Technology

The World’s Largest Automakers, By Market Value

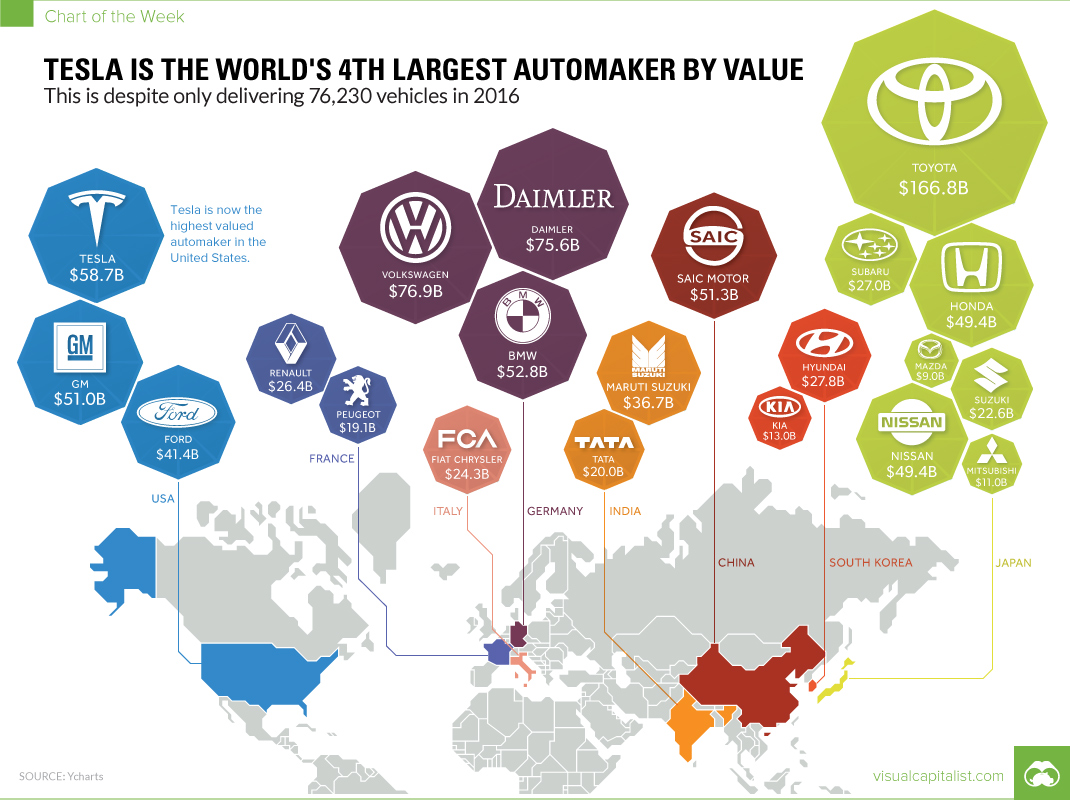

Tesla is the World’s 4th Largest Automaker by Value

This is despite only delivering 76,230 vehicles in 2016.

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

It’s been another breakout year for Tesla.

Over the course of 2017, the company’s market capitalization has soared beyond those of major manufacturers like Ford, GM, BMW, Honda, and Nissan. This thrust can be partly attributed to the company’s Model S, which reigns supreme as the top-selling plug-in electric car worldwide in 2015 and 2016.

But more importantly for Tesla, this massive momentum is based on the company’s much-anticipated future performance. Investors and analysts eagerly anticipate progress as the company ramps up production of the more affordable Model 3, and many also strongly believe that Elon Musk brings an “X Factor” that could translate into future returns.

In today’s charts, we look at Tesla’s ascent in valuation to become the #4 ranked automaker globally, and also the #1 maker in America. We also show why the value assigned to Tesla’s astonishing valuation may be premature, at least based on conventional metrics.

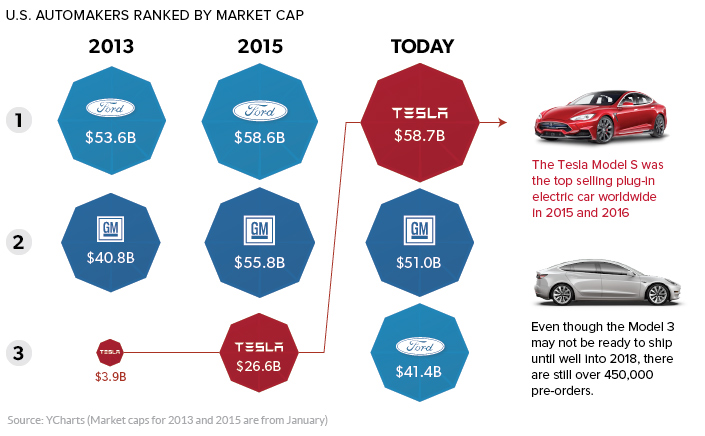

Tesla’s Rapid Ascent

In the opening months of 2013, Tesla was just starting to plan deliveries for its Model S. At the time, the company was worth a mere $3.9 billion – just 7% of the value of Ford.

Since then, Tesla’s value has skyrocketed to make it the most valued auto company in North America:

Despite only producing 76,230 vehicles in 2016, Tesla is now the biggest of the “Big 3” – and this puts a lot of pressure on the company to live up to the vast expectations held by investors and media.

The Speculator’s Gambit

With so much hype and value assigned to expectations of future performance, Tesla and its enthusiastic investors are in a potentially tough spot.

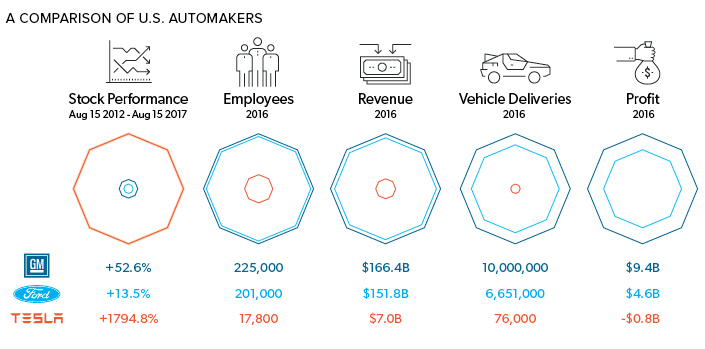

Even though it is the most valued car company in the United States, Tesla is much less impressive by more conventional metrics:

The company has just a fraction of the employees, vehicle deliveries, and revenue of its competitors. Tesla also treads a similar path to Amazon, in that it will likely take a while for the company to ever post a profit.

Here’s another look, this time showing Tesla’s metrics as a percentage of GM’s:

| Metric | Tesla | GM | Tesla (as a % of GM) |

|---|---|---|---|

| Employees (2016) | 17,800 | 225,000 | 7.9% |

| Vehicle Deliveries (2016) | 76,000 | 10,000,000 | 0.8% |

| Revenue (2016) | $7.0B | $166.4B | 4.2% |

| Profit (2016) | -$0.8B | $9.4B | n/a |

Tesla is producing less than 1% as many cars as GM, but is worth more in market value.

That’s not to say that Tesla will not ultimately live up to expectations – but it does put into perspective the risk of banking on these future returns.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science7 days ago

Science7 days agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023