Misc

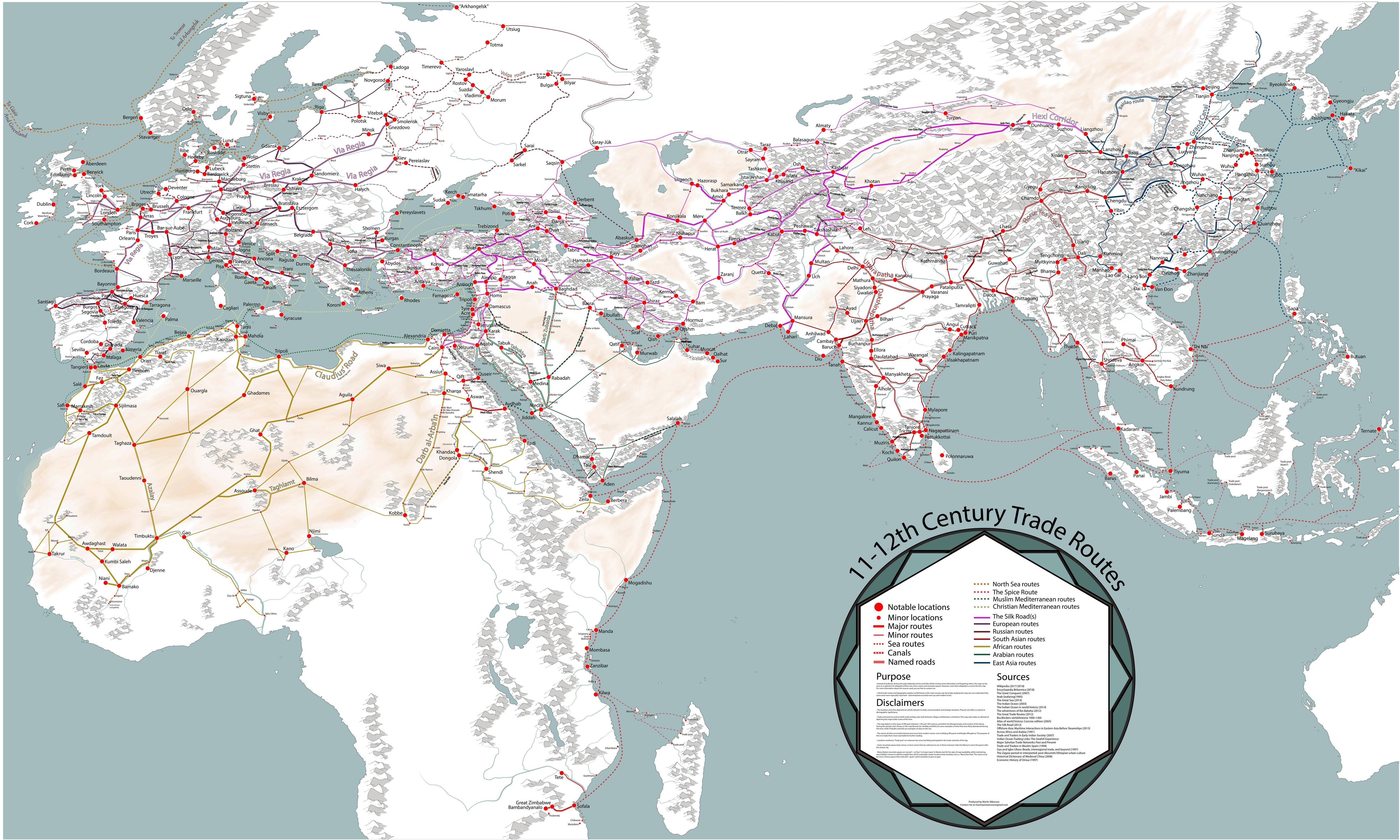

A Fascinating Map of Medieval Trade Routes

Globalization is so well established in today’s world that we don’t think twice about where our bananas or socks come from.

Long before fleets of container ships criss-crossed the world’s oceans, camel caravans and single-sail cogs transported regional goods across the world.

Connecting the World

Today’s interactive map, by Martin Jan Månsson, is a comprehensive snapshot of the world’s trade networks through the 11th and 12th centuries, which helped to connect kingdoms and merchants throughout Asia, Africa, and Europe.

A confluence of interesting factors helped bring these markets together to encourage commercial activity:

Crusading’s Commercial Corollary

The First Crusade kicked off in 1096, sparking a trend that would have an undeniable economic and cultural impact on Europe and the Middle East.

European fighters arriving in the Middle East came into contact with civilizations that were, in many ways, more advanced than their own. Merchants in the area had already been been trading with places further east, and demand for “exotic” goods shot up when crusaders returned to Europe with items both plundered and purchased.

The maritime infrastructure used to deliver all those soldiers laid the groundwork for moving goods between ports along the Mediterranean. Some ports, such as Alexandria, had separate ports for Muslim and Christian ships, which helped create a more stable pipeline of trade.

The Growing Influence of Cities

The dissolution of the Byzantine Empire and the Italian Kingdom left a vacuum that allowed Italian coastal cities to claim prominent roles in regional trade. The port cities of Venice and Genoa were transporting crusading soldiers to the front lines, so becoming hubs of trade in the Mediterranean was a natural evolution. Their geographic locations were also ideal entry points for goods moving along inland European trade routes.

In the 10th century, word of Ghana’s abundant gold supply spread to Middle East and actually triggered a rush by Muslim merchants to build connections in the region. A lucrative gold export industry encouraged the growth of cities to the south of the Sahara Desert, which formed critical links between Africa and the Mediterranean trade network.

Flying Cash

While Italian cities were cementing their role in Western trade, the Song Dynasty introduced an innovation that has important implications today: paper currency.

Paper notes, known as flying cash, backed only by the government’s word, helped eliminate the need for heavy coinage and allowed trade to flourish in China. Later on, Marco Polo would famously deliver this idea back to Europe.

The Silk Road

“The Silk Road” is a catch-all term for the many overland and maritime routes linking East Asia with Europe and the Middle East. Cities and towns along busy Silk Road routes thrived, and during the 12th century, Merv (in present day Turkmenistan) was actually the largest city in the world until it was decimated in 1221 by the Mongol Empire.

Trade routes like the Silk Road made the movement of physical goods possible, but perhaps more importantly, they facilitated cross-cultural exchange of ideas, religion, technology, and more.

VC+

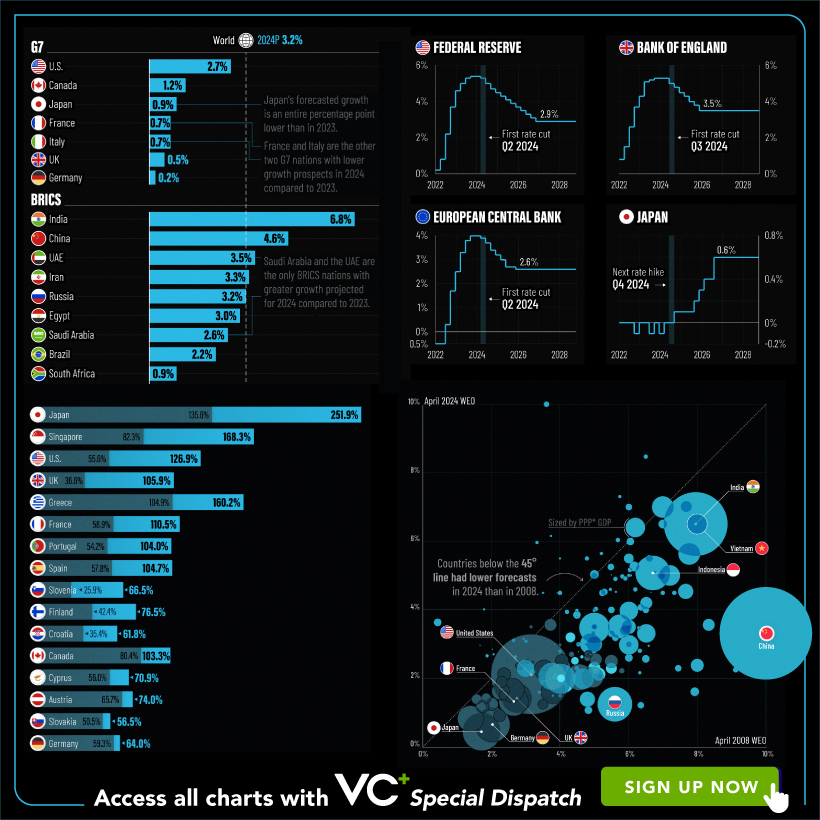

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

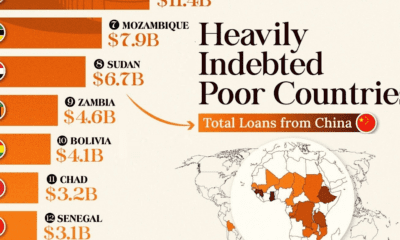

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001