Markets

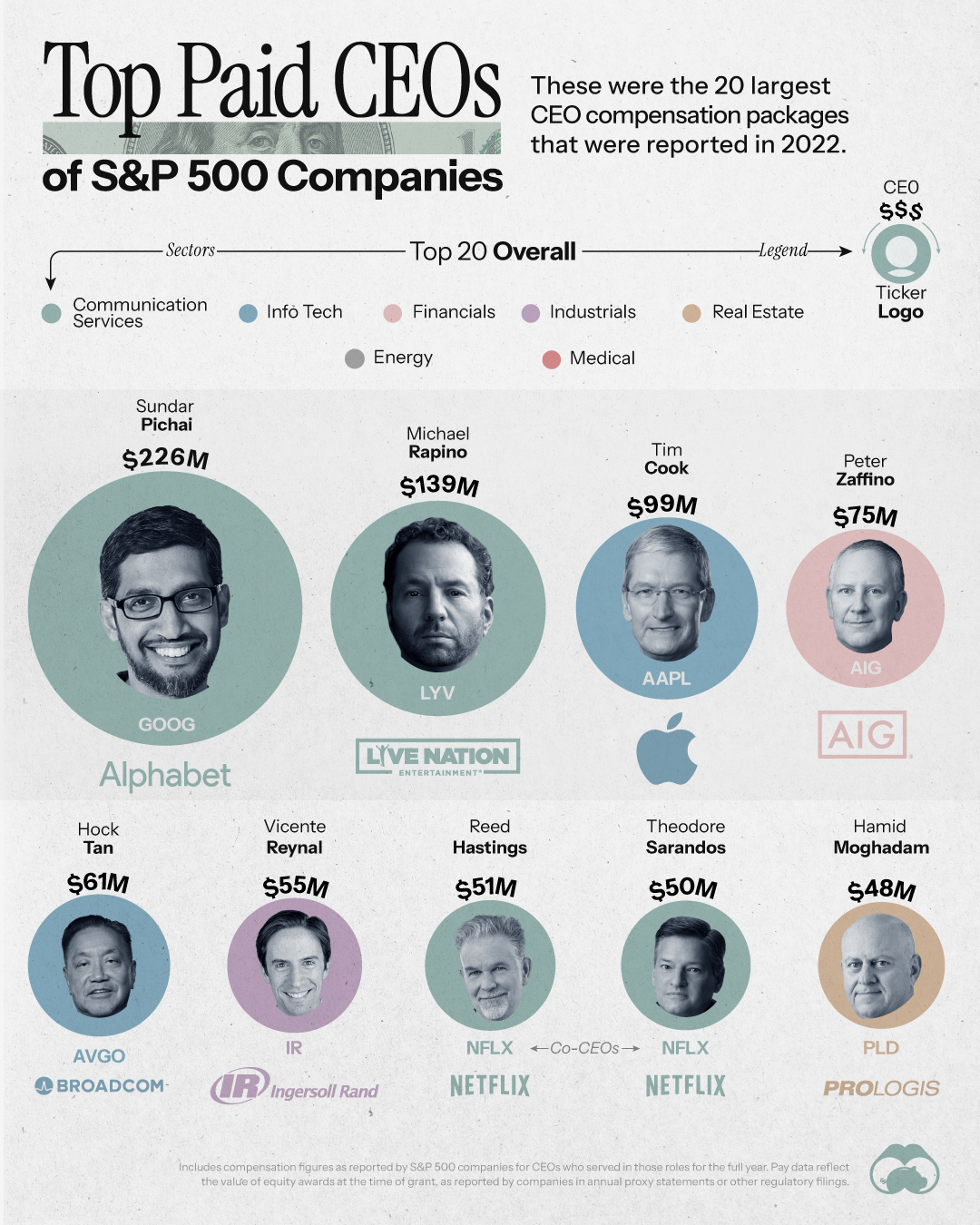

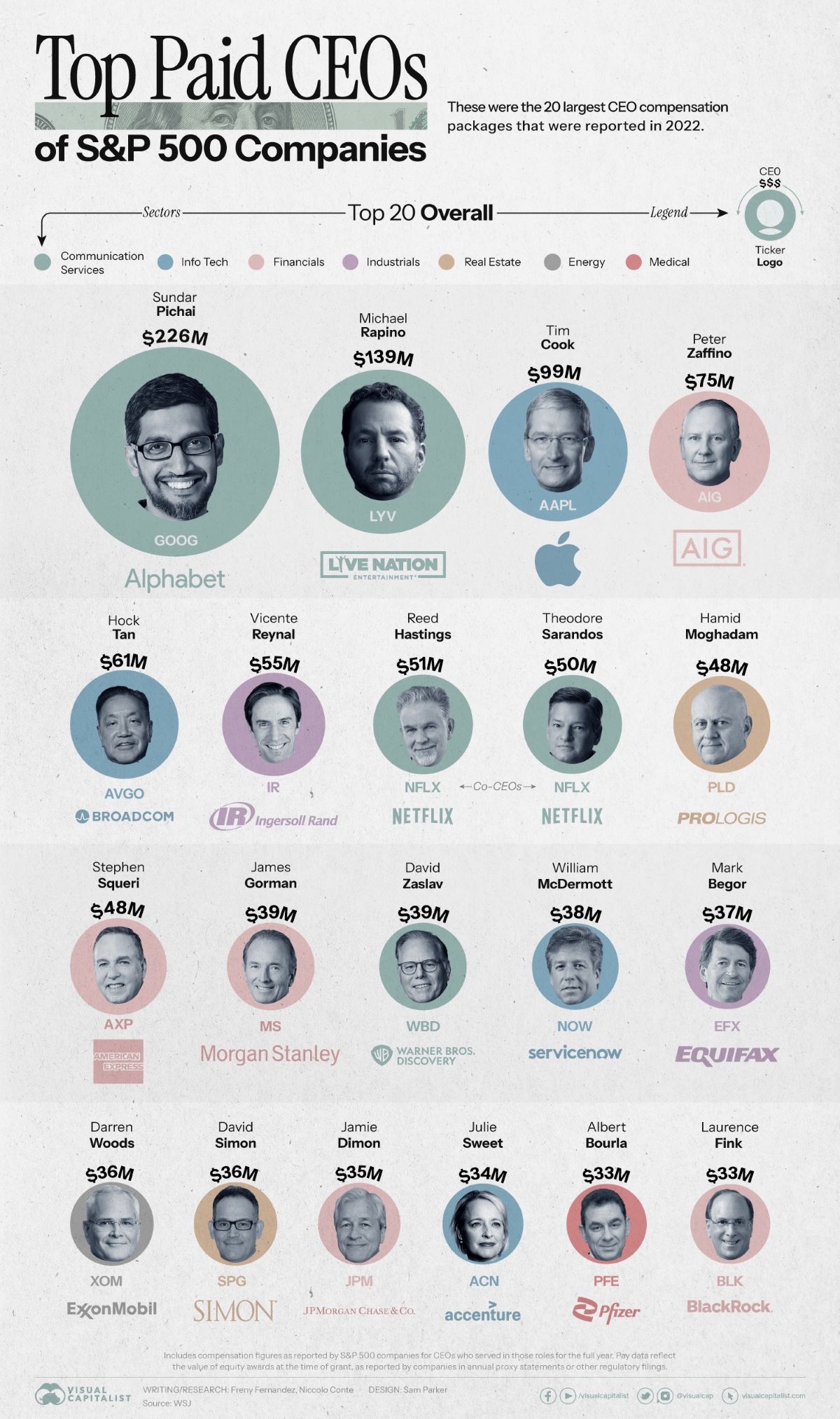

Ranked: The Highest Paid CEOs in the S&P 500

Ranked: The Highest Paid CEOs in the S&P 500

Many of the world’s most valuable companies are listed on the S&P 500, the benchmark index for the U.S. stock market.

For this reason, it is no surprise to see that CEOs of these key companies have multi-million dollar compensation packages. But what do these pay packages comprise? And do these CEOs always receive the compensation they are awarded? Or does it increase and decrease with stock market fluctuations?

In today’s infographic, we use data published by The Wall Street Journal to show the highest paid CEOs of S&P 500 companies in 2022, and delve into what their compensation includes.

The 20 Highest Paid CEOs

The compensation packages of CEOs of S&P 500 companies comprise not just salaries, but bonuses, stock awards, and other incentives.

Here are the CEOs of S&P 500 companies that were awarded the highest pay packages last year, and the sectors they belong to.

| CEO | Company | Sector | Total Pay |

|---|---|---|---|

| Sundar Pichai | Alphabet | Communication Services | $226M |

| Michael Rapino | Live Nation Entertainment | Communication Services | $139M |

| Tim Cook | Apple | Info Tech | $99M |

| Peter Zaffino | American International Group | Financials | $75M |

| Hock Tan | Broadcom | Info Tech | $61M |

| Vicente Reynal | Ingersoll Rand | Industrials | $55M |

| Reed Hastings | Netflix | Communication Services | $51M |

| Theodore Sarandos | Netflix | Communication Services | $50M |

| Hamid Moghadam | Prologis | Real Estate | $48M |

| Stephen Squeri | American Express | Financials | $48M |

| James Gorman | Morgan Stanley | Financials | $39M |

| David Zaslav | Warner Bros. Discovery | Communication Services | $39M |

| William McDermott | ServiceNow | Info Tech | $39M |

| Mark Begor | Equifax | Industrials | $37M |

| Darren W. Woods | Exxon Mobil | Energy | $36M |

| David Simon | Simon Property Group | Real Estate | $36M |

| James Dimon | JPMorgan Chase | Financials | $35M |

| Julie Sweet | Accenture | Info Tech | $34M |

| Albert Bourla | Pfizer | Medical | $33M |

| Laurence Fink | BlackRock | Financials | $33M |

Sundar Pichai, CEO of Google’s parent company, Alphabet, topped the list with an awarded pay package valued at around $226 million, which was over 800 times Google’s median employee compensation. His pay package included his annual salary of $2 million, a sum of $6 million for his personal security and stock awards valued at $218 million.

Meanwhile, Live Nation Entertainment CEO Michael Rapino’s awarded pay package shot up to $139 million in 2022 from almost $14 million the previous year. This included stock awards initially valued at $116 million. Tech companies Apple and Broadcom were not far behind. While Apple CEO Tim Cook’s compensation package was valued at $99 million in 2022, Broadcom’s president and CEO Hock Tan was awarded $61 million.

Other CEOs that made it to the list include global insurance giant AIG’s CEO, Peter Zaffino, and Netflix’s co-CEOs Ted Sarandos and Reed Hastings. While Hastings received a $10 million hike last year, he stepped down from this role in January 2023.

Rising Median CEO Income Hits a Wall

Over the last decade, the median pay awarded to CEOs across S&P 500 companies has doubled.

| Year | Median Total Compensation for S&P 500 CEOs | Change (%) |

|---|---|---|

| 2010 | $7.68M | n/a |

| 2011 | $7.56M | -2% |

| 2012 | $6.96M | -8% |

| 2013 | $7.95M | 14% |

| 2014 | $9.35M | 18% |

| 2015 | $9.72M | 4% |

| 2016 | $9.93M | 2% |

| 2017 | $10.62M | 7% |

| 2018 | $11.81M | 11% |

| 2019 | $12.20M | 3% |

| 2020 | $13.43M | 10% |

| 2021 | $14.67M | 9% |

| 2022 | $14.50M | -1% |

In 2021, this number hit a high of $14.7 million.

However, in 2022, the median CEO compensation package hit a wall for the first time in a decade as it slightly fell to $14.5 million.

Compensation Actually Paid

A compensation package dependent on market valuation means that these CEOs may receive more or less than the pay they are slated to receive.

This is because most stock awards aren’t granted when announced, but instead vest over time, becoming subject to changes in share prices.

In 2022, the SEC introduced new disclosure rules for companies to report this realized value for executive pay packages, appropriately called “compensation actually paid.”

| CEO | Company | Total Pay | Compensation Paid |

|---|---|---|---|

| Sundar Pichai | Alphabet | $226M | $116M |

| Michael Rapino | Live Nation Entertainment | $139M | $36M |

| Tim Cook | Apple | $99M | N/A |

| Peter Zaffino | American International Group | $75M | $91M |

| Hock Tan | Broadcom | $61M | N/A |

| Vicente Reynal | Ingersoll Rand | $55M | $51M |

| Reed Hastings | Netflix | $51M | $50M |

| Theodore (Ted) Sarandos | Netflix | $50M | $50M |

| Hamid. Moghadam | Prologis | $48M | -$8M |

| Stephen Squeri | American Express | $48M | $43M |

| James Gorman | Morgan Stanley | $39M | $31M |

| David Zaslav | Warner Bros. Discovery | $39M | -$41M |

| William McDermott | ServiceNow | $39M | -$76M |

| Mark Begor | Equifax | $37M | -$19M |

| Darren Woods | Exxon Mobil | $36M | $90M |

| David Simon | Simon Property Group | $36M | $30M |

| James Dimon | JPMorgan Chase | $35M | $37M |

| Julie Sweet | Accenture | $34M | N/A |

| Albert Bourla | Pfizer | $33M | $6M |

| Laurence Fink | BlackRock | $33M | -$6M |

The Wall Street Journal report revealed that many of the top-paid S&P 500 CEOs in 2022 received much smaller pay packages due to market fluctuations.

