Money

Ranked: The World’s Richest Families in 2020

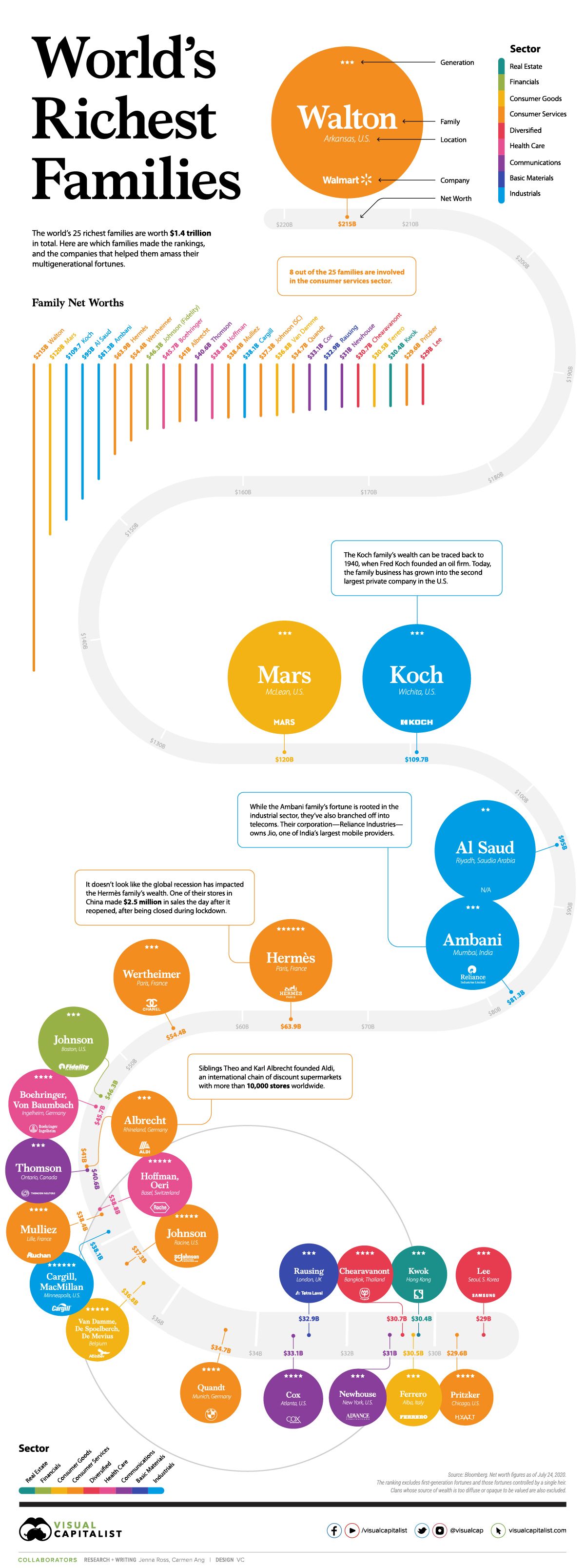

The World’s Richest Families in 2020

The COVID-19 pandemic hasn’t stopped the world’s wealthiest families from growing their fortunes. Over the past year, the richest family—the Waltons—grew their wealth by $25 billion, or almost $3 million per hour.

This graphic, using data from Bloomberg, ranks the 25 most wealthy families in the world. The data excludes first-generation wealth and wealth controlled by a single heir, which is why you don’t see Jeff Bezos or Bill Gates on the list. Families whose source of wealth is too diffused or opaque to be valued are also excluded.

The Full Breakdown

Intergenerational wealth is a powerful thing. It often prevails through market crashes, social turmoil, and economic uncertainty, and this year has been no exception.

Here’s a look at the 25 most wealthy families in 2020:

| Rank | Name | Company | Wealth, $B | Sector | Location |

|---|---|---|---|---|---|

| 1 | Walton | Walmart | 215 | Consumer services | 🇺🇸 Bentonville, Arkansas |

| 2 | Mars | Mars | 120 | Consumer goods | 🇺🇸 McLean, Virginia |

| 3 | Koch | Koch Industries | 109.7 | Industrials | 🇺🇸 Wichita, Kansas |

| 4 | Al Saud | N/A | 95 | Industrials | 🇸🇦 Riyadh, Saudi Arabia |

| 5 | Ambani | Reliance Industries | 81.3 | Industrials | 🇮🇳 Mumbai, India |

| 6 | Hermès | Hermès | 63.9 | Consumer services | 🇫🇷 Paris, France |

| 7 | Wertheimer | Chanel | 54.4 | Consumer services | 🇫🇷 Paris, France |

| 8 | Johnson (Fidelity) | Fidelity Investments | 46.3 | Financials | 🇺🇸 Boston, New York |

| 9 | Boehringer, Von Baumbach | Boehringer Ingelheim | 45.7 | Health care | 🇩🇪 Inglheim, Germany |

| 10 | Albrecht | Aldi | 41 | Consumer services | 🇩🇪 Rhineland, Germany |

| 11 | Thomson | Thomson Reuters | 40.6 | Communication | 🇨🇦 Ontario, Canada |

| 12 | Hoffmann, Oeri | Roche | 38.8 | Health care | 🇨🇭 Basel, Switzerland |

| 13 | Mulliez | Auchan | 38.4 | Consumer services | 🇫🇷 Lille, France |

| 14 | Cargill, MacMillan | Cargill | 38.1 | Industrials | 🇺🇸 Minneapolis, Minnesota |

| 15 | Johnson (SC) | SC Johnson | 37.3 | Consumer services | 🇺🇸 Racine, Wisconsin |

| 16 | Van Damme, De Spoelberch, De Mevius | Anheuser-Busch InBev | 36.8 | Consumer goods | 🇧🇪 Belgium |

| 17 | Quandt | BMW | 34.7 | Consumer services | 🇩🇪 Munich, Germany |

| 18 | Cox | Cox Enterprises | 33.1 | Communication | 🇺🇸 Atlanta, Georgia |

| 19 | Rausing | Tetra Laval | 32.9 | Materials | 🇬🇧 London, England |

| 20 | Newhouse | Advance Publications | 31 | Communication | 🇺🇸 New York, New York |

| 21 | Chearavanont | Charoen Pokphand Group | 30.7 | Diversified | 🇹🇭 Bangkok, Thailand |

| 22 | Ferrero | Ferrero | 30.5 | Consumer goods | 🇮🇹 Alba, Italy |

| 23 | Kwok | Sun Hung Kai Properties | 30.4 | Real estate | 🇭🇰 Hong Kong |

| 24 | Pritzker | Hyatt Hotels | 29.6 | Consumer services | 🇺🇸 Chicago, Illinois |

| 25 | Lee | Samsung | 29 | Diversified | 🇰🇷 Seoul, South Korea |

*Note: The Al Saud’s net worth is based on cumulative payouts royal family members were estimated to have received over the past 50 years.

The Waltons are the richest family on the list by far, with a net worth of $215 billion—that’s $95 billion more than the second wealthiest family. Sam Walton, the family’s patriarch, founded Walmart in 1962. Since then, it’s become the world’s largest retailer by revenue.

When Sam passed away in 1992, his three children—James, Alice, and Rob—inherited his fortune. Now, the trio co-owns about half of Walmart.

In second place is the Mars family, with a net worth of $120 billion. The family is well-known for their candy empire, but interestingly, about half of the company’s value comes from pet care holdings. Mars Inc. owns several popular pet food brands, including Pedigree, Cesar, and Royal Canin—and it expanded its pet presence further in 2017 when it acquired VCA, a company with almost 800 small animal vet hospitals across the U.S. and Canada.

The Koch family is the world’s third-richest family. Their fortune is rooted in an oil firm founded by Fred C. Koch. Following Fred’s death in 1967, the firm was inherited by his four sons—Frederick, Charles, David, and William. After a family feud, Frederick and William left the business, and Charles and David went on to build the mega industrial conglomerate known as Koch Industries.

Despite being affected by the oil crash this year, the Koch family’s wealth still sits at $109.7 billion. Before David’s passing in 2019, he and his brother Charles were heavily involved in politics—and their political efforts were the subject of much scrutiny.

Richest Families, by Sector

It’s important to note that many of these families have diversified their investments across a variety of industries. For instance, while the Koch family’s wealth is largely concentrated in the industrial sector and commodities, they also dabble in real-estate—in May 2020, they made a $200 million bet on U.S. rental homes.

That being said, it’s interesting to see where each of these families started, and which sectors have bred the highest number of ultra-wealthy families.

Here’s a breakdown of each sector and how many families on the list got started in them:

| Sector | Number of Families | Total Wealth, $B |

|---|---|---|

| Consumer Services | 8 | 514.3 |

| Industrials | 4 | 324.1 |

| Consumer Goods | 3 | 187.3 |

| Communications | 3 | 104.7 |

| Health Care | 2 | 84.5 |

| Diversified | 2 | 59.7 |

| Financials | 1 | 46.3 |

| Basical Materials | 1 | 32.9 |

| Real Estate | 1 | 30.4 |

The top sector is consumer services—8 of the 25 families are heavily involved in this sector. Walmart helped generate the most wealth out of families in this space, while luxury brands Hermès and Chanel were the source of fortune for the next two wealthiest families.

Industrial is the second largest sector, with 4 of the 25 families involved. It’s also one of the most lucrative sectors—out of the top five wealthiest families on the list, three are in industrials. The Koch family is the wealthiest family in this category, followed by the Al Saud family and the Ambani family, respectively.

Communications and consumer goods are tied for third, with 3 of the 25 families in each. The Thomsons, who founded Thomson Reuters, are the wealthiest family in communications, while the Mars family has the highest net worth in the consumer goods sector.

Resilient, but not Bulletproof

Despite a global recession, most of the world’s wealthiest families seem to be doing just fine—however, not everyone on the list has been thriving this year.

The Koch family’s fortune dropped by $15 billion from 2019 to 2020, and the current political climate in Hong Kong has had a negative impact on the Kwok family’s real estate empire.

While intergenerational wealth certainty has resilience, how much economic and social turmoil can it withstand? It’ll be interesting to see which families make the list in 2021.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees