Money

Here’s How Reserve Currencies Have Evolved Over 120 Years

Here’s How Reserve Currencies Have Evolved Over 120 Years

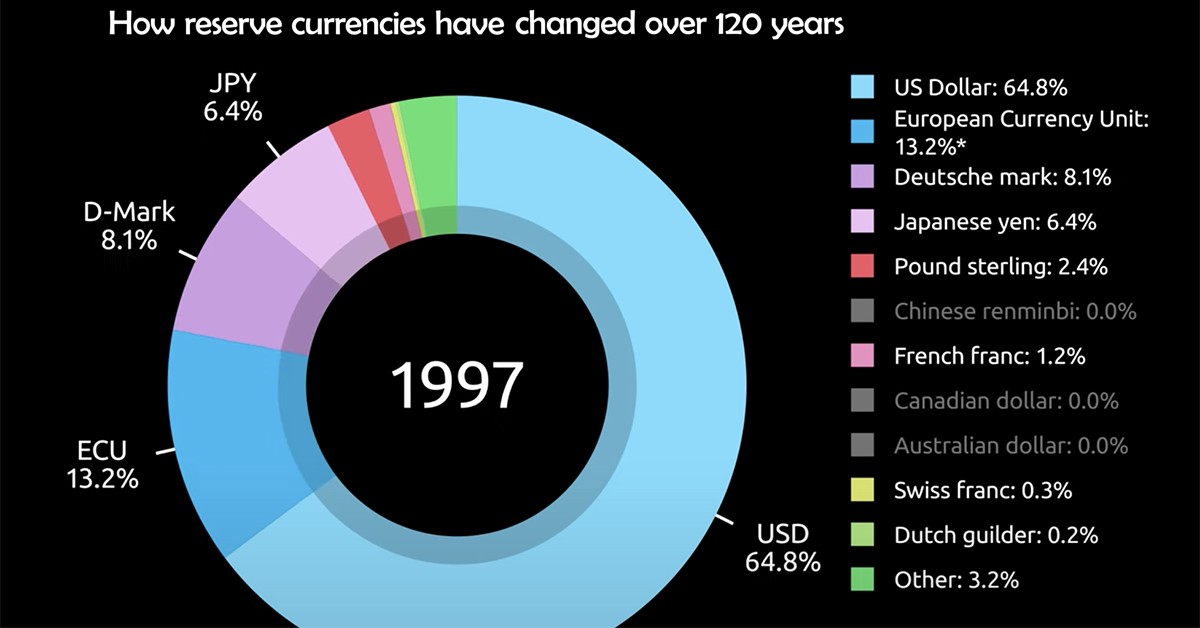

Over the last 120 years, the popularity of different reserve currencies have ebbed and flowed, reflecting the shifting fortunes of leading global economies.

For example, in the year 1900, the U.S. dollar and pound sterling made up 0% and 62% of global reserves respectively. But fast forward to 2020, and the pound now represents just 4.7% of global currency reserves, while the U.S. dollar stands at nearly 60%.

Today’s motion graphic from James Eagle looks at the year-over-year change in currency reserves as a portion of total reserves, spread across 120 years.

| Currency | 1900 | 1920 | 1940 | 1960 | 1980 | 2000 | 2020 |

|---|---|---|---|---|---|---|---|

| U.S. Dollar | 0.0% | 28.4% | 27.9% | 61.7% | 57.9% | 71.2% | 59.0% |

| Euro | 0.0% | 0.0% | 0.0% | 0.0% | 17.5% | 18.5% | 21.2% |

| Deutsche mark | 14.7% | 4.2% | 0.0% | 0.0% | 12.9% | 0.0% | 0.0% |

| Japanese yen | 0.0% | 0.0% | 0.0% | 0.0% | 3.9% | 5.8% | 6.0% |

| Pound sterling | 62.0% | 57.3% | 68.9% | 35.1% | 2.4% | 2.7% | 4.7% |

| Chinese renminbi | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.3% |

| French franc | 17.5% | 6.2% | 2.1% | 1.3% | 1.0% | 0.0% | 0.0% |

| Canadian dollar | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.1% |

| Australian dollar | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.8% |

| Swiss franc | 0.0% | 0.0% | 0.8% | 0.3% | 2.2% | 0.3% | 0.2% |

| Dutch guilder | 0.0% | 3.9% | 0.3% | 0.1% | 0.9% | 0.0% | 0.0% |

| Other | 5.7% | 0.0% | 0.0% | 1.6% | 1.3% | 1.5% | 2.7% |

What is a Reserve Currency?

A reserve currency is a large quantity of currency held in “reserve” by monetary authorities like central banks.

Currencies are often held in reserve in preparation for investments and transactions, among other things. Our vast global trade system, which is approaching $20 trillion in value, means plenty of currencies are always needed in reserve. In fact, an estimated $5 trillion in currency swaps hands every single day.

Here are some reasons that currency reserves are held:

- Exchange rate stability for the domestic currency

- To ensures liquidity in times of crisis

- To diversify central bank portfolios, which can reduce risk and improve credit ratings

- More than 65 countries peg their currencies to the U.S. dollar

- Five U.S. territories and a number of sovereign countries, such as Ecuador and Panama, use it as an official currency of exchange

- Around 90% of all Forex trading involves the U.S. dollar

All things equal, countries benefit economically from greater demand for their respective currencies.

The Rise and Fall of Reserve Currencies

Some economists argue that the demand for currencies in the long run revolves around the economic relevance of a country. In general, the larger and more powerful a nation’s economy is, the greater the network effect, and the more interlinked they are to the global economy. Thus, the greater demand there is to hold their currency in reserve.

The last 120 years of currency reserve data shows some support for this claim. For example, Japan’s economy hit a peak in terms of its relative share of global GDP in the early 1990s, just before the effects of the Lost Decade were felt. Subsequently, their peak as a reserve currency was around the same horizon, at 9.4% in 1990.

America’s Era of Dominance

Due to the economic strength of the United States in the post-WWII era, the dollar is what economists call a vehicle currency.

This means many non-dollar economies still choose to engage in international transactions using the dollar. These smaller and less accepted currencies are often converted to U.S. dollars before proceeding with any business or trade dealings. This is why, although Asian economies tend to have neighboring states as their top trade partners, they still engage in a massive portion of these transactions with the U.S. greenback as the currency of choice.

Here are some facts that further exemplify the strength and power of the U.S. dollar:

Additionally, the dollar is often seen as a haven in times of extreme uncertainty and tumult. Given its status as the world’s reserve currency, it can be perceived as less risky and can withstand economic shock to a greater degree relative to other currencies.

New Challengers to the Dollar

In the not too distant past, the U.S. displaced the UK economically and as the world’s reserve currency. Today, the U.S. economy is showing signs of slowing down, based on GDP growth.

China is on the rise, having already displaced the U.S. as the EU’s top trade partner. With projections for China to overtake the U.S. as the world’s largest economy before 2030 in nominal terms, could a new global reserve currency emerge?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries