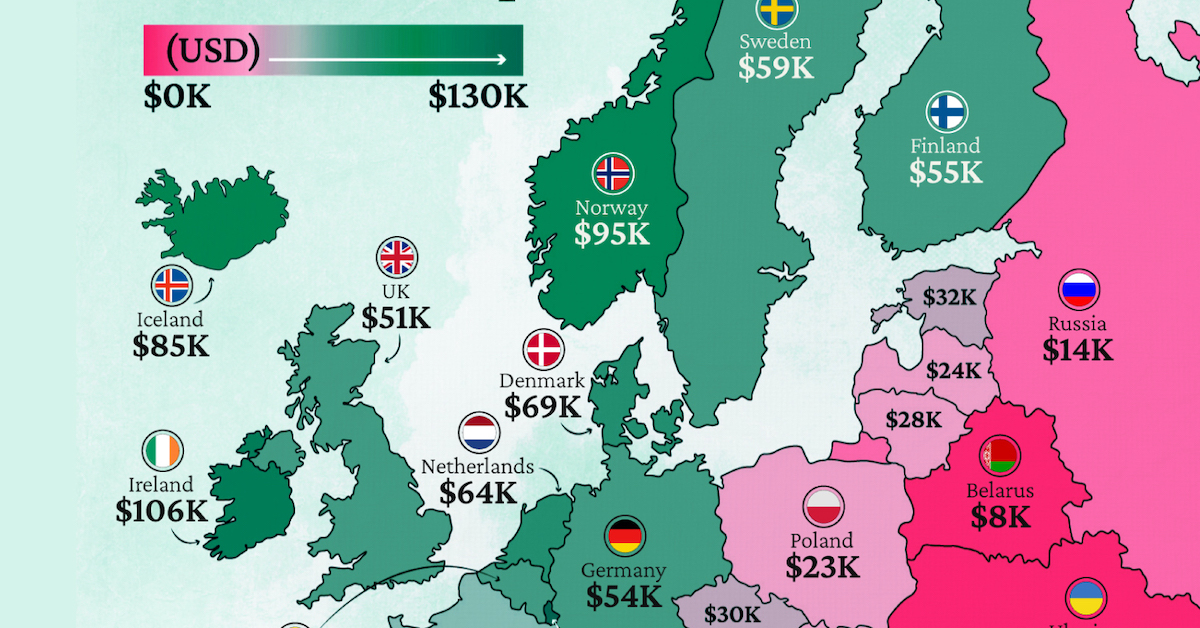

Mapped: Europe’s GDP Per Capita, by Country

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

Mapped: Europe’s GDP Per Capita, by Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Europe is home to some of the largest and most sophisticated economies in the world. But how do countries in the region compare with each other on a per capita productivity basis?

In this map, we show Europe’s GDP per capita levels across 44 nations in current U.S. dollars. Data for this visualization and article is sourced from the International Monetary Fund (IMF) via their DataMapper tool, updated April 2024.

Europe’s Richest and Poorest Nations, By GDP Per Capita

Luxembourg, Ireland, and Switzerland, lead the list of Europe’s richest nations by GDP per capita, all above $100,000.

| Rank | Country | GDP Per Capita (2024) |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $131,380 |

| 2 | 🇮🇪 Ireland | $106,060 |

| 3 | 🇨🇭 Switzerland | $105,670 |

| 4 | 🇳🇴 Norway | $94,660 |

| 5 | 🇮🇸 Iceland | $84,590 |

| 6 | 🇩🇰 Denmark | $68,900 |

| 7 | 🇳🇱 Netherlands | $63,750 |

| 8 | 🇸🇲 San Marino | $59,410 |

| 9 | 🇦🇹 Austria | $59,230 |

| 10 | 🇸🇪 Sweden | $58,530 |

| 11 | 🇧🇪 Belgium | $55,540 |

| 12 | 🇫🇮 Finland | $55,130 |

| 13 | 🇩🇪 Germany | $54,290 |

| 14 | 🇬🇧 UK | $51,070 |

| 15 | 🇫🇷 France | $47,360 |

| 16 | 🇦🇩 Andorra | $44,900 |

| 17 | 🇲🇹 Malta | $41,740 |

| 18 | 🇮🇹 Italy | $39,580 |

| 19 | 🇨🇾 Cyprus | $37,150 |

| 20 | 🇪🇸 Spain | $34,050 |

| 21 | 🇸🇮 Slovenia | $34,030 |

| 22 | 🇪🇪 Estonia | $31,850 |

| 23 | 🇨🇿 Czech Republic | $29,800 |

| 24 | 🇵🇹 Portugal | $28,970 |

| 25 | 🇱🇹 Lithuania | $28,410 |

| 26 | 🇸🇰 Slovakia | $25,930 |

| 27 | 🇱🇻 Latvia | $24,190 |

| 28 | 🇬🇷 Greece | $23,970 |

| 29 | 🇭🇺 Hungary | $23,320 |

| 30 | 🇵🇱 Poland | $23,010 |

| 31 | 🇭🇷 Croatia | $22,970 |

| 32 | 🇷🇴 Romania | $19,530 |

| 33 | 🇧🇬 Bulgaria | $16,940 |

| 34 | 🇷🇺 Russia | $14,390 |

| 35 | 🇹🇷 Türkiye | $12,760 |

| 36 | 🇲🇪 Montenegro | $12,650 |

| 37 | 🇷🇸 Serbia | $12,380 |

| 38 | 🇦🇱 Albania | $8,920 |

| 39 | 🇧🇦 Bosnia & Herzegovina | $8,420 |

| 40 | 🇲🇰 North Macedonia | $7,690 |

| 41 | 🇧🇾 Belarus | $7,560 |

| 42 | 🇲🇩 Moldova | $7,490 |

| 43 | 🇽🇰 Kosovo | $6,390 |

| 44 | 🇺🇦 Ukraine | $5,660 |

| N/A | 🇪🇺 EU Average | $44,200 |

Note: Figures are rounded.

Three Nordic countries (Norway, Iceland, Denmark) also place highly, between $70,000-90,000. Other Nordic peers, Sweden and Finland rank just outside the top 10, between $55,000-60,000.

Meanwhile, Europe’s biggest economies in absolute terms, Germany, UK, and France, rank closer to the middle of the top 20, with GDP per capitas around $50,000.

Finally, at the end of the scale, Eastern Europe as a whole tends to have much lower per capita GDPs. In that group, Ukraine ranks last, at $5,660.

A Closer Look at Ukraine

For a broader comparison, Ukraine’s per capita GDP is similar to Iran ($5,310), El Salvador ($5,540), and Guatemala ($5,680).

According to experts, Ukraine’s economy has historically underperformed to expectations. After the fall of the Berlin Wall, the economy contracted for five straight years. Its transition to a Western, liberalized economic structure was overshadowed by widespread corruption, a limited taxpool, and few revenue sources.

Politically, its transformation from authoritarian regime to civil democracy has proved difficult, especially when it comes to institution building.

Finally, after the 2022 invasion of the country, Ukraine’s GDP contracted by 30% in a single year—the largest loss since independence. Large scale emigration—to the tune of six million refugees—is also playing a role.

Despite these challenges, the country’s economic growth has somewhat stabilized while fighting continues.

-

Markets6 days ago

Markets6 days agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Markets2 weeks ago

Markets2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App