Technology

Visualized: The Esports Journey to Mainstream

Visualized: The Esports Journey to Mainstream

Although esports might seem like a relatively new phenomenon, its origins can be traced all the way back to the 1970s.

It was only in the past decade however, that a wave of technological innovation transformed the entire industry from an underground niche into a billion-dollar mainstream phenomenon.

Today, the nascent esports industry competes with some of the biggest sports leagues in the U.S., while global tech giants hastily invest billions of dollars to make their mark in what many consider to be the future of sports and entertainment.

How did it evolve into the industry we know today—and more importantly, will it maintain its furious pace of growth?

The History of Esports

Electronic sports (or esports), are organized, multiplayer video game competitions commonly played by professional gamers. Since its inception, the industry has continued to exceed expectations and reach new milestones every decade.

Note: The timeline of events are an abridged version of major achievements in the industry.

1970s: The Birth of Esports

The earliest known video game competition—the Intergalactic Spacewar Olympics—took place in 1972 at Stanford University. The winner of the event received an annual subscription to Rolling Stone magazine.

While it was a modest first prize for the industry, it would set a foundation for future prize pools in the millions of dollars.

1980s: More Gaming Options

The 1980s ushered in better consoles for esports. The Nintendo Entertainment System (NES) took graphics, controls, gameplay, and video game accessibility to the next level.

Five years later, the Sega Genesis console was released in the U.S. and Japan to compete with Nintendo—which held a 95% market monopoly at the time.

1990s: The First Tournaments

Nintendo increased its commitment to esports by hosting the Nintendo World Championships. After touring 30 cities in the U.S., the finals challenged players to games like Super Mario Bros. and Tetris, with a 40-inch TV awarded to the winner.

Developers and gaming entrepreneurs created a flurry of leagues, including QuakeCon in 1996, followed by both the Cyberathlete Professional League (CPL) and the Professional Gamers League (PGL) in 1997.

In just a few years, these competitions helped esports gain significant traction.

2000s: The Explosion of Esports

Esports fully burst into the mainstream with Amazon’s acquisition of Twitch for $970 million in 2014. The live video game streaming site gave esports a platform to reach previously unthinkable heights, with popular games like League of Legends (LoL) and Defense of the Ancients 2 (Dota) receiving millions of views.

In 2019, Google followed suit with its Stadia streaming service. The cloud-based video game platform aims to eliminate the need for hardware, allowing Google to aggressively compete in the esports space.

A Snapshot of Esports Today

The increasing involvement of developers and global tech giants has not only increased the audience size of esports—it has also led to bigger prize pools, and larger scale competitions across the world.

- Demographics: 50% of esports viewership now comes from Asia.

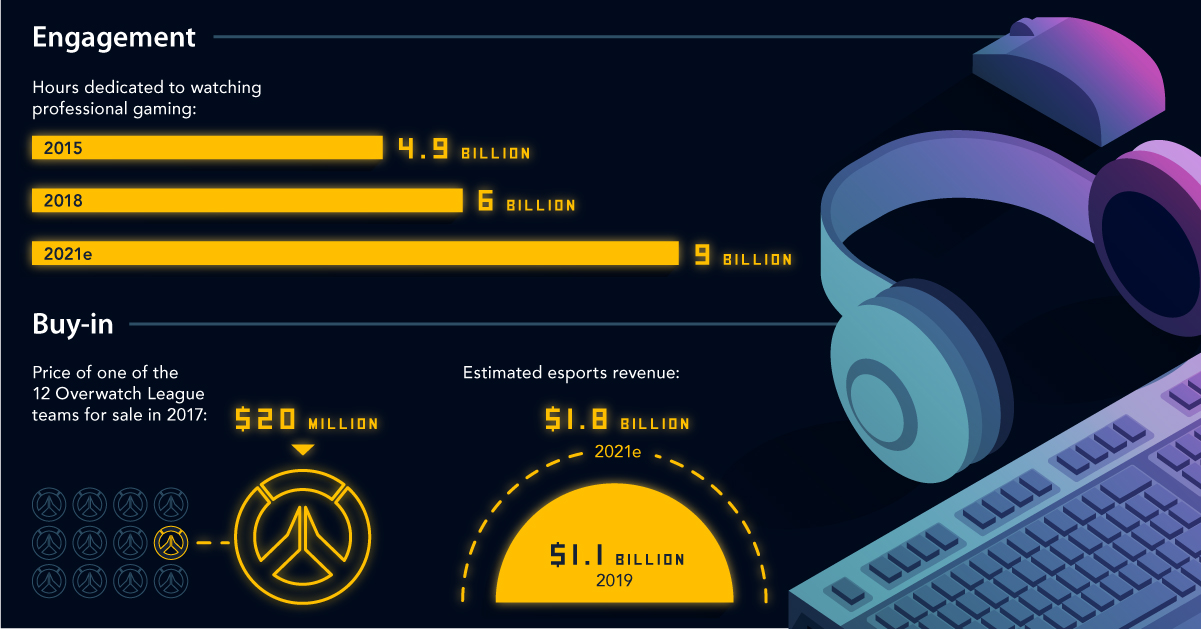

- Engagement: 6 billion hours were dedicated to watching esports in 2018, and will continue to grow to 9 billion by 2021.

- Buy-in: The price of one of the 12 Overwatch League teams for sale in 2017 was $20 million.

- Incentives: The Fortnite competition prize pool for the 2018 season was $100 million—equal to the entire esports prize pool in 2017.

It’s clear that esports continues to attract rapidly growing audiences at an unprecedented rate. However, there are still significant barriers inhibiting the industry from reaching its full potential.

The Future of esports

In order to maintain its furious pace of growth, the esports industry must first address five key challenges:

- Diversity of game genres: The industry will need to produce more game genres in order to appeal to a wider audience outside of its current player base.

- Geographic expansion of leagues: esports will need to expand to national, regional, and global levels if it wants to tap into bigger advertising budgets. However, while esports gains attention from global media, local events are more difficult to organize.

- Regulation of competitions: With multimillion-dollar prize pools at stake, new rules and regulations are needed to combat cheating and match fixing.

- Ownership of media rights: Content rights have not been a focus for publishers, as fan-generated content has served as free advertising for their games.

- Media alignment: Traditional media brands are still reluctant to associate themselves with esports, as prejudices against competitive gaming still exist. For example, gaming culture is viewed as a harmful distraction, rather than a legitimate sport.

In less than 50 years, esports has evolved into a dominant form of entertainment today, eclipsing film and music industries by a wide margin. With an increasingly mainstream audience, the industry’s popularity and profitability shows no signs of slowing down—despite the challenges it faces.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001