Technology

Visualizing the Future of Banking Talent

View a high resolution version of this graphic

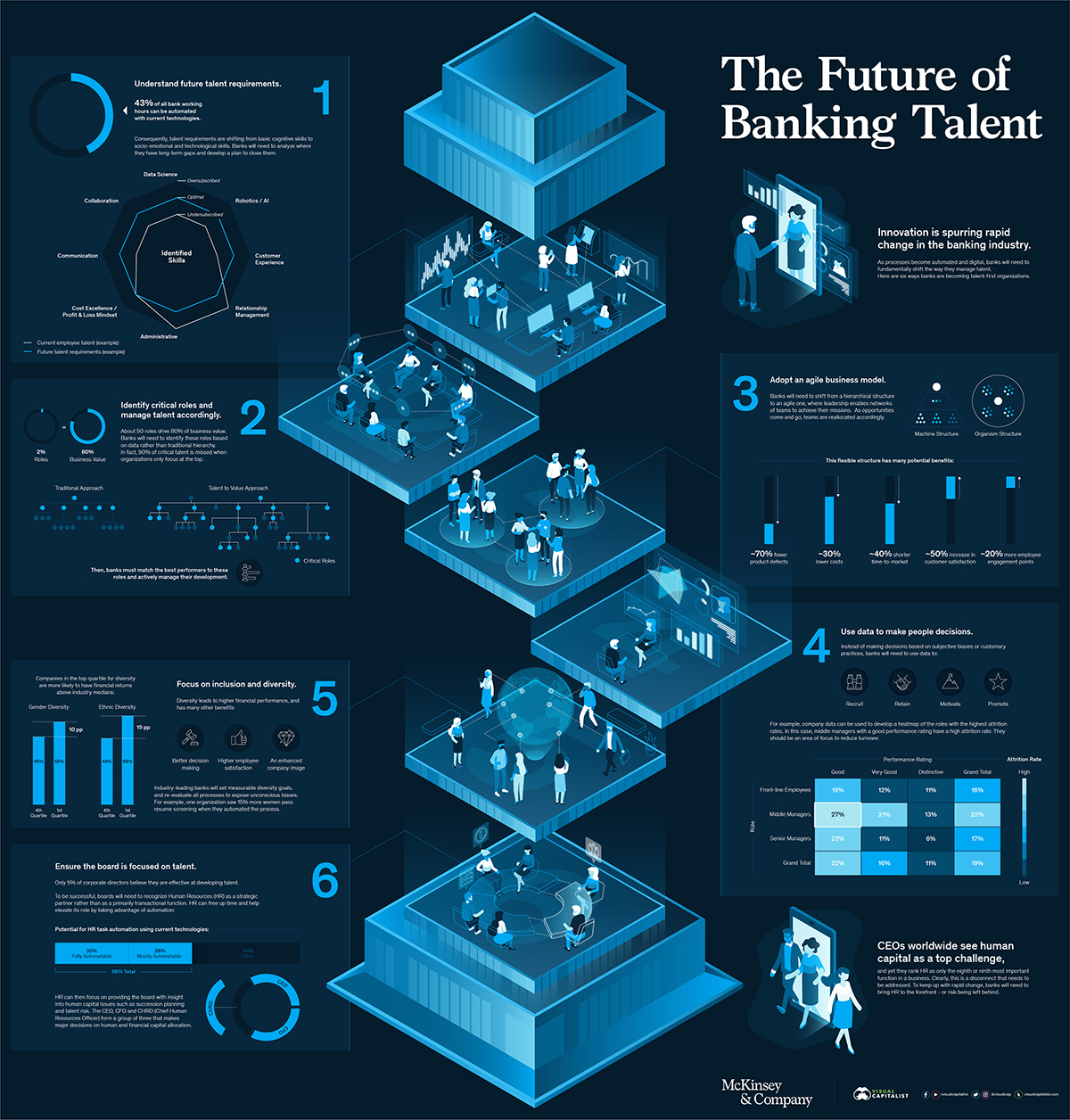

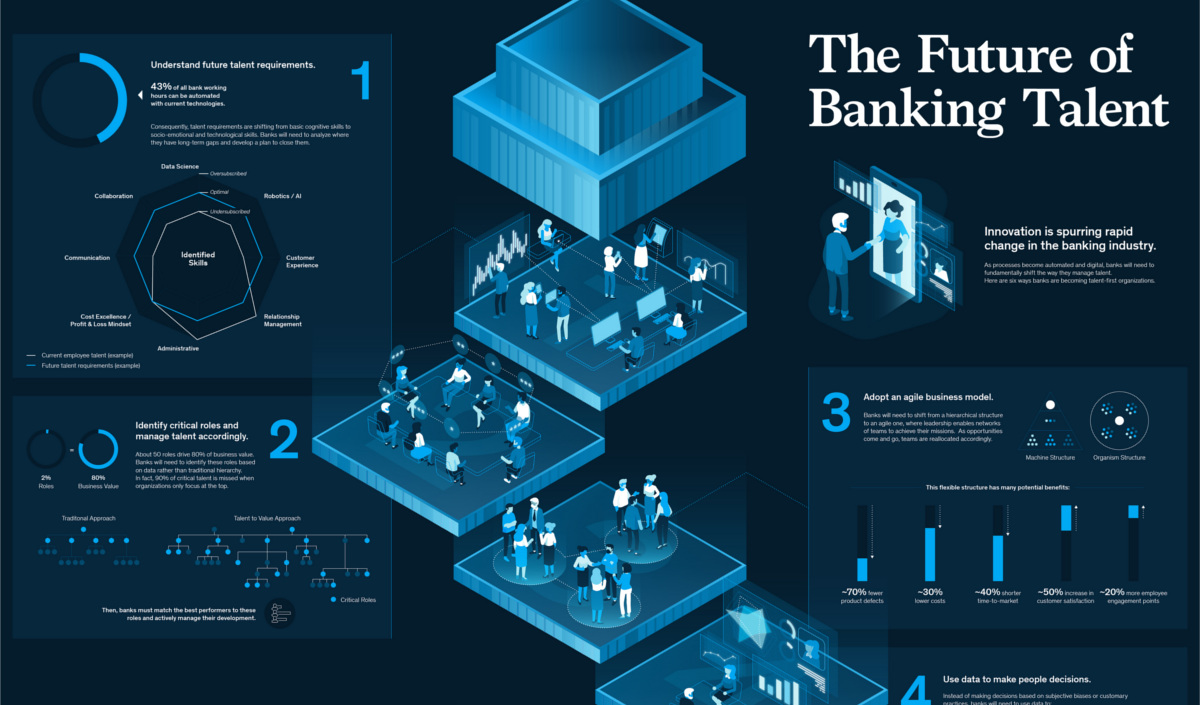

Visualizing the Future of Banking Talent

View the full-size version of the infographic by clicking here

Many organizations say that their greatest asset is their people. In fact, Richard Branson has famously stated that employees come first at Virgin, ranking ahead of customers and shareholders. So, how do businesses effectively manage this talent to drive success?

This question is top of mind for many bank CEOs. As processes become increasingly automated and digitized, the composition of banking talent is changing – and banks will need to become adept at hitting a moving target.

Six Ways Banks are Becoming Talent-First

Today’s infographic comes from McKinsey & Company, and it explores six ways banks are becoming talent-first organizations:

1. They understand future talent requirements.

43% of all bank working hours can be automated with current technologies.

Consequently, talent requirements are shifting from basic cognitive skills to socio-emotional and technological skills. Banks will need to analyze where they have long-term gaps and develop a plan to close them.

2. They identify critical roles and manage talent accordingly.

It is estimated that just 50 key roles drive 80% of bank business value. Banks will need to identify these roles based on data rather than traditional hierarchy. In fact, 90% of critical talent is missed when organizations only focus at the top.

Then, banks must match the best performers to these roles and actively manage their development.

3. They adopt an agile business model.

Banks will need to shift from a hierarchical structure to an agile one, where leadership enables networks of teams to achieve their missions. As opportunities come and go, teams are reallocated accordingly.

This flexible structure has many potential benefits, including fewer product defects, lower costs, shorter time-to-market, increases in customer satisfaction, and a bump in employee engagement.

4. They use data to make people decisions.

Instead of making decisions based on subjective biases or customary practices, banks will need to rely on the power of data to:

- Recruit

- Retain

- Motivate

- Promote

For example, company data can be used to develop a heatmap of the roles with the highest attrition rates. Leaders can then focus their retention efforts accordingly.

5. They focus on inclusion and diversity.

Gender and ethnicity diversification leads to higher financial performance, better decision making, higher employee satisfaction, and an enhanced company image.

Industry-leading banks will set measurable diversity goals, and re-evaluate all processes to expose unconscious biases. For example, one organization saw 15% more women pass resume screening when they automated the process.

6. They ensure the board is focused on talent.

Only 5% of corporate directors believe they are effective at developing talent.

To be successful, boards will need to recognize Human Resources (HR) as a strategic partner rather than as a primarily transactional function. The CEO, CFO, and CHRO (Chief Human Resources Officer) form a group of three that makes major decisions on human and financial capital allocation.

CEOs worldwide see human capital as a top challenge, and yet they rank HR as only the eighth or ninth most important function in a business. Clearly, this is a disconnect that needs to be addressed. To keep up with rapid change, banks will need to bring HR to the forefront – or risk being left behind.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?