Business

15 Warning Signs to Identify a Toxic Work Environment Before Taking a Job

According to Gallup, 85% of the world’s one billion full-time employees are unhappy at work.

While there are a number of reasons that contribute towards job dissatisfaction, a toxic work environment can have a significant impact on an employee’s performance, not to mention their physical and mental health.

But identifying red flags before accepting a job offer can be difficult; companies often sell themselves as a model workplace, when in reality, their inner workings are hugely problematic.

How to Identify a Toxic Work Environment

Today’s graphic comes to us from resume.io and it illustrates the 15 warning signs to look out for before, during, and after a job interview.

Lifting the Corporate Veil

A toxic work environment diminishes productivity by breeding a culture of discrimination, disorganization, bullying, and may even be fueled by unethical or selfish motivations.

Luckily, prospective employees can avoid 40 hours of torment a week by probing the company’s culture before signing on the dotted line. Here is a list of things to look out for:

Before the Interview

For better or worse, first impressions matter. Although excitement levels may be high, it’s important to pay attention to potential missteps, even before the interview starts.

- Vague job description: There should be clarity around the roles and responsibilities associated with the job, even if it is a new role in the company.

- Negative reviews on Glassdoor: Company review platforms are quickly becoming an indispensable tool for jobseekers who are interested in learning more about previous and current employees’ experiences.

- It took a long time to arrange an interview: Companies should show respect for the interviewee by getting back to them in a timely manner.

- Forgetting interviews: This could suggest that either the company has serious communication issues, or they do not prioritize interviewing potential employees.

- The interview starts late: Punctuality is not only expected from the person being interviewed, the interviewer should also be on time.

During the Interview

Adrenaline may be pumping when the interviewee is in the hot seat, but it’s crucial that they take stock of how the interviewers are conducting themselves.

- Unprepared interviewers: If the interview lacks structure, this could signal a disorganized team and a lack of clear expectations for the role.

- No interest in listening: Both parties need to put their best foot forward in an interview, to make sure that the interviewee’s personality and skill set aligns with the company, and vice versa.

- Authoritarian interviewer: This may indicate a lack of respect for employees.

- Inability to communicate company values: If company values are embodied by employees, then they should be top of mind and easily communicated.

- Questions are skimmed over: Companies should be transparent and be willing to provide comprehensive answers to any questions an interviewee may have.

After the Interview

In addition to assessing their own performance, interviewees should give careful consideration to how the entire interview experience went.

- Short interview: Either the company has already chosen another candidate, or they are desperate to fill the role as quickly as possible.

- Quiet workspace: A lack of teamwork or fearful employees could be the culprit for a silent office.

- No office tour: Companies should always give prospective employees a glimpse into what their day-to-day could look like by showing them around and introducing them to the team.

- Job offer was given on the day of the interview: The company could be trying to restrict the interviewee doing further research into the company, or simply filling the role as quickly as possible.

- Delayed decision-making: Failing to get back to someone who has done an interview shows a lack of respect for their time or disorganization on the company’s end.

It’s also worth mentioning that mistakes can be made by anyone, so it is perhaps not helpful to scrutinize companies for small errors in judgement when most of the experience has been positive.

Regardless, if there are any looming uncertainties, it is up to the person being interviewed to ask.

Finding the Courage to Ask Questions

When it comes to interviews, questioning the culture of the company is just as important as questioning the interviewee on their knowledge and skills.

“He who asks a question may be a fool for five minutes. He who does not ask questions, remains a fool forever.”

—Ancient Chinese proverb

Switching jobs is rarely an easy process, especially when jobseekers have come up against unforeseen challenges as a result of COVID-19.

But it is more important than ever for people to do their due diligence, and be brave enough to ask tough questions. Otherwise, they may have to repeat the cycle all over again—much sooner than they would have thought.