For example, Sundar Pichai ended up receiving about $116 million as the value of Alphabet’s stock dropped at the time that his grants vested. Similarly, Michael Rapino was paid almost $36 million, though his stock awards will continue vesting for another five years.

Barring Pichai, many of the names of the highest paid S&P 500 CEOs were eclipsed by CEOs of several energy companies, like Exxon Mobil and Chevron, whose stock prices shot up in 2022.

Markets

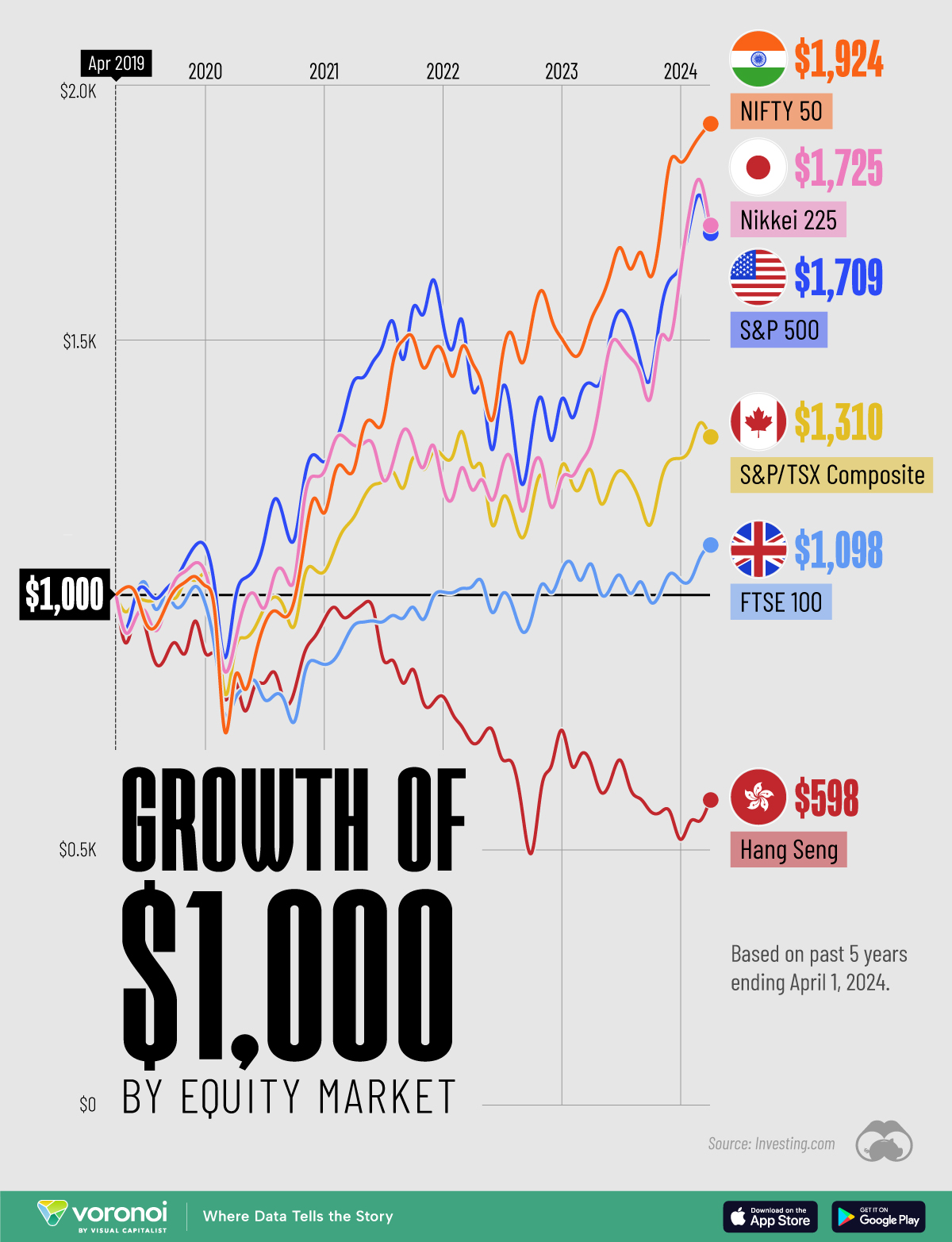

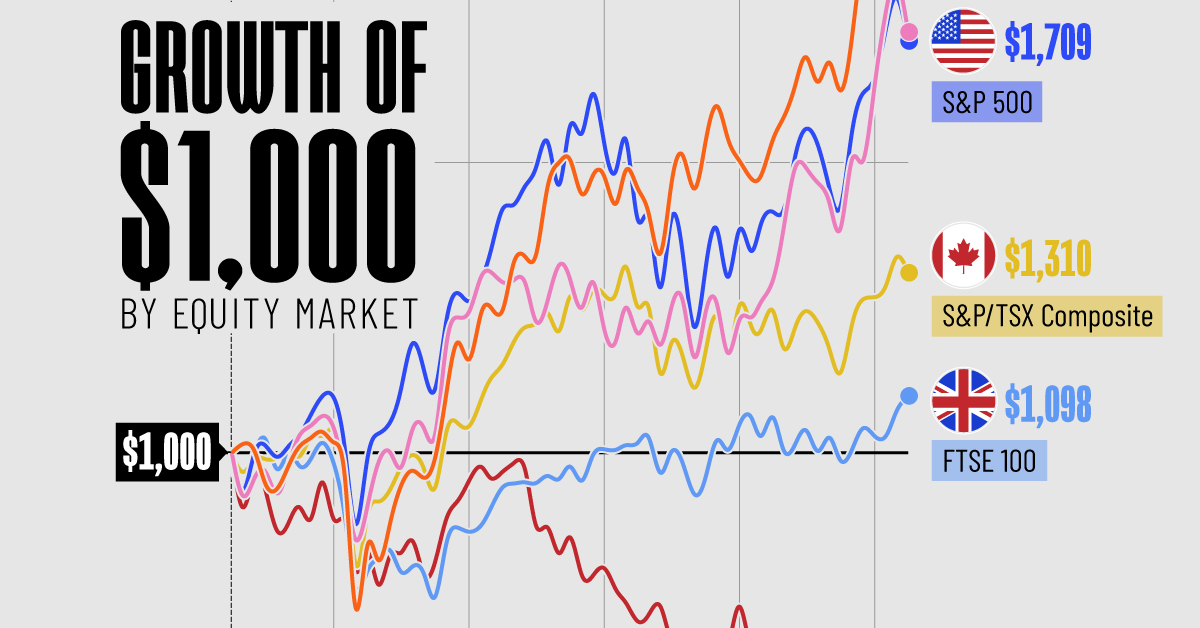

The Growth of a $1,000 Equity Investment, by Stock Market

In this graphic, we’ve visualized stock market growth by country over the past five years using major indices.

Visualizing Stock Market Growth by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we show the change in value of a $1,000 investment in various leading equity indexes from around the world. This data was sourced from Investing.com, and covers a five-year period from April 2019 to April 2024.

See the following table for the five-year annual return figures of the indexes shown above.

| Index | 5-Yr Return as of April 1, 2024 |

|---|---|

| 🇮🇳 NIFTY 50 | 92.4% |

| 🇯🇵 Nikkei 225 | 72.5% |

| 🇺🇸 S&P 500 | 70.9% |

| 🇨🇦 S&P/TSX Composite | 31.0% |

| 🇬🇧 FTSE 100 | 9.8% |

| 🇭🇰 Hang Seng | -40.2% |

In terms of stock market growth by country, India (represented here by the NIFTY 50) has impressively surpassed both the U.S. and Japan.

What is the NIFTY 50?

The NIFTY 50 is an index of the 50 largest and most actively traded Indian stocks. Similar to the S&P 500, it represents a range of industries and acts as a benchmark for investors to gauge the performance of the country’s broader stock market.

What’s Going on in India?

India’s multi-year bull market has led to several records being shattered in 2023. For example, the country’s total stock market market capitalization surpassed $4 trillion for the first time, while India-focused ETFs pulled in net inflows of $8.6 billion over the year.

A primary driver of this growth is the country’s fast-rising middle class. According to a report by Morgan Stanley, this “once-in-a-generation shift” will result in India having the third largest stock market globally by 2030, presumably behind the U.S. and China.

Japan Also Breaks Records

Japanese equities (represented in this graphic by the Nikkei 225) slightly outperformed the S&P 500 over the past five years. The index, which represents the top 225 companies on the Tokyo Stock Exchange, recently set a new record high for the first time since 1989.

Japanese companies have reported strong earnings as of late, partly thanks to a weak yen, which benefits many of the country’s export-reliant companies.

Learn More About Global Markets From Visual Capitalist

If you enjoyed this graphic, be sure to check out The World’s Biggest Stock Markets, by Country, which provides a unique perspective on country-level market capitalizations.

-

Energy6 days ago

Energy6 days agoMapped: The Age of Energy Projects in Interconnection Queues, by State

-

AI2 weeks ago

AI2 weeks agoVisualizing AI Patents by Country

-

Markets2 weeks ago

Markets2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green1 week ago

Green1 week agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue