Investor Education

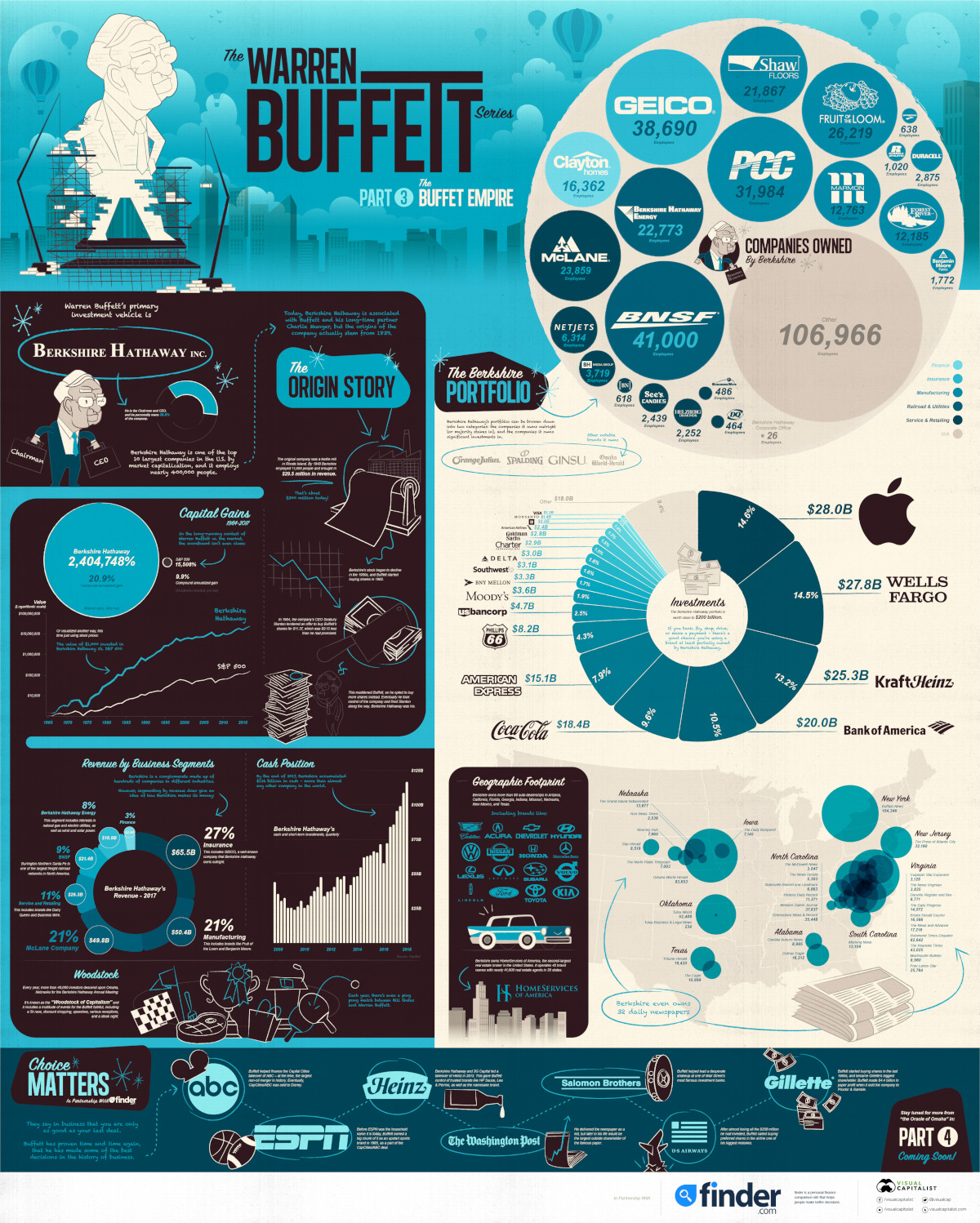

The Warren Buffett Empire in One Giant Chart

Most people know Berkshire Hathaway as the massive conglomerate that serves as the investment vehicle for Warren Buffett’s $83 billion fortune. However, far fewer people know what this giant does, and how it actually makes its money!

The Warren Buffett Series

Part 3: The Warren Buffett Empire

Today’s infographic breaks down the many companies and investments that Berkshire Hathaway owns.

It’s the third part of the Warren Buffett Series, which we’ve done in partnership with finder.com, a personal finance site that helps people make better decisions – whether they want to jump on the cryptocurrency craze or follow Buffett’s more traditional path to financial success.

Explore the full-screen version of this graphic

The Warren Buffett Empire in One Giant Chart

This giant infographic is best viewed using the full-size version. Also, don’t forget to check out Part 1 and Part 2 of our Warren Buffett Series.

If you look at any ranking of the world’s richest people, you will notice that most of the names derive their wealth from building individual, successful companies.

Topping today’s rich list is Jeff Bezos, who started Amazon in 1994. Further down, you see familiar names like Bill Gates (Microsoft), Amancio Ortega (Zara), Mark Zuckerberg (Facebook), Larry Ellison (Oracle), and so on.

Warren Buffett, who appears third on such a list, is completely unique in this sense. Through his holding company Berkshire Hathaway, he has bought, sold, or invested in hundreds of companies over the years, and their industries are all over the map. These investments include consumer goods companies like Coca-Cola, daily national newspapers like The Washington Post, and insurance companies like GEICO.

Buffett currently owns 36.8% of Berkshire – and at the time of publishing, Berkshire Hathaway is worth an impressive $480 billion, employing 377,000 people across many different industries.

Origin Story

Although Berkshire Hathaway is today associated with Buffett and his long-time partner Charlie Munger, the origins of the company actually stem from 1839.

The original company was a textile mill in Rhode Island, and by 1948 Berkshire employed 11,000 people and brought in $29.5 million in revenue (about $300 million in today’s dollars).

After Berkshire’s stock began to decline in the late 1950s, Buffett saw value in the company and started accumulating shares. By 1964, Buffett wanted out, and the company’s CEO Seabury Stanton tendered an offer to buy Buffett’s shares for $11.37, which was $0.13 less than he had promised.

This made Buffett mad, and instead of taking the offer, he opted to buy more shares. Eventually he took control of the company and fired Stanton.

The company was his, and the rest is history.

The Scoreboard

In the long-running contest of Warren Buffett vs. the market, the scoreboard isn’t even close:

| Berkshire Hathaway | S&P 500 | |

|---|---|---|

| Total gain (1964-2017) | 2,404,748% | 15,508% |

| Compound annualized gain | 20.9% | 9.9% |

Source: BH Annual Report. BH’s market value is after-tax, and S&P 500 is pre-tax, including dividends.

If you’re wondering how Warren Buffett developed such an impressive investing record, it’s worth seeing Part 2 of this series: Inside Buffett’s Brain.

Revenue by Business Segments

The Warren Buffett Empire is diverse, and made up of hundreds of companies in different industries.

However, segmenting by revenue does give an idea of how Berkshire makes its money:

| Revenue (Billions, 2017) | % of Total | |

|---|---|---|

| Insurance | $65.5 | 27% |

| BNSF | $21.4 | 9% |

| Berkshire Hathaway Energy | $18.9 | 8% |

| Manufacturing | $50.4 | 21% |

| McLane Company | $49.8 | 21% |

| Service and Retailing | $26.3 | 11% |

| Finance | $8.4 | 3% |

| Total | $240.7 | 100% |

The Berkshire Portfolio

Berkshire Hathaway’s portfolio can be broken down into two categories: the companies it owns outright (or majority stakes in), and the companies it owns significant investments in.

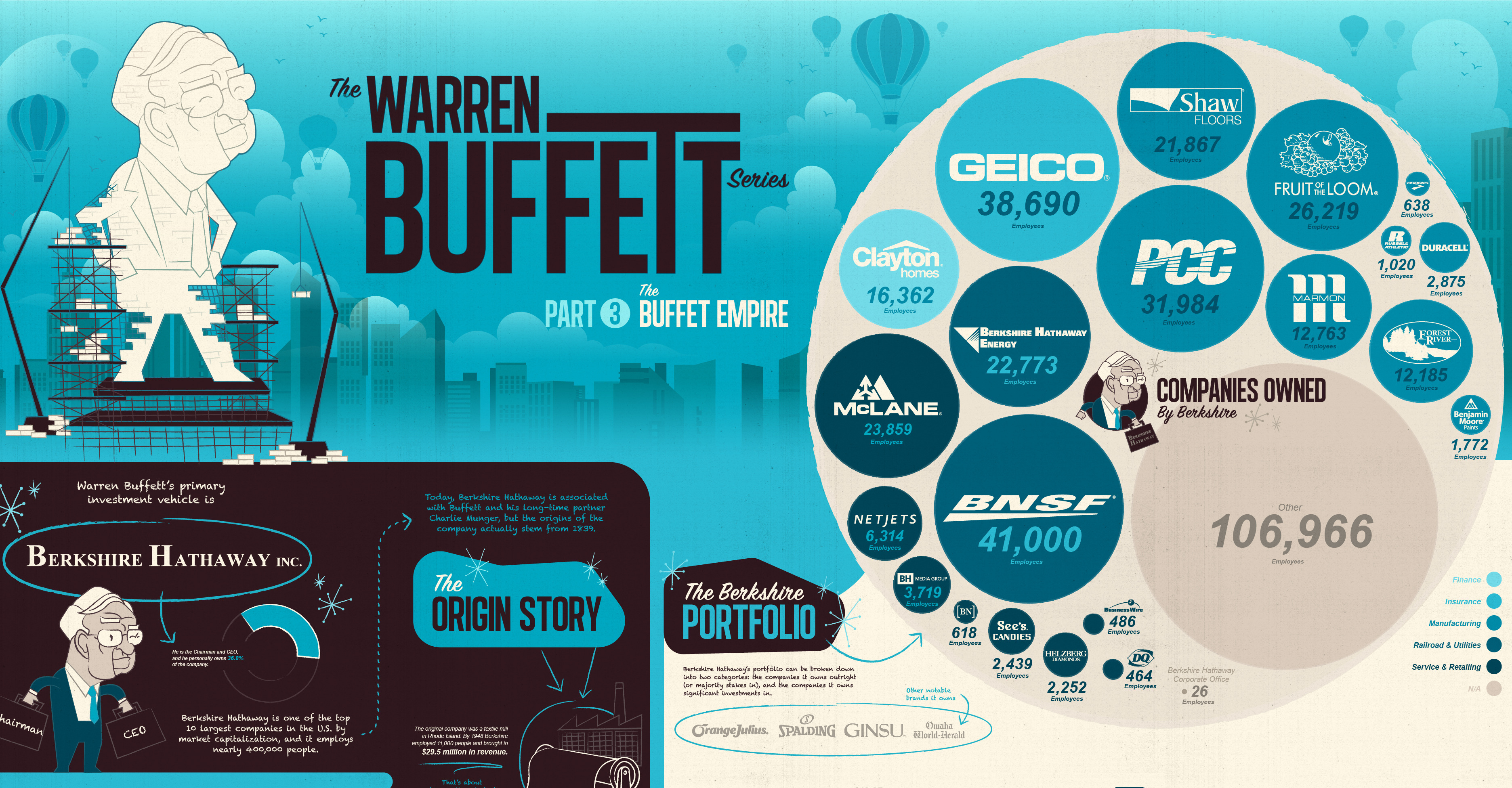

Companies Owned by Berkshire

Berkshire Hathaway owns well-known brands ranging from Dairy Queen to Duracell. Here are all those companies listed by number of employees:

| Industry | Company | Employees |

|---|---|---|

| Finance | Clayton Homes | 16,362 |

| Insurance | GEICO | 38,690 |

| Manufacturing | Precision Castparts | 31,984 |

| Manufacturing | Fruit of the Loom | 26,219 |

| Manufacturing | Shaw Industries | 21,867 |

| Manufacturing | The Marmon Group | 12,763 |

| Manufacturing | Forest River | 12,185 |

| Manufacturing | Duracell | 2,875 |

| Manufacturing | Benjamin Moore | 1,772 |

| Manufacturing | Russell Athletic | 1,020 |

| Manufacturing | Brooks Sports | 638 |

| Railroad and Utilities | BNSF Railways | 41,000 |

| Railroad and Utilities | Berkshire Hathaway Energy | 22,773 |

| Service and Retailing | McLane Company | 23,859 |

| Service and Retailing | NetJets | 6,314 |

| Service and Retailing | BH Media Group | 3,719 |

| Service and Retailing | See’s Candies | 2,439 |

| Service and Retailing | Helzberg Diamonds | 2,252 |

| Service and Retailing | The Buffalo News | 618 |

| Service and Retailing | Business Wire | 486 |

| Service and Retailing | Dairy Queen | 464 |

| n/a | Berkshire Hathaway Corporate Office | 26 |

| n/a | Other | 106,966 |

| Total | 377,291 |

Importantly, you’ll notice that there are only 26 employees in Berkshire Hathaway’s corporate office – that’s because Buffett is adamant that portfolio companies need to be well-managed in their own right, and he thinks this decentralization is a key to his success.

Investments

Here are the companies Berkshire Hathaway has significant investments in – the whole portfolio is worth nearly $200 billion:

| Company | Value (Billions) | % of Portfolio |

|---|---|---|

| Apple | 28.0 | 14.6% |

| Wells Fargo | 27.8 | 14.5% |

| Kraft Heinz | 25.3 | 13.2% |

| Bank of America | 20.0 | 10.5% |

| Coca Cola | 18.4 | 9.6% |

| American Express | 15.1 | 7.9% |

| Phillips 66 | 8.2 | 4.3% |

| U.S. Bancorp | 4.7 | 2.5% |

| Moody's | 3.6 | 1.9% |

| Bank of NY Mellon | 3.3 | 1.7% |

| Southwest Airlines | 3.1 | 1.6% |

| Delta Airlines | 3.0 | 1.6% |

| Charter Communications | 2.9 | 1.5% |

| Goldman Sachs | 2.8 | 1.5% |

| American Airlines | 2.4 | 1.3% |

| GM | 2.0 | 1.0% |

| Monsanto | 1.4 | 0.7% |

| Visa | 1.2 | 0.6% |

| Other | 18.0 | 9.4% |

| Total | 191.2 | 100.0% |

The portfolio is pretty much a microcosm of the American economy: it features banks, airlines, consumer goods companies, and even tech behemoths like Apple.

Other Brands

Lastly, it’s worth noting that Buffett doesn’t stop there – his company also owns 80 auto dealerships, the second-largest real estate broker in the country (HomeServices of America), and even 32 daily newspapers.

Deals that Made the Empire

The Warren Buffett Empire wouldn’t exist without Buffett being involved in some of most famous deals in business history. Below are some of the big names Buffett has been involved with.

ABC

Buffett helped finance the Capital Cities takeover of ABC – at the time, the largest non-oil merger in history. Eventually, CapCities/ABC was sold to Disney.

ESPN

Before ESPN was the household name it is today, Buffett owned a big chunk of it as an upstart sports brand in 1985, as a part of the CapCities/ABC deal.

Heinz

Berkshire Hathaway and 3G Capital led a takeover of Heinz in 2013. This gave Buffett control of trusted brands like HP Sauce, Lea & Perrins, as well as the namesake brand.

Washington Post

Buffett delivered the newspaper as a kid, but later in his life would be the largest outside shareholder of the famous paper.

Salomon Brothers

Buffett helped lead a desperate shakeup at one of Wall Street’s most famous investment banks.

USAir

After almost losing all the $358 million he had invested, Buffett called buying preferred shares in the airline one of his biggest mistakes.

Gillette

Buffett started buying shares in the last 1980s, and became Gillette’s biggest shareholder. Buffett made $4.4 billion in paper profit when it sold the company to Proctor & Gamble.

Investor Education

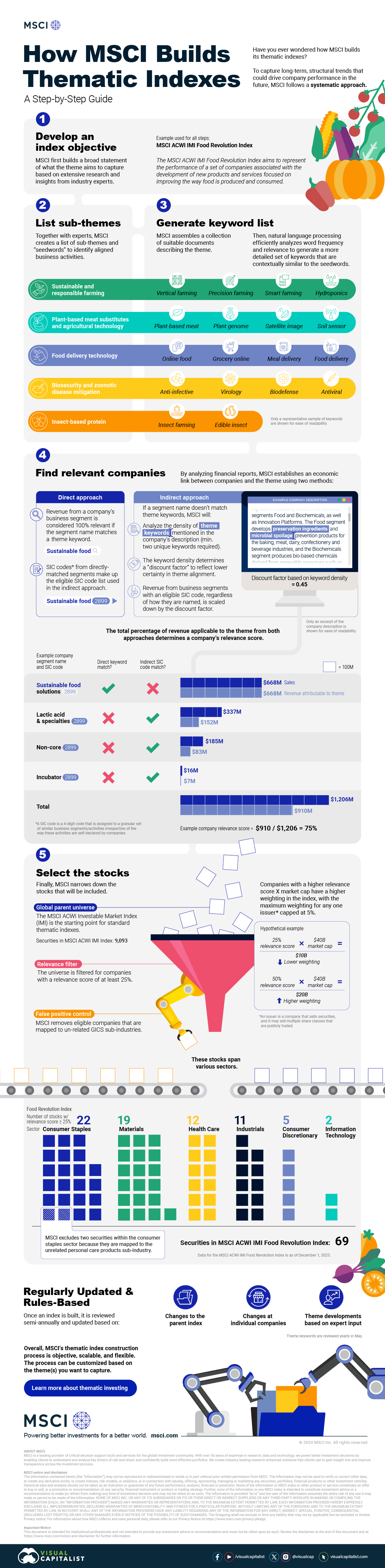

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

From developing an index objective to choosing relevant stocks, this graphic breaks down how MSCI builds thematic indexes using examples.

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

Have you ever wondered how MSCI builds its thematic indexes?

To capture long-term, structural trends that could drive business performance in the future, the company follows a systematic approach. This graphic from MSCI breaks down each step in the process used to create its thematic indexes.

Step 1: Develop an Index Objective

MSCI first builds a broad statement of what the theme aims to capture based on extensive research and insights from industry experts.

Steps 2 and 3: List Sub-Themes, Generate Keyword List

Together with experts, MSCI creates a list of sub-themes or “seedwords” to identify aligned business activities.

The team then assembles a collection of suitable documents describing the theme. Natural language processing efficiently analyzes word frequency and relevance to generate a more detailed set of keywords contextually similar to the seedwords.

Step 4: Find Relevant Companies

By analyzing financial reports, MSCI picks companies relevant to the theme using two methods:

- Direct approach: Revenue from a company’s business segment is considered 100% relevant if the segment name matches a theme keyword. Standard Industrial Classification (SIC) codes from these directly-matched segments make up the eligible SIC code list used in the indirect approach.

- Indirect approach: If a segment name doesn’t match theme keywords, MSCI will:

- Analyze the density of theme keywords mentioned in the company’s description. A minimum of two unique keywords is required.

- The keyword density determines a “discount factor” to reflect lower certainty in theme alignment.

- Revenue from business segments with an eligible SIC code, regardless of how they are named, is scaled down by the discount factor.

The total percentage of revenue applicable to the theme from both approaches determines a company’s relevance score.

Step 5: Select the Stocks

Finally, MSCI narrows down the stocks that will be included:

- Global parent universe: The ACWI Investable Market Index (IMI) is the starting point for standard thematic indexes.

- Relevance filter: The universe is filtered for companies with a relevance score of at least 25%.

- False positive control: Eligible companies that are mapped to un-related GICS sub-industries are removed.

Companies with higher relevance scores and market caps have a higher weighting in the index, with the maximum weighting for any one issuer capped at 5%. The final selected stocks span various sectors.

MSCI Thematic Indexes: Regularly Updated and Rules-Based

Once an index is built, it is reviewed semi-annually and updated based on:

- Changes to the parent index

- Changes at individual companies

- Theme developments based on expert input

Theme keywords are reviewed yearly in May. Overall, MSCI’s thematic index construction process is objective, scalable, and flexible. The process can be customized based on the theme(s) you want to capture.

Learn more about MSCI’s thematic indexes.

-

Investor Education5 months ago

Investor Education5 months agoThe 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Stocks10 months ago

Stocks10 months agoVisualizing BlackRock’s Top Equity Holdings

BlackRock is the world’s largest asset manager, with over $9 trillion in holdings. Here are the company’s top equity holdings.

-

Investor Education10 months ago

Investor Education10 months ago10-Year Annualized Forecasts for Major Asset Classes

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard.

-

Investor Education1 year ago

Investor Education1 year agoVisualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Debt2 years ago

Debt2 years agoCountries with the Highest Default Risk in 2022

In this infographic, we examine new data that ranks the top 25 countries by their default risk.

-

Markets2 years ago

Markets2 years agoThe Best Months for Stock Market Gains

This infographic analyzes over 30 years of stock market performance to identify the best and worst months for gains.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?