Money

The Geography of America’s Distressed Communities

Despite a recent slump in the markets, the U.S. economy is still putting up strong numbers. Unemployment is at its lowest point since the 1960s, and the U.S. manufacturing sector is thriving.

Looking beyond these big picture gains, many communities in the United States are struggling. Check cashing stores outnumber McDonald’s locations, the opioid epidemic rages on, and tens of millions are living in poverty around the country. It’s becoming more clear that the recovery from the financial crisis has been highly uneven.

The Data Behind Distress

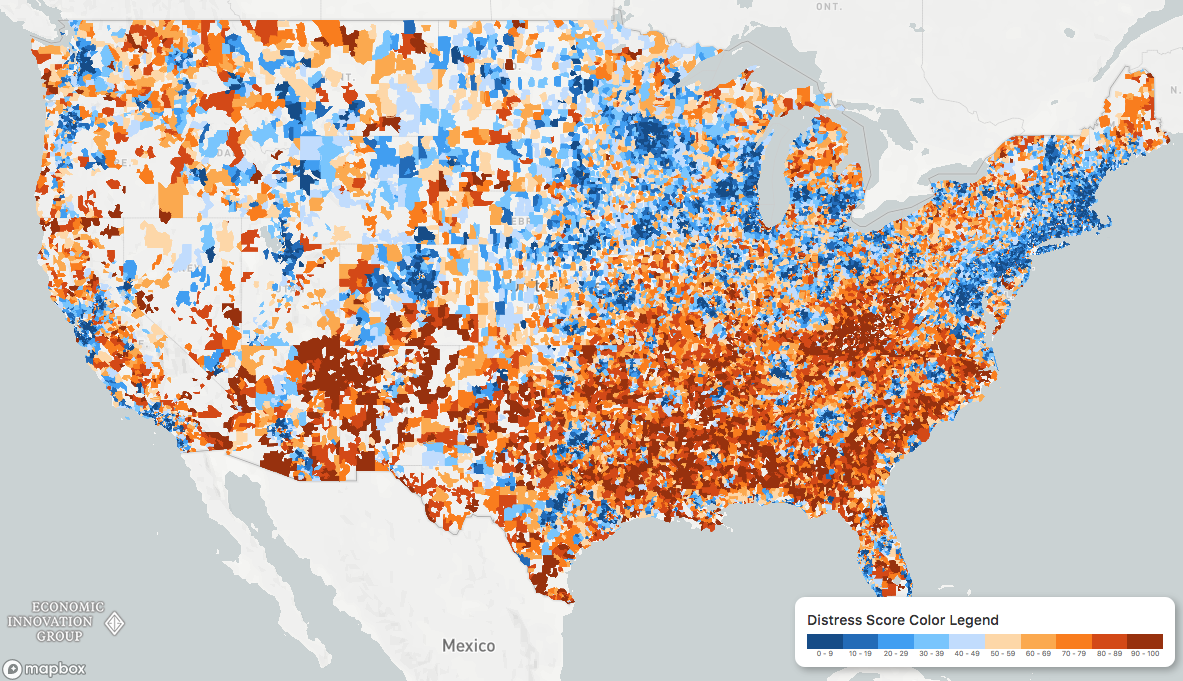

To understand the disconnect between struggling counties and a high-flying national economy, researchers at the Economic Innovation Group (EIG) created the Distressed Communities Index:

To calculate the “health” of communities around the country, the Economic Innovation Group (EIG) looked at everything from vacancy rates to median income ratios. When visualized, a picture emerges of an America divided into superstar regions and broad expanses of struggling communities.

Distressed and prosperous ZIP codes […] represent two almost diametrically opposed experiences of living in the United States.

– Distressed Communities Index Report (2018)

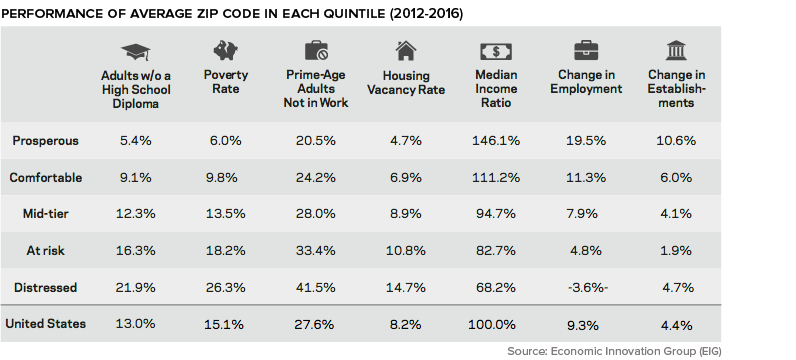

Community Quintiles

When communities are divided into quintiles, stark patterns emerge. In the most distressed zip codes, over 40% of “prime-age” adults are unemployed, one-in-five adults did not graduate high school, and the housing vacancy rate is nearly double the U.S. average.

As well, deaths related to substance abuse and mental illness are 64% higher in distressed communities.

Struggling States and Cities

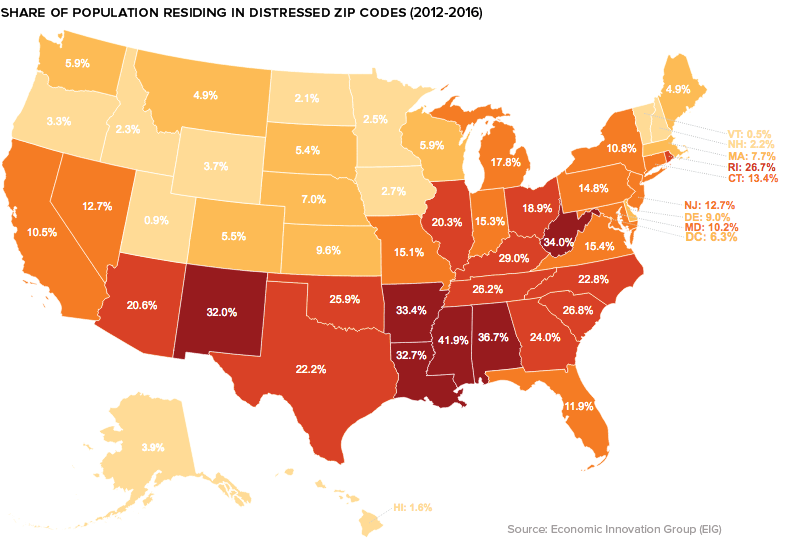

The DCI data reveals that those living in the lower half of the United States are more likely to call a distressed community home. In Alabama, Arkansas, Mississippi, and West Virginia, one-third or more of the population resides in the bottom quintile of zip codes.

On the flip side, in Colorado, Minnesota, Massachusetts, New Hampshire, and Utah well over 40% of the population live in prosperous zip codes.

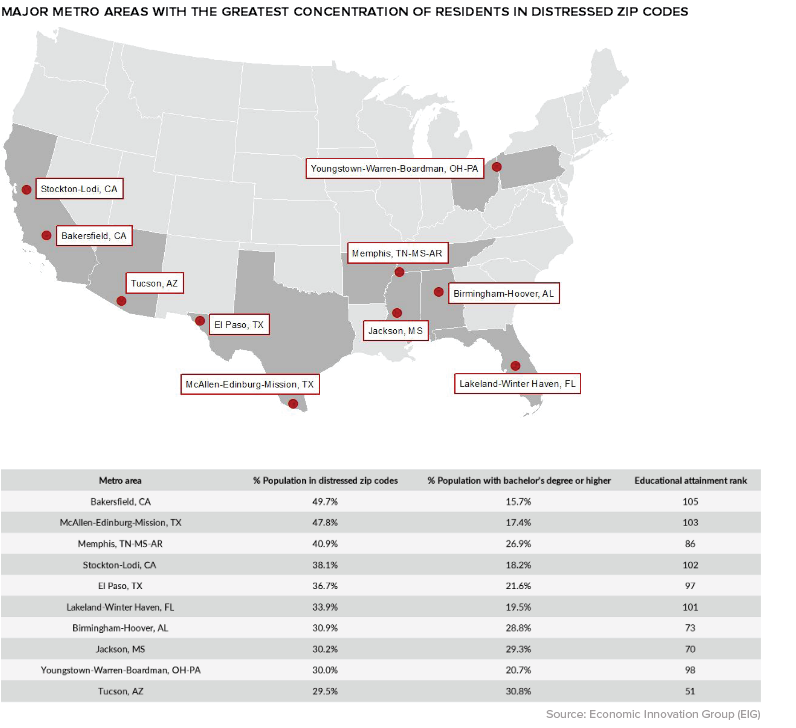

Zooming in beyond the state-level, a geographical trend becomes clear: many of the struggling communities in the index are classified as rural. Between 2007 and 2016, nearly a third of all rural zip codes were considered “downwardly mobile”, compared to only 16% of those in urban areas.

Though rural zip codes tend to fare worse than their more urban counterparts, there are exceptions to that trend. One example is Bakersfield, California, where almost half of the city’s population lives in a distressed community.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024