Countries

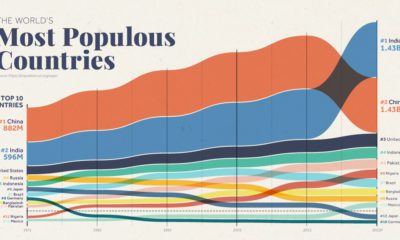

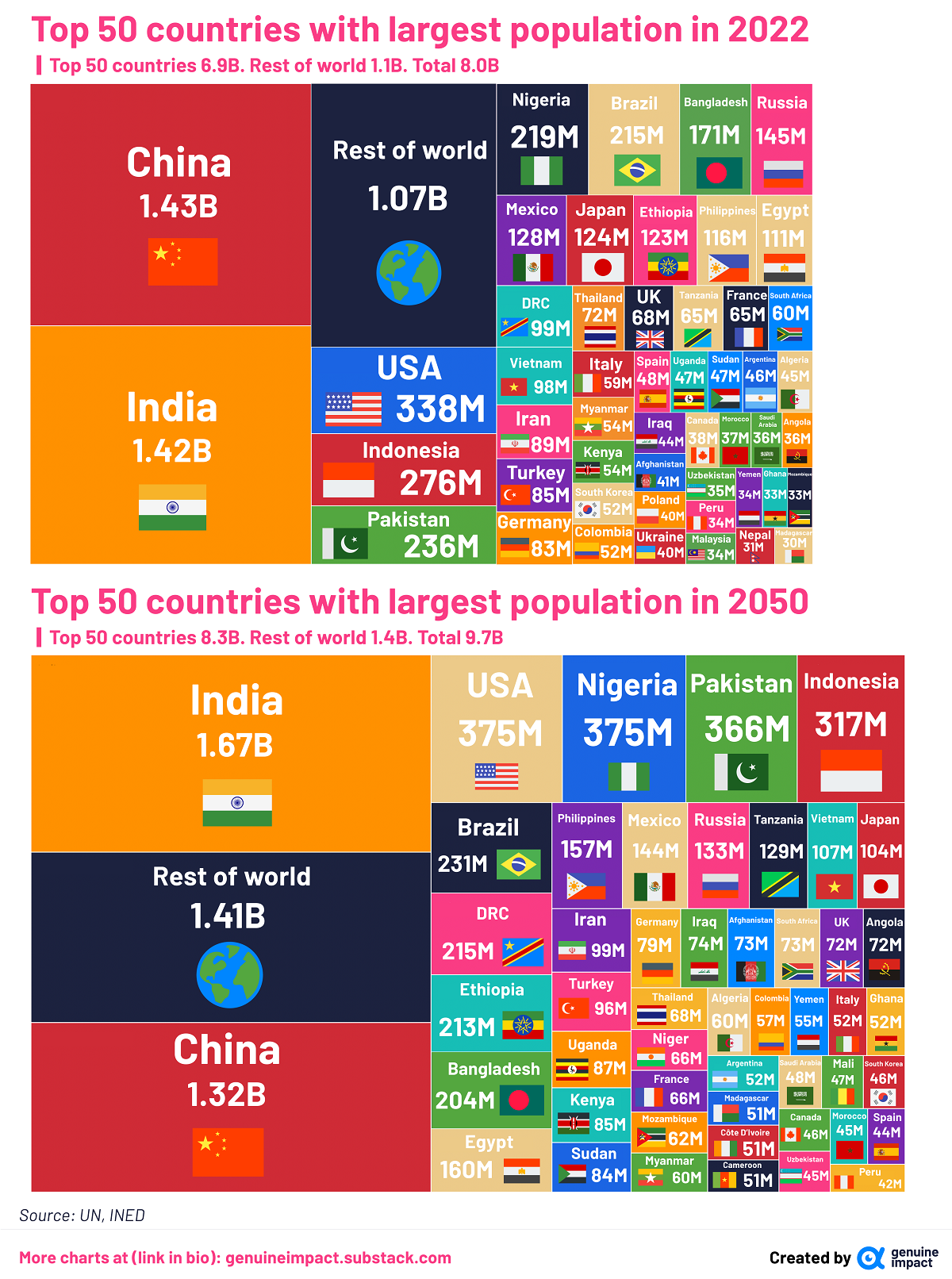

Visualizing the Changing World Population, by Country

Visualizing the Changing World Population, by Country

On average, there are 250 babies born every minute around the world. This adds up to over 130 million new human beings entering the world every year.

