Mining

How to Avoid Common Mistakes With Mining Stocks (Part 4: Project Quality)

Mining is a technical field and requires a comprehension of many complex factors.

This includes everything from the characteristics of an orebody to the actual extraction method envisioned and used—and the devil is often found in these technical details.

Part 4: Evaluating Technical Risks and Project Quality

We’ve partnered with Eclipse Gold Mining on an infographic series to show you how to avoid common mistakes when evaluating and investing in mining exploration stocks.

Here is a basic introduction to some technical and project quality characteristics to consider when looking at your next mining investment.

View the three other parts of this series so far:

- Mistakes made when choosing a team

- Mistakes made with the business plan

- Mistakes with project jurisdiction

Part 4: Technical Risks and Project Quality

So what must investors evaluate when it comes to technical risks and project quality?

Let’s take a look at four different factors.

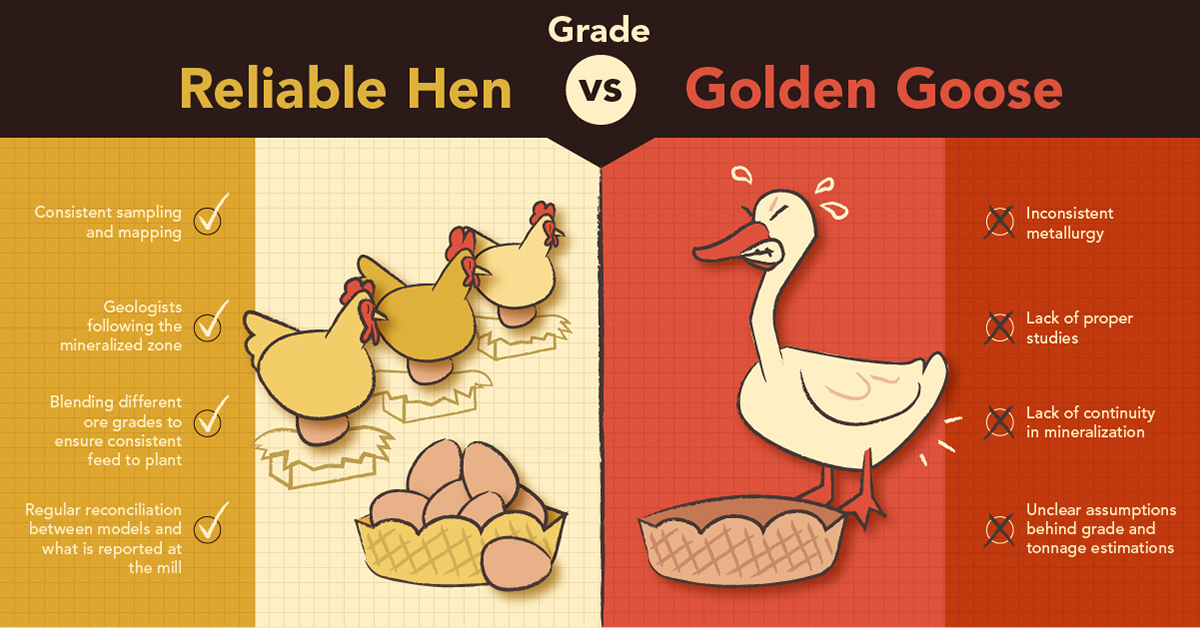

1. Grade: Reliable Hen Vs. Golden Goose

Once mining starts, studies have to be adapted to reality. A mine needs to have the flexibility and robustness to adjust pre-mine plans to the reality of execution.

A “Golden Goose” will just blunder ahead and result in failure after failure due to lack of flexibility and hoping it will one day produce a golden egg.

Many mining projects can come into operation quickly based on complex and detailed studies of a mineral deposit. However, it requires actual mining to prove these studies.

Some mining projects fail to achieve nameplate tonnes and grade once production begins. However, a team response to varying grades and conditions can still make a mine into a profitable mine or a “Reliable Hen.”

2. Money: Piggy Bank vs. Money Pit

The degree of insight into a mineral deposit and the appropriate density of data to support the understanding is what leads to a piggy bank or money pit.

Making a project decision on poor understanding of the geology and limited information leads to the money pit of just making things work.

Just like compound interest, success across many technical aspects increases revenue exponentially, but it can easily go the other way if not enough data is used to make a decision to put a project into production.

3. Environment: Responsible vs. Reckless

Not all projects are situated in an ideal landscape for mining. There are environmental and social factors to consider. A mining company that takes into account these facts has a higher chance of going into production.

Mineral deposits do not occur in convenient locations and require the disruption of the natural environment. Understanding how a mining project will impact its surroundings goes a long way to see whether the project is viable.

4. Team: Orchestra vs. One-Man Band

Mining is a complex and technical industry that relies on many skilled professionals with clear leadership, not just one person doing all the work.

Geologists, accountants, laborers, engineers, and investor relations officers are just some of the roles that a CEO or management team needs to deliver a profitable mine. A good leader will be the conductor of the varying technical teams allowing each to play their best at the right time.

Mining 101: Mining Valuation and Methods

In order to further consider a mining project’s quality, it is important to understand how the company is valued and how it plans to mine a mineral resource.

Valuation

There are two ways to look at the value of a mining project:

- The Discounted Cash Flow method estimates the present value of the cash that will come from a mining project over its life.

- In-situ Resource Value is a metric that values all the metal in the ground to give an estimate of the dollar value of those resources.

Mining Method

The location of the ore deposit and the quantity of its grade will determine what mining method a company will choose to extract the valuable ore.

- Open-pit mining removes valuable ore that is relatively near the surface of the Earth’s crust using power trucks and shovels to move large volumes of rock. Typically, it is a lower cost mining method, meaning lower grades of ore are economic to mine.

- Underground mining occurs when the ore body is too deep to mine profitably by open-pit. In other words, the quality of the orebody is high enough to cover the costs of complex engineering underneath the Earth’s crust.

When Technicals and Quality Align

This is a brief overview of where to begin a technical look at a mining project, but typically helps to form some questions for the average investor to consider.

Everything from the characteristics of an orebody to the actual extraction method will determine whether a project can deliver a healthy return to the investor.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees