Technology

Charting the Number of Failed Crypto Coins, by Year (2013-2022)

The Number of Failed Crypto Coins, by Year (2013-2022)

Ever since the first major crypto boom in 2011, tens of thousands of cryptocurrency coins have been released to market.

And while some cryptocurrencies performed well, others have ceased to trade or have ended up as failed or abandoned projects.

These graphics from CoinKickoff break down the number of failed crypto coins by the year they died, and the year they started. The data covers a decade of coin busts from 2013 through 2022.

Methodology

What is the marker of a “dead” crypto coin?

This analysis reviewed data from failed crypto coins listed on Coinopsy and cross-referenced against CoinMarketCap to verify previous market activity. The reason for each coin death was also tabulated, including:

- Failed Initial Coin Offerings (ICOs)

- Abandonment with less than $1,000 in trade volume over a three-month period

- Scams or coins that were meant as a joke

Dead Crypto Coins from 2013 to 2022

While many familiar crypto coins—Litecoin, Dogecoin, and Ethereum—are still on the market today, there were at least 2,383 crypto coins that bit the dust between 2013 and 2022.

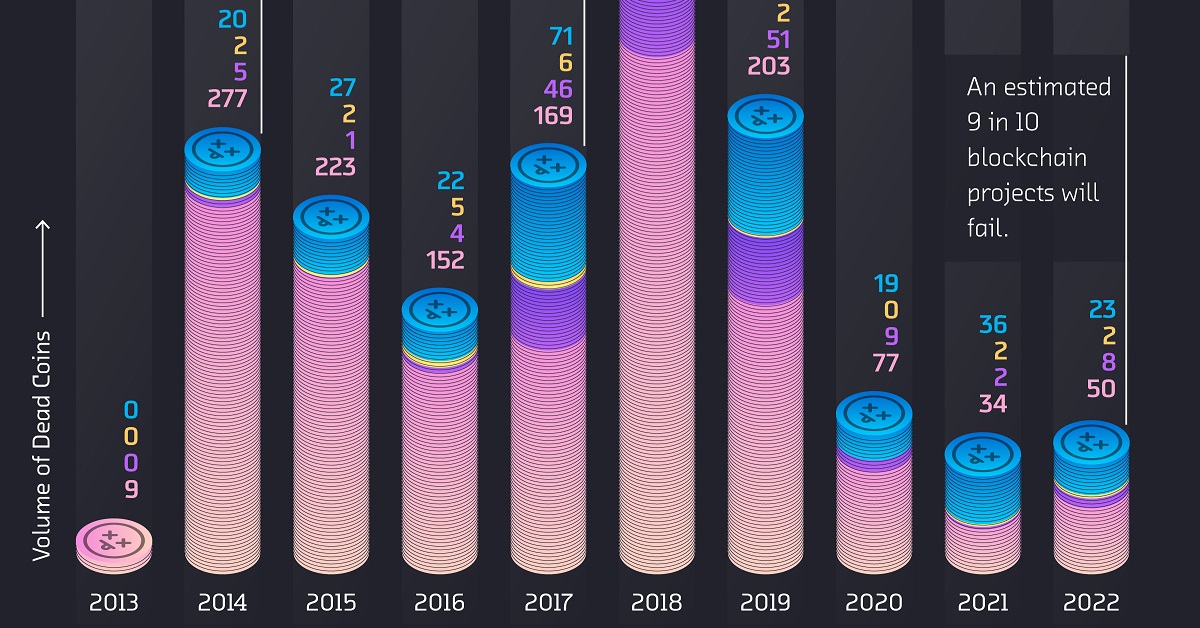

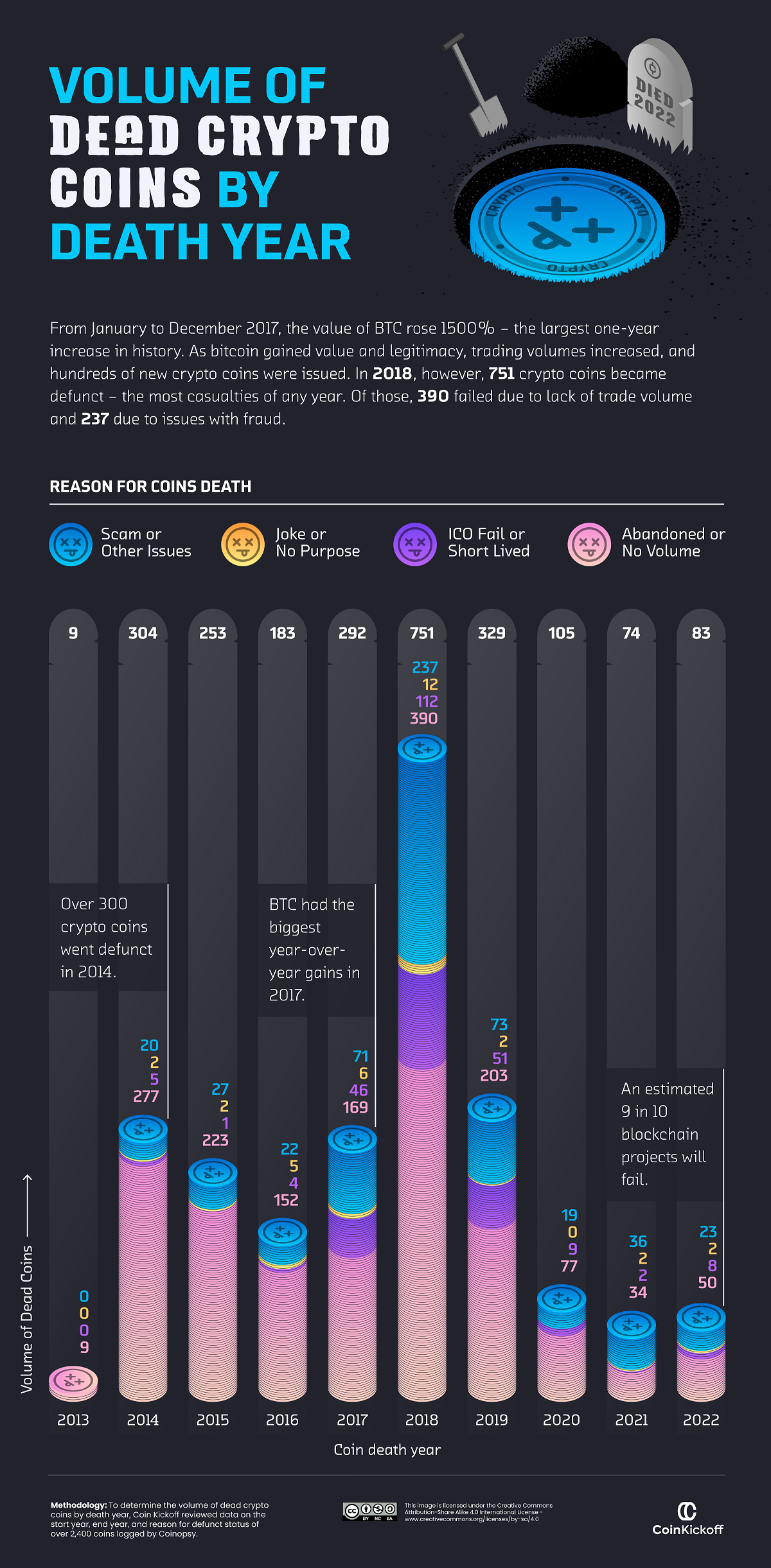

Here’s a breakdown of how many crypto coins died each year by reason:

| Dead Coins by Year | Abandoned / No Volume | Scams / Other Issues | ICO Failed / Short-Lived | Joke / No purpose |

|---|---|---|---|---|

| 2013 | 9 | 0 | 0 | 0 |

| 2014 | 277 | 20 | 5 | 2 |

| 2015 | 223 | 27 | 1 | 2 |

| 2016 | 152 | 22 | 4 | 5 |

| 2017 | 169 | 71 | 46 | 6 |

| 2018 | 390 | 237 | 112 | 12 |

| 2019 | 203 | 73 | 51 | 2 |

| 2020 | 77 | 19 | 9 | 0 |

| 2021 | 34 | 36 | 2 | 2 |

| 2022 | 50 | 23 | 8 | 2 |

| Total | 1,584 | 528 | 238 | 33 |

Abandoned coins with flatlining trading volume accounted for 1,584 or 66.5% of analyzed crypto failures over the last decade. Comparatively, 22% ended up being scam coins, and 10% failed to launch after an ICO.

As for individual years, 2018 saw the largest total of annual casualties in the crypto market, with 751 dead crypto coins. More than half of them were abandoned by investors, but 237 coins were revealed as scams or embroiled in other controversies, such as BitConnect which turned out to be a Ponzi scheme.

Why was 2018 such a big year for crypto failures?

This is largely because the year prior saw Bitcoin prices climb above $1,000 for the first time with an eventual peak near $19,000. As a result, speculation ran hot, new crypto issuances boomed, and many investors and firms got bullish on the market for the first time.

How Many Newly Launched Coins Died?

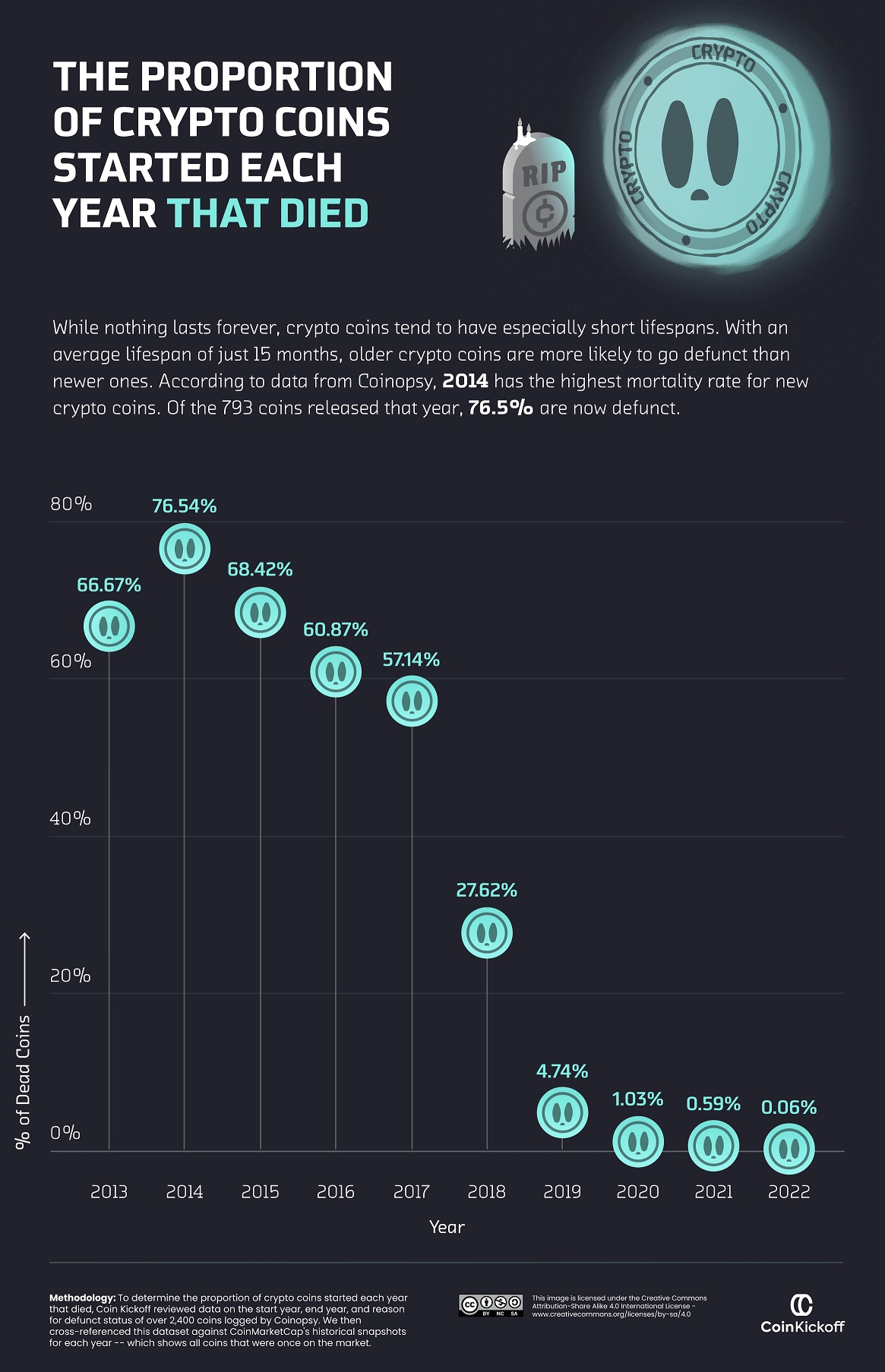

Of the hundreds of coins that launched in 2017, more than half were considered defunct by the end of 2022.

Indeed, a lot of earlier-launched coins have since died. The majority of coins launched between 2013 and 2017 have already become “dead coins” by the end of 2022.

| Coin Start Year | Dead Coins by 2022 |

|---|---|

| 2013 | 66.67% |

| 2014 | 76.54% |

| 2015 | 68.42% |

| 2016 | 60.87% |

| 2017 | 57.14% |

| 2018 | 27.62% |

| 2019 | 4.74% |

| 2020 | 1.03% |

| 2021 | 0.59% |

| 2022 | 0.06% |

Part of this is because the cryptocurrency field itself was still being figured out. Many coins were launched in a time of experimentation and innovation, but also of volatility and uncertainty.

However, the trend began to shift in 2018. Only 27.62% of coins launched in that year have bit the dust so far, and the failure rates in 2019 and 2020 fell further to only 4.74% and 1.03% of launched coins, respectively.

This suggests that the crypto industry has become more mature and stable, with newer projects establishing themselves more securely and investors becoming wiser to potential scams.

How will this trend evolve into 2023 and beyond?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue