Markets

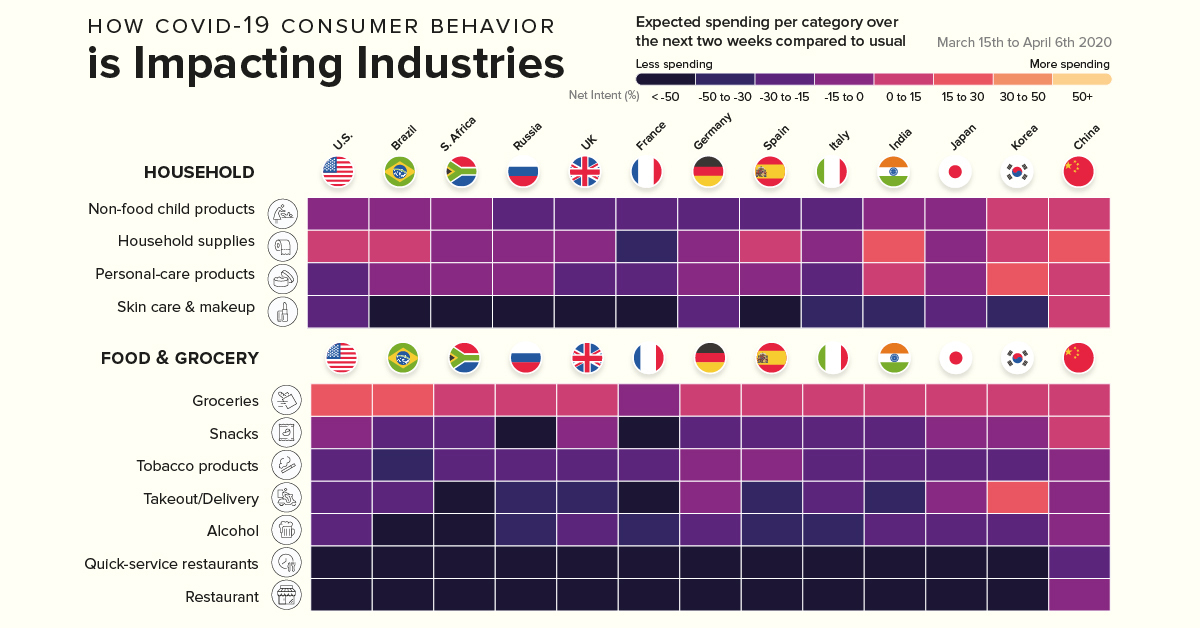

How COVID-19 Consumer Spending is Impacting Industries

How COVID-19 Consumer Spending is Impacting Industries

Consumer spending is one of the most important driving forces for global economic growth.

Beyond impacting some of the factors that determine consumer spend—such as consumer confidence, unemployment levels, or the cost of living—the COVID-19 pandemic has also drastically altered how and where consumers choose to spend their hard-earned cash.

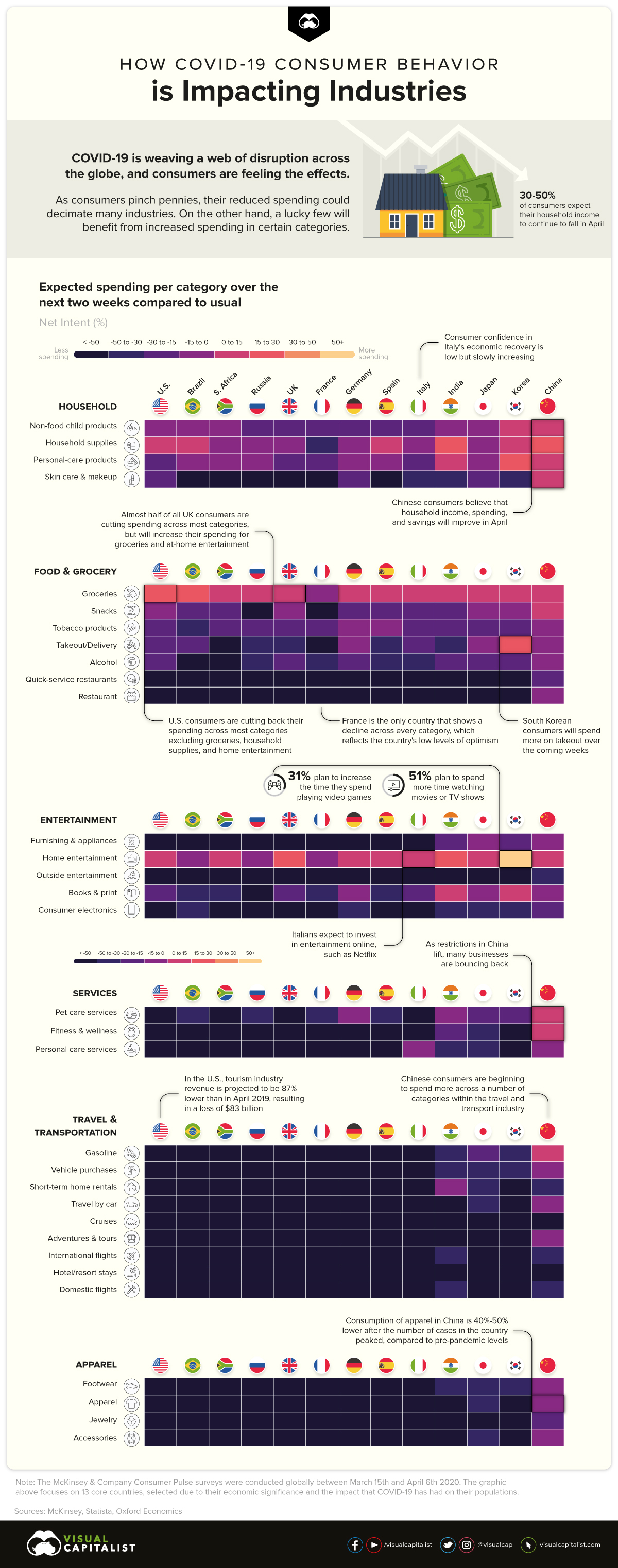

Today’s graphic pulls data from a global survey by McKinsey & Company that analyzes how consumers are reining in their spending, causing upheaval across every industry imaginable.

While some industries are in a better position to weather the impact of this storm, others could struggle to survive.

The Link Between Sentiment and Intent to Spend

As consumers grapple with uncertainty, their buying behavior becomes more erratic. What is clear however, is that they have reduced spending on all non-essential products and services.

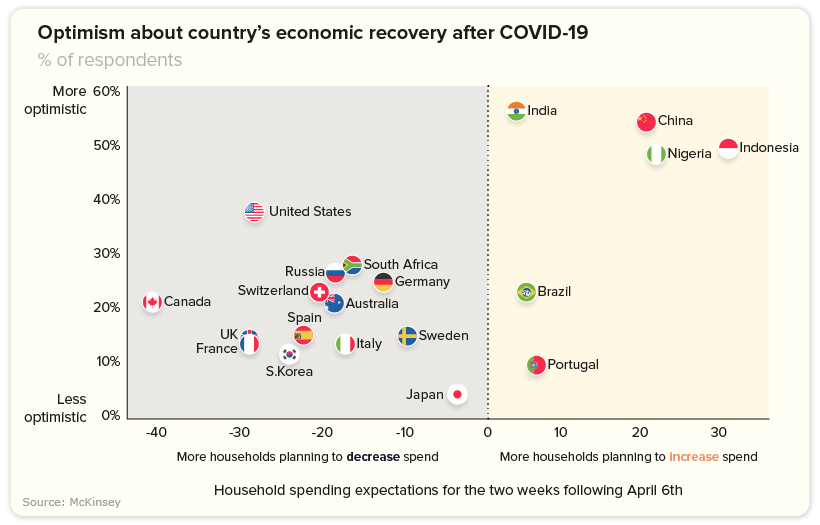

But as each country moves along the COVID-19 curve, we can see a glimmer of increasing optimism levels, which in turn is linked to higher spending.

India’s consumers, for example, are displaying higher levels of optimism, with more households planning to increase spend—a trend that is also evident in China, Indonesia, and Nigeria.

Meanwhile, American consumers are still more optimistic about the future than Europeans. 37% of Americans believe the country will recover in 2 or 3 months—albeit with optimism levels at the highest for people who earn over $100K.

Strategic Consumer Spending

Globally, consumers continue to spend—and in some cases, spend more compared to pre-pandemic levels—on some necessities such as groceries and household supplies.

Due to changes in media consumption habits, consumers in almost all countries surveyed say they will increase their spend on at-home entertainment. This is especially true for Korea, a country that already boasts a massive gaming culture.

As restrictions in China lift, many categories such as gasoline, wellness, and pet-care services appear to be bouncing back, which could be a positive sign for other countries following a similar trajectory. But while consumers amp up their spending on the things they need, they also anticipate spending less in other categories.

The Industries in the Red

Categories showing an alarming decline include restaurants and out-of-home entertainment.

However, there are two particularly hard-hit industries worth noting that are showing declines across every category and country:

Travel and Transport

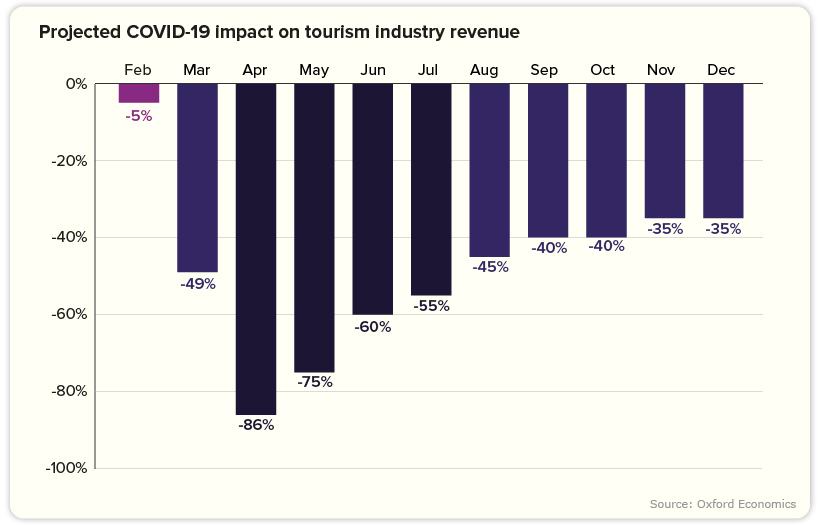

The inevitable decline in the travel and transportation industry is a reflection of mass social isolation levels and tightening travel restrictions.

In fact, the U.S. travel industry can expect to see an average decline in revenue of 81% for April and May. Throughout 2020, losses will equate to roughly $519 billion—translating to a broader $1.2 trillion contraction in total economic impact.

According to the World Travel and Tourism Council, a staggering 50 million jobs are at risk in the industry, with 30 million of those jobs belonging to employees in Asia.

Considering the travel and tourism industry accounts for 10.4% of global GDP, a slow recovery could have serious ramifications.

Apparel

Apparel is experiencing a similarly worrying slowdown, with consumption 40-50% lower in China compared to pre-pandemic levels. Both online and offline sales for businesses the world over are also taking a major hit.

As consumers hold back on their spending, clothing brands of all shapes and sizes are forced to scale back production, and reimagine how they position themselves.

“It’s an unprecedented interruption of an industry that has relied on speeding from one season’s sales to the next. And it is bringing with it a new sense of connectedness, responsibility and empathy.”

—Tamsin Blanchard, The Guardian

Towards an Uncertain Future

Clearly the force majeure that is COVID-19 has not impacted every industry equally.

For some, rebuilding their customer experience by appealing to changing values could result in a profitable, and perhaps much-needed revival. For other companies, there is no other choice but to play the waiting game.

Regardless, every industry faces one universal truth: life after the pandemic will look significantly different.

Markets

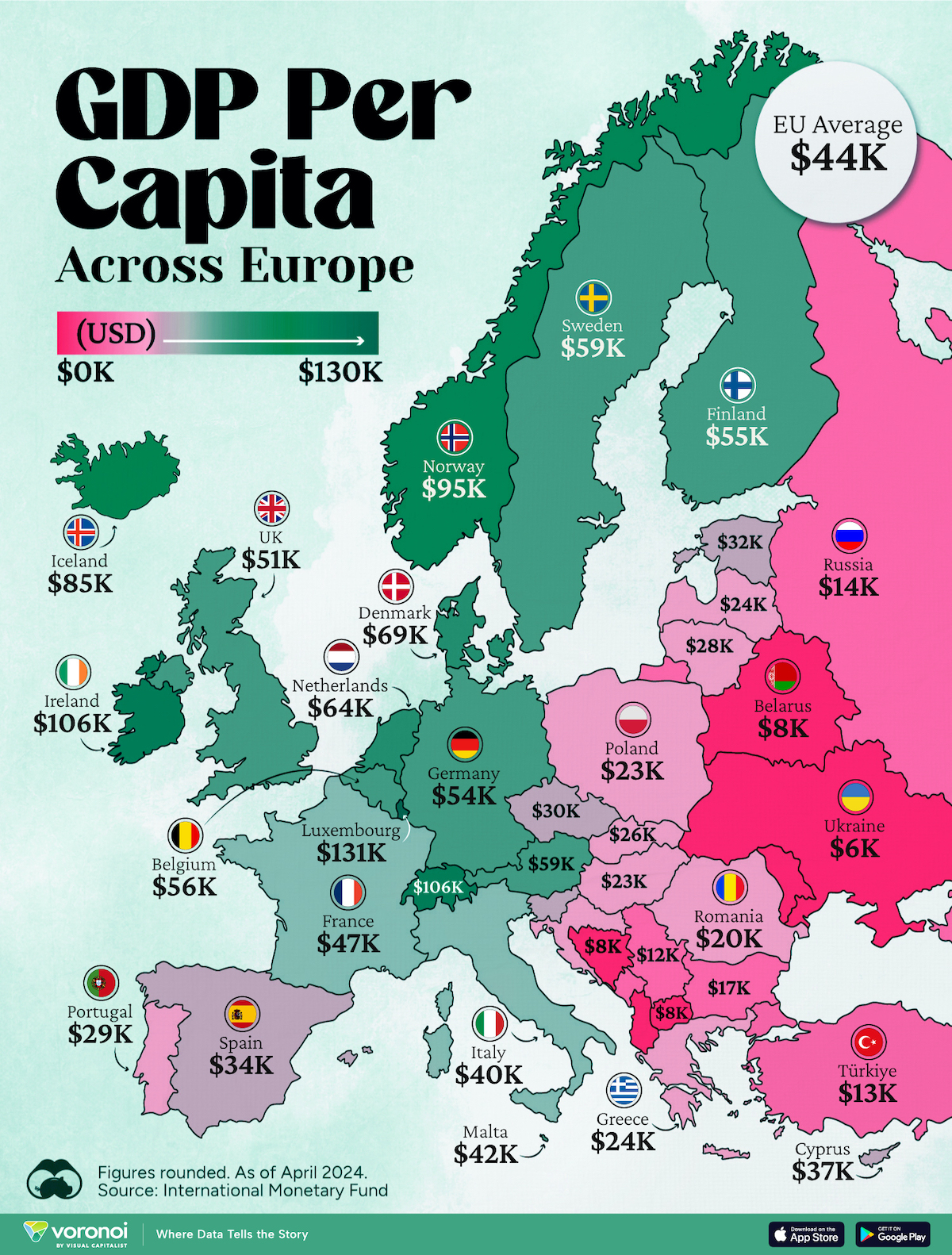

Mapped: Europe’s GDP Per Capita, by Country

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

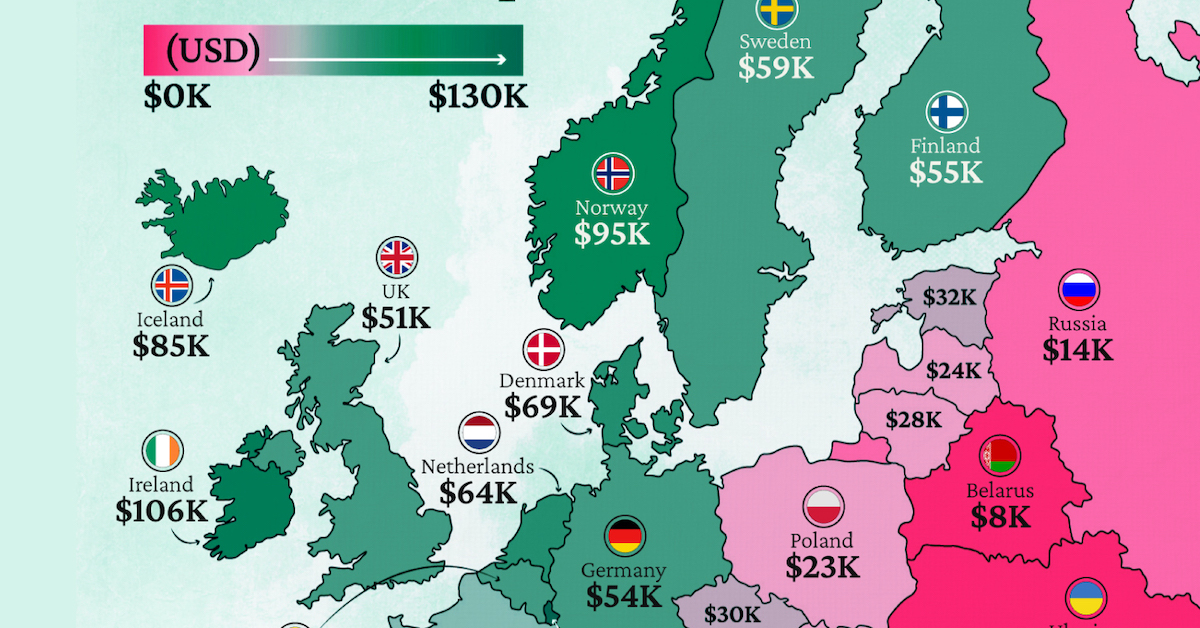

Mapped: Europe’s GDP Per Capita, by Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Europe is home to some of the largest and most sophisticated economies in the world. But how do countries in the region compare with each other on a per capita productivity basis?

In this map, we show Europe’s GDP per capita levels across 44 nations in current U.S. dollars. Data for this visualization and article is sourced from the International Monetary Fund (IMF) via their DataMapper tool, updated April 2024.

Europe’s Richest and Poorest Nations, By GDP Per Capita

Luxembourg, Ireland, and Switzerland, lead the list of Europe’s richest nations by GDP per capita, all above $100,000.

| Rank | Country | GDP Per Capita (2024) |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $131,380 |

| 2 | 🇮🇪 Ireland | $106,060 |

| 3 | 🇨🇭 Switzerland | $105,670 |

| 4 | 🇳🇴 Norway | $94,660 |

| 5 | 🇮🇸 Iceland | $84,590 |

| 6 | 🇩🇰 Denmark | $68,900 |

| 7 | 🇳🇱 Netherlands | $63,750 |

| 8 | 🇸🇲 San Marino | $59,410 |

| 9 | 🇦🇹 Austria | $59,230 |

| 10 | 🇸🇪 Sweden | $58,530 |

| 11 | 🇧🇪 Belgium | $55,540 |

| 12 | 🇫🇮 Finland | $55,130 |

| 13 | 🇩🇪 Germany | $54,290 |

| 14 | 🇬🇧 UK | $51,070 |

| 15 | 🇫🇷 France | $47,360 |

| 16 | 🇦🇩 Andorra | $44,900 |

| 17 | 🇲🇹 Malta | $41,740 |

| 18 | 🇮🇹 Italy | $39,580 |

| 19 | 🇨🇾 Cyprus | $37,150 |

| 20 | 🇪🇸 Spain | $34,050 |

| 21 | 🇸🇮 Slovenia | $34,030 |

| 22 | 🇪🇪 Estonia | $31,850 |

| 23 | 🇨🇿 Czech Republic | $29,800 |

| 24 | 🇵🇹 Portugal | $28,970 |

| 25 | 🇱🇹 Lithuania | $28,410 |

| 26 | 🇸🇰 Slovakia | $25,930 |

| 27 | 🇱🇻 Latvia | $24,190 |

| 28 | 🇬🇷 Greece | $23,970 |

| 29 | 🇭🇺 Hungary | $23,320 |

| 30 | 🇵🇱 Poland | $23,010 |

| 31 | 🇭🇷 Croatia | $22,970 |

| 32 | 🇷🇴 Romania | $19,530 |

| 33 | 🇧🇬 Bulgaria | $16,940 |

| 34 | 🇷🇺 Russia | $14,390 |

| 35 | 🇹🇷 Türkiye | $12,760 |

| 36 | 🇲🇪 Montenegro | $12,650 |

| 37 | 🇷🇸 Serbia | $12,380 |

| 38 | 🇦🇱 Albania | $8,920 |

| 39 | 🇧🇦 Bosnia & Herzegovina | $8,420 |

| 40 | 🇲🇰 North Macedonia | $7,690 |

| 41 | 🇧🇾 Belarus | $7,560 |

| 42 | 🇲🇩 Moldova | $7,490 |

| 43 | 🇽🇰 Kosovo | $6,390 |

| 44 | 🇺🇦 Ukraine | $5,660 |

| N/A | 🇪🇺 EU Average | $44,200 |

Note: Figures are rounded.

Three Nordic countries (Norway, Iceland, Denmark) also place highly, between $70,000-90,000. Other Nordic peers, Sweden and Finland rank just outside the top 10, between $55,000-60,000.

Meanwhile, Europe’s biggest economies in absolute terms, Germany, UK, and France, rank closer to the middle of the top 20, with GDP per capitas around $50,000.

Finally, at the end of the scale, Eastern Europe as a whole tends to have much lower per capita GDPs. In that group, Ukraine ranks last, at $5,660.

A Closer Look at Ukraine

For a broader comparison, Ukraine’s per capita GDP is similar to Iran ($5,310), El Salvador ($5,540), and Guatemala ($5,680).

According to experts, Ukraine’s economy has historically underperformed to expectations. After the fall of the Berlin Wall, the economy contracted for five straight years. Its transition to a Western, liberalized economic structure was overshadowed by widespread corruption, a limited taxpool, and few revenue sources.

Politically, its transformation from authoritarian regime to civil democracy has proved difficult, especially when it comes to institution building.

Finally, after the 2022 invasion of the country, Ukraine’s GDP contracted by 30% in a single year—the largest loss since independence. Large scale emigration—to the tune of six million refugees—is also playing a role.

Despite these challenges, the country’s economic growth has somewhat stabilized while fighting continues.

-

Markets5 days ago

Markets5 days agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Markets2 weeks ago

Markets2 weeks agoThe Top Private Equity Firms by Country

-

Jobs2 weeks ago

Jobs2 weeks agoThe Best U.S. Companies to Work for According to LinkedIn

-

Economy2 weeks ago

Economy2 weeks agoRanked: The Top 20 Countries in Debt to China

-

Politics1 week ago

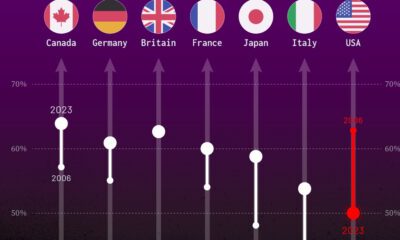

Politics1 week agoCharted: Trust in Government Institutions by G7 Countries

-

Energy1 week ago

Energy1 week agoMapped: The Age of Energy Projects in Interconnection Queues, by State

-

Mining1 week ago

Mining1 week agoVisualizing Global Gold Production in 2023

-

Markets1 week ago

Markets1 week agoVisualized: Interest Rate Forecasts for Advanced Economies