Money

Visualizing the Ranking of 100 Common Careers

If you’re like most Americans, you probably spend more than 40 hours a week on the job.

For this reason, your career of choice plays a big role in determining your overall well-being. Not only does your profession have a massive influence on the potential money you make, but it also impacts your stress, work-life balance, happiness, and feeling of accomplishment.

However, it’s well-known that not all careers are created equally – and while some are stress-free with comfortable salaries, others can be high-stress without the compensation to make up for it.

Ranked: 100 Common Careers

Today’s chart uses data from the 2018 Jobs Rated Report by CareerCast.com, and we’ve used it to rank 100 of the most common careers based on median income, as well as three other categories: stress, growth outlook, and workplace environment.

The careers at the top of the list below have the best aggregate score, while the jobs towards the end of the list tend to be high-stress, low-income.

The 2018 Jobs Rated Report uses median income, as well as three other key categories to compile its rankings of common careers:

- Workplace:

A score based on the relative physical and mental demands for the job - Stress:

A weighting of 11 different stress factors, which range from “deadlines” to “own life at risk” - Growth Outlook:

Factors such as employment growth, income growth potential, and unemployment

See the full methodology here, for a more detailed explanation of the above categories.

Choosing the Optimal Career

If your goal is to maximize income, then traditional high-paying careers – like being a lawyer, doctor, investment banker, or senior corporate executive – are a good way to go.

For many people, however, a good career is defined as being more than just having high earning potential. Ideally, it’s also low-stress, while providing a healthy workplace that makes workers look forward to their jobs every day.

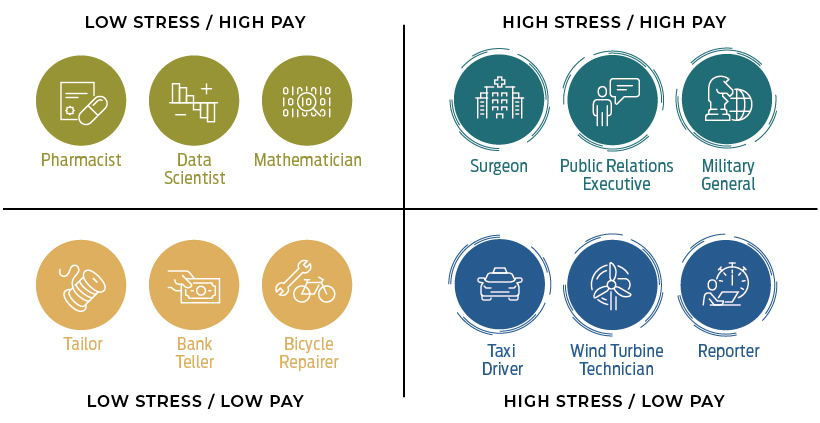

For people that think that way, it seems like being a pharmacist or a data scientist might present the best of both worlds:

At the same time, it may be safe to say that taxi drivers and reporters get the worst of both worlds: high stress and low pay.

Where does your occupation fall on the money/stress spectrum? Do you feel like the ranking above provides an accurate representation of your career?

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023