Mining

How to Avoid Common Mistakes With Mining Stocks (Part 2: Business Plan)

Everyone loves to talk about creating the next great mining business, but are they willing to put that talk into action?

There is real money and real management behind every company—but surprisingly, not every company has a concrete strategy to build a business and create value for shareholders.

Business Plan, or Lack Thereof?

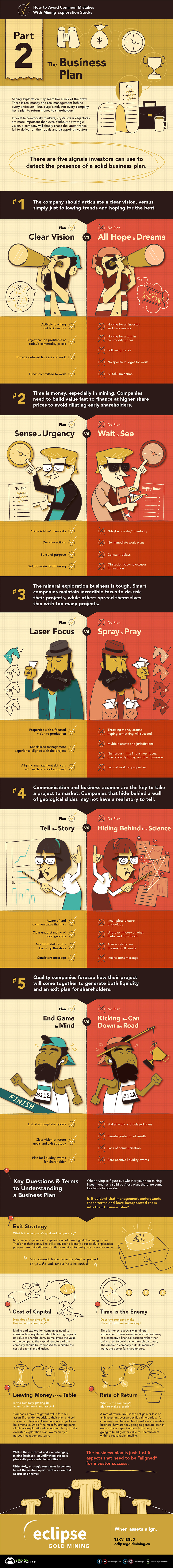

Today’s infographic comes to us from Eclipse Gold Mining and it shows you how to avoid common mistakes when evaluating and investing in mining exploration stocks.

Specifically, we look at five ways that potential investors can detect the presence and viability of a mining company’s business plan.

Visit Part 1 of “Common Mistakes With Mining Stocks” on Team by clicking here

So, what should investors be looking for, when it comes to examining the business plan of a mining exploration company?

#1: Clear Vision vs. All Hope & Dreams

A company should articulate a clear vision rather just simply following the trends and hoping for the best. A long term vision for a business plan is critical as it will be guiding and reminding stakeholders of the company’s purpose through the thick and thin.

Signs of a Clear Vision:

- The company is actively reaching out to investors

- Projects can be profitable at today’s commodity prices

- Provide detailed timelines of work

- Funds committed to work

A clear vision in business will give the company a direction to aim for, allowing everyone to work quickly towards objectives.

#2: Sense of Urgency vs. Wait & See

Time is money, especially in mining. Companies need to build value fast to finance at higher share prices so that early shareholders do not get diluted. A company needs to make concrete decisions that drive towards value creation.

Signs of a Sense of Urgency:

- “Time is now” mentality

- Decisive actions

- Sense of purpose

- Solution-oriented thinking

It is expensive to maintain a company, especially one that does not yet produce income. Expenses add up quickly and that is why management needs to make sure they focus their efforts and money on activities that generate value for shareholders.

#3: Laser Focus vs. Spray & Pray

The mineral exploration business is tough and each project requires the undivided attention of managers. Smart companies maintain incredible focus to de-risk their projects while others spread themselves thin with multiple projects.

- Properties with a focused vision towards production

- Specialized management experience aligned with the project

- Aligning management skill sets with each phase of a project

Signs of a Laser Focus:

In order to assess whether a company has the right focus you have to see whether the company is aligning its human assets with its physical assets and a goal in mind.

This focus will help to clarify the story for investors.

#4: Tell the Story vs. Hiding Behind the Science

Communication and business acumen are the key to take a project to market. Mining requires massive amounts of geological knowledge, but that is not the investor’s job to handle. They do not want to want to know the subtleties of geochemistry—they just want to know whether they can make money from those rocks.

Companies that hide behind a wall of geological slides may not have not a real story to tell, and they may be pulling investors into funding their own science projects. At the same time, investors need to make sure that the data being presented matches the story being told.

Signs of Telling the Story:

- Aware of risks, and communicating those risks

- Clear understanding of local geology

- Data from drill results back up the story

- Consistent message

If a company cannot communicate effectively, how are they going to deal with other, more complicated aspects of a mining business plan?

#5: Endgame in Mind vs. Kicking the Can Down the Road

A journey begins with a single step, but without a business plan and commitment, there will never be an end in sight. Quality companies foresee how their project will come together to generate both liquidity and an exit plan for shareholders. There are several clues investors can use to tell if a company is moving towards its goals.

Signs of the Endgame in Mind:

- List of accomplished goals

- Clear vision of future goals and exit strategy

- Plan for liquidity events for shareholder

The goal in investing is to make money. If shareholders are not making money, what is the point? If a company has no plan, it has no hope.

Making the Right Decisions

Understanding the characters that create value for mining companies is the first step, and the second step is assessing whether there is a viable business plan at hand.

While the risks are high, an effective plan is the first step towards reducing risks and providing shareholders with value.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees