Mining

9 Reasons Mining Investors are Looking at Yukon Companies

In the mining industry, location is paramount.

Invest your capital in a jurisdiction that doesn’t respect that investment, or in a place with little geological potential, and it’s possible that it will end up going to waste.

That’s why, when there’s a place on the map that has world-class geology and also a plan for working with miners and new explorers, the money begins to flow to take advantage of that potential.

Why Investors are Looking at the Yukon

Today’s infographic comes to us from the Yukon Mining Alliance and it shows nine reasons on why people are investing in Yukon mining and exploration companies today.

For resource investors, it is rare to see variables like government investment, jurisdiction, geological potential, and investment from major mining companies all aligning.

However, in the Yukon, it seems this may be the case.

9 Reasons for the Yukon

Here are nine reasons the Yukon is starting to attract more investment capital:

1. Rich History

Mining was central to the Yukon even over a century ago, when over 100,000 fortune-seekers stampeded into the Yukon with the goal of striking it rich in the famous Klondike Gold Rush.

2. Geological Profile

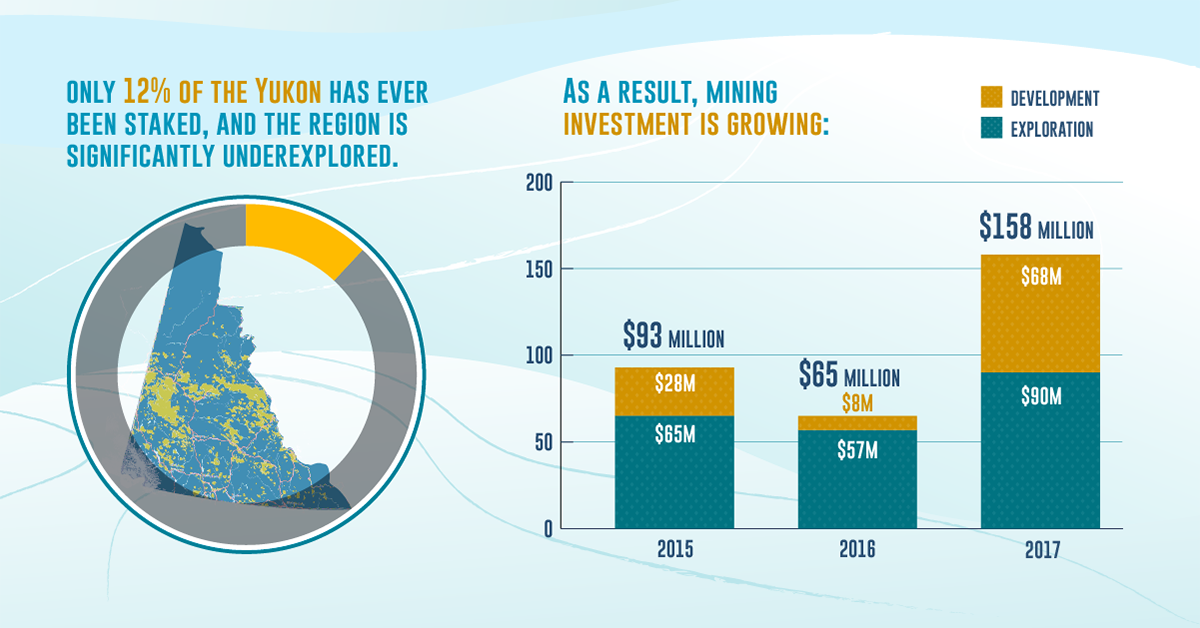

In the last decade, there have been major discoveries of gold, silver, copper, zinc, and lead in the Yukon – but perhaps most interestingly, only 12% of the Yukon has been staked, making the region highly under-explored. Spending on exploration and development rose from $93 million to $158 million from 2015-2017.

3. Major Investment

Major mining companies now have a stake in the polymetallic rush. Recent companies to foray into the Yukon include Agnico-Eagle, Barrick, Couer Mining, Goldcorp, Kinross, and Newmont.

4. Leaders in Exploration and Mining

Juniors in the region are working on new geological ideas as well as new technology to unlock the vast potential of the region.

5. Progressive Partnerships

First Nations and the Government of Yukon have recently championed a new government-to-government relationship that enables them to be on the exact same page when it comes to mineral projects.

6. Government Investment

The Yukon government is investing in new infrastructure (via the Resource Gateway Project). It also offers the Yukon Mineral Exploration Program (YMEP), which provides a portion of risk capital to explore and develop mineral projects to an advanced stage.

7. Made in Yukon Process

The Yukon government also tries to foster regulatory certainty to create clarity for companies and investors, by its customized tri-party process.

8. Infrastructure

The jurisdiction has 5,000km of government maintained roads, receives 95% of power from clean hydro, has international and local airports, and has access to three deep-water, ice-free ports.

9. Geopolitical Stability

Canada offers geopolitical stability to start with – but with unprecedented cooperation between the territorial government and First Nations, the Yukon is arguably a step above the rest of the country.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023