Money

Ranked: The Richest Veterans in America

Ranked: The Richest Veterans in America

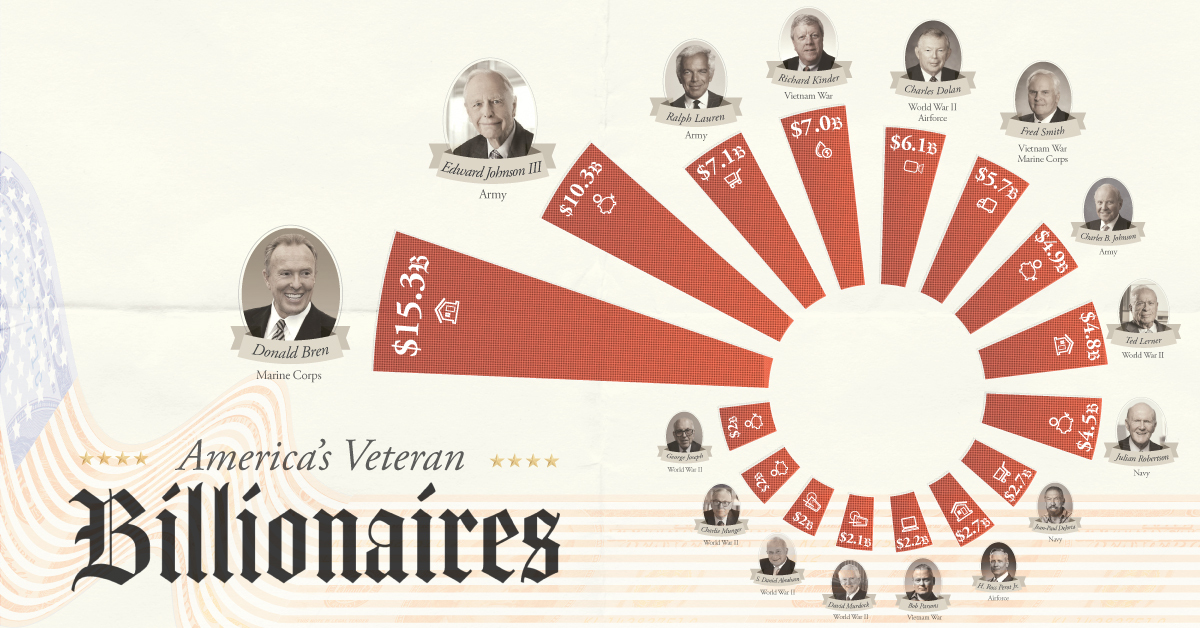

The U.S is home to 724 billionaires, many of whom have taken on immense risks in the financial world. 16 of these wealthy individuals have also taken on the risks that come with serving in the U.S. military.

These veteran billionaires are worth a collective $81.4 billion and have served in posts ranging from Reserve Officers’ Training Corps (ROTC) to infantrymen in the Second World War. This visual, using data from Forbes, ranks the richest living American veterans.

This visual categorizes the individuals by either the military branch or war served in depending on what was applicable or determinable.

I Want You for the U.S. Army

According to the Department of Veteran’s Affairs, there are around 18 million veterans in the U.S. Of these 18 million, less than 0.01% can claim the title of billionaire.

| Name | Net Worth (Billions, USD) | Industry | War / Unit Served |

|---|---|---|---|

| Donald Bren | $15.3 | Real Estate | Marine Corps |

| Edward Johnson III | $10.3 | Finance & Investments | Army |

| Ralph Lauren | $7.1 | Fashion & Retail | Army |

| Richard Kinder | $7.0 | Energy | Vietnam War |

| Charles Dolan & family | $6.1 | Media & Entertainment | WWII, Airforce |

| Fred Smith | $5.7 | Logistics | Vietnam War, Marine Corps |

| Charles B. Johnson | $4.9 | Finance & Investments | Army |

| Ted Lerner & family | $4.8 | Real Estate | WWII |

| Julian Robertson Jr. | $4.5 | Finance & Investments | Navy |

| John Paul DeJoria | $2.7 | Fashion & Retail | Navy |

| H. Ross Perot Jr. | $2.7 | Real Estate | Airforce |

| Bob Parsons | $2.2 | Technology | Vietnam War, Marine Corps |

| David H. Murdock | $2.1 | Food & Beverage | WWII |

| S. Daniel Abraham | $2.0 | Food & Beverage | WWII, Army |

| Charlie Munger | $2.0 | Finance & Investments | WWII, Army Air Corps |

| George Joseph | $2.0 | Finance & Investments | WWII |

Six of the above veteran billionaires served in WWII. They are some of the last surviving veterans of the historic war which was fought by 16 million Americans—today, only around 325,000 WWII veterans are still alive.

George Joseph, of Mercury Insurance Group, piloted a B17 Bomber plane in WWII, and completed around 50 missions. Warren Buffett’s business partner at Berkshire Hathaway, Charlie Munger, served in the Army Air Corps in the early 1940s.

Richard Kinder (Kinder Morgan Inc.) and Fred Smith (FedEx) both served in the Vietnam war.

One notable figure, Ralph Lauren, whose name is synonymous with his clothing products, served in the Army branch for two years in the early 1960s.

Taking on Financial Risk

Billionaire wealth continues to grow in America. Most of these veteran billionaires saw their net worths increase from 2020 to 2021, as, typically, wealth begets wealth. Here’s a look at the changes in net worth of the top five richest veterans who experienced increases:

- Edward Johnson III: +$4.9 Billion

- Ralph Lauren: +$1.4 Billion

- Richard Kinder: +$1.8 Billion

- Charles Dolan & Family: +$1.5 Billion

- Fred Smith: +$3.0 Billion

The majority of these veteran billionaires are in the finance industry and some are tied to well-known companies, but they didn’t always have billions on hand to help them exponentially grow their fortunes.

David Murdock was a high school dropout, and after serving in WWII, had no money to his name. He took over a failing company called Dole, and eventually gained the moniker of ‘pineapple king’ after reviving the business.

S. Daniel Abraham, who was an infantryman in WWII, went on to found Thompson Medical. Their main product was Slimfast, which he later sold to Unilever for $2.3 billion in cash in the early 2000s.

Bob Parsons, who received a Purple Heart for his service in Vietnam, started out his professional career as a CPA. He later founded the enormous domain giant, Go Daddy. He has claimed that his time in the military helped him succeed in business.

Peace and Prosperity

We currently live in one of the most peaceful and prosperous times in history, with wars like WWII feeling to many like a story from the past — but for others these conflicts were defining moments for their generation.

While many veterans struggle to readjust to civilian life, on average pre-9/11 veterans have reported fewer difficulties compared to post-9/11 veterans, and some have even managed to reach the highest levels of financial success.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

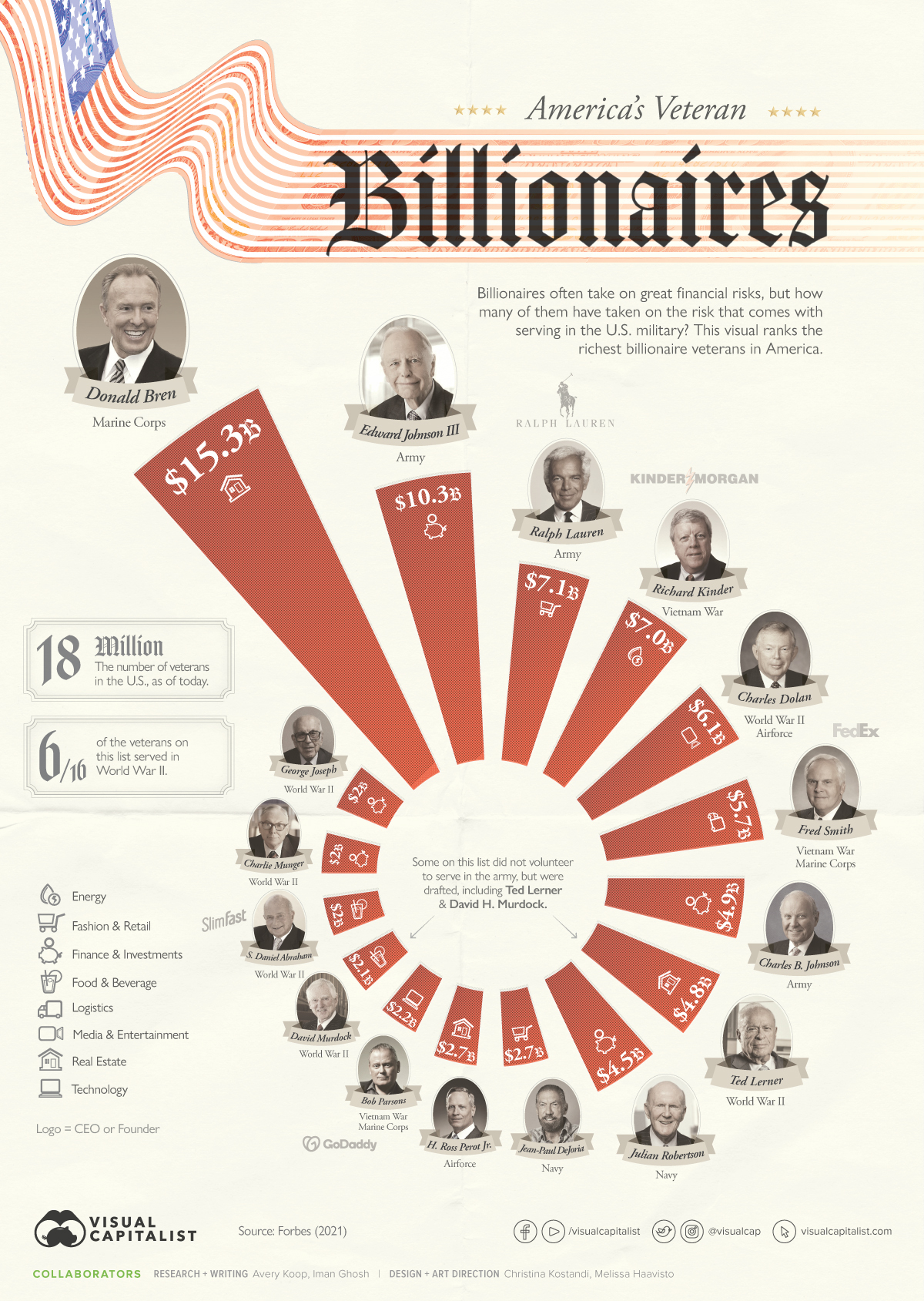

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Sports1 week ago

Sports1 week agoThe Highest Earning Athletes in Seven Professional Sports

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)