Technology

The Rising Problem of Crypto Theft, and How to Protect Yourself

Part of the appeal of cryptocurrency is that it exists “outside” of the system.

Using complex cryptography and decentralized ledgers, a blockchain can operate independently from the world’s most powerful countries, corporations, and banking institutions.

While this detachment from authority is extremely powerful, existing almost exclusively in the digital realm does have its drawbacks.

Preventing Crypto Theft

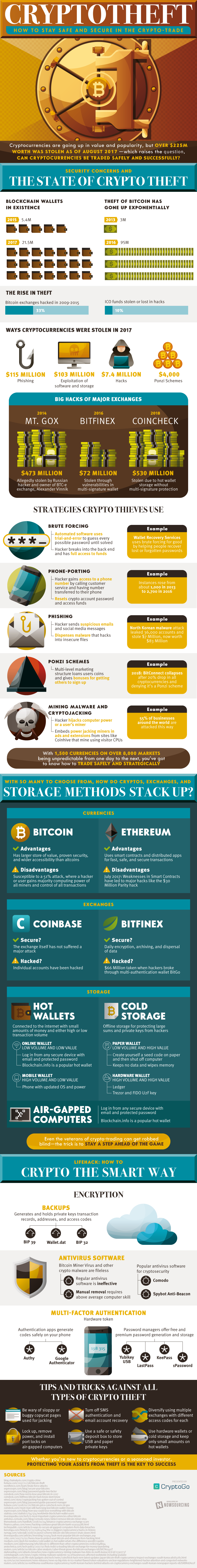

Today’s infographic from CryptoGo shows that as cryptocurrencies rise in prominence, so does its appeal to hackers, criminals, and other bad actors.

With millions of dollars being stolen via crypto theft, investors and other dabblers in cryptocurrency must take precautions to protect their assets for the long haul.

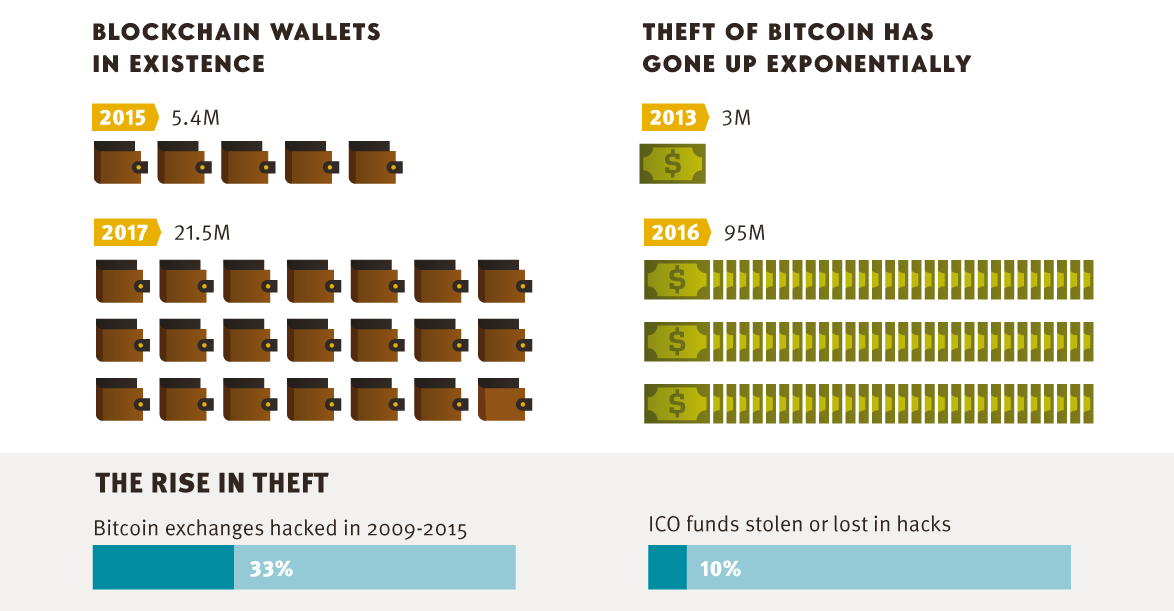

Crypto theft comes in many different forms, and at least $225 million of cryptocurrency has been stolen as of mid-2017.

There are various forms of crypto theft that have made this possible, including brute forcing, phishing, phone-porting, mining malware, and Ponzi schemes.

Strategies Used by Crypto Thieves

Here are the most prominent forms of crypto theft:

Brute Forcing

This is the form of hacking that most are familiar with. It involves automated software that simply tries different passwords until one works.

Phone-Porting

Using your phone number and a little “social engineering”, a hacker can convince a customer service rep that they are actually you. This allows them to reset your password and access your funds.

Phishing

In this case, a hacker will send you suspicious links through email or social media messages. By clicking on one of those links, malware is installed.

Ponzi Schemes

Multi-level marketing schemes that provide signing bonuses. These eventually collapse when prices change or signups stop. Once over, the thieves takes the money and run.

Mining Malware

Hackers hijack a computer’s power to mine cryptocurrency remotely.

Protecting Yourself

Crypto theft can be prevented by taking appropriate precautionary measures.

These include using encrypted backups to hold private keys and other data, using proper anti-virus software for crypto, and opting for multi-factor authentication.

Further, other general measures can also be taken to protect assets, such as holding only small amounts of cryptocurrency in hot wallets, using safety deposit boxes to store USB and private paper keys, turning off SMS authentication and email recovery options, and diversifying holdings through various exchanges.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees