Business

The Future of the CFO: From Number Cruncher to Value Driver

View the full-size version of this infographic.

Future of the CFO: From Number Cruncher to Value Driver

View the high resolution of this infographic by clicking here.

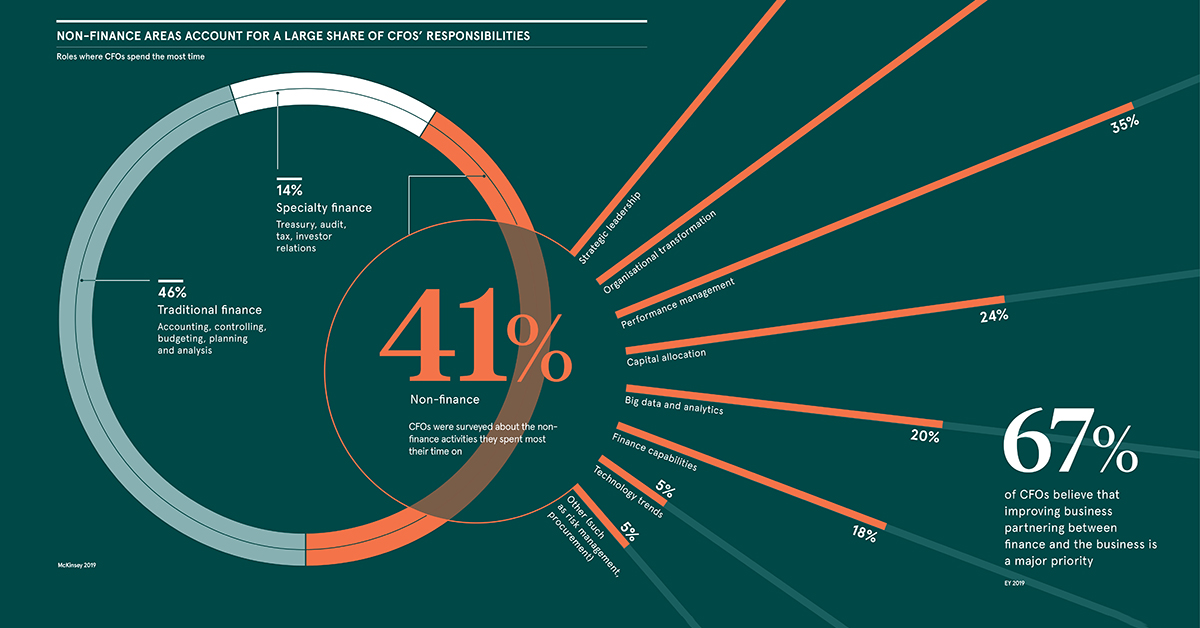

In today’s fast-paced business landscape, a company’s chief financial officer (CFO) is more integral to operations than ever. In fact, about 41% of CFOs spend the majority of their time on non-finance related activities, fueling data-driven decisions across the business.

The only problem? Leaders outside of finance still see CFOs contributing the most value in traditional finance areas, such as accounting and controlling.

Today’s infographic from Raconteur explores the expanding scope of CFO responsibilities, as well as the perception gap between CFOs and non-finance leaders when it comes to the former’s primary value-driving activities.

The CFO’s Expanding Role

Traditionally, the CFO was focused on financial reporting and issues such as compliance, accounts, and taxation. However, the scope of a CFO’s duties has increased dramatically in recent years. Thanks to technological advances, CFOs are now able to access massive amounts of data on their organization’s operational and financial performance.

“This puts the finance function at the heart or, arguably, the mind of the business from the outset, with many now being crowned as the ‘stewards’ of the long-term enterprise vision.”

—Robin Bryson, Interim CFO at Impero Software

Armed with data, CFOs can help predict headwinds, forecast performance, and make informed decisions across departments. In a global survey, McKinsey asked finance leaders about the breadth of their responsibilities. Of the CFOs who said they spend they a majority of their time on non-finance tasks, here’s where their attention is focused:

| Activity | % of CFOs Focused on Activity |

|---|---|

| Strategic leadership | 46% |

| Organizational transformation | 45% |

| Performance management | 35% |

| Capital allocation | 24% |

| Big data and analytics | 20% |

| Finance capabilities | 18% |

| Technology trends | 5% |

| Other (e.g. risk management) | 5% |

However, other business leaders remain in the dark about this broader role.

Differing Views

While the CFO’s job description has evolved considerably, outside perceptions of it have not. In a survey of both CFOs and non-finance leaders, there is a clear difference of opinion with regards to where financial leaders create the most value:

| Areas in which CFOs have created the most financial value | % of CFOs who agree | % of others who agree |

|---|---|---|

| Performance management | 39% | 19% |

| Strategic leadership | 39% | 25% |

| Traditional finance roles | 33% | 47% |

| Organizational transformation | 33% | 21% |

| Finance capabilities | 30% | 15% |

| Speciality finance roles | 30% | 27% |

| Cost and productivity management | 26% | 42% |

| Support for digital capabilities and advanced analytics | 15% | 10% |

| Mergers and acquisitions (including post-merger integration) | 14% | 23% |

| Capital allocation | 10% | 22% |

| Pricing of products and/or services | 10% | 8% |

| Management of activist investors | 3% | 3% |

CFOs see their largest contributions in the areas of performance management and strategic leadership, while others still consider the CFO’s value to be derived primarily from traditional finance and cost/productivity management.

How can CFOs demonstrate their increased responsibility to leaders outside of the finance realm?

Closing the Gap

According to McKinsey, CFOs can demonstrate their expanded role in three main ways:

1. Actively head up transformations.

While CFOs are already playing a role in transformations, non-finance leaders are less likely to perceive them as making strategic contributions. CFOs also tend to initiate the most transformations in the finance function alone.

To change perceptions, CFOs can lead enterprise-wide transformations, and communicate their strategic value through activities like high-level goal setting.

2. Lead the charge towards digitization and automation.

Few organizations have initiated the shift in a substantial way, with only ⅓ of finance respondents saying their companies digitized or automated more than 25% of their work in the last year.

However, the payoff is well worth the effort. Among those that have undertaken this level of change, 70% reported modest to substantial returns on investment.

3. Develop talent and capabilities across the organization.

CFOs have begun increasing their value through talent-building, but there is still a significant amount of room for further growth.

For example, CFOs can build capabilities during transformations, teach financial topics to non-finance leaders, and develop top talent across the organization.

Through these various strategies, CFOs can foster collaboration and understanding between departments—and succeed in their broader roles.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)