Demographics

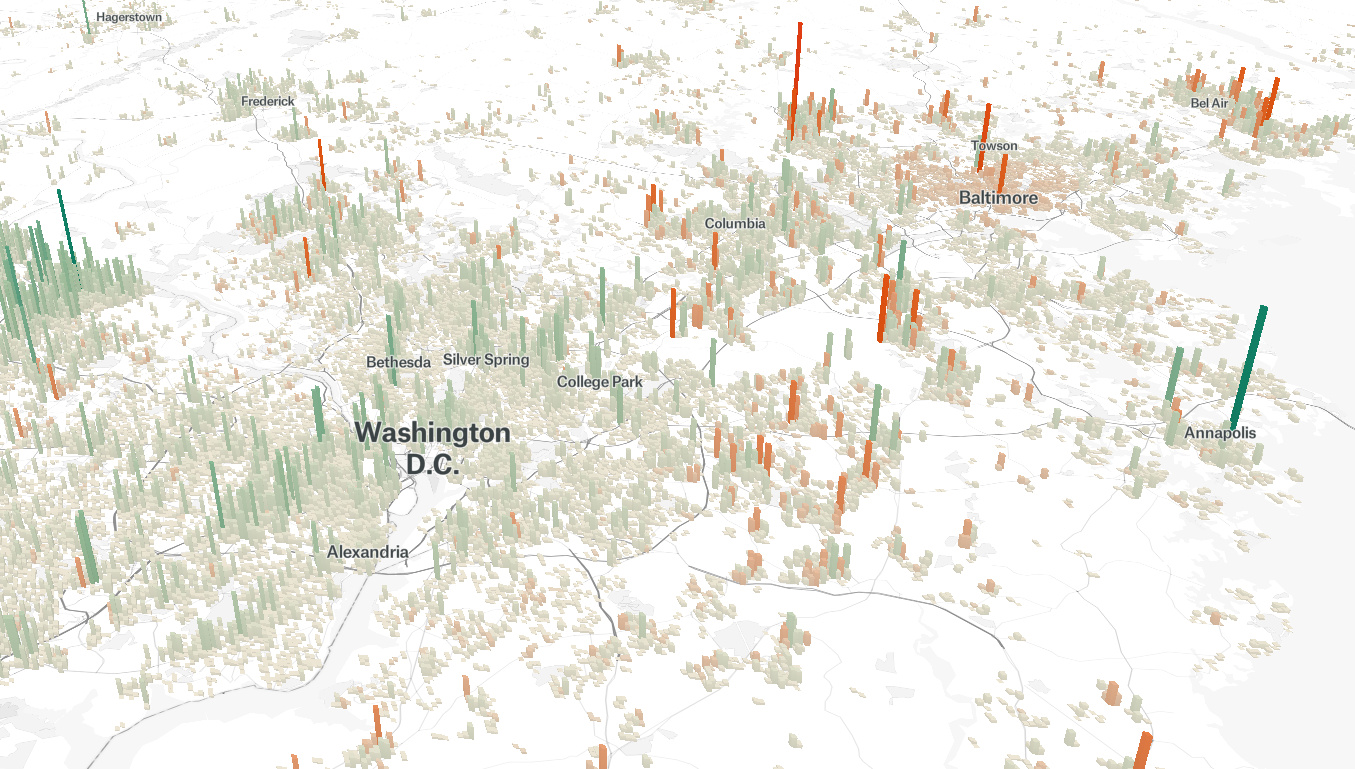

A 3D Look at Shifting Urban Populations

Cities are constantly evolving, and urban populations respond to a number of push–pull factors, including economic opportunity, lifestyle trends, land values, and natural disasters.

Beyond the headlines and raw census numbers, it can be difficult to take population patterns into perspective. The talented team over at The Pudding has created an amazing, granular map that shows these patterns as 3D stacks.

Our focus today will be on growth between 1990 and 2015, as urban settlement patterns across Canada and the U.S. shifted dramatically over this relatively short timeframe. Let’s take a look.

Growing Cities

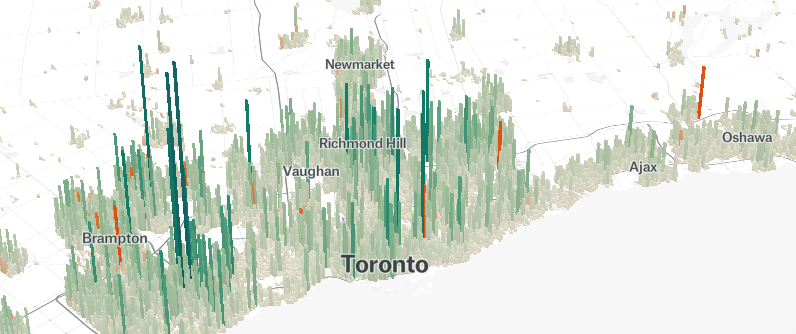

One of the most dramatic examples of robust growth is Toronto.

Canada’s largest city nearly doubled its population since 1990, and growth was distributed throughout the region. This city is a rare example of both extra-urban and downtown residential growth.

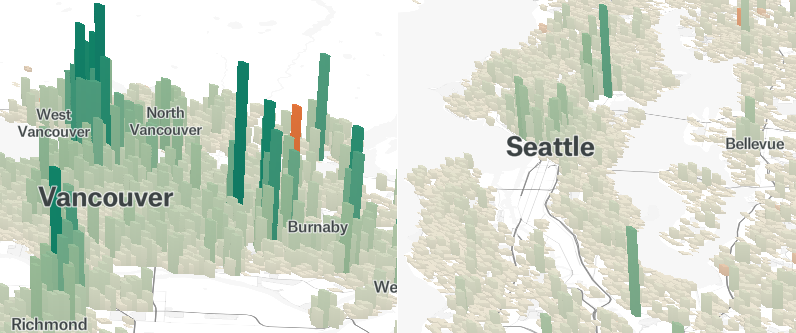

Vancouver is another Canadian city with a swelling urban population base. The city’s recent population growth has been heavily concentrated along transit lines and the downtown core, resulting in a “spiky” visualization which resembles the condo towers now dotting the city’s skyline.

Nearby, Seattle has added over a million people to its population since 1990. With one of the strongest economies in the country, it’s unlikely that momentum will slow any time soon.

Growing Suburbs

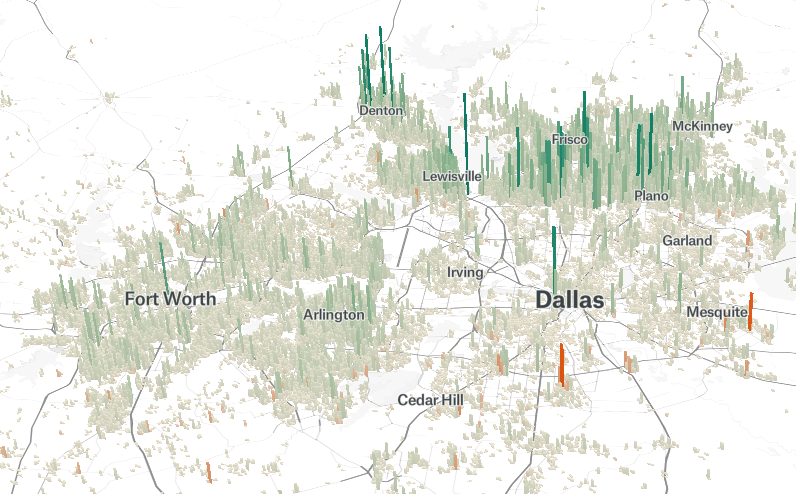

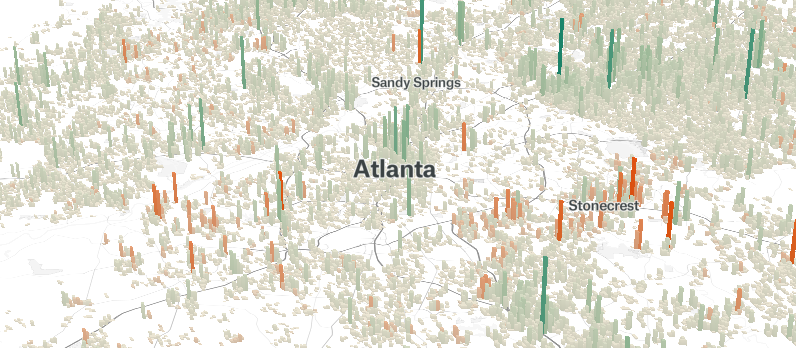

Only recently have some cities begun to see urban residential construction. For much of the ’90s and ’00s, America’s growth was in peripheral suburbs, where land was plentiful and cheap.

This sprawl effect is particularly easy to spot in the Texas Triangle – which encompasses the cities of San Antonio, Austin, Dallas–Fort Worth, and Houston – and Atlanta.

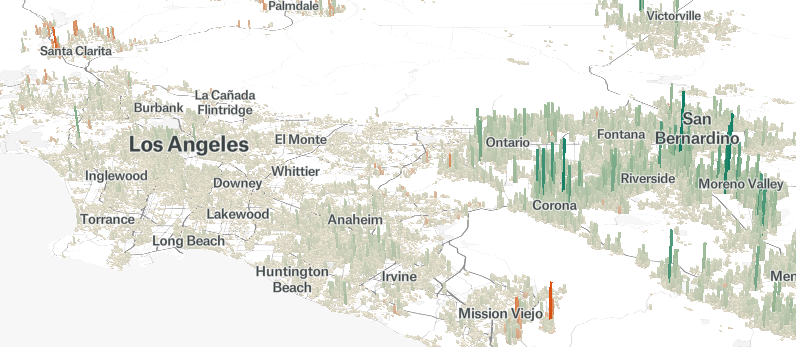

While Los Angeles did see a modest amount of growth over the past 25 years, it was the Inland Empire – anchored by San Bernardino and Riverside – that saw the most dramatic population growth in the region. The construction boom is only intensifying. The region added 50,000 new residents between 2016 and 2017.

Boomtowns

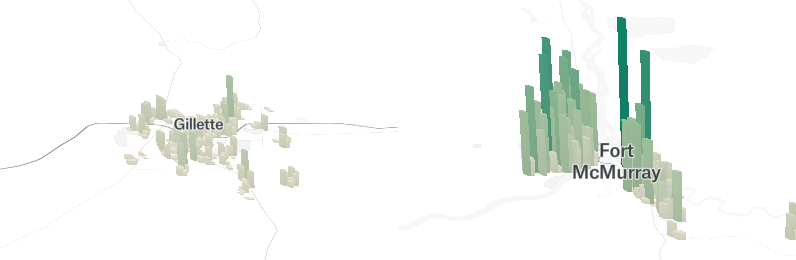

In general, smaller towns either lost population or remained relatively static. The exception is in places where resource extraction caused a growth spurt. Two prime examples are in Gillette, Wyoming, and Fort McMurray, Alberta. In the latter town, oil sands extraction added tens of thousands of new residents in a short amount of time.

Mixed growth and Static Cities

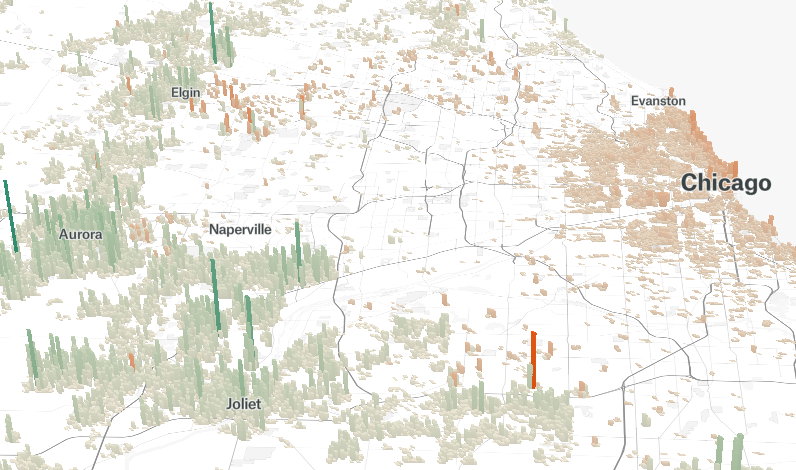

Chicago experienced one of the most striking growth patterns over the past 25 years. The contrast between urban decline and growth in the exurbs is clearly revealed in this visualization.

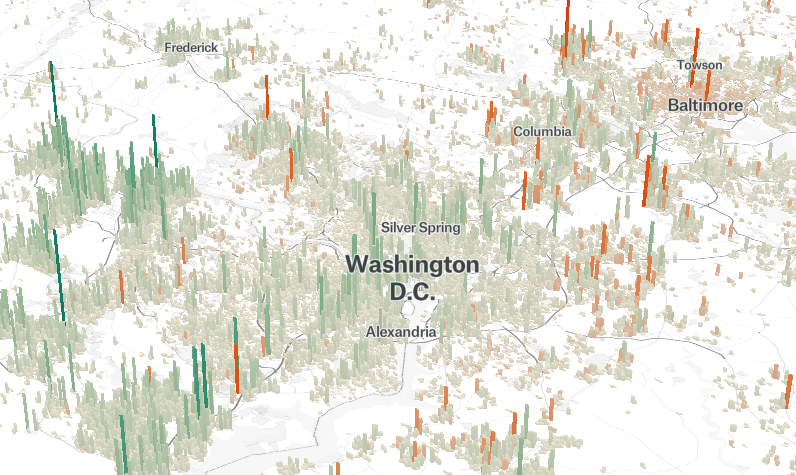

Contrast is also clear when looking at divergent patterns of Washington D.C. and Baltimore. The nation’s capital and surrounding areas have been growing steadily in recent years, whereas the neighboring city’s population is declining towards a 100-year low.

Static Cities

While a number of urban areas experienced dramatic shifts in the last couple of decades, some cities sidestepped wild population swings. For example, much of Philadelphia’s population pattern remains similar to what it was in 1990.

Scranton, Pennsylvania, and Springfield, Massachusetts, are examples of smaller cities that remained in stasis.

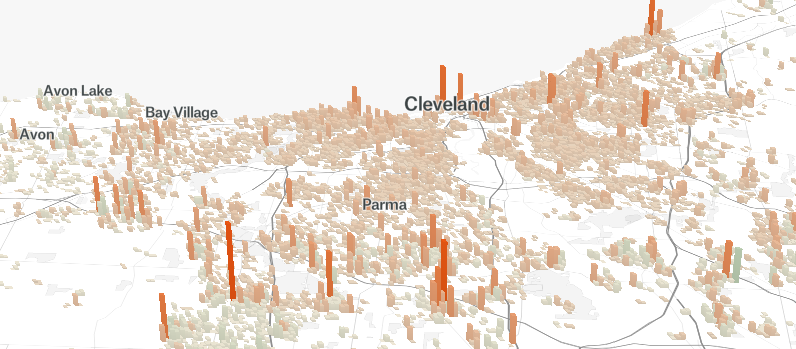

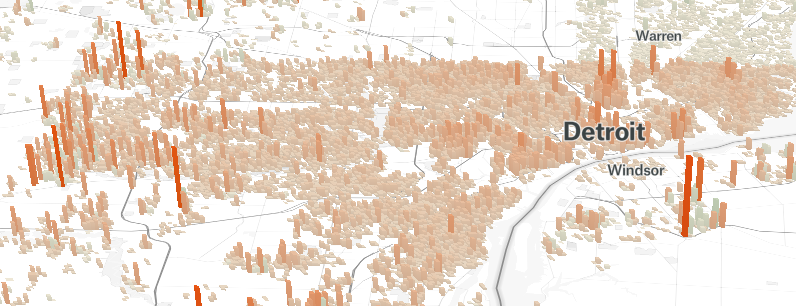

Decline and Disaster

A number of cities in America’s “Rust Belt” experienced declining populations. The visualizations of cities like Cleveland and Detroit show just how pronounced the exodus was.

The shrinking tax base and glut of vacant homes is causing a number of problems in the two cities, and with mixed economic prospects, it’s unclear what the next 25 years will bring in terms of population changes.

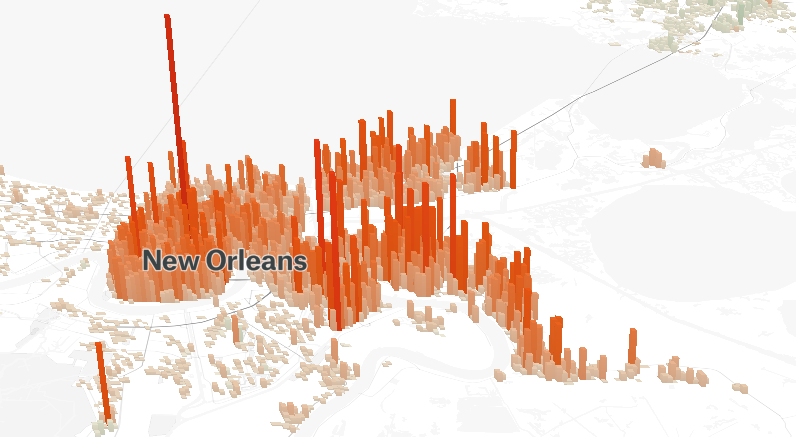

Often, population declines are the result of economic reasons such as a decline in manufacturing or general stagnation. On occasion though, the raw power of nature changes the course of a city’s history. This is the case in New Orleans, were Hurricane Katrina’s legacy is clearly seen in this visualization.

New Orleans did recover in the years after the hurricane. However, as of 2015, the city was still far below its pre-Katrina population. Resettlement has been patchy as well, which is reflected in the towering red peaks of the population map.

To explore your city or other parts of the world, visit The Pudding’s interactive map.

Demographics

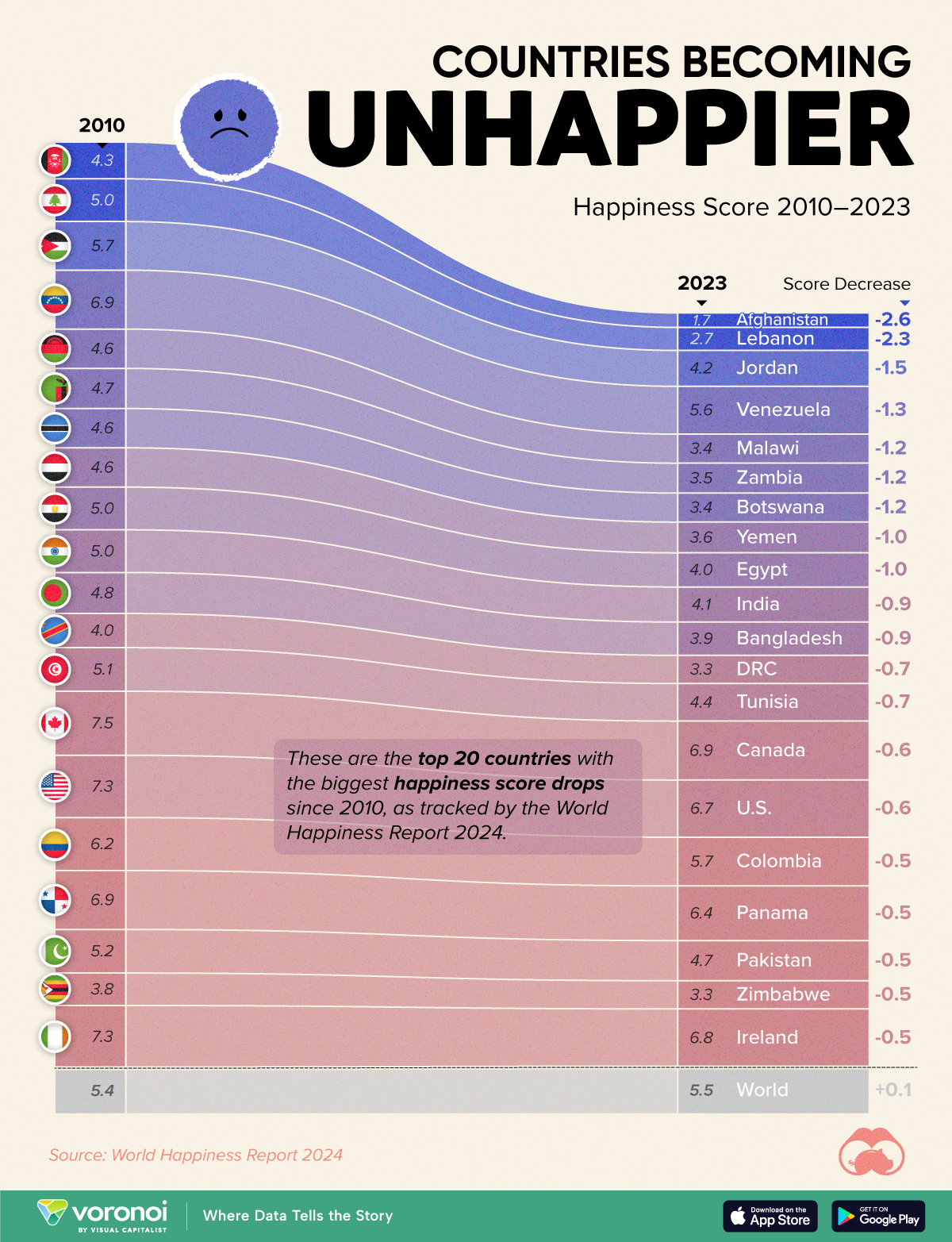

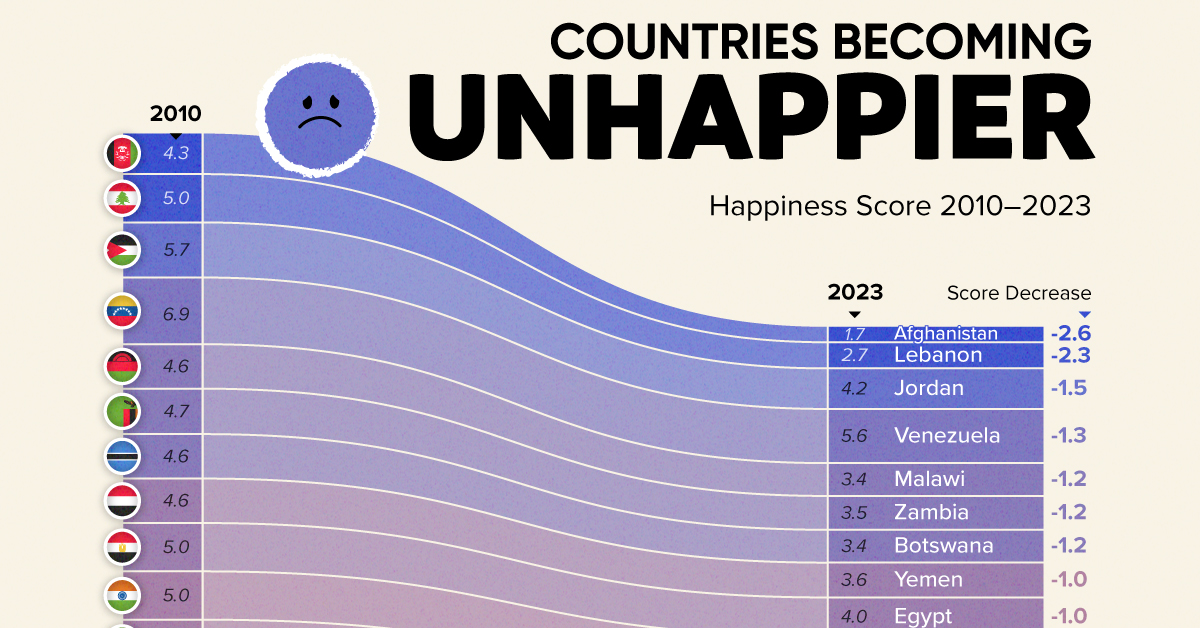

The Countries That Have Become Sadder Since 2010

Tracking Gallup survey data for more than a decade reveals some countries are witnessing big happiness declines, reflecting their shifting socio-economic conditions.

