Technology

How the eSports Industry Fares Against Traditional Sports

How the eSports Industry Fares Against Traditional Sports

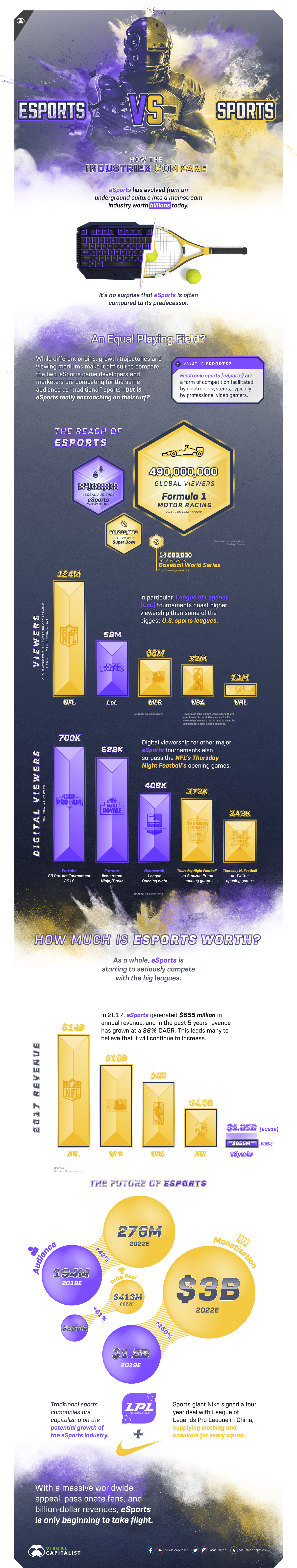

In just a decade, electronic sports (eSports) has evolved from an underground culture into a mainstream industry worth billions of dollars today.

The industry is growing at an explosive rate, and with major tech giants like Amazon and Google vying for a piece of the pie, the future of this industry is an exciting one.

It’s no surprise that eSports is often compared to its predecessor, traditional sports. However, eSports certainly has none of the typical confines of a traditional sport—so how does it compare in terms of audience size, market potential, and revenue?

An Equal Playing Field?

eSports is an umbrella term for competitions played on electronic systems, typically by professional video gamers—with the first competition dating back to 1972.

The 16 to 24-year-old audience has increased by 60% since 2017, fueling the rapid growth of this emerging industry. The global audience is expected to grow to 276 million by 2022, with League of Legends tournaments often boasting a higher viewership than some of the biggest U.S. leagues:

Cumulative Viewership (2017 finals)

- NFL Super Bowl: 124 million viewers

- League of Legends: 58 million viewers

- MLB World Series: 38 million viewers

- NBA Finals: 32 million viewers

- NHL Stanley Cup Finals: 11 million viewers

While viewership can surpass that of well-known professional leagues, it doesn’t yet stack up in terms of monetization. That said, this aspect is now increasing enough to be seen as a threat to more traditional leagues.

How Much is eSports Worth?

According to Goldman Sachs, eSports will exceed $1 billion in revenue in 2019, and reach $3 billion by 2022. eSports creates the foundation for an entire ecosystem of opportunities, which include live-streaming, game development, player fanbases, and brand investments for sponsorship and advertising—where 82% of revenue currently comes from.

Although eSports under-indexes on monetization relative to the size of its audience, there is a huge opportunity for it to close the gap, given the predicted 35% compound annual growth rate (CAGR) for total eSports revenue between 2017 and 2022.

Getting Attention from the World’s Biggest Players

The success of eSports tournaments is attributed to live-streaming platforms. Amazon’s purchase of leading video-streaming site, Twitch, allowed Amazon to tap into the rapidly growing eSports audience, along with other live-streaming opportunities. Since the acquisition in 2014, the number of average viewers has doubled to 15 million, half of YouTube’s daily viewership.

Google, which lost the bidding war for Twitch, has recently made its own big move into gaming with cloud gaming service Google Stadia. Ultimately, the company hopes it will help keep live-streamers on YouTube instead of competing platforms.

The Future of eSports

Over time, eSports will tap into bigger advertising budgets, and reach national, regional, and global levels, as traditional sports are able to. eSports will also be a medal event in the 2022 Asian Games, which could pave the way for full Olympic status.

As a whole, eSports is starting to seriously compete with the big leagues. With a massive worldwide appeal, passionate fans, and billion-dollar revenues, the industry is only beginning to take flight.

The debate however, is not around the battle between eSports and traditional sports. It is around the shift to celebrating a culture that is completely virtual, over one that is physical—which has much bigger implications.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?