Blockchain

Mapping the Most Important Ethereum Forks

Mapping the Major Ethereum Forks

Many people are familiar with blockchain technology, but did you know that Ethereum has the largest and most active blockchain community in the world?

Unlike many other blockchain networks, Ethereum is programmable. This customizable feature has enabled developers to solve problems ranging from digital identification and privacy, to corporate ownership and data security.

When the blockchain community disagrees on what changes the network needs to function smoothly or when such changes should take place, developers plan for a fork (an offshoot) of the underlying code rules.

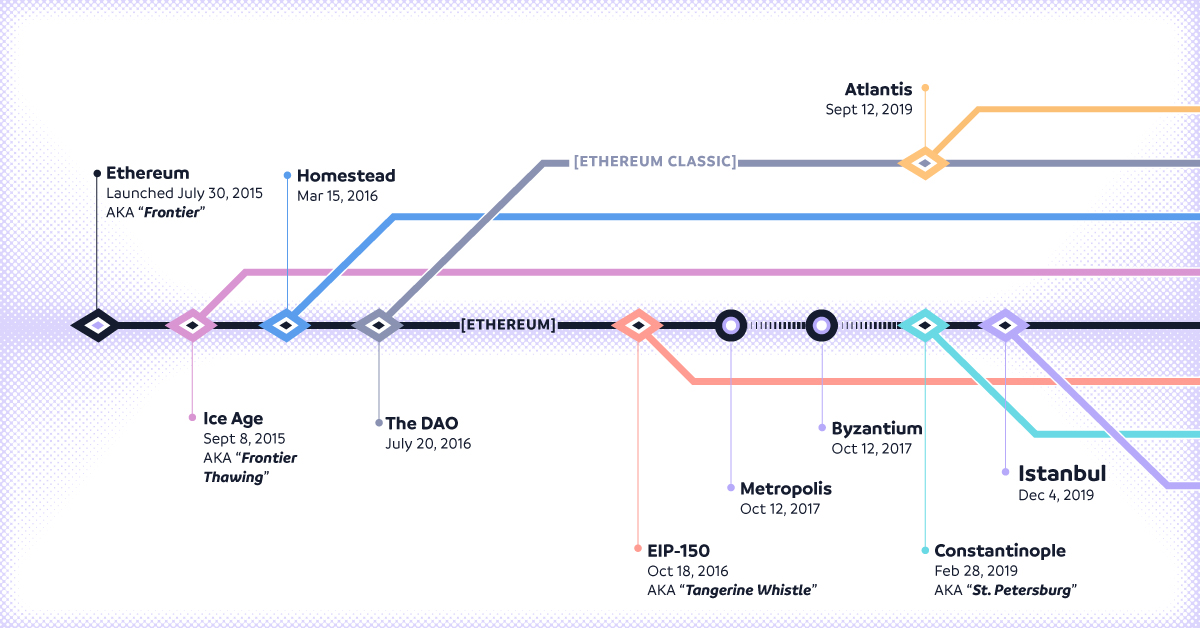

Today’s graphic maps out the major Ethereum blockchain forks that have occurred to date, highlighting key events that surrounded each of these updates. It also includes details on the highly anticipated Istanbul hard fork, planned for December 2019.

Four Types of Forks

Forks are common practice in the software industry, and happen for one of two reasons: split opinions within the community, and required changes to the blockchain code.

When either reason is discussed, four major types of forks can occur.

- Codebase Forks: Copy of the original code, to allow for minor tweaks without developing the whole blockchain code from scratch.

- Blockchain Forks: Branching or splitting a blockchain’s whole transaction history, causing the new network to develop a distinct identity.

- Soft Forks: Gradual software upgrades—bug fixes, security checks, and new features.

- Hard Forks: A permanent division of the blockchain.

There are currently three types of hard forks:

- Planned

Scheduled upgrades to the network, often abandoning the old chain - Contentious

Community disagreements cause major code changes, forming a new chain - Spin-off Coins

Minor changes to the blockchain’s code that create new coins

Let’s dive into the timeline of major Ethereum forks, and explore a few of their defining moments and characteristics.

Mapping the Major Ethereum Forks

Below are some of the most prominent and important forks—both hard and soft—on the Ethereum blockchain since its launch.

Ethereum

Vitalik Buterin, founder of Ethereum, and his team finished the 9th and final proof of concept known as Olympic in May 2015. The Ethereum blockchain, also known as Frontier, went live shortly after, on July 30, 2015.

Ice Age

Also known as “Frontier Thawing”, this was the first (unplanned) fork of the Ethereum blockchain, providing security and speed updates to the network.

Homestead

Homestead is widely considered Phase 2 of Ethereum’s development evolution. This rollout included three critical updates to Ethereum: the removal of centralization on the network, enabling users to hold and transact with ETH, and to write and deploy smart contracts.

The DAO

The Decentralized Autonomous Organization (DAO) event was the most contentious event in Ethereum’s short history. The DAO team raised US$150 million through a 2016 token sale—but an unknown hacker stole US$50 million in ether (ETH), prompting the developer community to hard fork in order to recover the stolen funds.

Ethereum Classic

Widely regarded as the only Ethereum fork of any significance, this hard fork was based on the controversial DAO event. The original chain became known as Ethereum Classic, and the new chain moved forward as the main Ethereum chain.

Atlantis

This September 2019 hard fork event required all software users to upgrade their clients in order to stay with the current network. Enhancements included better security, stability, and network performance for higher volumes of traffic.

Metropolis-Byzantium

Regarded as the third phase of Ethereum’s evolution, the Metropolis-Byzantium soft fork functioned more like an operating system upgrade, rather than a full split.

Metropolis-Constantinople

Constantinople is the current version of the Ethereum blockchain. This hard fork occurred concurrently with the St. Petersburg update. Important changes included closing a major security loophole that could have allowed hackers to easily access users’ funds.

Constantinople’s most notable improvements include smart contracts being able to verify each other using only the unique string of computer code of another smart contract, and reduced gas fees─namely, the price users pay to process transactions more quickly.

Future Forks in the Road

The Ethereum community is preparing for the next hard fork event Istanbul, scheduled for release on December 4th, 2019.

Ethereum’s 4th and projected final stage of development is Serenity, which has yet to be scheduled. Community members have speculated what changes will come with Serenity, but many agree that the Ethereum blockchain will shift focus from Proof of Work to Proof of Stake.

- Proof of Work (PoW): “Miners” are rewarded with cryptocurrency for solving puzzles that process and post blocks of data to the network

- Proof of Stake (PoS): Miners are chosen from a pool of miners, based on the stake of cryptocurrency they bid; no puzzle = no reward

Proof of Stake means that there is less competition for completing blocks of data, significantly reducing the energy required to process data. Currently, a single Bitcoin transaction consumes the same electricity as 1.75 American households do in a day.

Ethereum Leads the Way

Ethereum continues to be a leading blockchain platform, with the highest number of decentralized apps (dApps) and a massive, engaged community.

To date, cryptocurrencies have largely been the focus of news headlines. However, we’ve only begun to scratch the surface of what blockchain can offer, and the value it will create beyond the financial world.

[Blockchain] could be the foundation of a whole new era whereby our basic right to privacy is protected, because identity is the foundation of freedom and it needs to be managed responsibly.

—Don Tapscott, Executive Chairman of the Blockchain Research Institute

Green

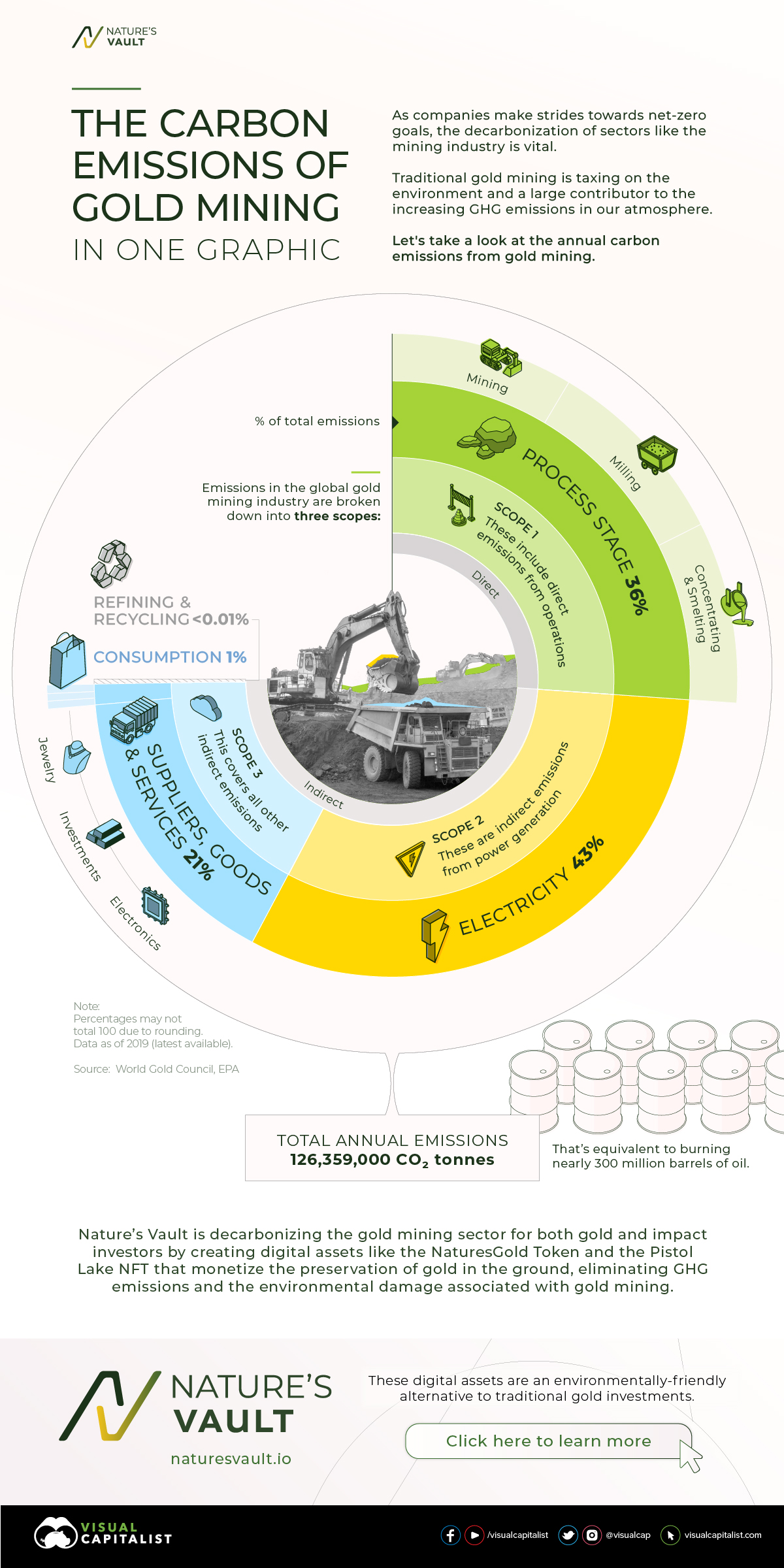

The Carbon Emissions of Gold Mining

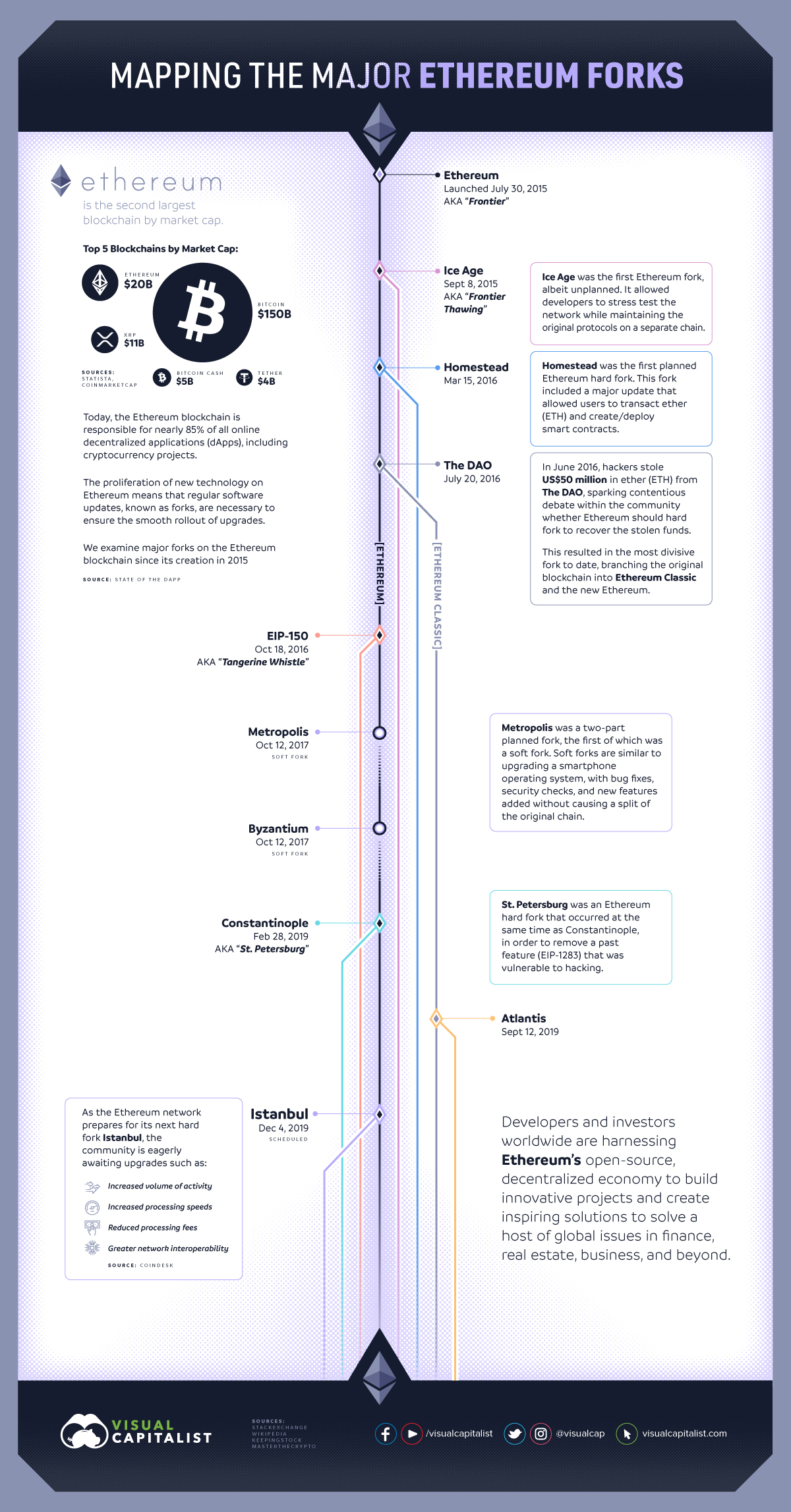

Gold has a long history as a precious metal, but just how many carbon emissions does mining it contribute to?

The Carbon Emissions of Gold Mining

As companies progress towards net-zero goals, decarbonizing all sectors, including mining, has become a vital need.

Gold has a long history as a valuable metal due to its rarity, durability, and universal acceptance as a store of value. However, traditional gold mining is a process that is taxing on the environment and a major contributor to the increasing carbon emissions in our atmosphere.

The above infographic from our sponsor Nature’s Vault provides an overview of the global carbon footprint of gold mining.

The Price of Gold

To understand more about the carbon emissions that gold mining contributes to, we need to understand the different scopes that all emissions fall under.

In the mining industry, these are divided into three scopes.

- Scope 1: These include direct emissions from operations.

- Scope 2: These are indirect emissions from power generation.

- Scope 3: These cover all other indirect emissions.

With this in mind, let’s break down annual emissions in CO2e tonnes using data from the World Gold Council as of 2019. Note that total emissions are rounded to the nearest 1,000.

| Scope | Type | CO2e tonnes |

|---|---|---|

| 1 | Mining, milling, concentrating and smelting | 45,490,000 |

| 2 | Electricity | 54,914,000 |

| 3 | Suppliers, goods, and services | 25,118,000 |

| 1,2,3 | Recycled Gold | 4,200 |

| 3 | Jewelry | 828,000 |

| 3 | Investment | 4,500 |

| 3 | Electronics | 168 |

| TOTAL | 126,359,000 |

Total annual emissions reach around 126,359,000 CO2e tonnes. To put this in perspective, that means that one year’s worth of gold mining is equivalent to burning nearly 300 million barrels of oil.

Gold in Nature’s Vault

A significant portion of gold’s downstream use is either for private investment or placed in banks. In other words, a large amount of gold is mined, milled, smelted, and transported only to be locked away again in a vault.

Nature’s Vault is decarbonizing the gold mining sector for both gold and impact investors by eliminating the most emission-intensive part of the mining process—mining itself.

By creating digital assets like the NaturesGold Token and the Pistol Lake NFT that monetize the preservation of gold in the ground, emissions and the environmental damage associated with gold mining are avoided.

How Does it Work?

Through the same forms of validation used in traditional mining by Canada’s National Instrument NI 43-101 and Australia’s Joint Ore Reserve Committee (JORC), Nature’s Vault first determines that there is gold in an ore body.

Then, using blockchain and asset fractionalization, the mineral rights and quantified in-ground gold associated with these mineral rights are tokenized.

This way, gold for investment can still be used without the emission-intensive process that goes into mining it. Therefore, these digital assets are an environmentally-friendly alternative to traditional gold investments.

Click here to learn more about gold in Nature’s Vault.

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

Going on a cruise ship and flying domestically are the most carbon-intensive travel methods.

-

Green3 weeks ago

Green3 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

-

Green3 weeks ago

Green3 weeks agoRanked: The Countries With the Most Air Pollution in 2023

South Asian nations are the global hotspot for pollution. In this graphic, we rank the world’s most polluted countries according to IQAir.

-

Green4 weeks ago

Green4 weeks agoTop Countries By Forest Growth Since 2001

One country is taking reforestation very seriously, registering more than 400,000 square km of forest growth in two decades.

-

Green1 month ago

Green1 month agoRanked: Top Countries by Total Forest Loss Since 2001

The country with the most forest loss since 2001 lost as much forest cover as the next four countries combined.

-

Agriculture2 months ago

Agriculture2 months agoThe World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

-

Markets5 days ago

Markets5 days agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

Visual Capitalist1 week ago

Visual Capitalist1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Markets1 week ago

Markets1 week agoThe Top Private Equity Firms by Country