The Countries That Have Become Sadder Since 2010

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Can happiness be quantified?

Some approaches that try to answer this question make a distinction between two differing components of happiness: a daily experience part, and a more general life evaluation (which includes how people think about their life as a whole).

The World Happiness Report—first launched in 2012—has been making a serious go at quantifying happiness, by examining Gallup poll data that asks respondents in nearly every country to evaluate their life on a 0–10 scale. From this they extrapolate a single “happiness score” out of 10 to compare how happy (or unhappy) countries are.

More than a decade later, the 2024 World Happiness Report continues the mission. Its latest findings also include how some countries have become sadder in the intervening years.

Which Countries Have Become Unhappier Since 2010?

Afghanistan is the unhappiest country in the world right now, and is also 60% unhappier than over a decade ago, indicating how much life has worsened since 2010.

In 2021, the Taliban officially returned to power in Afghanistan, after nearly two decades of American occupation in the country. The Islamic fundamentalist group has made life harder, especially for women, who are restricted from pursuing higher education, travel, and work.

On a broader scale, the Afghan economy has suffered post-Taliban takeover, with various consequent effects: mass unemployment, a drop in income, malnutrition, and a crumbling healthcare system.

| Rank | Country | Happiness Score Loss (2010–24) | 2024 Happiness Score (out of 10) |

|---|---|---|---|

| 1 | 🇦🇫 Afghanistan | -2.6 | 1.7 |

| 2 | 🇱🇧 Lebanon | -2.3 | 2.7 |

| 3 | 🇯🇴 Jordan | -1.5 | 4.2 |

| 4 | 🇻🇪 Venezuela | -1.3 | 5.6 |

| 5 | 🇲🇼 Malawi | -1.2 | 3.4 |

| 6 | 🇿🇲 Zambia | -1.2 | 3.5 |

| 7 | 🇧🇼 Botswana | -1.2 | 3.4 |

| 8 | 🇾🇪 Yemen | -1.0 | 3.6 |

| 9 | 🇪🇬 Egypt | -1.0 | 4.0 |

| 10 | 🇮🇳 India | -0.9 | 4.1 |

| 11 | 🇧🇩 Bangladesh | -0.9 | 3.9 |

| 12 | 🇨🇩 DRC | -0.7 | 3.3 |

| 13 | 🇹🇳 Tunisia | -0.7 | 4.4 |

| 14 | 🇨🇦 Canada | -0.6 | 6.9 |

| 15 | 🇺🇸 U.S. | -0.6 | 6.7 |

| 16 | 🇨🇴 Colombia | -0.5 | 5.7 |

| 17 | 🇵🇦 Panama | -0.5 | 6.4 |

| 18 | 🇵🇰 Pakistan | -0.5 | 4.7 |

| 19 | 🇿🇼 Zimbabwe | -0.5 | 3.3 |

| 20 | 🇮🇪 Ireland | -0.5 | 6.8 |

| N/A | 🌍 World | +0.1 | 5.5 |

Nine countries in total saw their happiness score drop by a full point or more, on the 0–10 scale.

Noticeably, many of them have seen years of social and economic upheaval. Lebanon, for example, has been grappling with decades of corruption, and a severe liquidity crisis since 2019 that has resulted in a banking system collapse, sending poverty levels skyrocketing.

In Jordan, unprecedented population growth—from refugees leaving Iraq and Syria—has aggravated unemployment rates. A somewhat abrupt change in the line of succession has also raised concerns about political stability in the country.

-

Lithium6 days ago

Lithium6 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?