Markets

The Pandemic Economy: What are Shoppers Buying Online During COVID-19?

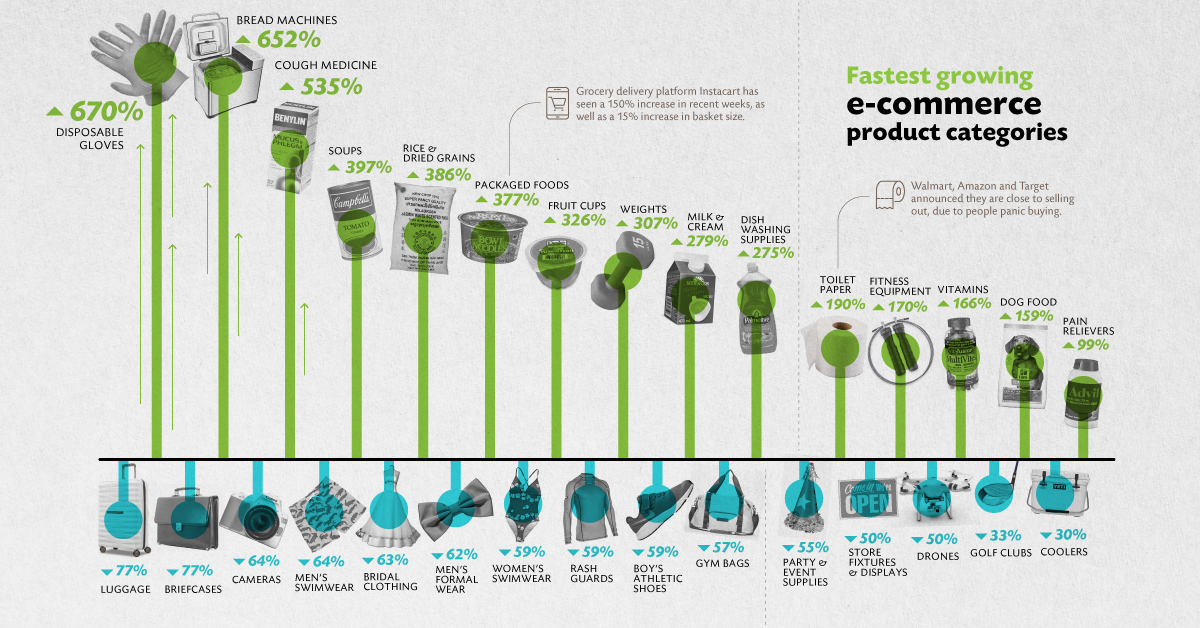

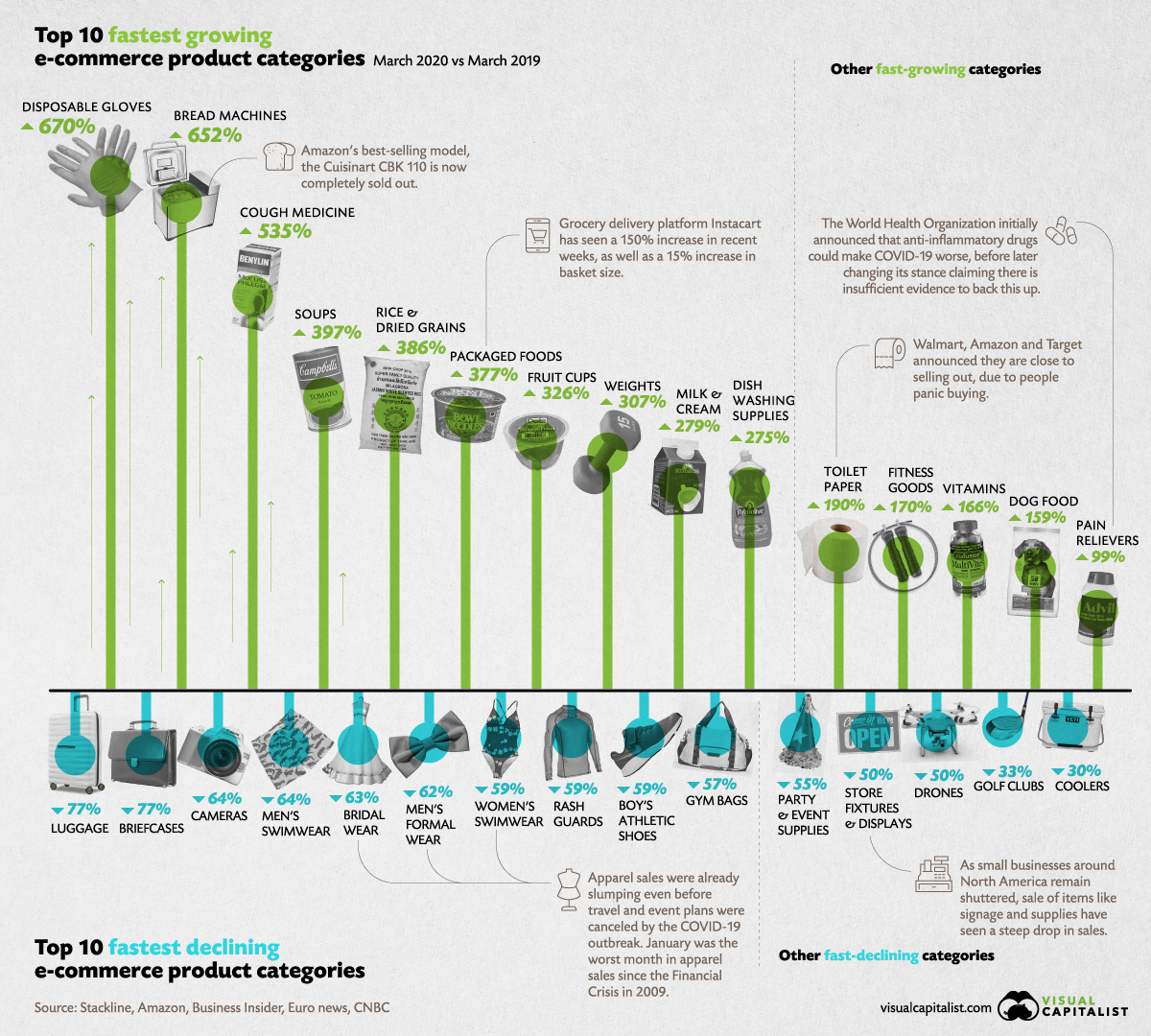

The Fastest Growing and Declining E-Commerce Categories

The COVID-19 pandemic is having a significant impact on every aspect of life, including how people shop for their necessities, and their not-so-necessities.

With online retail sales estimated to reach an eye-watering $6.5 trillion by 2023, the ecommerce sector was already booming. But since the outbreak, online shopping has been catapulted into complete overdrive. Even the largest retailers on the planet are struggling to keep up with the unprecedented consumer demand—but what exactly are people buying?

To answer this question, retail intelligence firm Stackline analyzed ecommerce sales across the U.S. and compiled a list of the fastest growing and declining ecommerce categories (March 2020 vs. March 2019) with surprising results.

The Frenzy of Buyer Behavior

As people come to terms with their new living situations, their buying behavior has adapted to suit their needs. While panic buying may have slowed in some countries, consumers continue to stock up on supplies, or “pandemic pantry products”.

Many consumers are also using their newfound time to focus on their health, with 85% of consumers taking up some kind of exercise while in social isolation, and 40% of them saying they intend to keep it up when restrictions are lifted.

These changing behaviors have resulted in a number of product categories experiencing a surge in demand — and although a lot of them are practical, others are wonderfully weird.

The Fastest Growing Categories

While the below list features several shelf-stable items, it seems as though consumers are taking matters into their own hands, with bread making machines sitting in second place and retailers selling out of their top models.

It’s clear from the list that consumers are considering positive changes to their lifestyle while in isolation, as fitness, smoking cessation, and respiratory categories are all experiencing growth.

Explore the 100 fastest growing product categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Disposable Gloves | 670% |

| #2 | Bread Machines | 652% |

| #3 | Cough & Cold | 535% |

| #4 | Soups | 397% |

| #5 | Dried Grains & Rice | 386% |

| #6 | Packaged Foods | 377% |

| #7 | Fruit Cups | 326% |

| #8 | Weight Training | 307% |

| #9 | Milk & Cream | 279% |

| #10 | Dishwashing Supplies | 275% |

| #11 | Paper Towels | 264% |

| #12 | Hand Soap & Sanitizer | 262% |

| #13 | Pasta | 249% |

| #14 | Vegetables | 238% |

| #15 | Flour | 238% |

| #16 | Facial Tissues | 235% |

| #17 | Allergy Medicine | 232% |

| #18 | Women’s Health | 215% |

| #19 | Cereals | 214% |

| #20 | Power Generators | 210% |

| #21 | Laundry Supplies | 200% |

| #22 | Household Cleaners | 195% |

| #23 | Soap & Body Wash | 194% |

| #24 | Toilet Paper | 190% |

| #25 | Jerky & Dried Meats | 187% |

| #26 | Chips & Pretzels | 186% |

| #27 | Crackers | 184% |

| #28 | Health Monitors | 182% |

| #29 | Popcorn | 179% |

| #30 | Computer Monitors | 172% |

| #31 | Fitness Equipment | 170% |

| #32 | Single Vitamins | 166% |

| #33 | Nut & Seed Butters | 163% |

| #34 | Cat Food | 162% |

| #35 | Fruit Snacks | 162% |

| #36 | Baby Care Products | 162% |

| #37 | Refrigerators | 160% |

| #38 | Baking Mixes | 160% |

| #39 | Toilet Accessories | 160% |

| #40 | Dog Food | 159% |

| #41 | Diapers | 154% |

| #42 | Yoga Equipment | 154% |

| #43 | Bottled Beverages | 153% |

| #44 | Baby Meals | 153% |

| #45 | Cookies | 147% |

| #46 | Digestion & Nausea | 144% |

| #47 | Snack Foods | 141% |

| #48 | Herbal Supplements | 136% |

| #49 | Cooking Oils | 135% |

| #50 | Water | 130% |

| #51 | Incontinence & Tummy | 129% |

| #52 | Mutivitamin | 126% |

| #53 | Cat Litter | 125% |

| #54 | Training Pads and Trays | 125% |

| #55 | Juices | 125% |

| #56 | Smoking Cessation | 122% |

| #57 | Dried Fruit & Raisins | 120% |

| #58 | Salt & Pepper Seasoning | 118% |

| #59 | Craft Kits & Projects | 117% |

| #60 | Batteries | 116% |

| #61 | Trash Bags | 116% |

| #62 | Nuts & Seeds | 116% |

| #63 | Hair Coloring | 115% |

| #64 | Sauce & Gravy | 115% |

| #65 | Deli Foods | 114% |

| #66 | Syrups | 114% |

| #67 | Breads & Bakery | 114% |

| #68 | Minerals | 113% |

| #69 | Condiments | 111% |

| #70 | First Aid | 108% |

| #71 | Nail Care | 108% |

| #72 | Humidifiers | 105% |

| #73 | Art Paint | 104% |

| #74 | Office Chairs | 104% |

| #75 | Deodorant | 103% |

| #76 | Jams, Jellies & Spreads | 102% |

| #77 | Coffee | 101% |

| #78 | Spices & Seasoning | 100% |

| #79 | Skin Care | 99% |

| #80 | Pain Relievers | 99% |

| #81 | Cooking Vinegars | 98% |

| #82 | Air Purifiers | 97% |

| #83 | Granola & Nutrition Bars | 97% |

| #84 | Pudding & Gelatin | 97% |

| #85 | Toy Clay & Dough | 95% |

| #86 | Single Spices | 95% |

| #87 | Bird Food & Treats | 91% |

| #88 | Lab & Science Products | 90% |

| #89 | Eczema & Psoriasis | 90% |

| #90 | Ping Pong | 89% |

| #91 | Chocolate | 86% |

| #92 | Baking Ingredients | 84% |

| #93 | Energy Supplements | 84% |

| #94 | Respiratory | 82% |

| #95 | Office Desks | 82% |

| #96 | Potty Training Supplies | 82% |

| #97 | Herbs, Spices & Seasonings | 82% |

| #98 | Keyboard & Mice | 80% |

| #99 | Body Lotion | 79% |

| #100 | Safes | 69% |

Interestingly, toilet paper has seen more growth than baby care products, and cured meats have seen more growth than water. But while some categories are experiencing a drastic increase in demand, others are slumping in the pandemic economy.

The Fastest Declining Categories

An unprecedented wave of event and vacation cancellations is having a huge impact on the products people consume. For instance, luggage and suitcases, cameras, and men’s swimwear have all seen a dip in sales.

See the full list of 100 fastest declining categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Luggage & Suitcases | -77% |

| #2 | Briefcases | -77% |

| #3 | Cameras | -64% |

| #4 | Men’s Swimwear | -64% |

| #5 | Bridal Clothing | -63% |

| #6 | Men's Formal Wear | -62% |

| #7 | Women’s Swimwear | -59% |

| #8 | Rash Guards | -59% |

| #9 | Boy’s Athletic Shoes | -59% |

| #10 | Gym Bags | -57% |

| #11 | Backpacks | -56% |

| #12 | Snorkelling Equipment | -56% |

| #13 | Girl’s Swimwear | -55% |

| #14 | Baseball Equipment | -55% |

| #15 | Event & Party Supplies | -55% |

| #16 | Motorcycle Protective Gear | -55% |

| #17 | Camera Bags & Cases | -54% |

| #18 | Women’s Suits & Dresses | -53% |

| #19 | Women’s Boots | -51% |

| #20 | Cargo Racks | -51% |

| #21 | Women’s Sandals | -50% |

| #22 | Drones | -50% |

| #23 | Boy's Active Clothing | -50% |

| #24 | Lunch Boxes | -50% |

| #25 | Store Fixtures & Displays | -50% |

| #26 | Automotive Mats | -50% |

| #27 | Men’s Outerwear | -49% |

| #28 | Watches & Accessories | -49% |

| #29 | Cargo Bed Covers | -48% |

| #30 | Track & Field Equipment | -48% |

| #31 | Ceiling Lighting | -47% |

| #32 | Camera Lenses | -47% |

| #33 | Girl’s Coats and Jackets | -47% |

| #34 | Women’s Hats & Caps | -47% |

| #35 | Women's Outerwear | -47% |

| #36 | Video Cameras | -46% |

| #37 | Wheels & Tires | -46% |

| #38 | Motorcycle Parts | -45% |

| #39 | Women’s Wallets | -45% |

| #40 | Shocks & Struts | -44% |

| #41 | Transmission & Parts | -44% |

| #42 | Girl’s Athletic Shoes | -44% |

| #43 | Women’s Shoes | -44% |

| #44 | Telescopes | -44% |

| #45 | Sunglasses & Eyeglasses | -43% |

| #46 | Men’s Tops | -41% |

| #47 | Video Projectors | -40% |

| #48 | Men’s Athletic Shoes | -40% |

| #49 | Marine Electronics | -40% |

| #50 | Hand Tools | -40% |

| #51 | Wine Racks | -40% |

| #52 | Men's Shoes | -40% |

| #53 | Clocks | -39% |

| #54 | Baby Girl’s Shoes | -39% |

| #55 | Bracelets | -39% |

| #56 | Men’s Boots | -39% |

| #57 | Tapestries | -39% |

| #58 | Camping Equipment | -39% |

| #59 | Men’s Bottoms | -38% |

| #60 | Cell Phones | -38% |

| #61 | Tool Storage & Organizers | -38% |

| #62 | Necklaces | -38% |

| #63 | Swimming Equipment | -37% |

| #64 | Men’s Hats & Caps | -37% |

| #65 | Girl’s Shoes | -37% |

| #66 | Industrial Tools | -36% |

| #67 | Juicers | -36% |

| #68 | Desktops | -35% |

| #69 | Classroom Furniture | -35% |

| #70 | Bar & Wine Tools | -35% |

| #71 | Glassware & Drinkware | -35% |

| #72 | Musical Instruments | -34% |

| #73 | Power Winches | -34% |

| #74 | Home Bar Furniture | -34% |

| #75 | Office Storage Supplies | -34% |

| #76 | Girl's Active Clothing | -34% |

| #77 | Women’s Tops | -34% |

| #78 | Braces, Splints & Supports | -34% |

| #79 | Car Anti-theft | -34% |

| #80 | Rings | -34% |

| #81 | Blankets & Quilts | -33% |

| #82 | Women's Athletic Shoes | -33% |

| #83 | Kitchen Sinks | -33% |

| #84 | Golf Clubs | -33% |

| #85 | Equestrian Equipment | -33% |

| #86 | GPS & Navigation | -32% |

| #87 | Recording Supplies | -32% |

| #88 | Home Audio | -32% |

| #89 | Boy's Accessories | -32% |

| #90 | Earrings | -32% |

| #91 | Dining Sets | -31% |

| #92 | Calculators | -31% |

| #93 | Boy's Shoes | -31% |

| #94 | Volleyball Equipment | -31% |

| #95 | Strollers | -31% |

| #96 | Coolers | -30% |

| #97 | Sanders & Grinders | -30% |

| #98 | Men's Activewear | -29% |

| #99 | Living Room Furniture | -29% |

| #100 | Climbing & Hiking Bags | -28% |

Regardless of which list a product falls under, it is clear that the pandemic has impacted retailers of every kind in both positive and negative ways.

The New Normal?

Officially the world’s largest retailer, Amazon has announced it can no longer keep up with consumer demand. As a result, it will be delaying the delivery of non-essential items, or in some cases not taking orders for non-essentials at all.

This presents a double-edged sword, as the new dynamic that is bringing some retailers unprecedented demand could also bring about an untimely end for others.

Meanwhile, the question remains: will this drastic change in consumer behavior stabilize once we flatten the curve, or is this our new normal?

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy1 day ago

Economy1 day agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries