Datastream

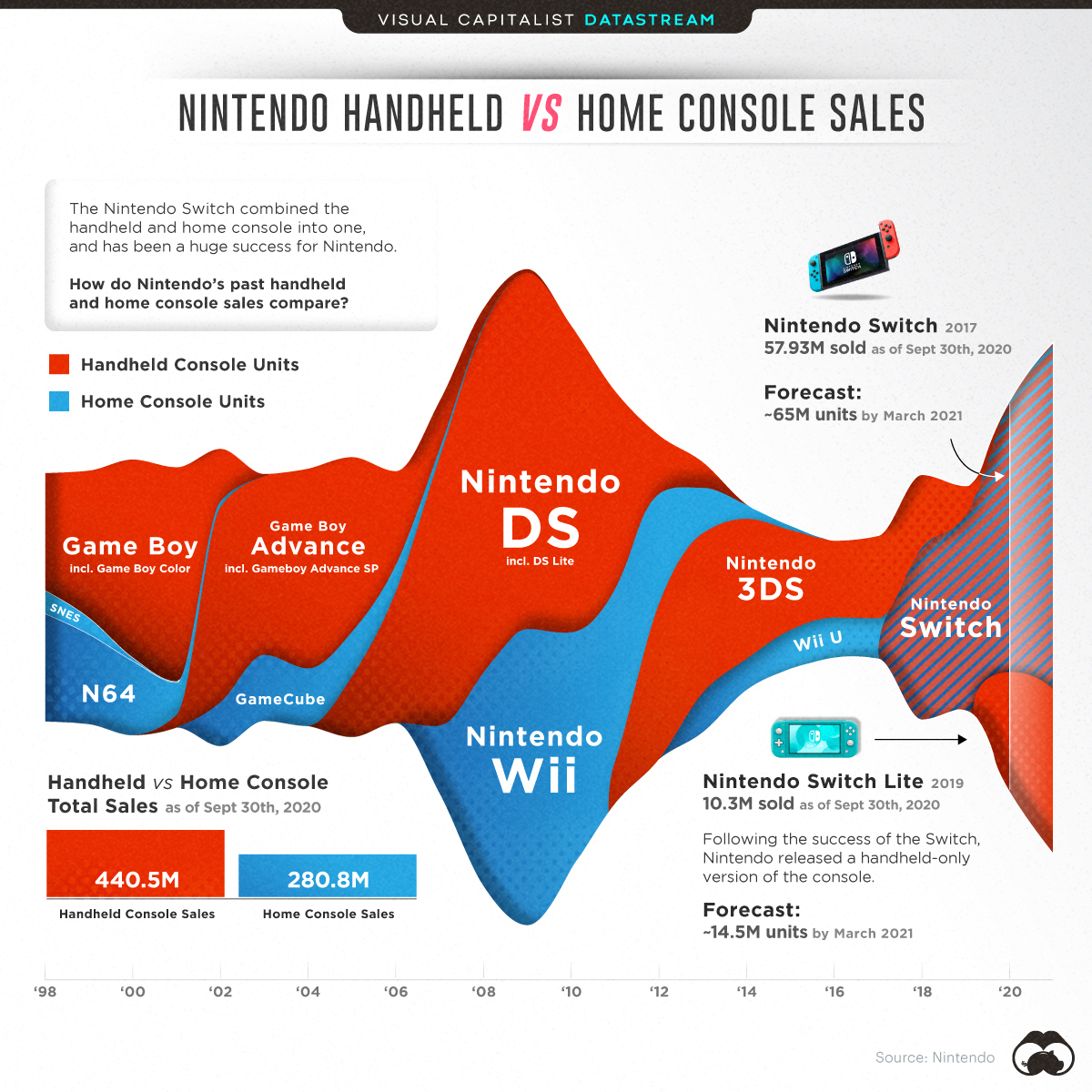

Visualizing Nintendo’s Handheld vs. Home Console Sales

The Briefing

- Nintendo’s handheld consoles have regularly outsold their home console counterparts

- Nintendo handhelds have sold 440.53M units vs. 280.87M Nintendo home console units

- Despite the Switch being hybrid, Nintendo still released a handheld-only version: the Switch Lite

Comparing Nintendo’s Handheld vs. Home Console Sales

Since the release of the original Game Boy in 1989, Nintendo has dominated the handheld game console marketplace.

Since then, the company has always offered a handheld and a home console, enabling them to capture a broader audience of gamers and non-gamers.

While handheld systems have regularly outsold their home console counterparts, combining the two into the hybrid Nintendo Switch has proven profitable for Nintendo.

The Power of Portable Games

The popularity of handheld game consoles isn’t surprising when considering their lower price points and accessibility.

Nintendo’s handheld consoles typically cost about 30-50% less compared to the home console of the same generation.

| Game Console | Console Type | U.S. Price |

|---|---|---|

| NES | Home | $199 |

| Game Boy | Handheld | $89 |

| SNES | Home | $199 |

| Nintendo 64 | Home | $199 |

| Game Boy Color | Handheld | $99 |

| Game Boy Advance | Handheld | $99 |

| Nintendo GameCube | Home | $199 |

| Nintendo DS | Handheld | $149 |

| Nintendo Wii | Home | $249 |

| Nintendo 3DS | Handheld | $249 |

| Wii U | Home | $349 |

| Nintendo Switch | Hybrid | $299 |

| Nintendo Switch Lite | Handheld | $199 |

The lower price point makes handhelds an easier purchase for parents, and their portability makes them a flexible entertainment option. A handheld console is an easy distraction wherever the kids are, and ensures the TV isn’t occupied when they’re gaming at home.

How the Switch Unified the Handheld and Home Console

The hybrid approach for the Nintendo Switch has proven successful, offering flexibility in how to play while bringing home console graphics and bigger budget games to the small screen.

With more than 58M units sold since release, the Switch’s popularity led to the 2019 release of the Nintendo Switch Lite, a sleeker handheld-only version which costs $100 less.

The new console’s lower price-point and color variations have helped it sell more than 10M units as of Nintendo’s latest numbers (Sept. 2020). In a financial results briefing, Nintendo noted that the Switch lite has attracted more female users, and that it was the second Nintendo Switch system for more than 40% of buyers.

While many thought the Switch Lite to be redundant considering the original’s handheld capabilities, both new and old audiences have shown there’s still an appetite for handheld-only consoles.

»If you found this article interesting, you might enjoy this full-length post on Nintendo console sales: Switch to Success: 20 Years of Nintendo Console Sales

Where does this data come from?

Source: Nintendo filings

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001