Real Estate

Ranked: Canada’s Housing Markets, by Price Growth in 2023

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Ranked: Canada’s Housing Markets By Price Growth in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Between 2010 and 2022, real Canadian housing prices jumped 90%, making Canada one of the most expensive and unaffordable housing markets in the world.

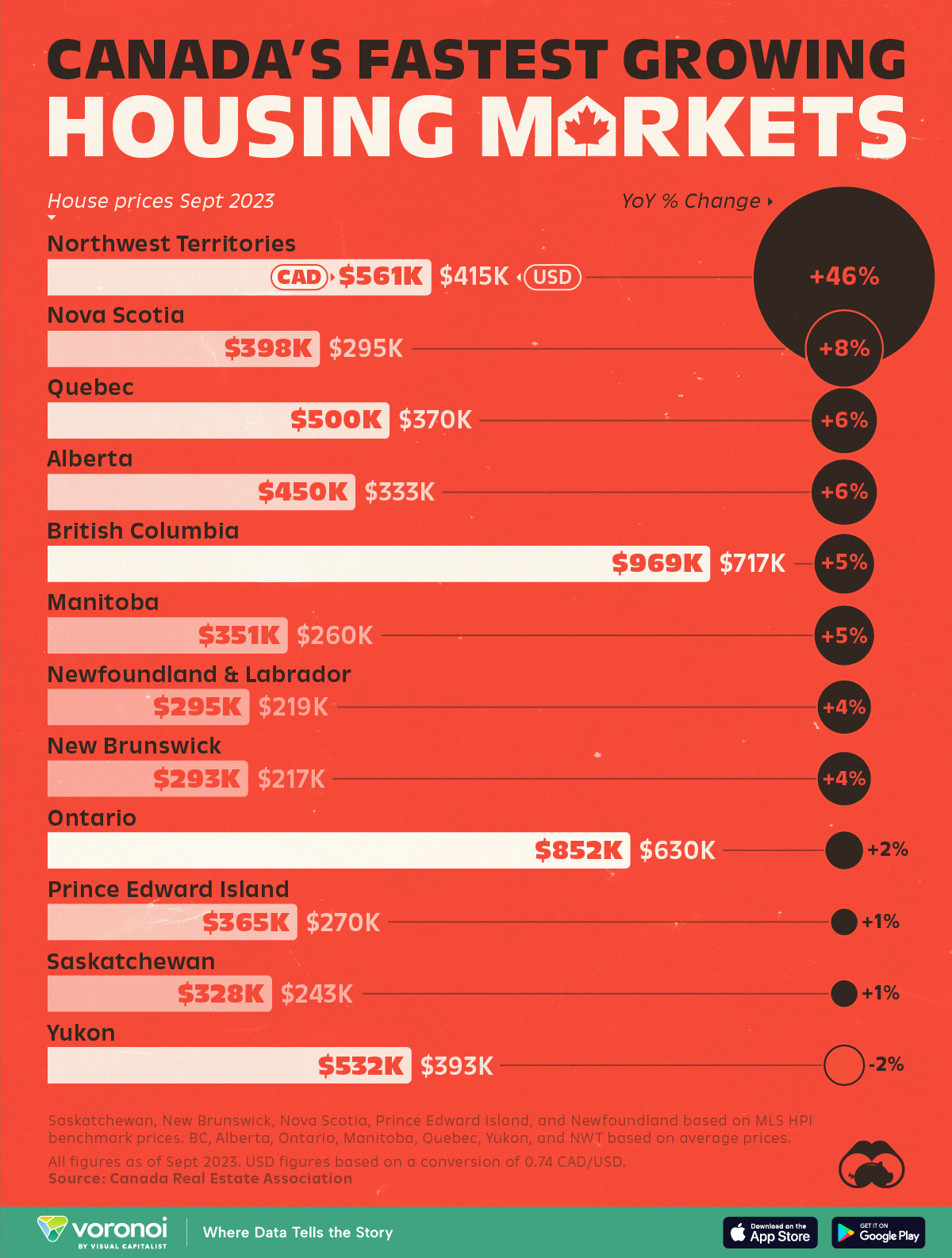

We visualize the average price of housing across Canada’s provinces and territories in 2023 (excluding Nunavut), based on data from the Canada Real Estate Association (CREA).

The data visualized above is a mix of averages provided by provincial organizations to CREA as well as benchmarks found using CREA’s MLS® HPI tool. Data from the MLS tool is labeled with an asterisk in the below table, and the methodology behind how it is calculated can be found here.

All prices in this article are in Canadian dollars (CAD). The chart above adds in the U.S. dollar (USD) equivalent based on a 0.74 CAD/USD conversion rate.

One Canadian Housing Market is Not Slowing Down

The average price of a house in the Northwest Territories (NWT) comfortably crossed half a million dollars in September, 2023, a 40% jump from $385,500 a year earlier.

However a house in NWT still costs below the country-wide average of $640,000.

Here’s how the rest of Canada’s housing markets did between September 2022–23, ranked by percentage price growth.

| Rank | Province / Territory | Average House Price (Sept 2022, CAD) | Average House Price (Sept 2023, CAD) | YoY Change |

|---|---|---|---|---|

| 1 | Northwest Territories | $385,492 | $561,080 | +46% |

| 2 | Novia Scotia* | $370,000 | $398,000 | +8% |

| 3 | Quebec | $470,108 | $499,911 | +6% |

| 4 | Alberta | $425,132 | $450,105 | +6% |

| 5 | British Columbia | $922,152 | $969,306 | +5% |

| 6 | Manitoba | $335,488 | $351,445 | +5% |

| 7 | Newfoundland & Labrador | $285,100 | $295,400 | +4% |

| 8 | New Brunswick* | $280,600 | $292,600 | +4% |

| 9 | Ontario | $835,848 | $851,756 | +2% |

| 10 | Prince Edward Island* | $362,300 | $365,200 | +1% |

| 11 | Saskatchewan* | $324,500 | $328,000 | +1% |

| 12 | Yukon | $541,363 | $531,609 | -2% |

Note: *Data from MLS® HPI tool. Other data are average prices. Nunavut data not available from the source.

The price boom in NWT, which picked up pace during the pandemic, is due to a lack of supply and new construction. The territory has also seen greater wildfire risk over the years—in 2023, nearly 70% of the population faced displacement due to encroaching fires. Over the long, hot summer, wildfires wiped out towns and forced the entire city of Yellowknife (population 20,000) to evacuate for three weeks.

The federal government has promised the construction of 50 new affordable homes to mitigate some of the destruction.

While no other housing market has mirrored what’s happening in NWT, every one of them, except the Yukon has seen some sort of price growth.

For British Columbia, and Ontario—the country’s most expensive regions—prices are closer to $1 million than not. Their biggest cities, Vancouver and Toronto routinely feature in annual reports on real estate bubbles around the world.

However, both regions have recently seen a housing supply surge which may cause prices to drop as much as 10% in 2024—still leaving them 15% higher than before the pandemic.

Markets

Ranked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

The Most Valuable Housing Markets in America

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

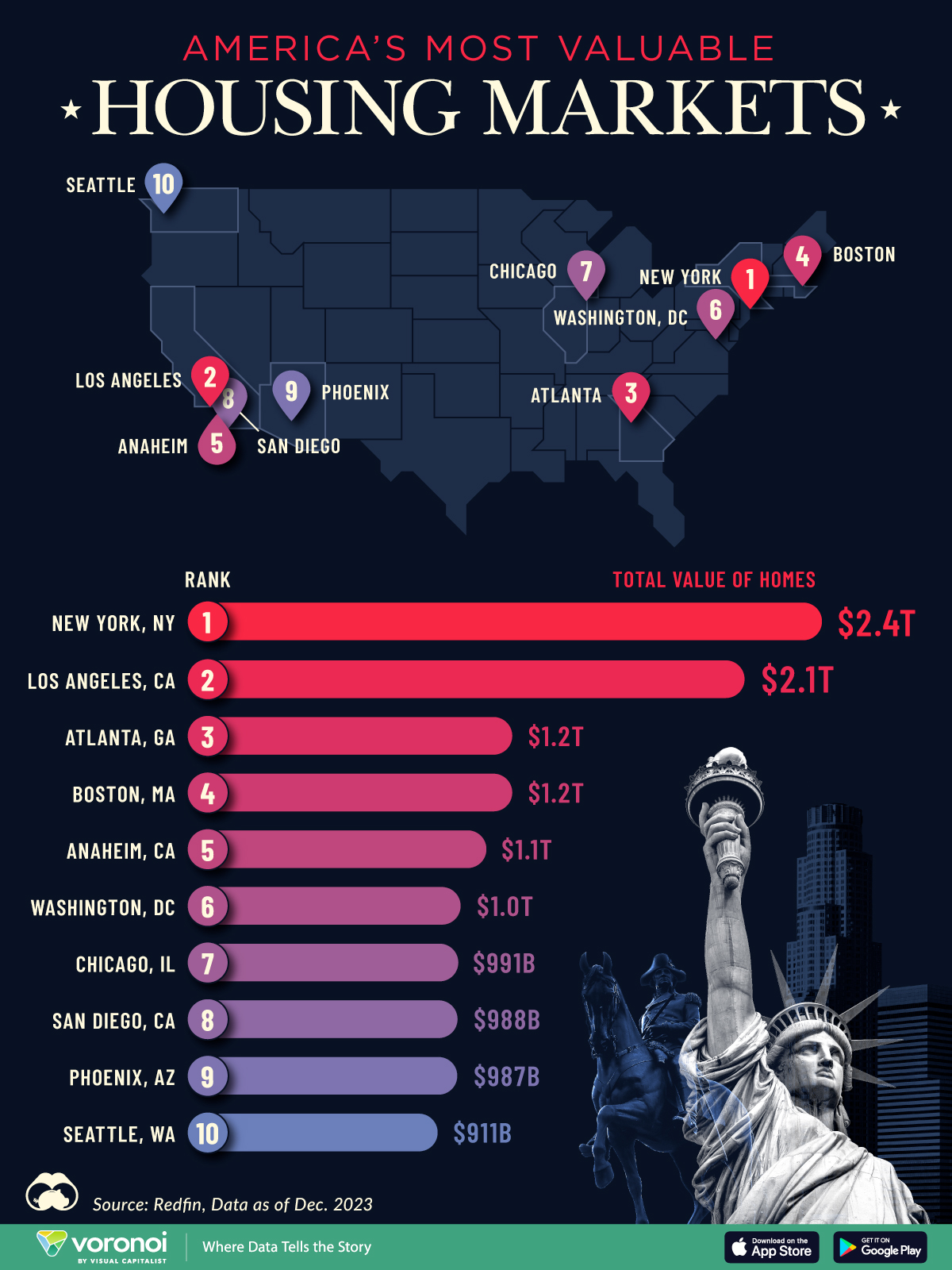

The residential real estate market in the U.S. stands as one of the largest asset classes in the country, worth $47.5 trillion in 2023.

Despite a slowdown in home sales, the total value of homes increased $2.4 trillion last year as low inventory levels pushed up prices. Affordable metropolitan areas saw steady price growth, while expensive metros experienced slower price appreciation.

This graphic shows America’s most valuable housing markets, using data from Redfin.

Top U.S. Residential Real Estate Markets

To calculate the largest U.S. housing markets, Redfin analyzed 90 million properties covering single-family homes, townhouses, condos, and two-to four-unit multifamily properties.

Below, we show the most valuable residential markets as of December 2023:

| Rank | U.S. Metro | Total Value of Homes | Total Value of Homes YoY Change |

|---|---|---|---|

| 1 | New York, NY | $2.4T | -1.0% |

| 2 | Los Angeles, CA | $2.1T | +4.3% |

| 3 | Atlanta, GA | $1.2T | +6.2% |

| 4 | Boston, MA | $1.2T | +8.3% |

| 5 | Anaheim, CA | $1.1T | +8.0% |

| 6 | Washington, DC | $1.0T | +6.2% |

| 7 | Chicago, IL | $991B | +7.4% |

| 8 | San Diego, CA | $988B | +9.4% |

| 9 | Phoenix, AZ | $987B | +4.2% |

| 10 | Seattle, WA | $911B | +4.6% |

With a housing market worth $2.4 trillion, New York, NY tops the list.

Unlike the majority of large U.S. cities, the aggregate value of homes declined as buyers became increasingly priced out of the market. At the same time, homeowners hesitated to sell in order to lock in low mortgage rates. In fact, more than 80% of mortgage holders in New York City have interest rates that are 5% or lower.

Los Angeles, CA falls in second, with a residential real estate market worth $2.0 trillion. Last year, existing home sales tumbled 24.8%, falling to the lowest point since 2007. However, the housing shortage led prices to increase amid high demand. The median sale price climbed to $975,000 in February 2024, a 5.9% jump compared to the same time last year.

Atlanta, GA ranks third and is the most overpriced housing market in the country according to one countrywide analysis. Homes have been selling for 41.7% more than their worth as of the February 2024 data update.

People are flocking to the city for many reasons. General housing affordability is a major driver, along with its thriving tech center. Along with this, state tax credits have increasingly made it a hub for the TV and film industries, earning it the moniker “Y’allywood”. Another factor in Atlanta’s inflating housing market are large investment firms, which own a huge footprint of homes in the city.

Editor’s note: For those wondering about the Bay Area, the data groups cities like San Francisco ($657 billion), San Jose ($821 billion), and Oakland ($881 billion) as individual entities, which puts them outside the cutoff. See the Redfin data for the full list of cities.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees