Money

Where the World’s Ultra Rich Population Lives

Where the World’s Ultra Rich Population Lives

We’ve recently broken down data on the global population of millionaires by city, and even the residences of the world’s top 50 billionaires.

But still, there’s something extremely interesting about dissecting the lifestyles of the ultra rich – particularly in looking at where they live, and also how they tend to migrate when local conditions are not conducive to wealth-building or the safety of their fortunes and families.

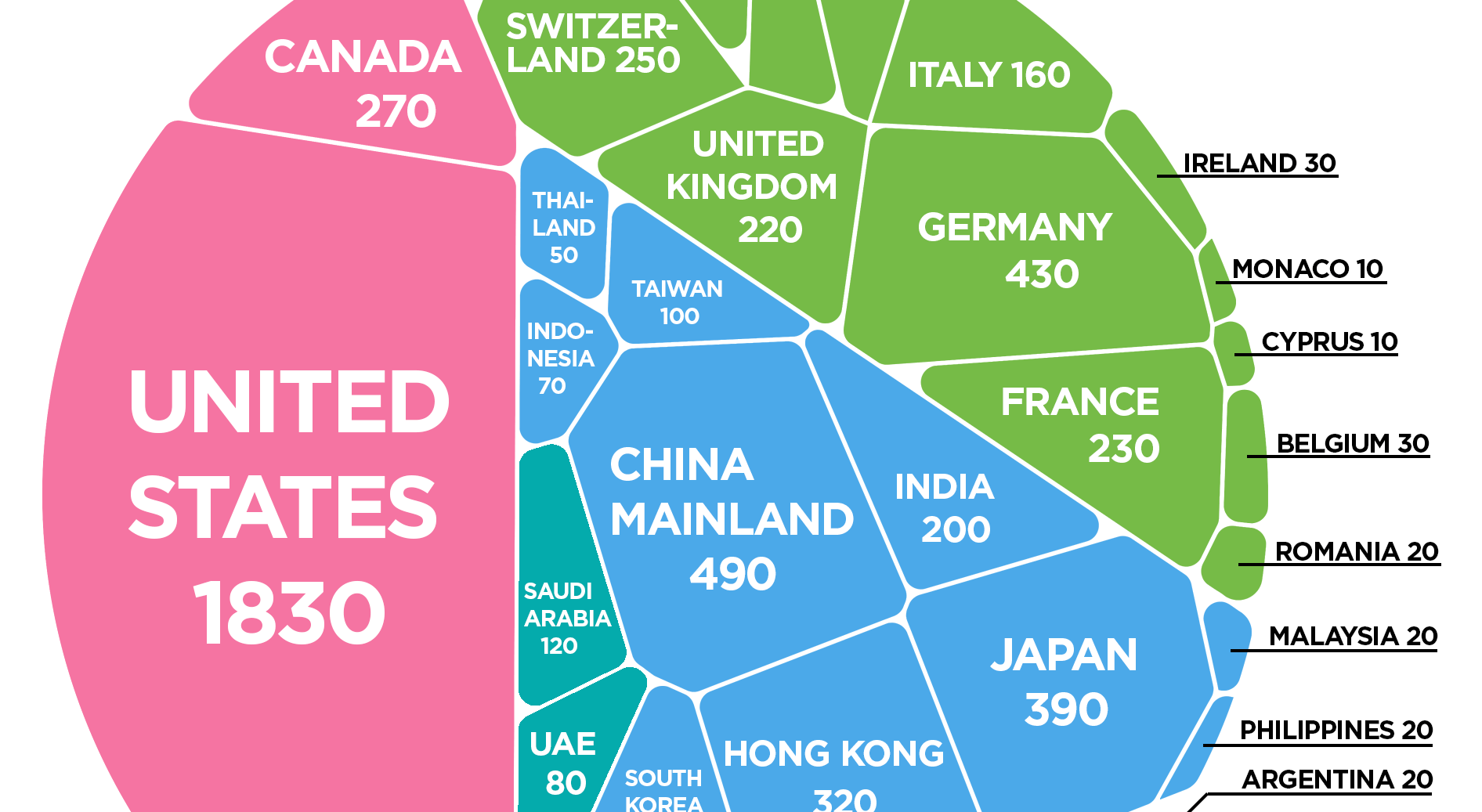

Ultra Rich: By Region

Today’s infographic comes to us from HowMuch.net, and it breaks down the population of ultra high net worth individuals that have personal wealth levels exceeding the $500 million mark. It uses information from the 2018 edition of the Knight Frank Wealth Report.

First, we’ll look at these totals on a regional level:

| Region | Population (>$500M wealth) | % of Global Pop |

|---|---|---|

| North America | 2,100 | 31.8% |

| Asia | 1,860 | 28.1% |

| Europe | 1,680 | 25.4% |

| Middle East | 280 | 4.2% |

| Latin America & Caribbean | 280 | 4.2% |

| Russia & CIS | 220 | 3.3% |

| Africa | 120 | 1.8% |

| Australasia | 70 | 1.1% |

| 6,610 | 100.0% |

As you can see, the vast amount of half-billionaires are located in North America (31.8%), Asia (28.1%), and Europe (25.4%). That means that fewer than 15% of these ultra rich live in the Middle East, Australasia, Russia & CIS, Latin America, and Africa combined.

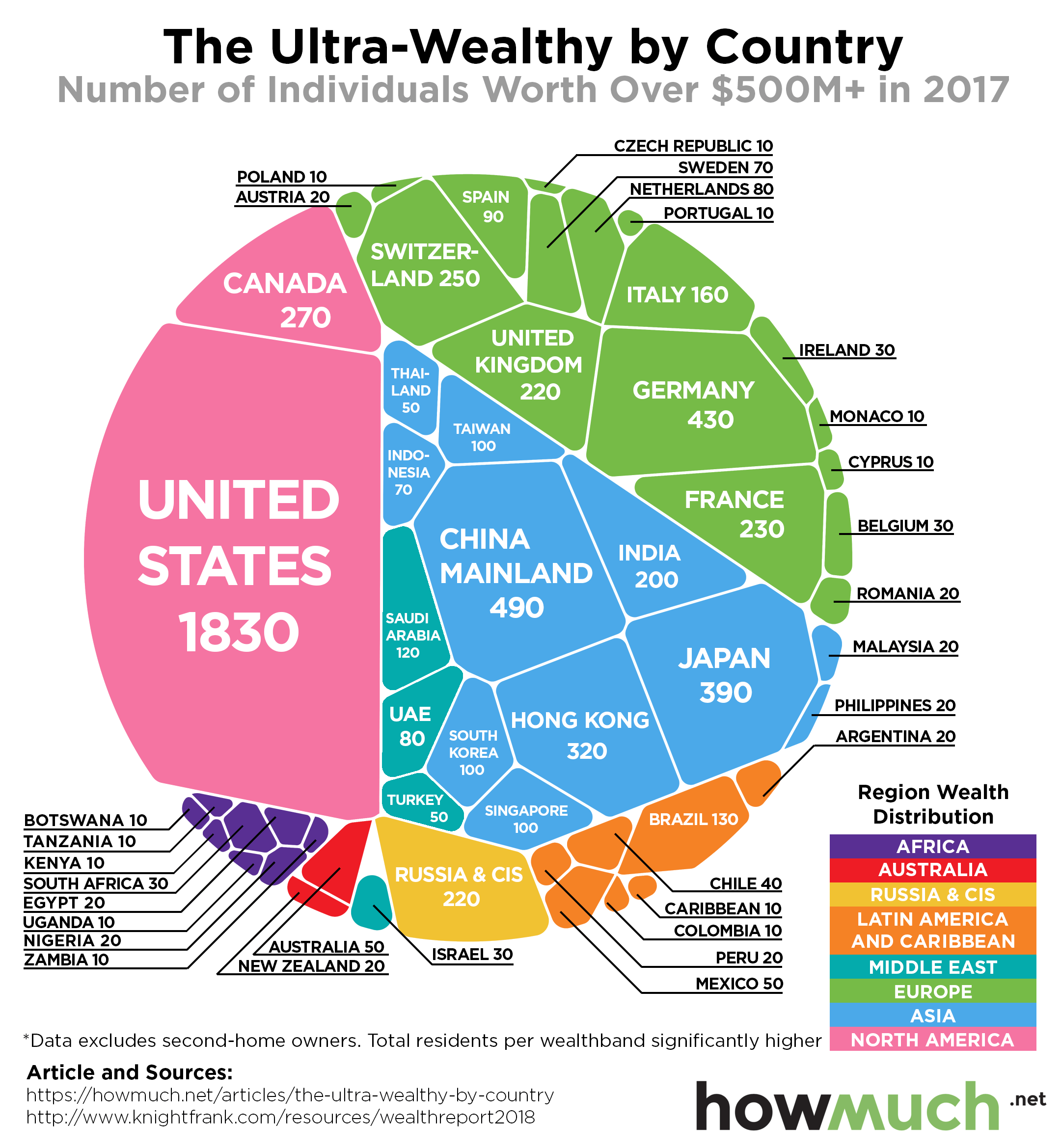

Ultra Rich: By Country

Now, we’ll look at the 14 countries that have greater than 100 ultra rich people (>$500 million) as residents:

| Rank | Country | Region | Population (>$500M wealth) |

|---|---|---|---|

| #1 | United States | North America | 1,830 |

| #2 | China (Mainland) | Asia | 490 |

| #3 | Germany | Europe | 430 |

| #4 | Japan | Asia | 390 |

| #5 | Hong Kong | Asia | 320 |

| #6 | Canada | North America | 270 |

| #7 | Switzerland | Europe | 250 |

| #8 | France | Europe | 230 |

| #9 | Russia & CIS | Russia & CIS | 220 |

| #10 | United Kingdom | Europe | 220 |

| #11 | India | Asia | 200 |

| #12 | Italy | Europe | 160 |

| #13 | Brazil | Latin America | 130 |

| #14 | Saudi Arabia | Middle East | 120 |

Note: this list excludes second-home owners.

Sitting at the top of the list is the United States with 1,830 people that hold fortunes larger than $500 million. That’s equal to roughly 28% of the global half-billionaire population.

Following the U.S. is China, which counts 810 people as having a wealth over $500 million. These numbers are broken down into Mainland China and Hong Kong on the graph and table, because they were tallied using different sources.

Canada tallies surprisingly high here – the country only ranks #10 globally based on its number of (billionaires), but ranks #6 in terms of half-billionaires with 270 in total.

Lastly, it should be noted that just missing the cut-off on the above list were Taiwan, South Korea, and Singapore, three Asian countries that tied with 100 half-billionaires each.

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Editor’s note: The debt shown in this visualization focuses only on direct external debt, and does not include publicly-traded, liquid, debt securities like bonds. Furthermore, it’s worth noting the World Bank data excludes some countries with data accuracy or reporting issues, such as Venezuela.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Money6 days ago

Money6 days agoCharted: Which Country Has the Most Billionaires in 2024?

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Countries2 weeks ago

Countries2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

Economy2 weeks ago

Economy2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology2 weeks ago

Technology2 weeks agoVisualizing AI Patents by Country

-

Economy1 week ago

Economy1 week agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024