Maps

The Most Profitable Industry in Every U.S. State

The Most Profitable Industry in Every U.S. State

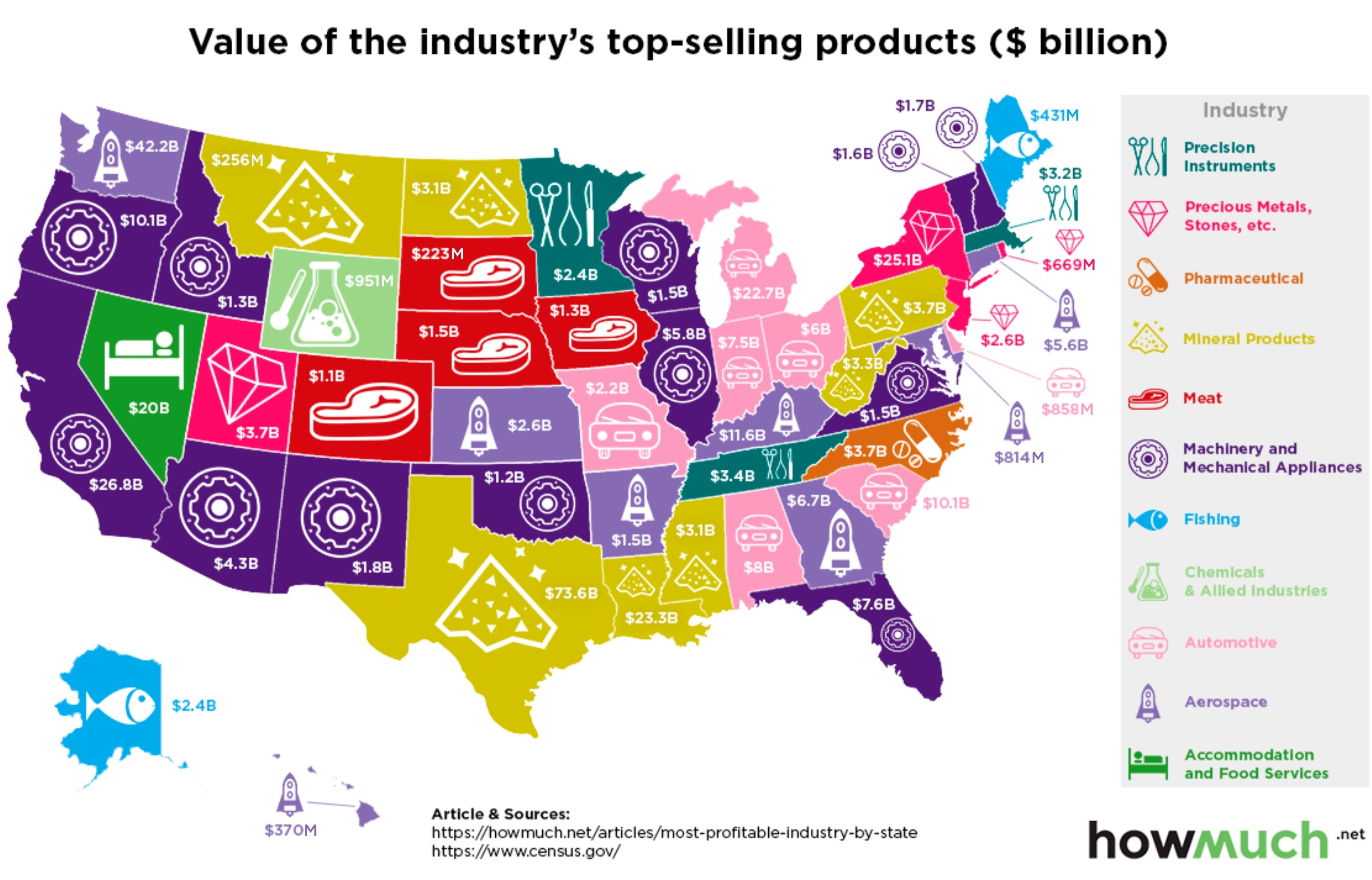

A glance the leading industries in the U.S. reveals a few surprises – and less diversity than you might think.

Today’s graphic from HowMuch.net uses data from GO Banking Rates and the U.S. Census Bureau to map out the most profitable industry in each U.S. State.

A Unique State Identity

While each U.S. state is unique in its cultural identity, the lay of the land determines which industries will thrive. Where some regions are ideal for agriculture, others have built a strong foundation of industry and research, and still others have established themselves as tourism hubs.

Whatever industry has staked its claim in your particular state, it has a direct link to your state exports and local economy.

It’s important to note that the most profitable industry is not necessarily the biggest industry in each state. The following figures are based on the value of top-selling industry products in 2017, using Harmonized System (HS) codes and U.S. Census Bureau data.

Rounding out the top five:

- Texas – Abundant oil supply helped the Lone Star State bring in more than $73 billion from mineral products last year.

- Washington – Despite a 9% drop from the previous year, aerospace still pulled in $42 billion for Washington state in 2017.

- California – Machinery and mechanical appliances lead the Golden State, to the tune of $27 billion.

- New York – Diamonds are New York’s best friend, where the precious metals and stones industry earned more than $25 billion in export sales.

- Louisiana – Its proximity to the Gulf of Mexico makes Louisiana a hub for mineral products, particularly oil. The industry raked in more than $23 billion in exports last year.

Diversify and Conquer

While some of these designations are nearly automatic – like fishing in Maine and Alaska – others are more surprising. Most surprising of all is the variety, or lack thereof: 50 states share a mere 11 major industries. When those industries are touched by market volatility or trade disruptions, it can prompt a ripple effect across several state economies.

Here’s a detailed breakdown of each state’s major industry, and the value of top-selling products last year:

| State | Most Profitable Industry | Value of industry's top-selling products (2017) |

|---|---|---|

| Alabama | Automotive | $8 billion |

| Alaska | Fishing | $2.359 billion |

| Arizona | Machinery and Mechanical Appliances | $4.27 billion |

| Arkansas | Aerospace | $1.5 billion |

| California | Machinery and Mechanical Appliances | $27 billion |

| Colorado | Meat | $1 billion |

| Connecticut | Aerospace | $5.627 billion |

| Delaware | Automotive | $858 million |

| Florida | Machinery and Mechanical Appliances | $7.576 billion |

| Georgia | Aerospace | $6.694 billion |

| Hawaii | Aerospace | $370 million |

| Idaho | Machinery and Mechanical Appliances | $1.309 billion |

| Illinois | Machinery and Mechanical Appliances | $5.7 billion |

| Indiana | Automotive | $7.526 billion |

| Iowa | Meat | $1.324 billion |

| Kansas | Aerospace | $2.565 billion |

| Kentucky | Aerospace | $11.649 billion |

| Louisiana | Mineral Products | $23 billion |

| Maine | Fishing | $431 million |

| Maryland | Aerospace | $814 million |

| Massachusetts | Precision Instruments | $3.2 billion |

| Michigan | Automotive | $22.735 billion |

| Minnesota | Precision Instruments | $2.417 billion |

| Mississippi | Mineral Products | $3.076 billion |

| Missouri | Automotive | $2.234 billion |

| Montana | Mineral Products | $256 million |

| Nebraska | Meat | $1.52 billion |

| Nevada | Accommodation and Food Services | $20 billion |

| New Hampshire | Machinery and Mechanical Appliances | $1.685 billion |

| New Jersey | Precious Metals, Stones, etc. | $2.624 billion |

| New Mexico | Machinery and Mechanical Appliances | $1.835 billion |

| New York | Precious Metals, Stones, etc. | $25 billion |

| North Carolina | Medical | $3.698 billion |

| North Dakota | Mineral Products | $1.814 billion |

| Ohio | Automotive | $6 billion |

| Oklahoma | Machinery and Mechanical Appliances | $1.1 billion |

| Oregon | Machinery and Mechanical Appliances | $10.125 billion |

| Pennsylvania | Mineral Products | $3.672 billion |

| Rhode Island | Precious Metals, Stones, etc. | $670 million |

| South Carolina | Automotive | $10.107 billion |

| South Dakota | Meat | $223 million |

| Tennessee | Precision Instruments | $3.425 billion |

| Texas | Mineral Products | $73 billion |

| Utah | Precious Metals, Stones, etc. | $3.714 billion |

| Vermont | Machinery and Mechanical Appliances | $1.6 billion |

| Virginia | Machinery and Mechanical Appliances | $1.5 billion |

| Washington | Aerospace | $42.163 billion |

| West Virginia | Mineral Products | $3.261 billion |

| Wisconsin | Machinery and Mechanical Appliances | $1.538 billion |

| Wyoming | Chemicals and Allied Industries | $1.25 billion |

Maps

The Largest Earthquakes in the New York Area (1970-2024)

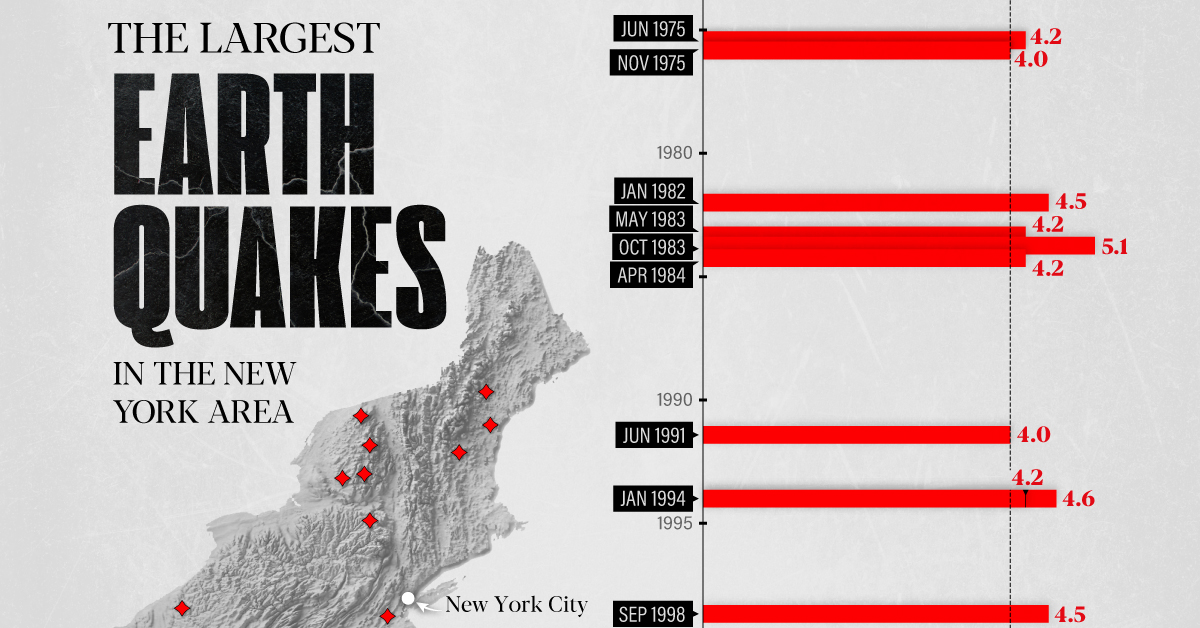

The earthquake that shook buildings across New York in April 2024 was the third-largest quake in the Northeast U.S. over the past 50 years.

The Largest Earthquakes in the New York Area

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

The 4.8 magnitude earthquake that shook buildings across New York on Friday, April 5th, 2024 was the third-largest quake in the U.S. Northeast area over the past 50 years.

In this map, we illustrate earthquakes with a magnitude of 4.0 or greater recorded in the Northeastern U.S. since 1970, according to the United States Geological Survey (USGS).

Shallow Quakes and Older Buildings

The earthquake that struck the U.S. Northeast in April 2024 was felt by millions of people from Washington, D.C., to north of Boston. It even caused a full ground stop at Newark Airport.

The quake, occurring just 5 km beneath the Earth’s surface, was considered shallow, which is what contributed to more intense shaking at the surface.

According to the USGS, rocks in the eastern U.S. are significantly older, denser, and harder than those on the western side, compressed by time. This makes them more efficient conduits for seismic energy. Additionally, buildings in the Northeast tend to be older and may not adhere to the latest earthquake codes.

Despite disrupting work and school life, the earthquake was considered minor, according to the Michigan Technological University magnitude scale:

| Magnitude | Earthquake Effects | Estimated Number Each Year |

|---|---|---|

| 2.5 or less | Usually not felt, but can be recorded by seismograph. | Millions |

| 2.5 to 5.4 | Often felt, but only causes minor damage. | 500,000 |

| 5.5 to 6.0 | Slight damage to buildings and other structures. | 350 |

| 6.1 to 6.9 | May cause a lot of damage in very populated areas. | 100 |

| 7.0 to 7.9 | Major earthquake. Serious damage. | 10-15 |

| 8.0 or greater | Great earthquake. Can totally destroy communities near the epicenter. | One every year or two |

The largest earthquake felt in the area over the past 50 years was a 5.3 magnitude quake that occurred in Au Sable Forks, New York, in 2002. It damaged houses and cracked roads in a remote corner of the Adirondack Mountains, but caused no injuries.

| Date | Magnitude | Location | State |

|---|---|---|---|

| April 20, 2002 | 5.3 | Au Sable Forks | New York |

| October 7, 1983 | 5.1 | Newcomb | New York |

| April 5, 2024 | 4.8 | Whitehouse Station | New Jersey |

| October 16, 2012 | 4.7 | Hollis Center | Maine |

| January 16, 1994 | 4.6 | Sinking Spring | Pennsylvania |

| January 19, 1982 | 4.5 | Sanbornton | New Hampshire |

| September 25, 1998 | 4.5 | Adamsville | Pennsylvania |

| June 9, 1975 | 4.2 | Altona | New York |

| May 29, 1983 | 4.2 | Peru | Maine |

| April 23, 1984 | 4.2 | Conestoga | Pennsylvania |

| January 16, 1994 | 4.2 | Sinking Spring | Pennsylvania |

| November 3, 1975 | 4 | Long Lake | New York |

| June 17, 1991 | 4 | Worcester | New York |

The largest earthquake in U.S. history, however, was the 1964 Good Friday quake in Alaska, measuring 9.2 magnitude and killing 131 people.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries