Technology

The Rise of Online Dating, and the Company That Dominates the Market

The Rise of Online Dating, and the One Company That Dominates the Market

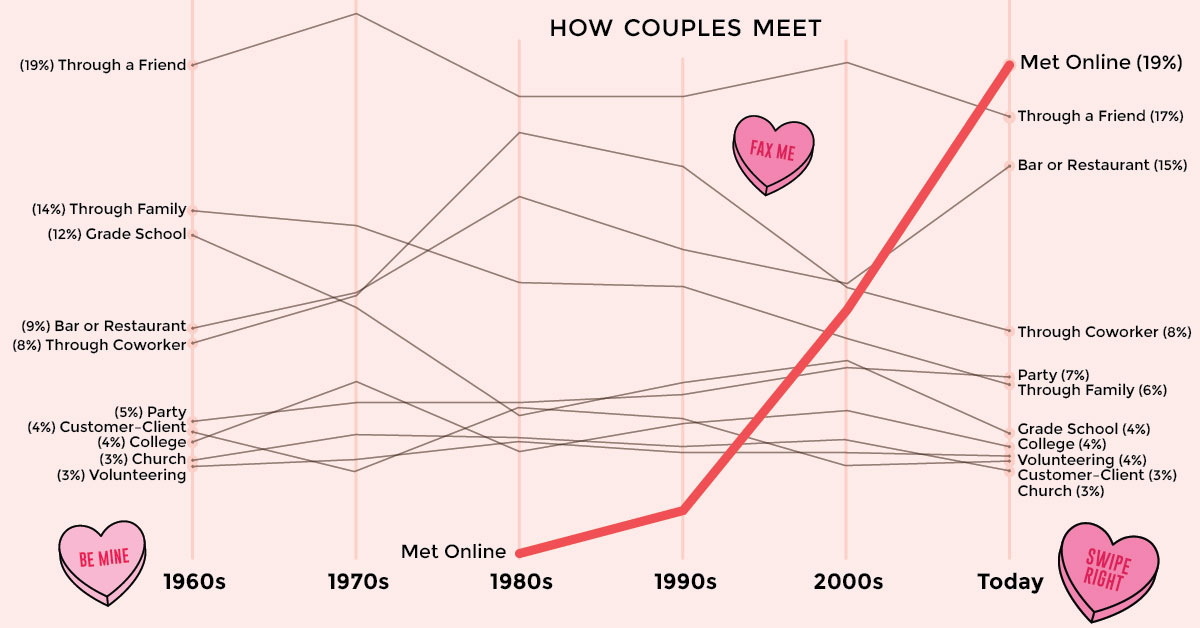

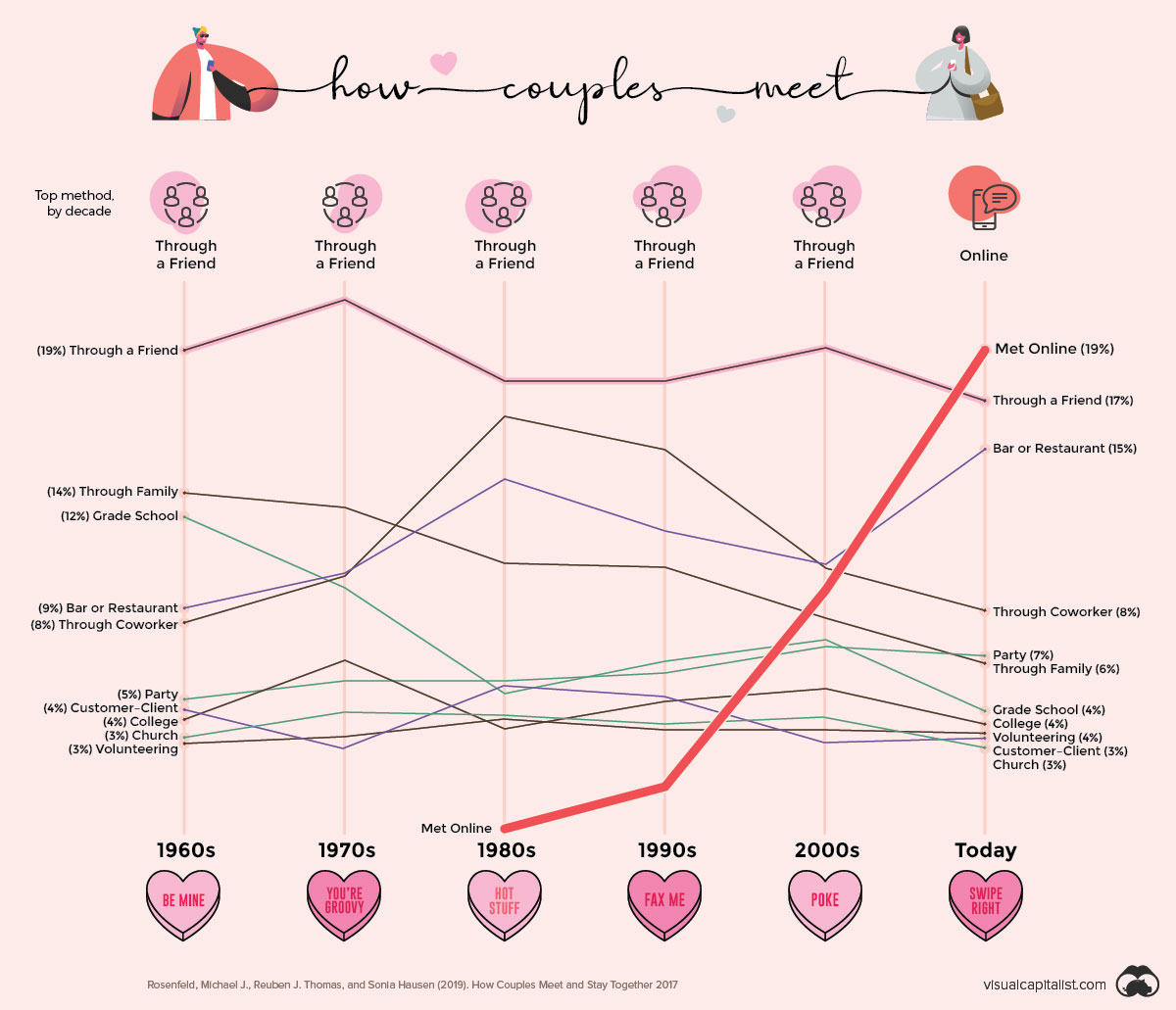

Couples used to meet in real life, but now more and more people are “matching” online.

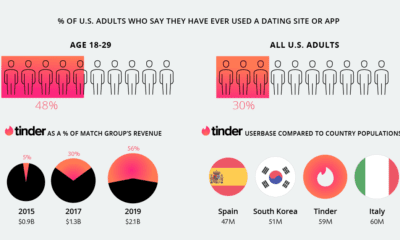

While online dating was once considered taboo, the number of couples meeting online has more than doubled in the last decade to about 1-in-5. Nowadays, you’re much more likely to meet your next partner online rather than through your family or co-workers. But don’t worry, your friends are still a good help too.

The data used in today’s chart is from the “How Couples Meet and Stay Together” survey by Stanford University. This unique dataset charts a significant shift in the way couples meet each other, and demonstrates how our changing communication habits are driving massive growth in the online dating market.

The Rise of Dating Apps

The rise of online dating in the last decade goes hand in hand with the rise of dating apps.

Tinder globally popularized app-based matchmaking when it launched on iPhones in 2012, and later on Android in 2013. Unlike traditional dating websites, which required lengthy profiles and complicated profile searches, Tinder gamified online dating with quick account setups and its “swipe-right-to-like” approach. By 2017, Tinder had grown to 57 million active users across the globe and billions of swipes per day.

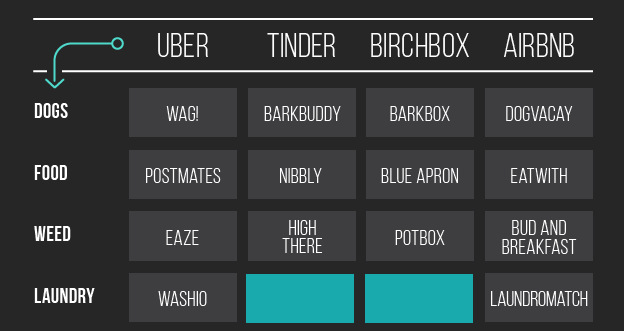

Since the launch of Tinder, hundreds of dating services have appeared on app stores worldwide. Investors are taking notice of this booming market, while analysts estimate the global online dating market could be worth $12 billion by next year.

But it might surprise you that despite the growing variety of dating options online, most popular apps are owned by just one group.

The Big Business of Dating Apps: Match Group

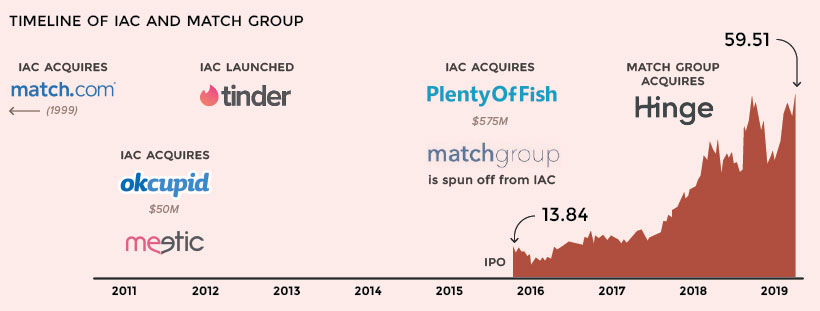

Today, nearly all major dating apps are owned by the Match Group, a publicly-traded pure play that was spun out of IAC, a conglomerate controlled by media mogul Barry Diller.

IAC saw the online dating trend early, purchasing early online dating pioneer Match.com way back in 1999. However, with online dating shifting into the mainstream over recent years, the strategy quickly shifted to aggressively buying up major players in the market.

We’re highly acquisitive, and we’re always talking to companies. If you want to sell, you should be talking to us.

–Mandy Ginsberg, Match Group CEO

In addition to its prized app Tinder – which doubled its revenue in 2018 to $805 million – Match Group owns popular online dating services like OkCupid, Plenty of Fish, Hinge, and has even bought out international competitors like Meetic in Europe, and Eureka in Japan. The dating giant reported revenues of $1.73 billion in 2018.

According to reports, Match Group now owns more than 45 dating-related businesses, including 25 acquisitions.

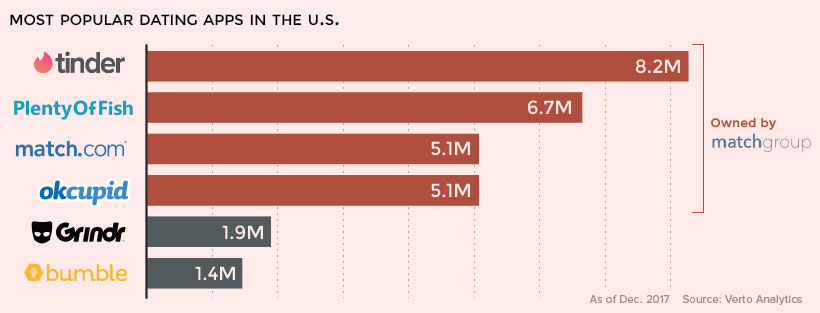

As Match Group continues to swallow up the online dating market, it now boasts dating sites or apps in every possible niche – including the four most-used apps in the United States.

Despite Match Group’s dominant efforts, there are still two competitors that remain outside the dating giant’s reach.

The One That Got Away

In 2017, Match Group tried to acquire its last major competitor, Bumble – which had grown to over 23 million users in just three years – for $450 million. Bumble rejected the offer and by the next year, Match Group sued Bumble for patent infringement, for what some felt was a bargaining chip to force an acquisition.

Bumble responded with an ad in the Dallas Morning News denouncing Match Group: “We swipe left on your multiple attempts to buy us, copy us, and, now, to intimidate us. We’ll never be yours. No matter the price tag, we’ll never compromise our values.”

It remains to be seen if Match Group will be able to acquire Bumble, but another tech giant’s decision to launch its own dating service has also complicated Match’s conquest of the online dating market.

New Face in Town

In 2018, social media giant Facebook launched its own dating service—potentially leveraging its 2.2 billion active users—to join the online dating market.

While the announcement initially caused Match Group’s stock to drop 21%, it since has rebounded as Facebook has been slow to roll out their service.

Going forward, Match Group’s dominance may be hindered by anti-trust calls in the U.S., Bumble’s growth and direct competition to Tinder, and whether the sleeping giant Facebook can change the global online dating market with its own service.

Who will win our hearts?

Hat tip to Nathan Yau at Flowing Data, who introduced us to the data on how couples meet. His dynamic chart is worth a look as well.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees