Markets

Which Countries Have the Lowest Inflation?

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

Which Countries Have the Lowest Inflation?

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

Investors are bracing for longer inflation.

The Federal Reserve indicated that more restrictive monetary policy is in the cards amid strong employment gains. In Europe, while inflation has fallen, it is still far above the 2% target. Across the Euro area inflation is estimated to have reached 8.5% in January.

At the same time, some countries have managed to tamp down inflation. Slower growth, cheaper import costs, and foreign exchange policy are some of the factors keeping inflation subdued.

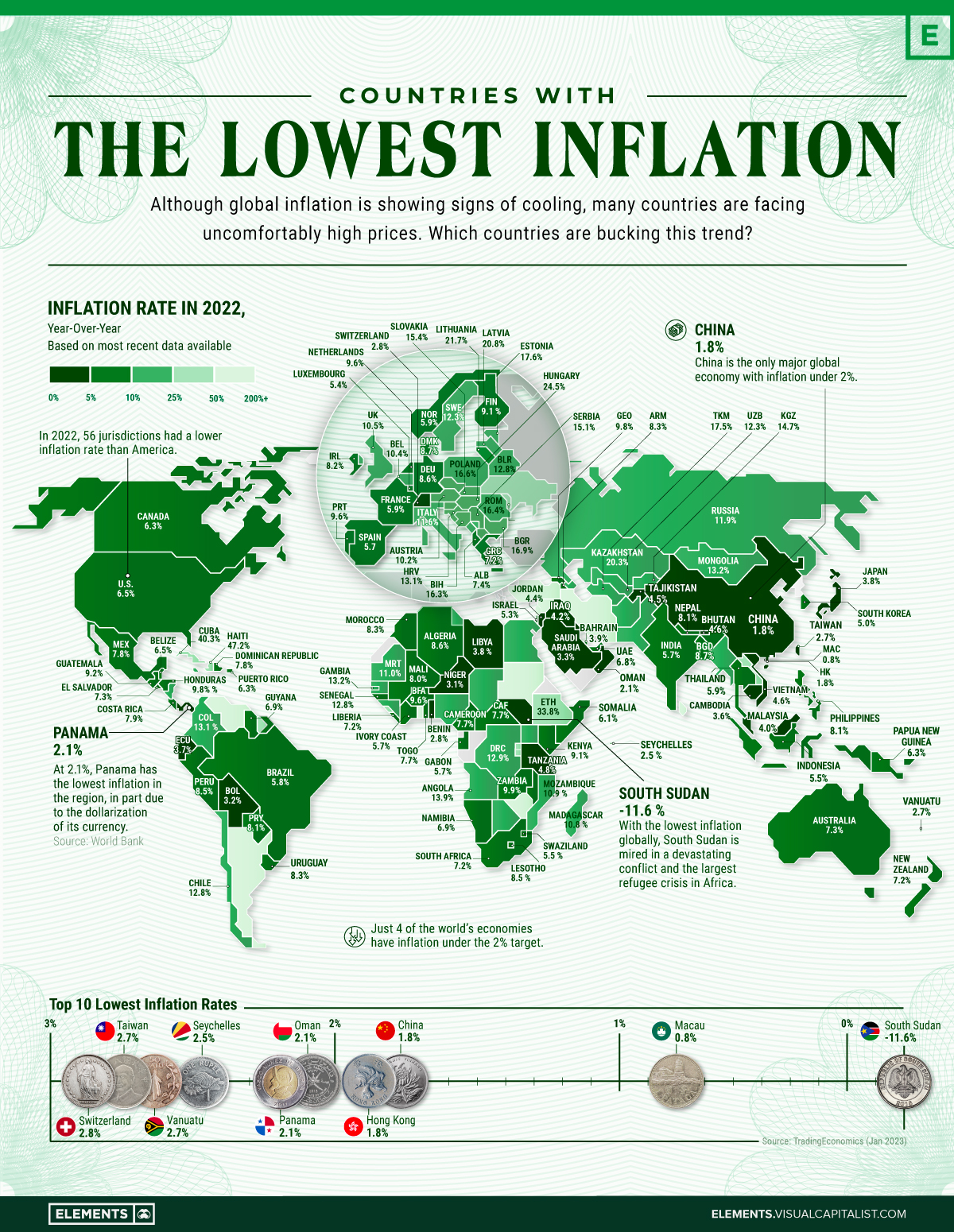

As price pressures rattle global markets, the above infographic maps inflation rates globally using data from Trading Economics, focusing in on the countries with the lowest inflation levels.

World’s Lowest Inflation Rates

Many of the lowest inflation rates around the world are located in Asia, including Macau, China, Hong Kong, and Taiwan. In this region, widespread lockdowns strained growth and consumer spending, lessening inflationary pressures. Last year, Chinese consumers saved $2.2 trillion in bank deposits during these restrictions which were lifted earlier this year.

Inflation in the region was impacted by several other factors. Earlier on in the pandemic, Asian countries including China were less impacted by rising food costs, services inflation, and supply-chain disruptions, unlike what was seen in North America and Europe.

But now as China has reopened, some signs of inflation are beginning to appear. Food prices are up 4.8% annually in December, and hotel rates are rising.

| Rank | Country / Region | Inflation Rate, Year-Over-Year | Date |

|---|---|---|---|

| 1 | 🇸🇸 South Sudan | -11.6% | Dec 2022 |

| 2 | 🇲🇴 Macau | 0.8% | Nov 2022 |

| 3 | 🇨🇳 China | 1.8% | Dec 2022 |

| 4 | 🇭🇰 Hong Kong SAR | 1.8% | Nov 2022 |

| 5 | 🇴🇲 Oman | 2.1% | Nov 2022 |

| 6 | 🇵🇦 Panama | 2.1% | Dec 2022 |

| 7 | 🇸🇨 Seychelles | 2.5% | Dec 2022 |

| 8 | 🇻🇺 Vanuatu | 2.7% | Mar 2022 |

| 9 | 🇹🇼 Taiwan | 2.7% | Dec 2022 |

| 10 | 🇨🇭 Switzerland | 2.8% | Dec 2022 |

| 11 | 🇱🇮 Liechtenstein | 2.8% | Dec 2022 |

| 12 | 🇧🇯 Benin | 2.8% | Dec 2022 |

| 13 | 🇲🇻 Maldives | 2.8% | Nov 2022 |

| 14 | 🇳🇪 Niger | 3.1% | Dec 2022 |

| 15 | 🇧🇳 Brunei | 3.1% | Nov 2022 |

| 16 | 🇧🇴 Bolivia | 3.2% | Nov 2022 |

| 17 | 🇰🇼 Kuwait | 3.2% | Nov 2022 |

| 18 | 🇸🇦 Saudi Arabia | 3.3% | Dec 2022 |

| 19 | 🇰🇭 Cambodia | 3.6% | Oct 2022 |

| 20 | 🇫🇯 Fiji | 3.6% | Dec 2022 |

| 21 | 🇪🇨 Ecuador | 3.7% | Dec 2022 |

| 22 | 🇯🇵 Japan | 3.8% | Nov 2022 |

| 23 | 🇱🇾 Libya | 3.8% | Nov 2022 |

| 24 | 🇧🇲 Bermuda | 3.8% | Oct 2022 |

| 25 | 🇧🇭 Bahrain | 3.9% | Nov 2022 |

| 26 | 🇲🇾 Malaysia | 4.0% | Nov 2022 |

| 27 | 🇵🇸 Palestine | 4.1% | Dec 2022 |

| 28 | 🇮🇶 Iraq | 4.2% | Nov 2022 |

| 29 | 🇯🇴 Jordan | 4.4% | Dec 2022 |

| 30 | 🇹🇯 Tajikistan | 4.5% | Nov 2022 |

| 31 | 🇻🇳 Vietnam | 4.6% | Dec 2022 |

| 32 | 🇧🇹 Bhutan | 4.6% | Nov 2022 |

| 33 | 🇹🇿 Tanzania | 4.8% | Dec 2022 |

| 34 | 🇳🇨 New Caledonia | 4.9% | Dec 2022 |

| 35 | 🇰🇷 South Korea | 5.0% | Dec 2022 |

| 36 | 🇮🇱 Israel | 5.3% | Dec 2022 |

| 37 | 🇱🇺 Luxembourg | 5.4% | Dec 2022 |

| 38 | 🇸🇿 Swaziland | 5.5% | Oct 2022 |

| 39 | 🇮🇩 Indonesia | 5.5% | Dec 2022 |

| 40 | 🇬🇦 Gabon | 5.7% | Oct 2022 |

| 41 | 🇨🇮 Ivory Coast | 5.7% | Nov 2022 |

| 42 | 🇪🇸 Spain | 5.7% | Dec 2022 |

| 43 | 🇮🇳 India | 5.7% | Dec 2022 |

| 44 | 🇧🇷 Brazil | 5.8% | Dec 2022 |

| 45 | 🇹🇭 Thailand | 5.9% | Dec 2022 |

| 46 | 🇫🇷 France | 5.9% | Dec 2022 |

| 47 | 🇳🇴 Norway | 5.9% | Dec 2022 |

| 48 | 🇶🇦 Qatar | 5.9% | Dec 2022 |

| 49 | 🇩🇯 Djibouti | 6.1% | Sep 2022 |

| 50 | 🇸🇴 Somalia | 6.1% | Dec 2022 |

| 51 | 🇹🇹 Trinidad and Tobago | 6.2% | Sep 2022 |

| 52 | 🇵🇬 Papua New Guinea | 6.3% | Sep 2022 |

| 53 | 🇵🇷 Puerto Rico | 6.3% | Nov 2022 |

| 54 | 🇨🇦 Canada | 6.3% | Dec 2022 |

| 55 | 🇧🇸 Bahamas | 6.5% | Sep/22 |

| 56 | 🇧🇿 Belize | 6.5% | Nov 2022 |

| 57 | 🇺🇸 U.S. | 6.5% | Dec 2022 |

| 58 | 🇦🇼 Aruba | 6.6% | Nov 2022 |

| 59 | 🇸🇬 Singapore | 6.7% | Nov 2022 |

| 60 | 🇹🇱 East Timor | 6.7% | Nov 2022 |

| 61 | 🇦🇪 UAE | 6.8% | Jun 2022 |

| 62 | 🇳🇦 Namibia | 6.9% | Dec 2022 |

| 63 | 🇬🇾 Guyana | 6.9% | Nov 2022 |

| 64 | 🇳🇿 New Zealand | 7.2% | Sep 2022 |

| 65 | 🇿🇦 South Africa | 7.2% | Dec 2022 |

| 66 | 🇬🇷 Greece | 7.2% | Dec 2022 |

| 67 | 🇱🇷 Liberia | 7.2% | Sep 2022 |

| 68 | 🇦🇺 Australia | 7.3% | Sep 2022 |

| 69 | 🇲🇹 Malta | 7.3% | Dec 2022 |

| 70 | 🇸🇻 El Salvador | 7.3% | Dec 2022 |

| 71 | 🇦🇱 Albania | 7.4% | Dec 2022 |

| 72 | 🇨🇻 Cape Verde | 7.6% | Dec 2022 |

| 73 | 🇨🇲 Cameroon | 7.7% | Sep 2022 |

| 74 | 🇨🇫 Central African Republic | 7.7% | Nov 2022 |

| 75 | 🇹🇬 Togo | 7.7% | Dec 2022 |

| 76 | 🇲🇽 Mexico | 7.8% | Dec 2022 |

| 77 | 🇩🇴 Dominican Republic | 7.8% | Dec 2022 |

| 78 | 🇨🇷 Costa Rica | 7.9% | Dec 2022 |

| 79 | 🇨🇾 Cyprus | 7.9% | Dec 2022 |

| 80 | 🇲🇱 Mali | 8.0% | Nov 2022 |

| 81 | 🇳🇵 Nepal | 8.1% | Nov 2022 |

| 82 | 🇵🇭 Philippines | 8.1% | Dec 2022 |

| 83 | 🇵🇾 Paraguay | 8.1% | Dec 2022 |

| 84 | 🇧🇧 Barbados | 8.2% | Oct 2022 |

| 85 | 🇮🇪 Ireland | 8.2% | Dec 2022 |

| 86 | 🇺🇾 Uruguay | 8.3% | Dec 2022 |

| 87 | 🇲🇦 Morocco | 8.3% | Nov 2022 |

| 88 | 🇦🇲 Armenia | 8.3% | Dec 2022 |

| 89 | 🇵🇪 Peru | 8.5% | Dec 2022 |

| 90 | 🇱🇸 Lesotho | 8.5% | Oct 2022 |

| 91 | 🇩🇿 Algeria | 8.6% | Nov 2022 |

| 92 | 🇩🇪 Germany | 8.6% | Dec 2022 |

| 93 | 🇩🇰 Denmark | 8.7% | Dec 2022 |

| 94 | 🇧🇩 Bangladesh | 8.7% | Dec 2022 |

| 95 | 🇫🇴 Faroe Islands | 8.8% | Sep 2022 |

| 96 | 🇫🇮 Finland | 9.1% | Dec 2022 |

| 97 | 🇰🇪 Kenya | 9.1% | Dec 2022 |

| 98 | 🇰🇾 Cayman Islands | 9.2% | Sep 2022 |

| 99 | 🇬🇹 Guatemala | 9.2% | Dec 2022 |

| 100 | 🇬🇼 Guinea Bissau | 9.4% | Nov 2022 |

*Inflation rates based on latest available data.

Globally, one outlier is South Sudan. Political instability and violence have depressed growth and inflation, which stood at -11.6% in December. As it faces a severe humanitarian crisis, the country has the lowest inflation rate worldwide.

Oil-producing nation Oman has also seen low inflation, at 2.1%. One reason for this is that the Omani rial is pegged to the U.S. dollar, keeping the currency anchored. Inflation has remained moderate over the last decade in the country.

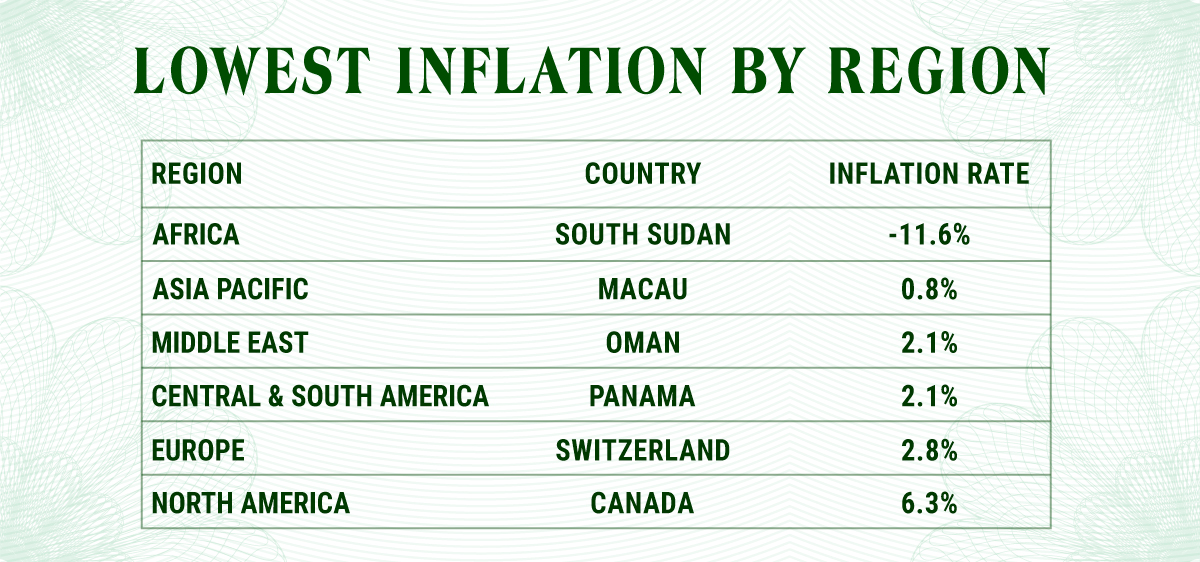

The Country With the Lowest Inflation, by Region

In Europe, Switzerland has the lowest inflation rate, at 2.8%, or roughly one-third of the Euro area’s. It is also the lowest rate in the OECD. The country’s strong currency has shielded it from inflationary pressures and high import prices.

Meanwhile, Swiss production prices have risen marginally above inflation, to 4.1% annually in mid-2022. Last year, the Swiss central bank raised interest rates for the first time since 2007 from -0.75% to -0.25% following 20 years of deflation.

Panama has the lowest rate in Latin America. The dollarization of the Panamanian balboa has helped quash price pressures. In July, the government regulated the price of 72 items to keep the cost of living from rising after three weeks of protests as inflation climbed as high as 5.2% during the course of 2022.

With the lowest inflation in Asia, Macau witnessed the tourism industry fall off a cliff given lockdown measures, and the economy saw both its GDP and inflation collapse in 2022. Its real GDP is projected to have fallen close to 30% for the year.

Future Gazing

The IMF estimates that 84% of countries around the world will have lower inflation than last year. By 2024, both headline and core inflation are projected to remain above pre-pandemic levels at 4.1%.

Opposing forces of China’s reopening and weaker global growth could offset inflationary pressures, yet this interplay—among a host of other factors—remains to be seen.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy3 days ago

Economy3 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)