Markets

Visualizing 1 Billion Square Feet of Empty Office Space

1 Billion Square Feet of Empty Office Space

In April, one of America’s largest office owners, Brookfield, defaulted on a $161 million loan.

The loan, covering 12 office buildings, was mainly concentrated in the Washington, D.C. market. Faced with low occupancy rates, it joined other office giants Blackstone and WeWork defaulting on office debt this year.

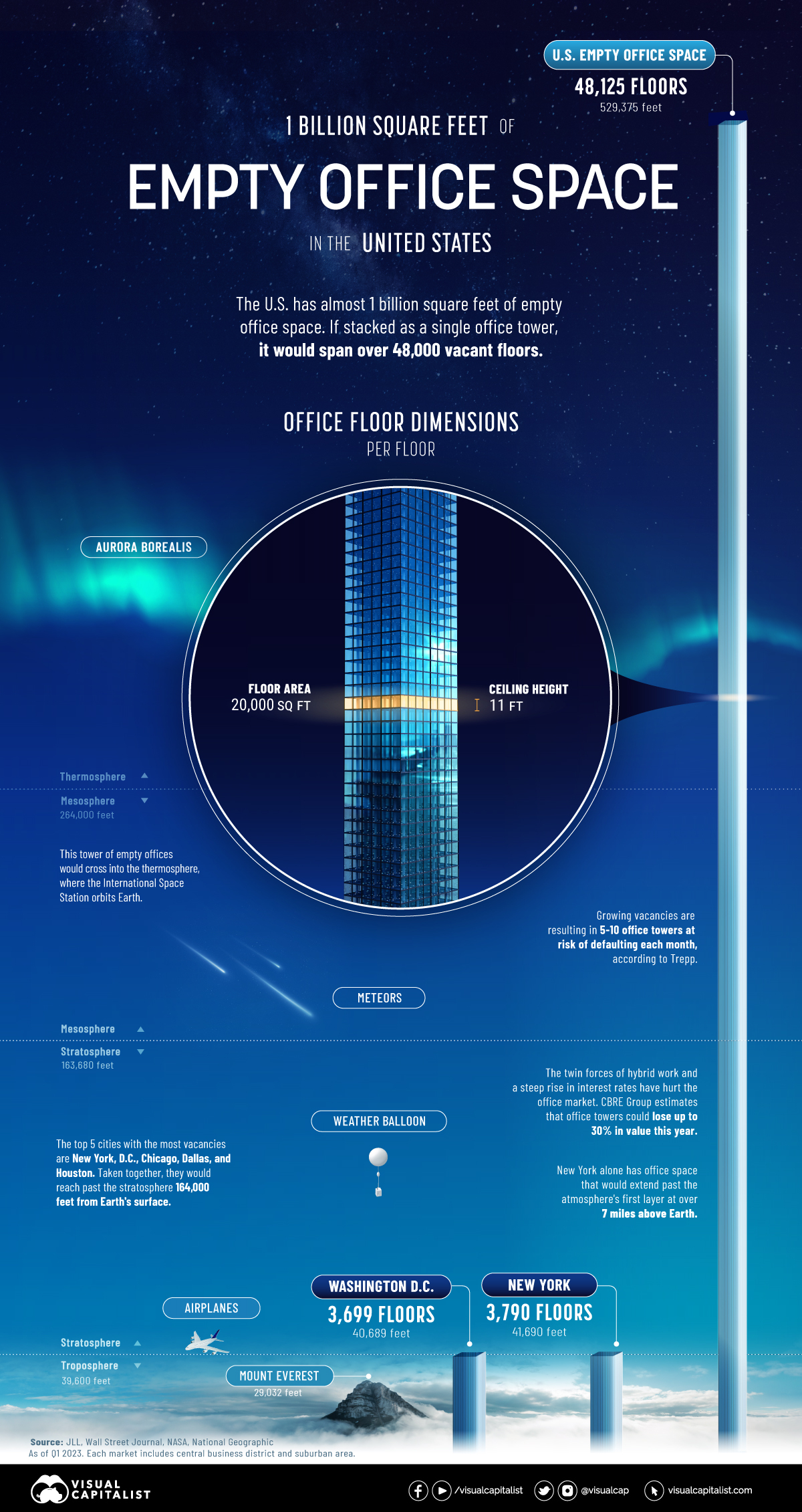

The above graphic shows nearly 1 billion square feet of empty office space in the U.S. based on data from JLL—and the wider implications of office towers standing empty.

Ranking U.S. Cities by Empty Office Space

At the end of the first quarter of 2023, a record 963 million square feet of office space was unoccupied in America. An estimated five to 10 office towers are at risk of defaulting each month according to Manus Clancy, senior managing director at Trepp.

Here are cities ranked by their total square feet of office vacancy as of Q1 2023. Figures include central business districts and suburban areas.

| Ranking | Market | Total Vacancy (SF) | Total Vacancy (%) |

|---|---|---|---|

| 1 | New York | 75.8M | 16.1% |

| 2 | Washington, D.C. | 74.0M | 20.8% |

| 3 | Chicago | 63.2M | 23.5% |

| 4 | Dallas | 53.5M | 25.0% |

| 5 | Houston | 49.3M | 25.6% |

| 6 | Los Angeles | 47.1M | 24.1% |

| 7 | New Jersey | 43.3M | 25.8% |

| 8 | Atlanta | 38.1M | 21.6% |

| 9 | Boston | 31.8M | 19.1% |

| 10 | Philadelphia | 27.8M | 18.8% |

| 11 | Denver | 27.3M | 21.6% |

| 12 | Phoenix | 25.2M | 23.9% |

| 13 | San Francisco | 22.8M | 26.4% |

| 14 | Seattle | 21.4M | 17.7% |

| 15 | Minneapolis | 19.9M | 19.7% |

| 16 | Detroit | 18.0M | 19.3% |

| 17 | Orange County | 17.7M | 17.6% |

| 18 | Salt Lake City | 13.9M | 18.5% |

| 19 | Kansas City | 13.8M | 20.8% |

| 20 | Pittsburgh | 13.8M | 21.8% |

| 21 | Charlotte | 13.7M | 20.6% |

| 22 | Austin | 13.6M | 18.9% |

| 23 | Baltimore | 13.1M | 18.2% |

| 24 | Portland | 12.8M | 17.5% |

| 25 | Silicon Valley | 12.1M | 17.3% |

| 26 | Oakland–East Bay | 11.7M | 22.0% |

| 27 | San Diego | 10.7M | 12.3% |

| 28 | St. Louis | 10.5M | 21.9% |

| 29 | Cincinnati | 10.1M | 21.4% |

| 30 | Sacramento | 9.9M | 19.6% |

| 31 | Fairfield County | 9.7M | 25.4% |

| 32 | Columbus | 9.7M | 21.7% |

| 33 | Milwaukee | 9.2M | 24.0% |

| 34 | Nashville | 9.0M | 18.9% |

| 35 | Raleigh-Durham | 8.9M | 15.2% |

| 36 | Indianapolis | 8.6M | 22.4% |

| 37 | Tampa | 8.2M | 17.2% |

| 38 | Fort Worth | 7.6M | 16.7% |

| 39 | Miami | 7.6M | 16.2% |

| 40 | Cleveland | 7.3M | 18.3% |

| 41 | San Antonio | 7.2M | 17.8% |

| 42 | Long Island | 6.3M | 15.2% |

| 43 | Westchester County | 5.8M | 22.1% |

| 44 | Jacksonville | 5.4M | 18.6% |

| 45 | Orlando | 5.0M | 13.3% |

| 46 | San Francisco Peninsula | 4.4M | 13.3% |

| 47 | Richmond | 4.3M | 13.3% |

| 48 | Fort Lauderdale | 4.3M | 16.1% |

| 49 | North San Francisco Bay | 4.0M | 18.3% |

| 50 | Louisville | 3.6M | 16.8% |

| 51 | Des Moines | 3.2M | 12.0% |

| 52 | Hampton Roads | 3.1M | 14.7% |

| 53 | West Palm Beach | 2.4M | 10.3% |

| 54 | Grand Rapids | 1.8M | 13.2% |

| United States | 962.5M | 20.2% |

Numbers may not total 100 due to rounding.

New York has roughly 76 million square feet of empty office space. If this were stacked as a single office building, it would stretch 7 miles into the atmosphere. In 2019, the office sector accounted for about a third of all jobs in the city.

Falling closely behind is Washington, D.C. with a 21% vacancy rate—8% higher than what is typically considered healthy. Occupiers are downsizing given remote work trends, yet some office buildings are being converted to residential properties, curtailing vacancy rates.

Across 54 markets in the dataset, San Francisco has the highest vacancy rate at over 26%. Prior to the pandemic, vacancy rates were about 4%. This year, Salesforce walked away from a 30-story tower in downtown San Francisco spanning 104,000 square feet in an effort to cut costs.

Overall, rising interest rates and higher vacancies have hurt U.S. office markets, with many cities potentially seeing an uptick in vacancies going forward.

Empty Office Space: Impact on Banks

Office building valuations are projected to fall 30% in 2023 according to Richard Barkham, global chief economist at CBRE Group.

A sharp decline in property values could potentially result in steep losses for banks. This is especially true for small and regional banks that make up the majority of U.S. office loans. Big banks cover roughly 20% of office and downtown retail totals.

Consider how commercial real estate exposure breaks down by different types of banks:

| Bank Assets | Commercial Real Estate Loans % of Total Assets | Share of Industry Assets |

|---|---|---|

| <$100M | 11.3% | 0.2% |

| $100M-$1B | 26.9% | 4.7% |

| $1B-$10B | 32.5% | 9.7% |

| $10B-$250B | 18.1% | 30.1% |

| >$250B | 5.6% | 55.5% |

Source: FitchRatings

For big banks, a recent stress test by the Federal Reserve shows that a 40% decline in commercial property values could result in a $65 billion loss on their commercial loan portfolios. The good news is that many big banks are sitting on healthy capital reserves based on requirements set in place after the global financial crisis.

Smaller banks are a different story. Many have higher loan concentrations and less oversight on reserve requirements. If these loan portfolios deteriorate, banks may face a downgrade in ratings and higher credit losses.

Additionally, banks with loans in markets with high vacancy rates like San Francisco, Houston, and Washington, D.C. could see more elevated risk.

How High Rates Could Escalate Losses

Adding further strain are the ramifications of higher interest rates.

Higher rates have negatively impacted smaller banks’ balance sheets—meaning they are less likely to issue new loans. This is projected to cause commercial real estate transaction volume to decline 27% in 2023, contributing to lower prices. Banks have already slowed lending for commercial real estate in 2023 due to credit quality concerns.

The good news is that some banks are extending existing loan terms or restructuring debt. In this way, banks are willing to negotiate new loan agreements to prevent widespread foreclosures from hurting their commercial loan portfolios. Short-term extensions on existing loans were often seen during the global financial crisis.

Still, foreclosures could take place if restructuring the loan doesn’t make financial sense.

Overall, only so many banks may be willing to wait out the uncertainty with loan extensions if fundamentals continue to worsen. Offices that are positioned to weather declines will likely have better quality, location, roster of tenants, and financing structures.

Markets

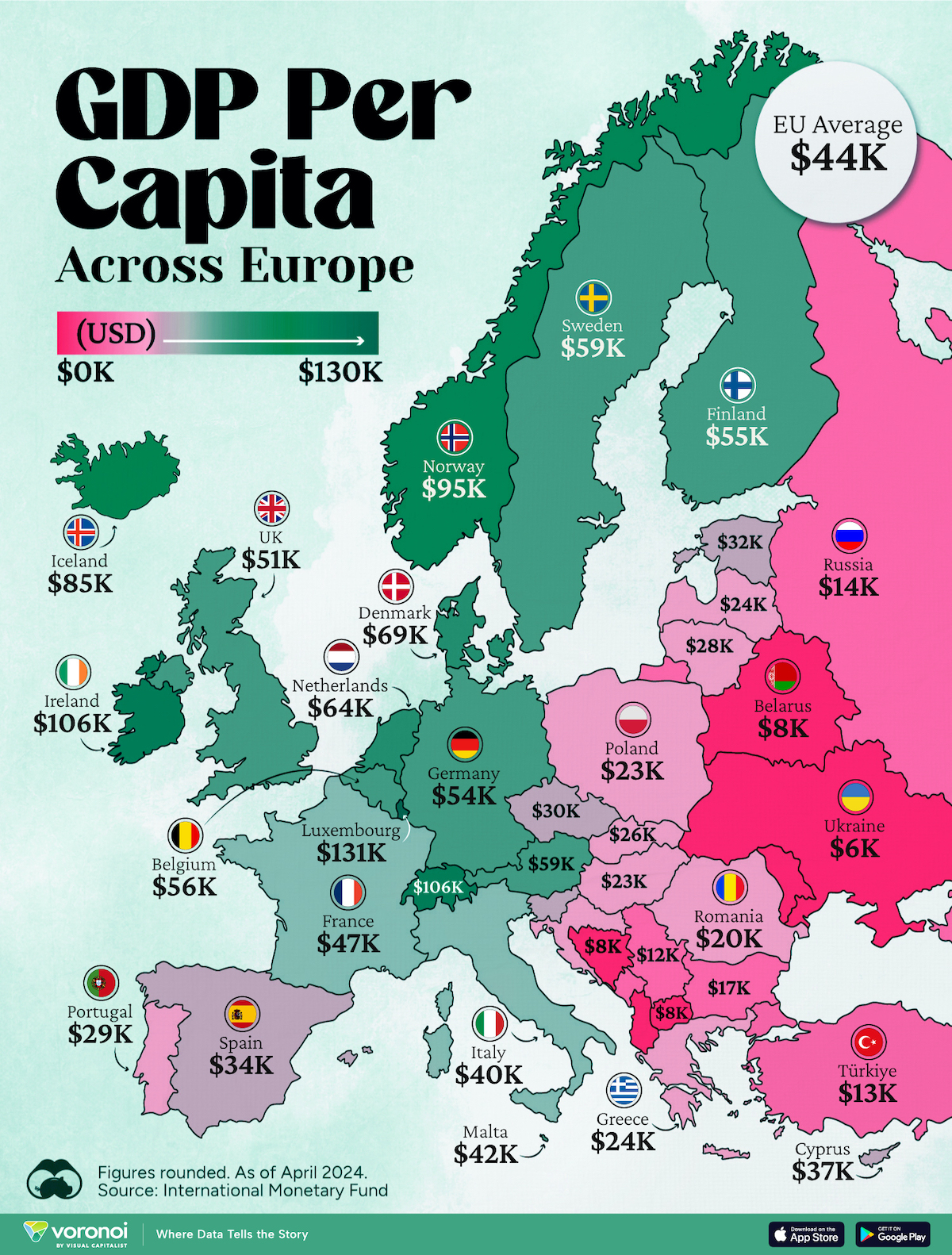

Mapped: Europe’s GDP Per Capita, by Country

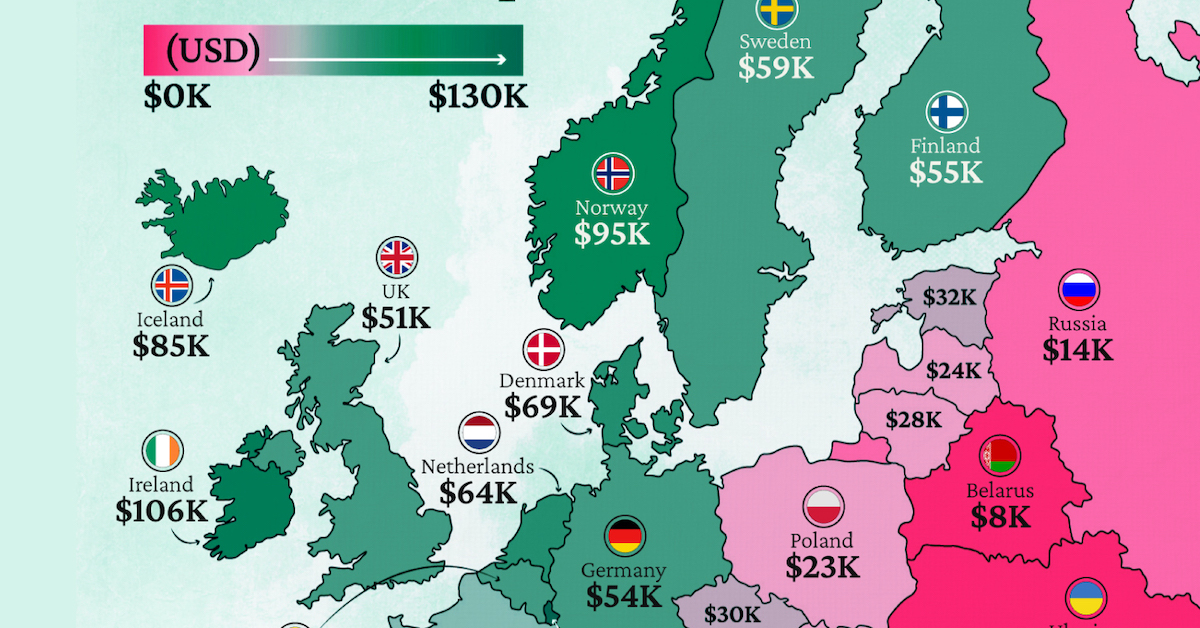

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

Mapped: Europe’s GDP Per Capita, by Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Europe is home to some of the largest and most sophisticated economies in the world. But how do countries in the region compare with each other on a per capita productivity basis?

In this map, we show Europe’s GDP per capita levels across 44 nations in current U.S. dollars. Data for this visualization and article is sourced from the International Monetary Fund (IMF) via their DataMapper tool, updated April 2024.

Europe’s Richest and Poorest Nations, By GDP Per Capita

Luxembourg, Ireland, and Switzerland, lead the list of Europe’s richest nations by GDP per capita, all above $100,000.

| Rank | Country | GDP Per Capita (2024) |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $131,380 |

| 2 | 🇮🇪 Ireland | $106,060 |

| 3 | 🇨🇭 Switzerland | $105,670 |

| 4 | 🇳🇴 Norway | $94,660 |

| 5 | 🇮🇸 Iceland | $84,590 |

| 6 | 🇩🇰 Denmark | $68,900 |

| 7 | 🇳🇱 Netherlands | $63,750 |

| 8 | 🇸🇲 San Marino | $59,410 |

| 9 | 🇦🇹 Austria | $59,230 |

| 10 | 🇸🇪 Sweden | $58,530 |

| 11 | 🇧🇪 Belgium | $55,540 |

| 12 | 🇫🇮 Finland | $55,130 |

| 13 | 🇩🇪 Germany | $54,290 |

| 14 | 🇬🇧 UK | $51,070 |

| 15 | 🇫🇷 France | $47,360 |

| 16 | 🇦🇩 Andorra | $44,900 |

| 17 | 🇲🇹 Malta | $41,740 |

| 18 | 🇮🇹 Italy | $39,580 |

| 19 | 🇨🇾 Cyprus | $37,150 |

| 20 | 🇪🇸 Spain | $34,050 |

| 21 | 🇸🇮 Slovenia | $34,030 |

| 22 | 🇪🇪 Estonia | $31,850 |

| 23 | 🇨🇿 Czech Republic | $29,800 |

| 24 | 🇵🇹 Portugal | $28,970 |

| 25 | 🇱🇹 Lithuania | $28,410 |

| 26 | 🇸🇰 Slovakia | $25,930 |

| 27 | 🇱🇻 Latvia | $24,190 |

| 28 | 🇬🇷 Greece | $23,970 |

| 29 | 🇭🇺 Hungary | $23,320 |

| 30 | 🇵🇱 Poland | $23,010 |

| 31 | 🇭🇷 Croatia | $22,970 |

| 32 | 🇷🇴 Romania | $19,530 |

| 33 | 🇧🇬 Bulgaria | $16,940 |

| 34 | 🇷🇺 Russia | $14,390 |

| 35 | 🇹🇷 Türkiye | $12,760 |

| 36 | 🇲🇪 Montenegro | $12,650 |

| 37 | 🇷🇸 Serbia | $12,380 |

| 38 | 🇦🇱 Albania | $8,920 |

| 39 | 🇧🇦 Bosnia & Herzegovina | $8,420 |

| 40 | 🇲🇰 North Macedonia | $7,690 |

| 41 | 🇧🇾 Belarus | $7,560 |

| 42 | 🇲🇩 Moldova | $7,490 |

| 43 | 🇽🇰 Kosovo | $6,390 |

| 44 | 🇺🇦 Ukraine | $5,660 |

| N/A | 🇪🇺 EU Average | $44,200 |

Note: Figures are rounded.

Three Nordic countries (Norway, Iceland, Denmark) also place highly, between $70,000-90,000. Other Nordic peers, Sweden and Finland rank just outside the top 10, between $55,000-60,000.

Meanwhile, Europe’s biggest economies in absolute terms, Germany, UK, and France, rank closer to the middle of the top 20, with GDP per capitas around $50,000.

Finally, at the end of the scale, Eastern Europe as a whole tends to have much lower per capita GDPs. In that group, Ukraine ranks last, at $5,660.

A Closer Look at Ukraine

For a broader comparison, Ukraine’s per capita GDP is similar to Iran ($5,310), El Salvador ($5,540), and Guatemala ($5,680).

According to experts, Ukraine’s economy has historically underperformed to expectations. After the fall of the Berlin Wall, the economy contracted for five straight years. Its transition to a Western, liberalized economic structure was overshadowed by widespread corruption, a limited taxpool, and few revenue sources.

Politically, its transformation from authoritarian regime to civil democracy has proved difficult, especially when it comes to institution building.

Finally, after the 2022 invasion of the country, Ukraine’s GDP contracted by 30% in a single year—the largest loss since independence. Large scale emigration—to the tune of six million refugees—is also playing a role.

Despite these challenges, the country’s economic growth has somewhat stabilized while fighting continues.

-

Energy4 days ago

Energy4 days agoWho’s Building the Most Solar Energy?

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which Country Has the Most Billionaires in 2024?

-

Markets2 weeks ago

Markets2 weeks agoThe Top Private Equity Firms by Country

-

Jobs2 weeks ago

Jobs2 weeks agoThe Best U.S. Companies to Work for According to LinkedIn

-

Economy1 week ago

Economy1 week agoRanked: The Top 20 Countries in Debt to China

-

Misc1 week ago

Misc1 week agoCharted: Trust in Government Institutions by G7 Countries

-

Energy1 week ago

Energy1 week agoMapped: The Age of Energy Projects in Interconnection Queues, by State

-

Mining1 week ago

Mining1 week agoVisualizing Global Gold Production in 2023