Mining

Why Gold is Money: A Periodic Perspective

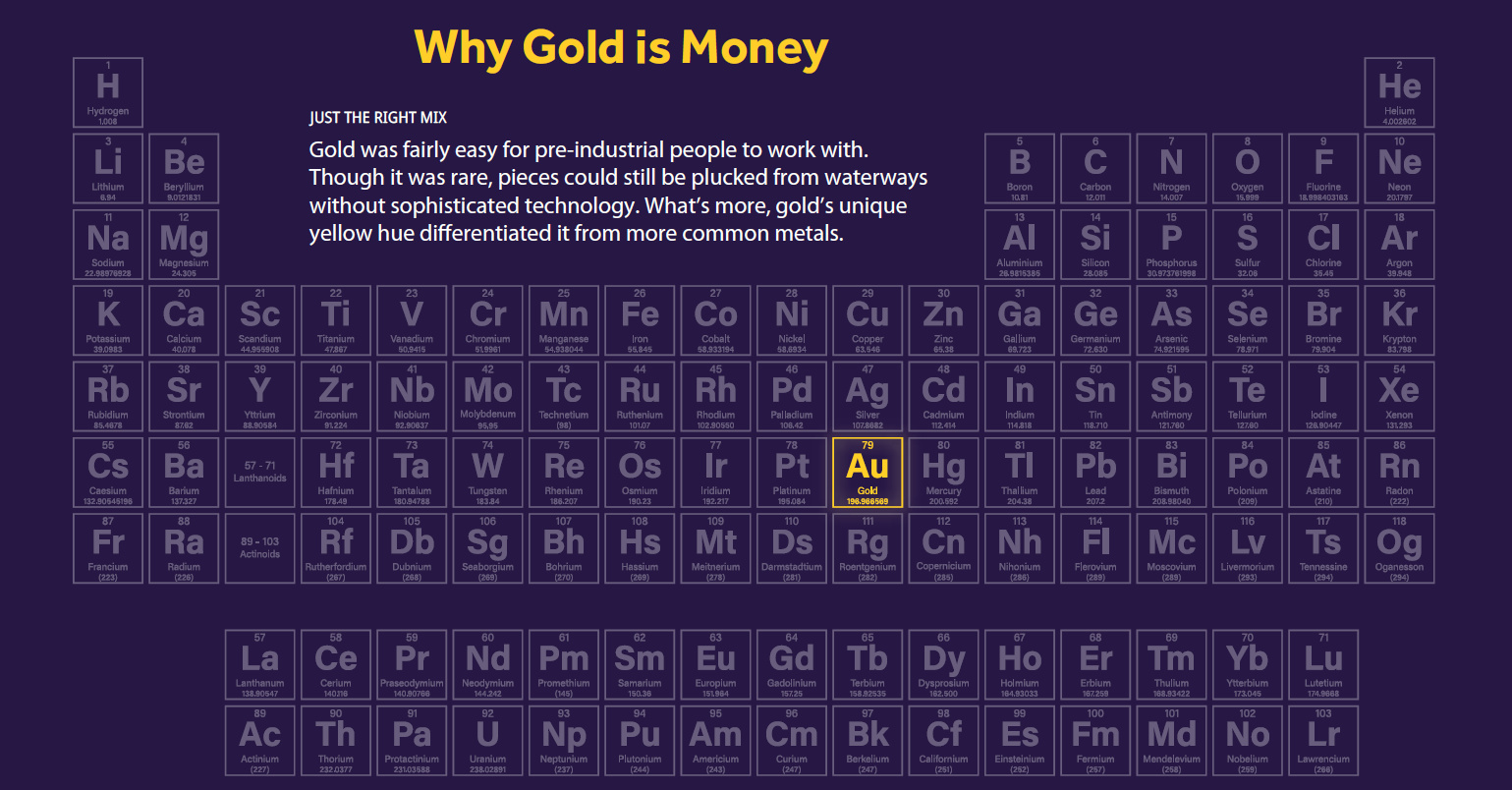

Why Gold is Money

The economist John Maynard Keynes famously called gold a “barbarous relic”, suggesting that its usefulness as money is an artifact of the past. In an era filled with cashless transactions and hundreds of cryptocurrencies, this statement seems truer today than in Keynes’ time.

However, gold also possesses elemental properties that has made it an ideal metal for money throughout history.

Sanat Kumar, a chemical engineer from Columbia University, broke down the periodic table to show why gold has been used as a monetary metal for thousands of years.

The Periodic Table

The periodic table organizes 118 elements in rows by increasing atomic number (periods) and columns (groups) with similar electron configurations.

Just as in today’s animation, let’s apply the process of elimination to the periodic table to see why gold is money:

- Gases and Liquids

Noble gases (such as argon and helium), as well as elements such as hydrogen, nitrogen, oxygen, fluorine and chlorine are gaseous at room temperature and standard pressure. Meanwhile, mercury and bromine are liquids. As a form of money, these are implausible and impractical. - Lanthanides and Actinides

Next, lanthanides and actinides are both generally elements that can decay and become radioactive. If you were to carry these around in your pocket they could irradiate or poison you. - Alkali and Alkaline-Earth Metals

Alkali and alkaline earth metals are located on the left-hand side of the periodic table, and are highly reactive at standard pressure and room temperature. Some can even burst into flames. - Transition, Post Transition Metals, and Metalloids

There are about 30 elements that are solid, nonflammable, and nontoxic. For an element to be used as money it needs to be rare, but not too rare. Nickel and copper, for example, are found throughout the Earth’s crust in relative abundance. - Super Rare and Synthetic Elements

Osmium only exists in the Earth’s crust from meteorites. Meanwhile, synthetic elements such as rutherfordium and nihonium must be created in a laboratory.

Once the above elements are eliminated, there are only five precious metals left: platinum, palladium, rhodium, silver and gold. People have used silver as money, but it tarnishes over time. Rhodium and palladium are more recent discoveries, with limited historical uses.

Platinum and gold are the remaining elements. Platinum’s extremely high melting point would require a furnace of the Gods to melt back in ancient times, making it impractical. This leaves us with gold. It melts at a lower temperature and is malleable, making it easy to work with.

Gold as Money

Gold does not dissipate into the atmosphere, it does not burst into flames, and it does not poison or irradiate the holder. It is rare enough to make it difficult to overproduce and malleable to mint into coins, bars, and bricks. Civilizations have consistently used gold as a material of value.

Perhaps modern societies would be well-served by looking at the properties of gold, to see why it has served as money for millennia, especially when someone’s wealth could disappear in a click.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees