Technology

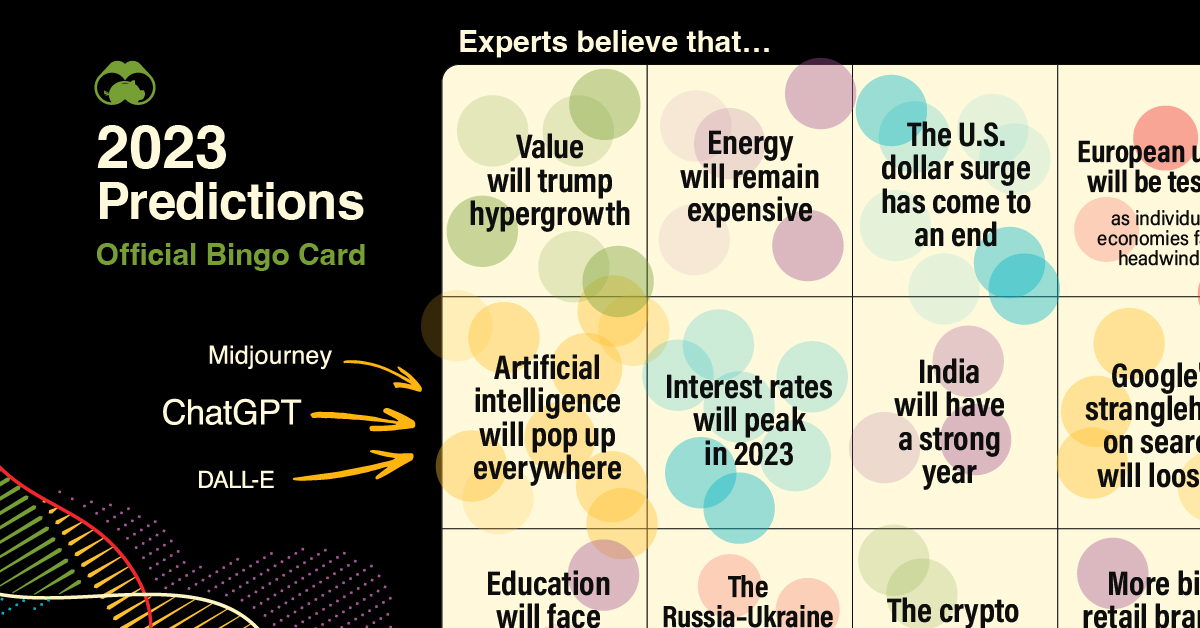

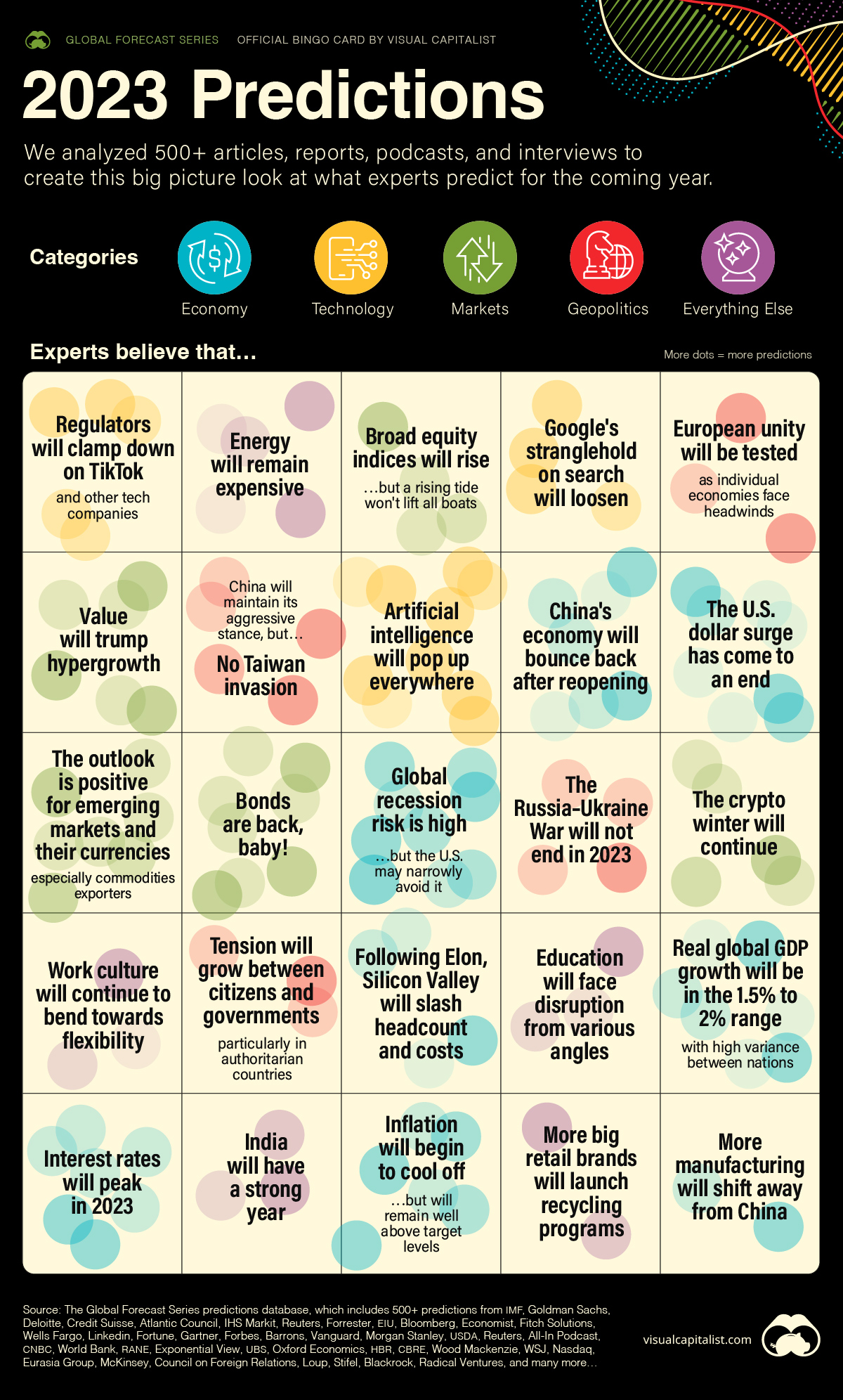

Prediction Consensus: What the Experts See Coming in 2023

Prediction Consensus: What the Experts See Coming in 2023

In this, our fourth year of Prediction Consensus (now part of our more comprehensive 2023 Global Forecast Series), we’ve learned a few things about the universe of predictions, experts, outlooks, and forecasts.

- Experts are reasonably good at predicting the future one year out, though they are also in a strong position to help shape the future through their influential thought leadership and actions.

- Situations can and will flare up in unexpected ways, which can have knock-on effects on the whole system (e.g. COVID-19, Ukraine invasion).

- Experts are just as susceptible to hype as the rest of us, as evidenced by the glut of Web3 predictions in 2022 and AI predictions this year.

Of course, we’re susceptible to hype as well, which is why we asked ChatGPT to write the intro to this article:

Not bad. But, simple curiosity aside, it’s the practical considerations we’ll focus on today. This article serves as an overview of how experts think the markets will move, how trends will develop, and which risks and opportunities to watch over the coming 12 months.

Let’s gaze into the crystal ball.

The Economic Vibe Check

First, we’ll look at some big picture themes, and how experts see them playing out over 2023.

Inflation: This was the top economic story of last year, so it’s a natural starting place. Many of the expert opinions in this year’s database (now at 500+ predictions) are pointing to inflation easing off as the year progresses*. On the downside, few predict that inflation will drop back down to the 2% range that Fed policymakers favor.

GDP: Forecasters have been revising their economic projections downward in recent weeks. The latest was World Bank, which now sees global growth declining to 1.7% in 2023, down from 3% just six months ago. Most of the predictions in our database see global economic growth in the range of 1.5% to 2%.

Recession: As 2022 came to a close, the broad sentiment among experts in the financial industry is that recession is all but inevitable in developed markets this year. As dawn breaks in 2023, a few analysts now feel that the U.S.—and possibly Europe—could narrowly avoid recession.

Markets: Experts on Wall Street and beyond are cautiously optimistic about equities, and after the worst year on record for bonds in 2022, most analysts are declaring that “Bonds are back”.

*Interestingly, this was also last year’s prediction, but the scale of Russia’s invasion of Ukraine was a curve ball that caught many experts off guard.

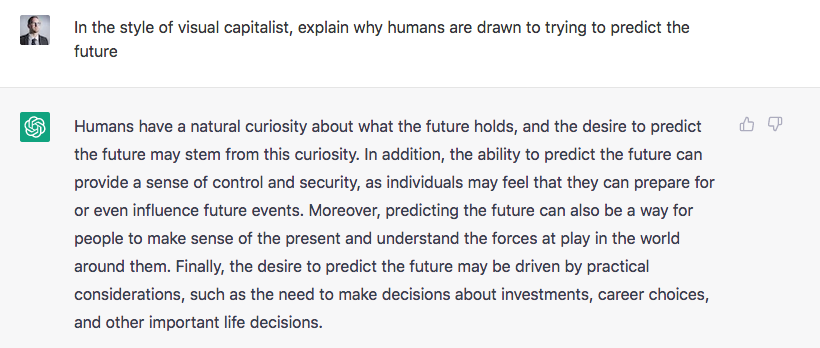

AI is Eating the World

Jobs being displaced by automation is far from a new theme, but given the exponential improvements in AI in recent years, the risk to entire industries feels more existential today.

As an example, let’s consider art and design. One of the ways many illustrators and artists earn a living is through commissions—essentially being hired and paid to create a specific piece of art in their style.

Today though, free, powerful AI tools, such as Midjourney, allow users to generate high-quality art in an infinite number of styles with just a few clicks. Real art will never truly go out of style, and accomplished artists will always attract an audience, but this one example shows how quickly technology can disrupt an industry. (Artists can take solace in the fact that AI is still comically bad at rendering hands.)

Of course, there are obvious positive aspects to this technological advancement as well. Generative AI tools are useful for generating ideas and mock-ups, and even functional snippets of code. AI systems like AlphaFold unlock a world of possibilities in scientific domains.

From the hundreds of predictions we evaluated, it’s clear that experts view AI as a major catalyst this year. AI start-ups are forcing Big Tech to innovate faster, and employees are finding new ways to use AI-powered tools to increase productivity.

Experts predict that AI will impact peoples’ lives in a much more visible and tangible way in 2023 than in past years.

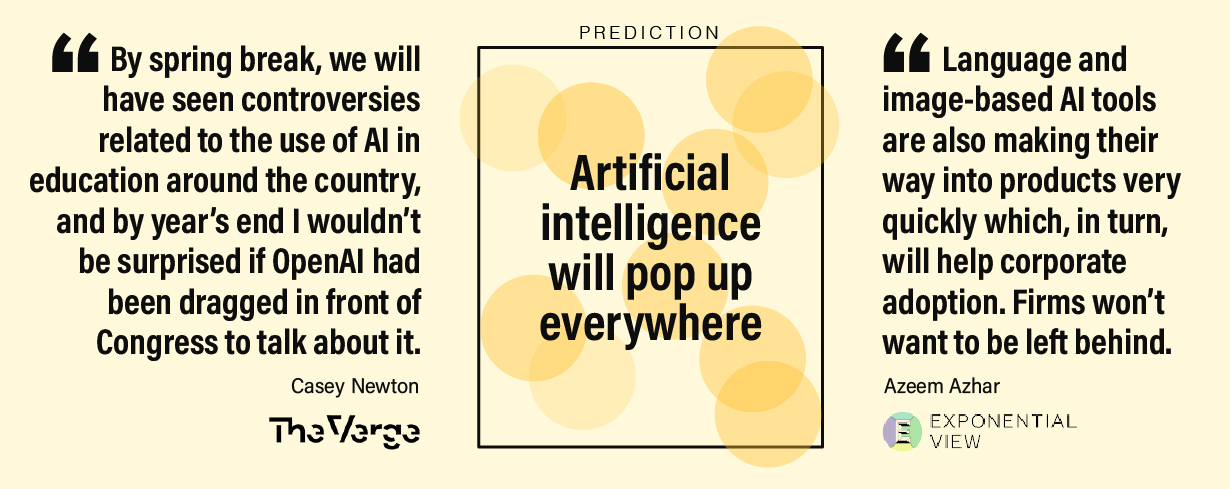

The China Factor

As world’s second largest economy and linchpin of global trade, events in China have a major impact on the world economy.

Xi Jinping’s reversal of Zero-COVID restrictions should drastically change the trajectory of the country’s economy. For one, reopening will unleash a flood of household spending and consumption.

China’s reopening will also impact other economies as well. For example, the resumption of travel will be a boon to destinations favored by Chinese vacationers. Economically, Hong Kong stands to benefit immensely—its GDP could jump upwards of 8% after reopening is complete. Emerging market commodity exporters could see a lift as well, though inflation could be reinvigorated as a result.

In the U.S., a storm is brewing over the extremely popular video app, TikTok. Many experts predict that regulators will either ban the app altogether in 2023, or force the sale of the company to an American entity. Regardless how that situation plays out, it underscores the souring relationship between the U.S. and China. The rivalry will continue to have ripple effects on the global markets throughout the year.

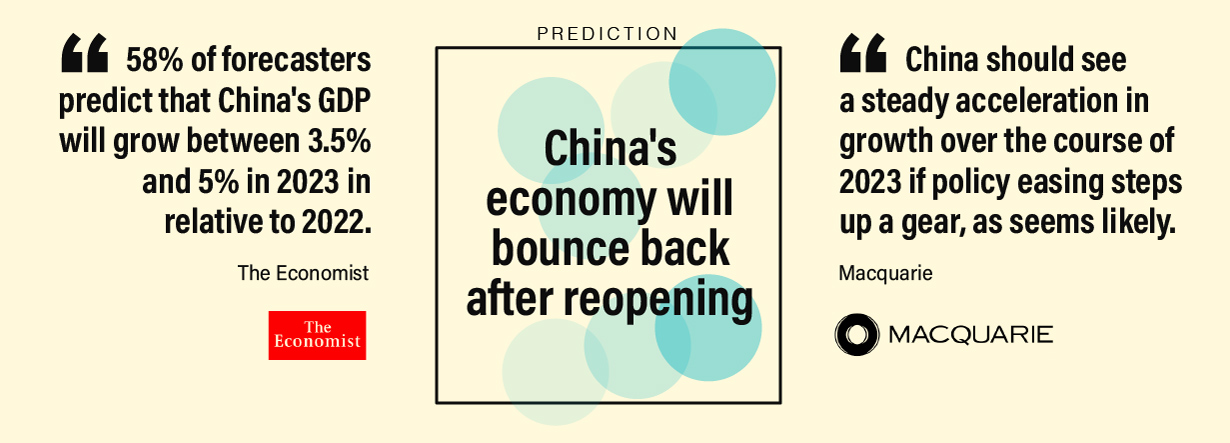

Energy

Energy was the S&P 500’s top performing sector two years in a row, and many experts feel that more growth is on the horizon.

The global system that supplies us with energy is breathtakingly complex, with a lot of unpredictable factors at play. Of all factors, conflict can create the most volatility, and 2023 has a number of geopolitical risks that could impact energy supplies. First, Europe will continue to diversify its energy imports away from Russia. Recently, liquefied natural gas from the U.S. has helped fill gaps.

Next, Iran could be a flashpoint in the Middle East this year. A brewing conflict in the region could cause instability, which will have knock-on effects on the energy industry—particularly in the event of attacks on oil and gas infrastructure.

Here are a few other factors to consider this coming year:

- The U.S. Energy Department will aim to replenish its Strategic Petroleum Reserve

- Easing of U.S. sanctions on Venezuela could lay the ground work for increased oil production

- In post-Zero-COVID China, economic activity will increase, pushing up demand

- In the UK, the energy price guarantee will rise in April, meaning higher energy bills for households

The Elon Playbook

After a lull in December (nobody wants to be the company that fires people during the holiday season) tech and tech-adjacent companies have resumed their zealous slashing of headcounts.

There had been a slew of layoffs already in 2023, topped by Salesforce, which is trimming 7,000 jobs, and Amazon, which is cutting 18,000 roles—primarily impacting the corporate side of the business.

Given the influence of Elon Musk in the tech industry, many experts are suggesting that his strategy of ruthlessly slashing headcount at Twitter might serve as inspiration for other technology leaders.

Employees in the tech industry are very well compensated, and many were hired during periods of intense competition between companies to attract talent and capture market share.

During a downturn, it’s tempting—and often necessary—for companies to course-correct. There were also predictions that the whole start-up and investment ecosystem could be switching from a hypergrowth to a value-focused mindset, which is a theme that is worth consideration in 2023.

Technology

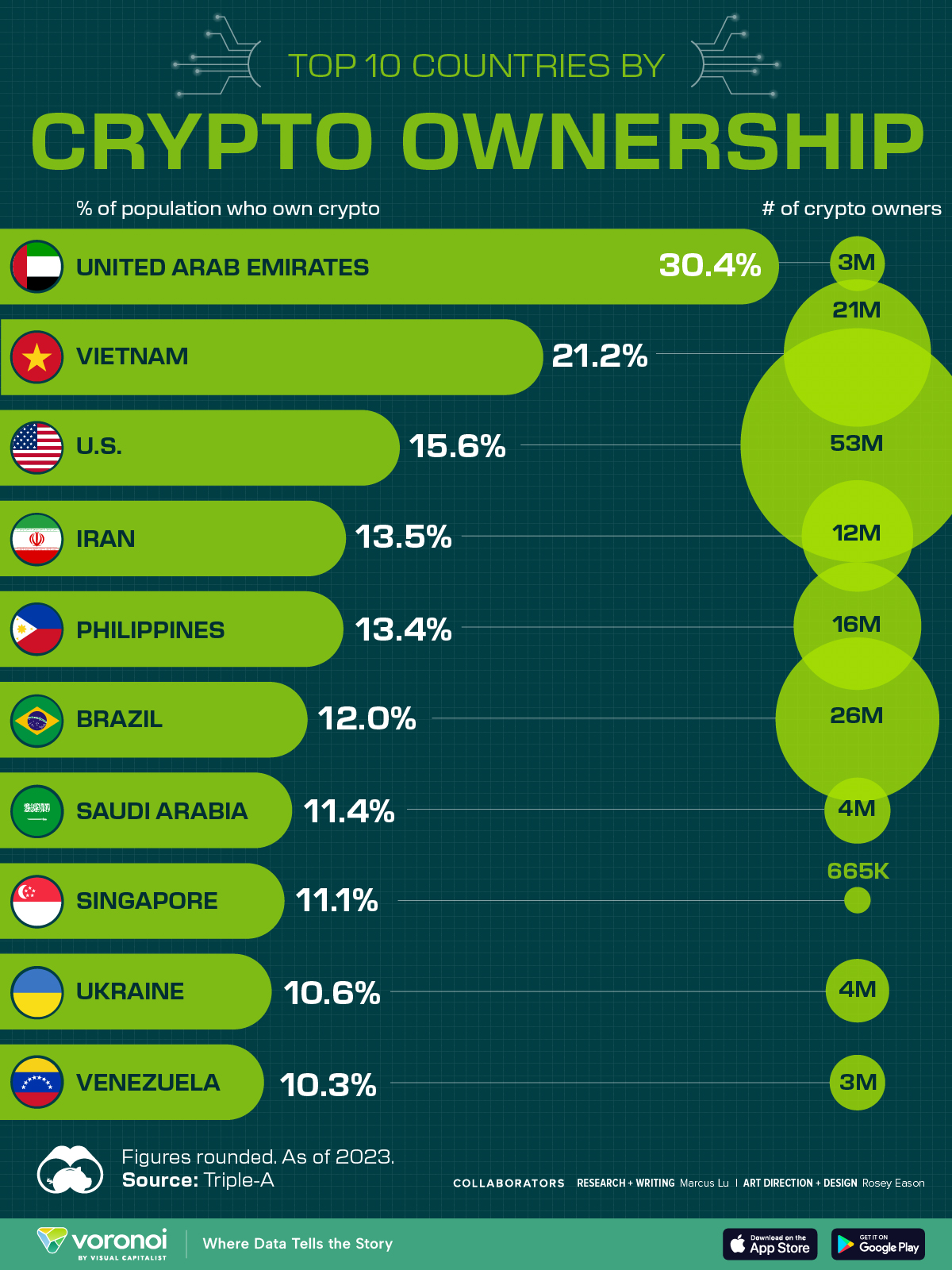

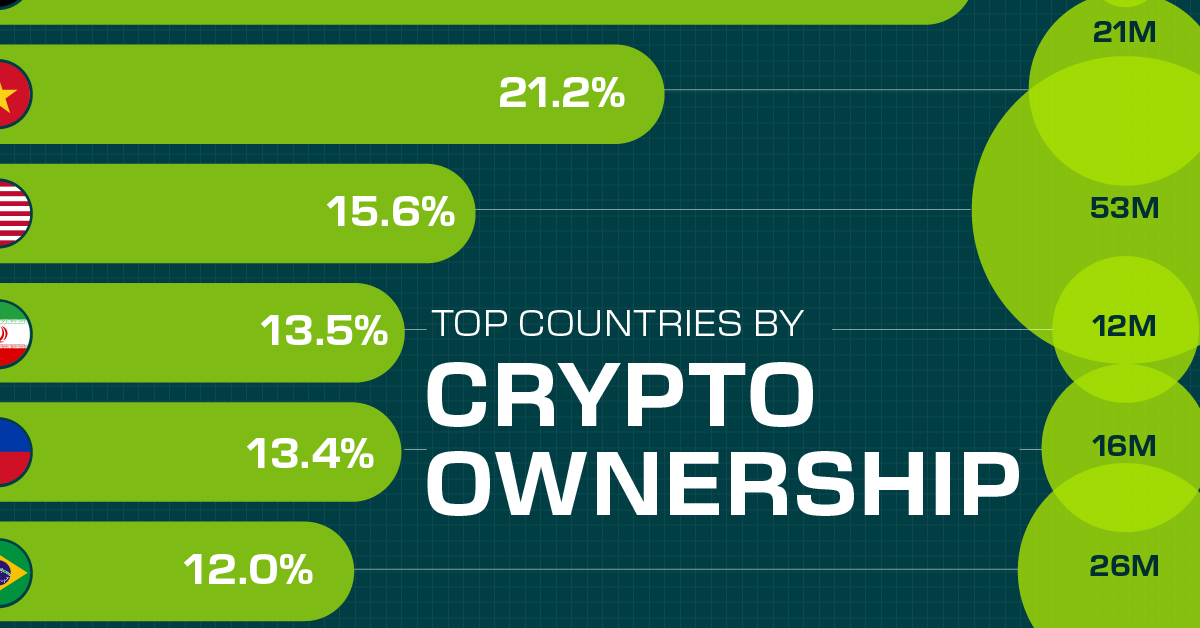

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Markets5 days ago

Markets5 days agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

Visual Capitalist1 week ago

Visual Capitalist1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Markets1 week ago

Markets1 week agoThe Top Private Equity Firms by Country