Markets

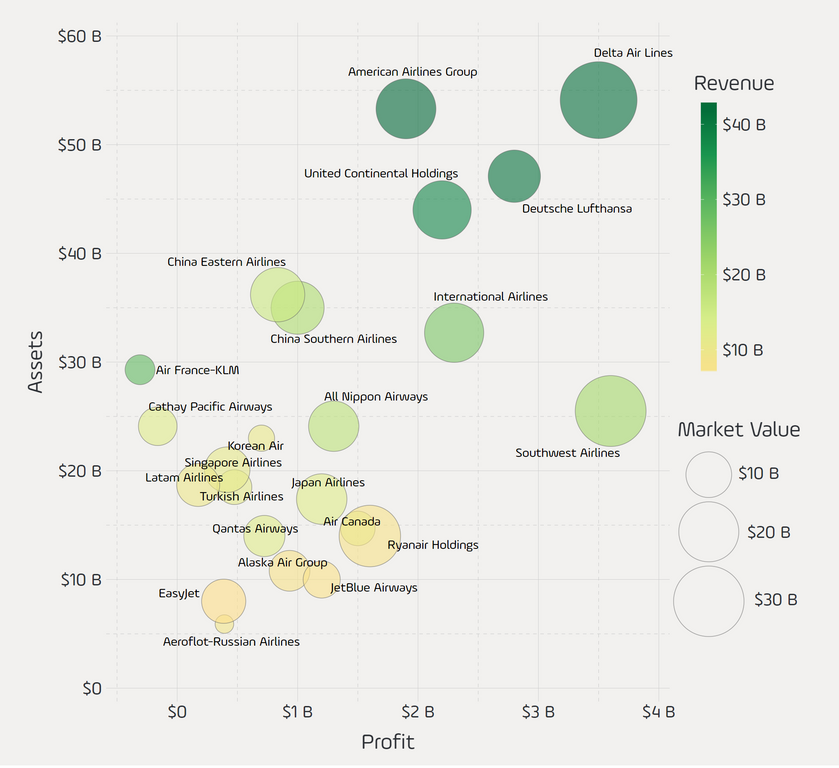

Visualizing the World’s Largest Airline Companies

Through most of its history, the commercial airline industry has had a somewhat turbulent relationship with investors.

For example, during the span of 2003-2011, the three major U.S. carriers (American, United, and Delta) all filed for bankruptcy, and this was subsequently after merging with other large airlines (US Airways, Continental, and Northwest) that each had their own solvency issues.

Despite the rough ride a decade ago, just last year the industry raked in $35.6 billion in profits – a record-setting amount according to the International Air Transport Association (IATA). Even legendary investor Warren Buffett is flying high on airline stocks at the moment, and he’s recently floated the idea of buying a whole carrier for Berkshire’s portfolio.

Comparing Airlines

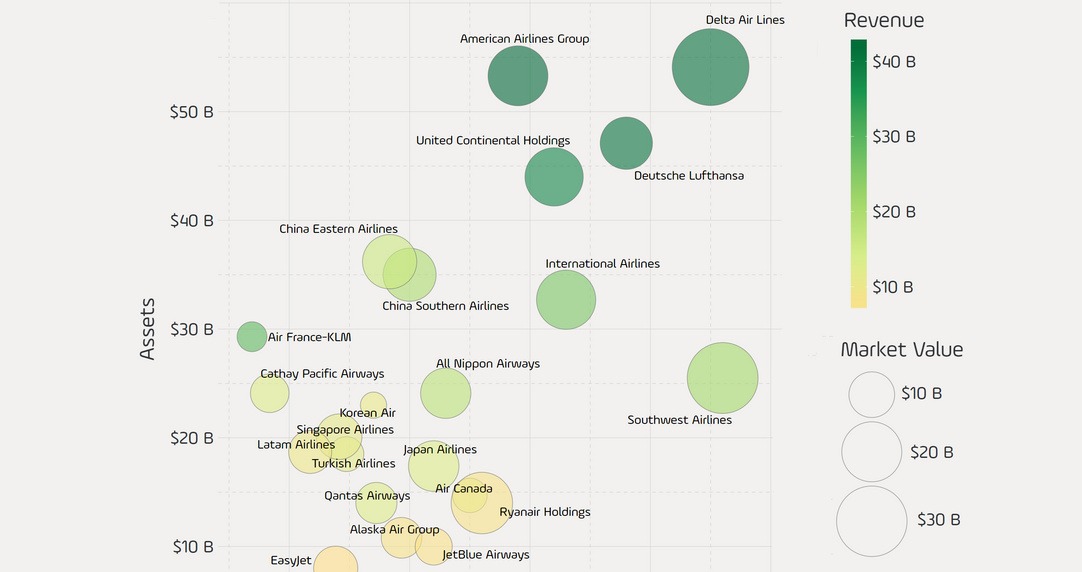

Today’s graphic comes from Reddit user /u/takeasecond and it uses data from the Forbes Global 2000 list to plot the world’s largest publicly-traded airlines in terms of revenue, profit, assets, and market value.

It provides some interesting insights on the industry, showing some unexpected carriers leading the way.

There are four companies that stand out instantly on the chart. Air France-KLM and Cathay Pacific are both easy to spot, but for the wrong reasons. They are to the left of the $0 profit line, and Forbes has their most recent net incomes listed as -$309 million and -$162 million respectively.

In the upper right corner, Delta Air Lines appears to be one of the healthiest companies by many measures. It ranks second in sales ($42B) and profitability ($3.5B), and comes out on top in terms of assets ($54B) and market value ($37B).

Finally, to the bottom right is Southwest Airlines – it has the highest profitability ($3.6B) but is able to do it at far higher margins than the rest of the pack.

Ranking Profitability and Sales

Here are two of the most important metrics – revenue and profit – for the 10 publicly-traded airlines with the most sales:

| Rank | Airline | Revenue ($B) | Profit ($B) | Margin |

|---|---|---|---|---|

| #1 | American Airlines | $43.0 | $1.9 | 4.4% |

| #2 | Delta Air Lines | $42.1 | $3.5 | 8.3% |

| #3 | Deutsche Lufthansa | $41.5 | $2.8 | 6.7% |

| #4 | United Continental | $38.3 | $2.2 | 5.7% |

| #5 | Air France-KLM | $29.1 | -$0.3 | -1.1% |

| #6 | International Airlines | $26.0 | $2.3 | 8.8% |

| #7 | Southwest | $21.2 | $3.6 | 17.0% |

| #8 | China Southern | $19.7 | $1.0 | 5.1% |

| #9 | All Nippon | $17.8 | $1.3 | 7.3% |

| #10 | China Eastern | $15.7 | $0.8 | 5.3% |

Note: Margin is calculated based on Forbes’ numbers above

In recent months, the IATA has revised its outlook for 2018 after originally forecasting record-setting airline revenues again.

The organization now sees profits falling to $33.8 billion, a 12% decrease on its original forecast.

Markets

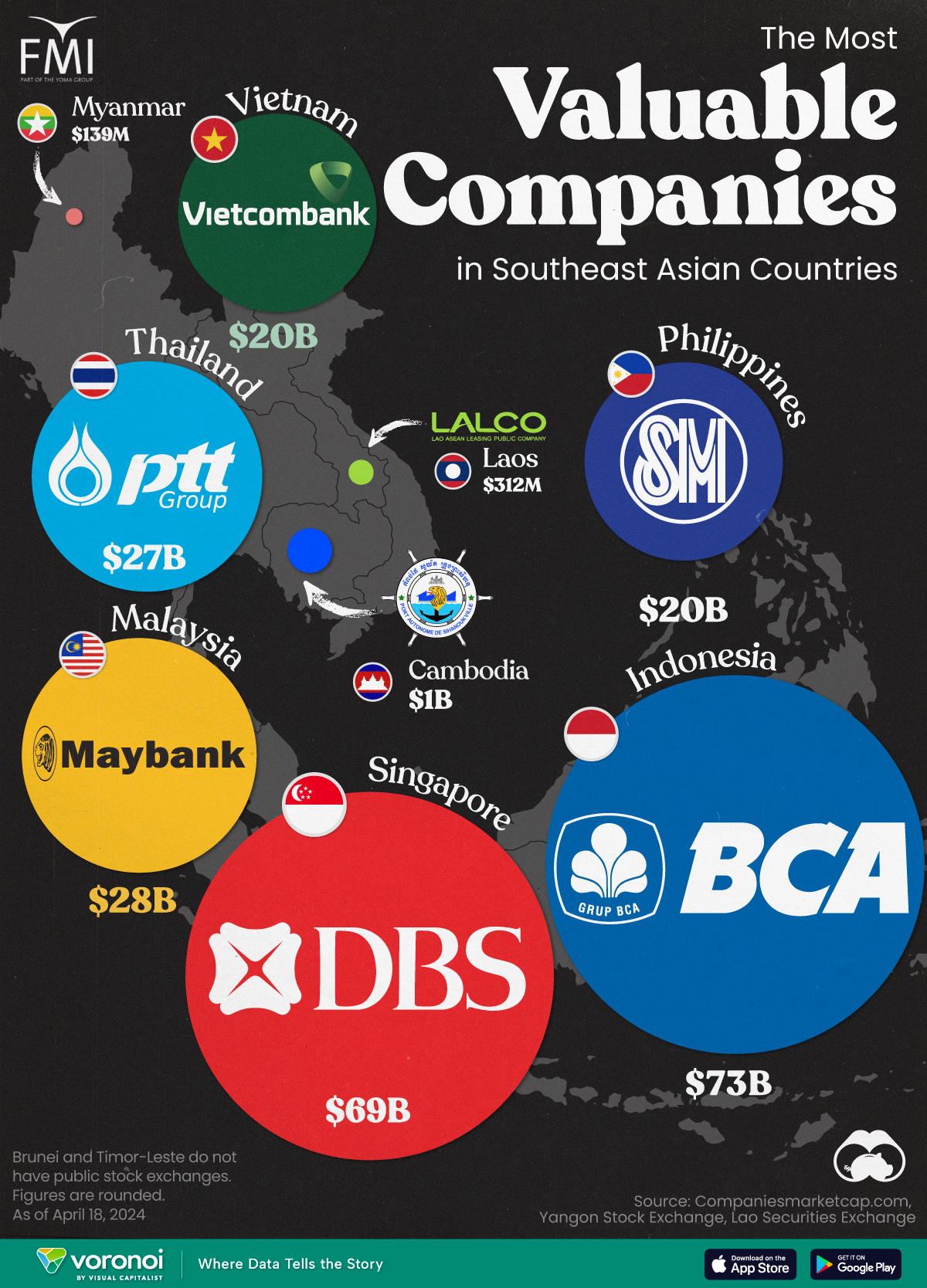

Mapped: The Most Valuable Company in Each Southeast Asian Country

Six businesses in the broader financial space are present on this list of the largest companies, by market cap, in each Southeast Asian country.

The Most Valuable Company in Each Southeast Asian Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Southeast Asia has been emerging as an economic powerhouse in the past decade. However, there are very noticeable disparities in the sizes of the largest publicly-traded corporations in countries within the region.

In this visualization, we map the most valuable company in each Southeast Asian country, by their market capitalization in current U.S. dollars as of April 18th, 2024.

Data for this visualization and article is sourced from Companiesmarketcap.com, and the Laos and Yangon stock exchanges.

Southeast Asia’s Biggest Companies are Banks

The most valuable companies in Indonesia and Singapore, Bank Central Asia and DBS Group, are each worth more than $60 billion, and both are banks.

In the quartet of Malaysia, Thailand, Vietnam, and the Philippines, the largest companies by market cap are all worth around $20 billion. Out of the four, two are banks.

| Country | Company | Market Cap |

|---|---|---|

| 🇮🇩 Indonesia | 🏦 Bank Central Asia | $73B |

| 🇸🇬 Singapore | 🏦 DBS Group | $69B |

| 🇲🇾 Malaysia | 🏦 Maybank | $28B |

| 🇹🇭 Thailand | ⛽ PTT PCL | $27B |

| 🇻🇳 Vietnam | 🏦 Vietcombank | $20B |

| 🇵🇭 Philippines | 📈 SM Investments Corporation | $20B |

| 🇰🇭 Cambodia | 🚢 Sihanoukville Autonomous Port | $1B |

| 🇱🇦 Laos | 🏭 LALCO | $312M |

| 🇲🇲 Myanmar | 📈 First Myanmar Investment | $139M |

Note: Figures are rounded, and current as of April 18th, 2024.

Cambodia stands by itself, with its most valuable publicly listed company, Sihanoukville Autonomous Port, worth $1 billion.

Meanwhile, LALCO in Laos is a credit leasing company worth $312 million and Myanmar’s biggest company, First Myanmar Investment, is worth $139 million.

Finally, Brunei and Timor-Leste do not have public stock exchanges, but for different reasons.

Most of Brunei’s economy relies on the state-owned oil sector, which also helps make its sultan the world’s second-richest monarch. However, in Timor-Leste, a small population combined with limited access to credit and liquidity has led to limited opportunities for the creation of publicly-listed companies or an exchange.

-

Economy7 days ago

Economy7 days agoRanked: The Top 20 Countries in Debt to China

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

AI2 weeks ago

AI2 weeks agoVisualizing AI Patents by Country

-

Economy2 weeks ago

Economy2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology1 week ago

Technology1 week agoAll of the Grants Given by the U.S. CHIPS Act

-

Green1 week ago

Green1 week agoThe Carbon Footprint of Major Travel Methods