Business

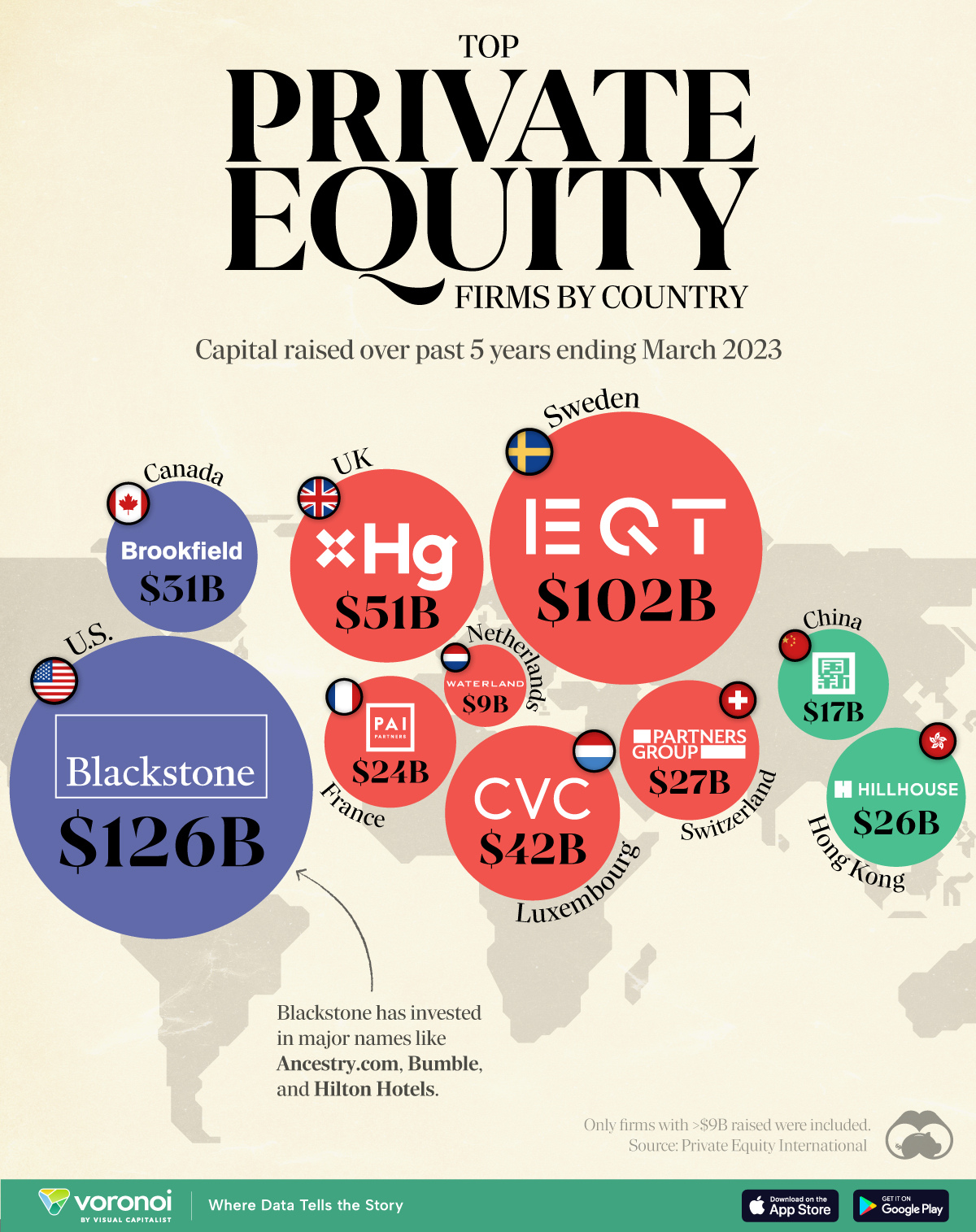

The Top Private Equity Firms by Country

This map visualizes the leading private equity firms of major countries, ranked by capital raised over the past five years.

The Top Private Equity Firms by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Private equity firms are investment management companies that pool investor capital to acquire stakes in private companies. Through strategic management, they aim to enhance the value of these companies, then profit from a future sale or public offering.

To gain insight into this industry, we’ve visualized the top private equity firms in various countries, ranked by the amount of capital they raised over the past five years ending March 2023.

The cutoff for inclusion in this graphic was $9 billion raised. All figures come from Private Equity International’s PEI 300 ranking.

Data and Highlights

The data we used to create this graphic is included in the table below.

| Country | Firm | Amount raised |

|---|---|---|

| 🇺🇸 US | Blackstone | $126B |

| 🇸🇪 Sweden | EQT | $102B |

| 🇬🇧 UK | Hg | $51B |

| 🇱🇺 Luxembourg | CVC Capital Partners | $42B |

| 🇨🇦 Canada | Brookfield Asset Management | $31B |

| 🇨🇭 Switzerland | Partners Group | $27B |

| 🇭🇰 Hong Kong | Hillhouse Capital Group | $26B |

| 🇫🇷 France | PAI Partners | $24B |

| 🇨🇳 China | China Reform Fund Management Corp | $17B |

| 🇳🇱 Netherlands | Waterland Private Equity | $9B |

U.S.-based Blackstone is the world’s largest private equity firm, with operations in additional areas like credit, infrastructure, and insurance.

While not shown in this graphic, the U.S. largely dominates the private equity landscape. If we were to rank the top 10 private equity firms by the same metric (capital raised over past five years), U.S. firms would account for eight of them.

More About Blackstone

Blackstone was founded in 1985 by Peter G. Peterson and Stephen A. Schwarzman, both former Lehman Brothers employees.

Notably investments that Blackstone has made include Ancestry.com, where it acquired a majority stake for nearly $5 billion in 2020.

In 2007, it also acquired Hilton Worldwide (one of the world’s biggest hotel operators) for roughly $26 billion.

Sweden’s EQT

EQT is Sweden’s largest private equity firm, and third largest globally. It is just one of three firms that have raised over $100B in capital over the past five years alongside Blackstone and KKR (also American).

EQT made news earlier this year when it raised $24B in two years for its EQT X private equity fund, which invests in the healthcare, technology and tech-enabled service sectors.

If you found this post interesting, check out this graphic that visualizes the most common types of investments that financial advisors use with their clients.

-

Economy7 days ago

Economy7 days agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Energy2 weeks ago

Energy2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?