Then it’s no surprise that the world’s population, which now stands at a whopping 8 billion, has more than tripled since the mid-20th century.

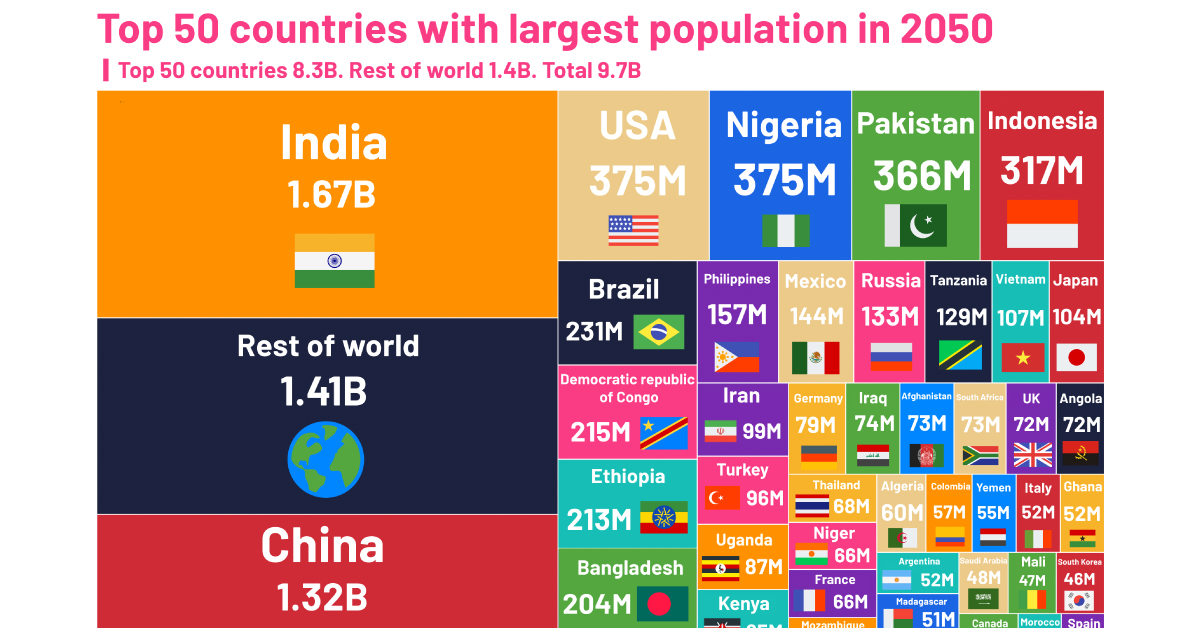

This graphic by Truman Du uses December 2022 population data from the UN and summaries from the French Institute for Demographic Studies (INED) to show the unequal rise and fall of the world’s population by 2050.

Let’s take a closer look at some of these population trends.

Most Populous Countries: 2022 vs. 2050

The Asian countries of India and China have topped the rankings of the world’s most populous countries for hundreds of years.

China currently holds the number one spot on this list. But the population of India is expected to surpass that of China’s by later this year, eventually reaching a total of 1.67 billion in 2050.

| Rank | Most Populous Countries (2022) | Population (2022) | Most Populous Countries (2050) | Population (2050) |

|---|---|---|---|---|

| 1 | China | 1.43B | India | 1.67B |

| 2 | India | 1.42B | China | 1.32B |

| 3 | United States of America | 338M | United States of America | 375M |

| 4 | Indonesia | 276M | Nigeria | 375M |

| 5 | Pakistan | 236M | Pakistan | 366M |

| 6 | Nigeria | 219M | Indonesia | 317M |

The United States, Nigeria, Pakistan, and Indonesia are the next most populous countries in 2022, and they are expected to hold onto these spots until 2050. However, they have a long way to go before catching up with the top two, as their combined population doesn’t add up to half that of India and China’s total.

Interestingly, it is estimated that Nigeria’s population will shoot up to 375 million by 2050, almost matching the population of the United States. In 2022, the African country’s population was just around 219 million. This expected spike is largely due to a high birth rate and booming economy, and the resultant rural-to-urban migration.

Countries with Declining Populations

While many countries will be seeing their populations boom over the next three decades, other nations such as China are expected to experience the opposite.

| Country | Population (2022) | Population (2050F) |

|---|---|---|

| China | 1.425 billion | 1.316 billion |

| Japan | 123.9 million | 104.1 million |

| Russian Federation | 144.7 million | 133.4 million |

| Italy | 59.0 million | 52.4 million |

| Republic of Korea | 51.8 million | 45.9 million |

| Germany | 83.4 million | 79.1 million |

| Thailand | 71.7 million | 68.1 million |

| Spain | 47.6 million | 44.3 million |

Several countries in the world are expected to see their populations decline over the next 30 years. And the main reason for this: extremely low birth rates.

South Korea, which has the world’s lowest fertility rate, is expected to see a sharp decline of almost 12% in its population as it falls to 46 million by 2050.

Changing world population trends like this can pose challenges for economies around the world, such as labor shortages, aging populations, and an increasing financial burden on younger generations.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Demographics

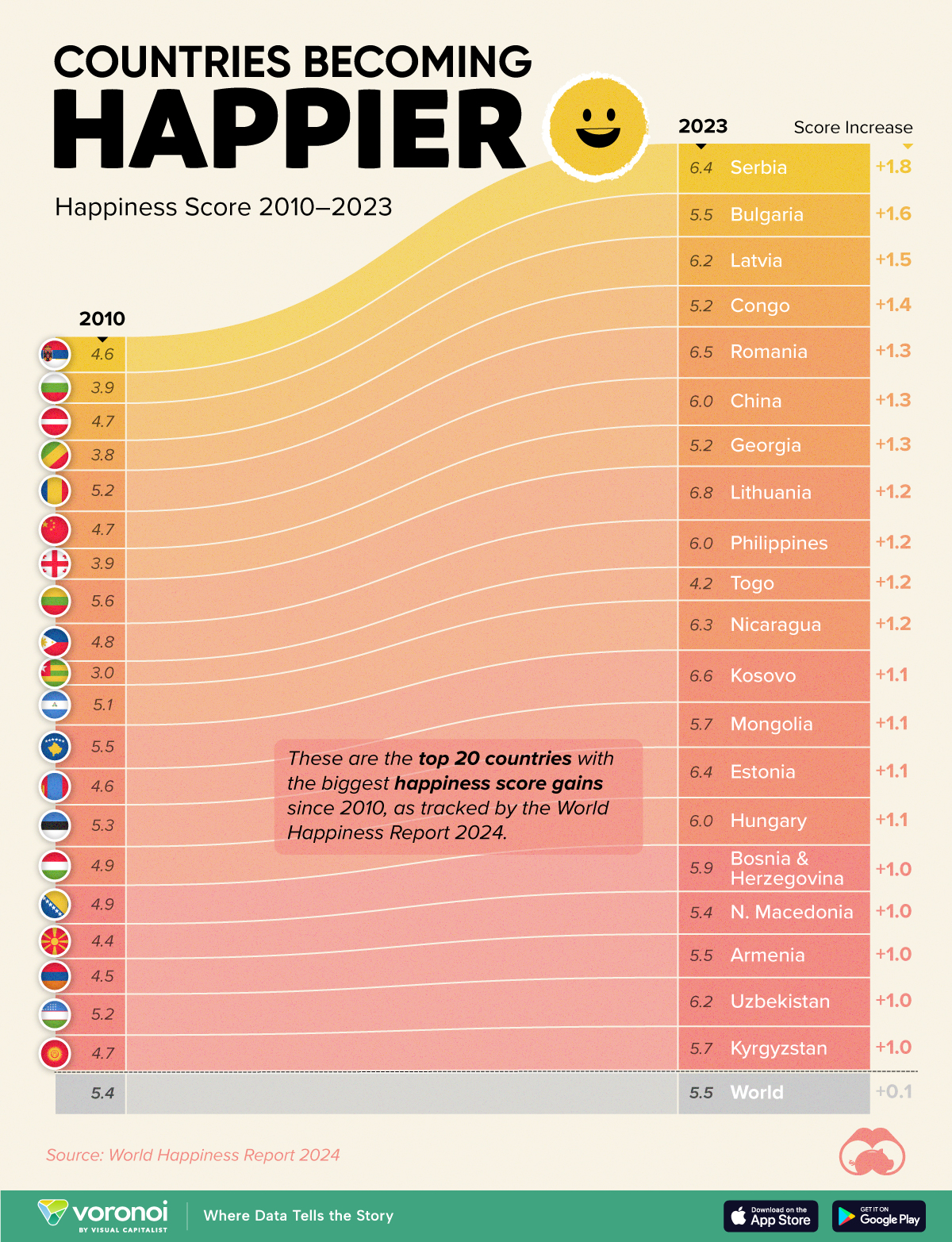

Countries With the Largest Happiness Gains Since 2010

Tracking Gallup survey data for more than a decade reveals insights into the regions seeing happiness gains.

Countries With the Largest Happiness Gains Since 2010

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2011, Bhutan sponsored a UN resolution that invited governments to prioritize happiness and well-being as a way to measure social and economic development.

And thus, the World Happiness Report was born.

In 2012, the first report released, examining Gallup poll data from 2006–2010 that asked respondents in nearly every country to evaluate their life on a 0–10 scale. From this they extrapolated a single “happiness score” out of 10 to compare how happy countries are.

More than a decade later, the 2024 World Happiness Report continues the mission to quantify, measure, and compare well-being. Its latest findings also include how countries have become happier in the intervening years.

We visualize these findings in the above chart, which shows the 20 countries that have seen their happiness scores grow the most since 2010.

Which Countries Have Become Happier Since 2010?

Serbia leads a list of 12 Eastern European nations whose average happiness score has improved more than 20% in the last decade.

In the same time period, the Serbian economy has doubled to $80 billion, and its per capita GDP has nearly doubled to $9,538 in current dollar terms.

| Rank | Country | Happiness Score Gains (2010–2024) | 2024 Happiness Score (out of 10) |

|---|---|---|---|

| 1 | 🇷🇸 Serbia | +1.8 | 6.4 |

| 2 | 🇧🇬 Bulgaria | +1.6 | 5.5 |

| 3 | 🇱🇻 Latvia | +1.5 | 6.2 |

| 4 | 🇨🇬 Congo | +1.4 | 5.2 |

| 5 | 🇷🇴 Romania | +1.3 | 6.5 |

| 6 | 🇨🇳 China | +1.3 | 6.0 |

| 7 | 🇬🇪 Georgia | +1.3 | 5.2 |

| 8 | 🇱🇹 Lithuania | +1.2 | 6.8 |

| 9 | 🇵🇭 Philippines | +1.2 | 6.0 |

| 10 | 🇹🇬 Togo | +1.2 | 4.2 |

| 11 | 🇳🇮 Nicaragua | +1.2 | 6.3 |

| 12 | 🇽🇰 Kosovo | +1.1 | 6.6 |

| 13 | 🇲🇳 Mongolia | +1.1 | 5.7 |

| 14 | 🇪🇪 Estonia | +1.1 | 6.4 |

| 15 | 🇭🇺 Hungary | +1.1 | 6.0 |

| 16 | 🇧🇦 Bosnia & Herzegovina | +1.0 | 5.9 |

| 17 | 🇲🇰 North Macedonia | +1.0 | 5.4 |

| 18 | 🇦🇲 Armenia | +1.0 | 5.5 |

| 19 | 🇺🇿 Uzbekistan | +1.0 | 6.2 |

| 20 | 🇰🇬 Kyrgyzstan | +1.0 | 5.7 |

| N/A | 🌍 World | +0.1 | 5.5 |

Since the first report, Western Europe has on average been happier than Eastern Europe. But as seen with these happiness gains, Eastern Europe is now seeing their happiness levels converge closer to their Western counterparts. In fact, when looking at those under the age of 30, the most recent happiness scores are nearly the same across the continent.

All in all, 20 countries have increased their happiness score by a full point or more since 2010, on the 0–10 scale.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries