Datastream

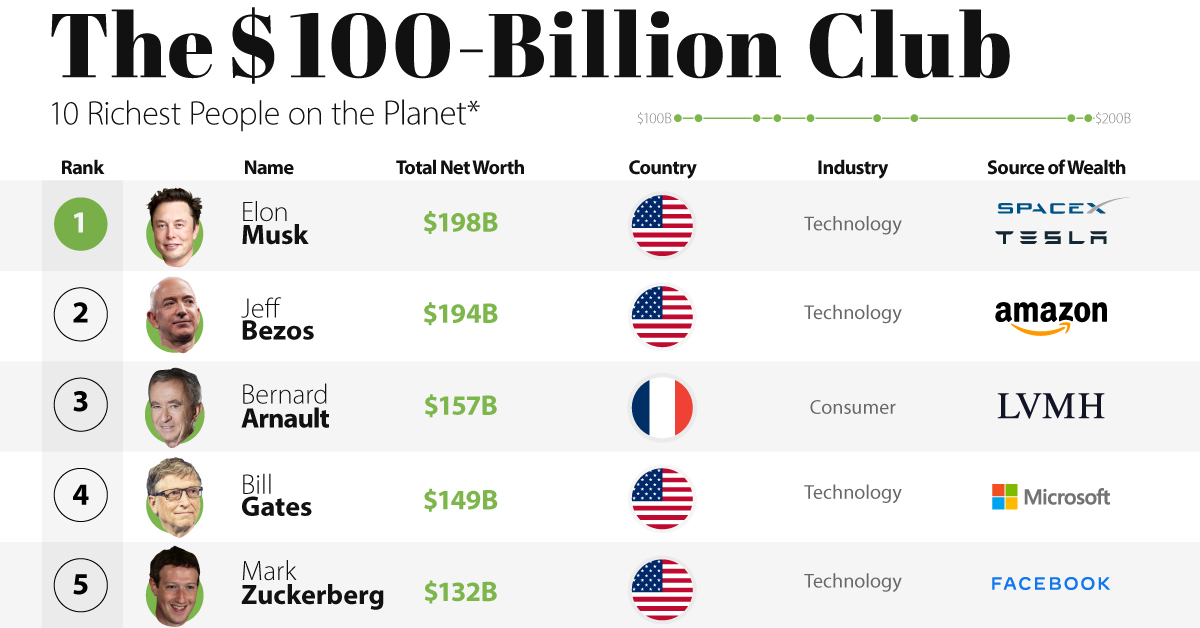

Ranked: The Top 10 Richest People on the Planet

The Briefing

- Elon Musk is currently the richest person in the world, with a total net worth of $198 billion as of Sept 21, 2021

- Jeff Bezos comes in second place, with a net worth of $194 billion

Ranked: The Top 10 Richest People on the Planet

The top 10 richest people on the planet have a combined net worth of $1.4 trillion. For some context, that’s roughly the same size as Australia’s GDP.

Who are these ultra-wealthy individuals, and what’s the source of their wealth? Here’s a look at the top 10 richest people on the planet, and how they’ve made their billions.

Who’s in the $100 Billion Club?

Elon Musk is currently the richest of them all, with a total net worth of $198 billion. That’s $60 billion more than the entire group’s average of $138 billion.

| Rank | Name | Total Net Worth | Country | Industry | Source of Wealth |

|---|---|---|---|---|---|

| 1 | Elon Musk | $198 B | U.S. | Technology | Tesla, Space X |

| 2 | Jeff Bezos | $194 B | U.S. | Technology | Amazon |

| 3 | Bernard Arnault | $157 B | France | Consumer | LVMH |

| 4 | Bill Gates | $149 B | U.S. | Technology | Microsoft |

| 5 | Mark Zuckerberg | $132 B | U.S. | Technology | |

| 6 | Larry Page | $124 B | U.S. | Technology | |

| 7 | Sergey Brin | $119 B | U.S. | Technology | |

| 8 | Steve Ballmer | $105 B | U.S. | Technology | Microsoft |

| 9 | Larry Ellison | $100 B | U.S. | Technology | Oracle |

| 10 | Warren Buffett | $100 B | U.S. | Diversified | Berkshire Hathaway |

This is fairly unsurprising considering how well Tesla stock has been performing over recent years. While many skeptics expect the Tesla bubble to burst eventually—including famous investor Michael Burry—so far, the car company’s value has continued to surge.

With a current market cap of $768 billion, Tesla’s worth more than the next six largest car manufacturers combined.

Musk took the top spot from Jeff Bezos, who just a few months ago, held the title as the world’s richest person. However, it’s worth noting that things could change at the drop of a hat, since the pair are constantly neck and neck.

Third on the list is Bernard Arnault, CEO of the luxury brand conglomerate Louis Vuitton Moët Hennessy (LVMH), which owns Louis Vuitton, Dior, Fendi, Loro Piana, and Bulgari. Arnault is the wealthiest person in Europe, and actually even became the wealthiest in the world for a brief stint in May.

The Money’s in Tech (and in the U.S.)

When looking at this ranking, there are two obvious trends:

- Most of these billionaires are in the tech industry, apart from Bernard Arnault and Warren Buffett

- All are men located America, with the exception of Arnault

Considering America’s tech sector is only expected to grow in the coming years, it’s likely that American tech billionaires will continue their reign for the foreseeable future.

Where does this data come from?

Source: Bloomberg Billionaires Index

Notes: Data as of September 21st, 2021

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries