Technology

The Times They Are A-Changin’

The Times They Are A-Changin’

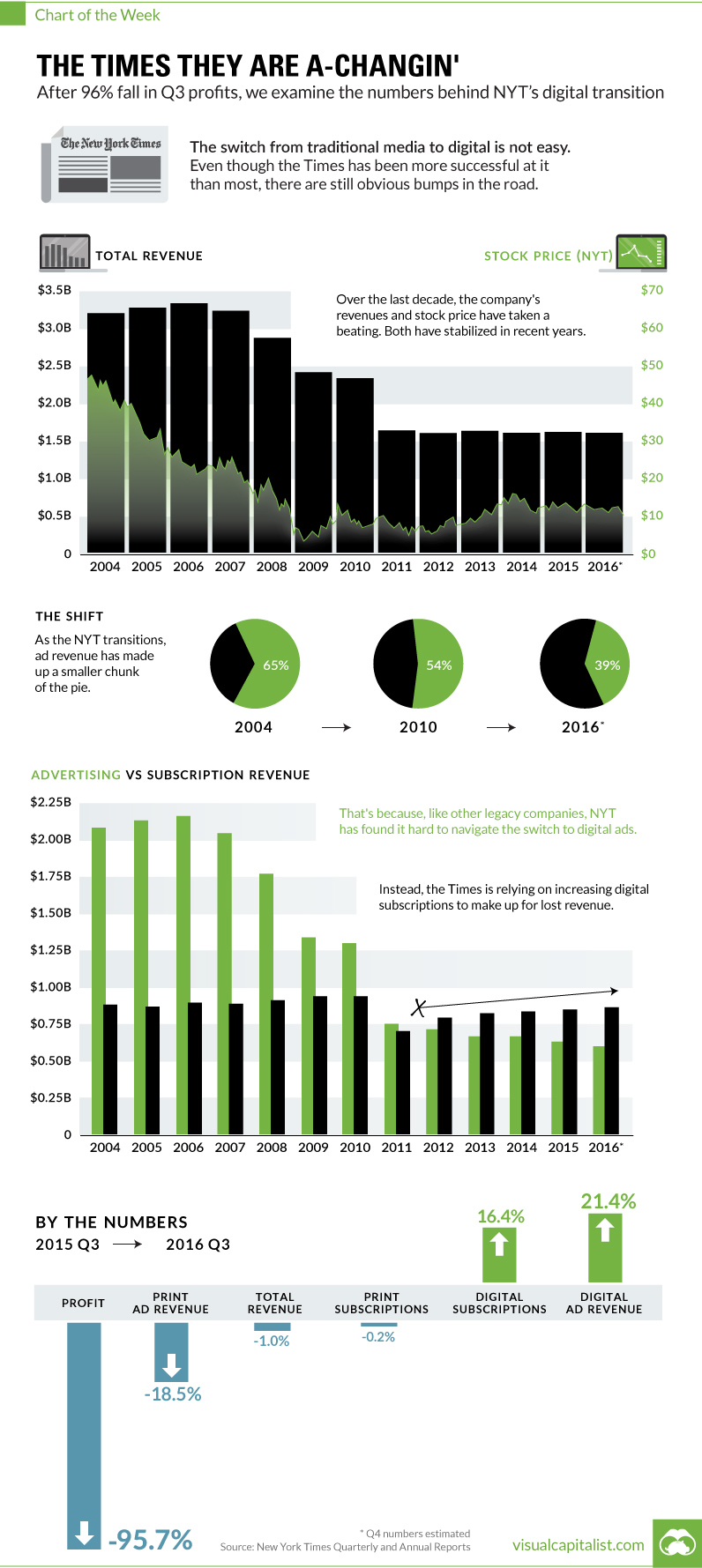

The Numbers Behind the New York Times’ digital transition

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

For the most part, legacy print media stalwarts are dying a death by a thousand cuts.

There are exceptions to this rule, and The New York Times is often touted as the best example of an old-school media company that is successfully navigating the challenging transition to digital. They’ve experimented with different types of content and tactics to get eyeballs, while also shifting their company-wide strategy and culture to take a digital-first approach.

While pundits give credit to the Times for their latest efforts, this doesn’t mean it’s been an easy transition for the iconic newspaper. The path forward has been littered with roadbumps, and the most recent one is hard to ignore for shareholders.

Earlier this week, The New York Times announced a 95.7% decrease in quarterly profit. We dug a little deeper in this week’s chart to provide some context behind the newspaper’s challenges in maintaining its relevance in the 21st century.

Goodbye, Ad Dollars

The primary challenge faced by the Times is pretty obvious.

In the early 2000s, the company easily made over $2 billion in advertising revenue per year. Today, they make about $600 million from ads.

Why has the transition to digital hurt ad revenues so much? There are a bunch of reasons, but here’s a few of them:

- Physical circulation of The New York Times and other newspapers is dropping rapidly.

- Traditional display ads aren’t particularly effective, and are part of the “old-school” of digital thought.

- Programmatic bidding drives down prices for these ads, bringing in even less revenue.

- Digital lends itself to long-term, results-driven campaigns. It takes time to set these up and measure them properly, especially at scale.

- Ads need to match the editorial stream to be effective. Quality over quantity.

- There’s more competition in the digital space, which is a stark contrast to the distribution oligopolies enjoyed by big newspapers in the legacy era.

- Madison Avenue is also slow at switching to digital, which only adds to the lag time.

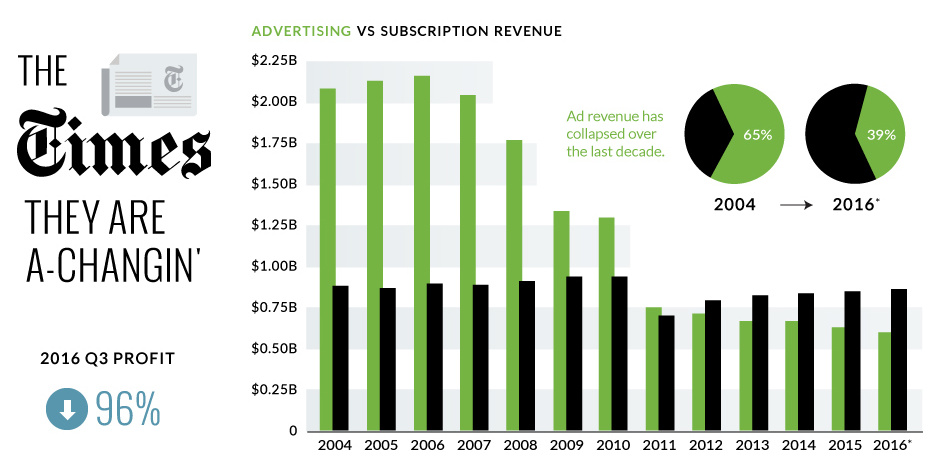

These are just some of the reasons why advertising was able to make up 65% of the Times’ revenues in 2004, but only 39% in 2016.

Hello, Digital Subscriptions

While I don’t personally agree that a paywall is a long-term answer to any of their problems, it is true that the New York Times has used this as a temporary crutch to at least counter lost ad dollars.

In Q3 2016, revenue from digital-only subscriptions increased 16.4%, and money coming in from subscriptions has increased year-on-year since 2011.

Sometime between 2011 and 2012, subscription revenue (powered by digital-only subscriptions) passed ad revenues as the most important source of incoming cash for the company. The ramp-up has been impressive, and The New York Times now has 1.6 million digital subscribers.

My personal take? Digital subscriptions will plateau in the next five years or maybe sooner. Further, I think that content that isn’t industry or niche-specific will generally drift towards being free for users over time. The New York Times will have to solve their ad problem, but the paywall will buy them a bit of time to do so.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue