Energy

Visualizing the Global Transition to Green Energy

Visualizing The Global Transition to Green Energy

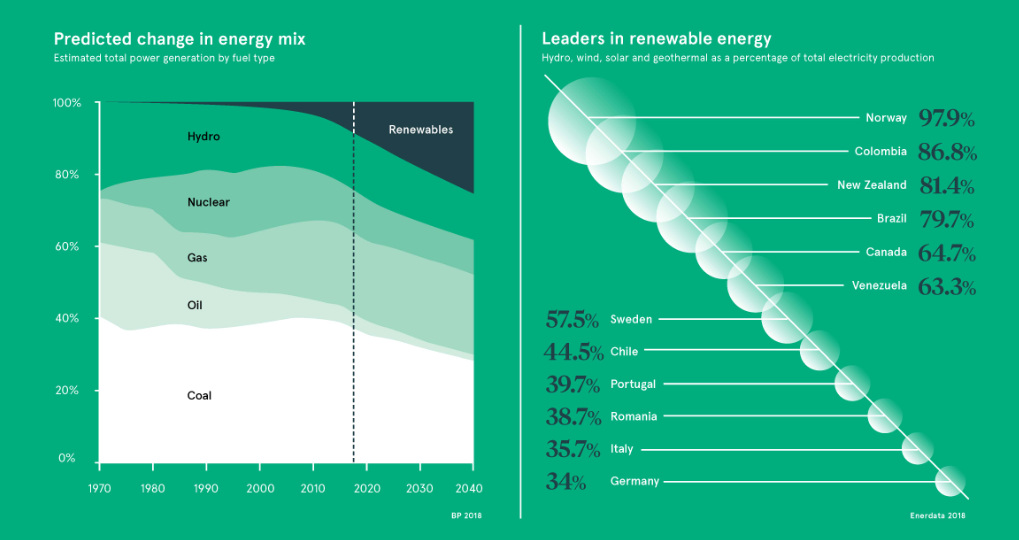

A fully green future could be closer than you think. With each passing year, the steadily declining price of renewable energy makes it increasingly competitive against fossil fuels.

Today’s infographic from Raconteur breaks down the material shift towards renewable energy, and where in the world it’s taking place.

Time to go green

A recent United Nations report estimates that renewables must make up 70% to 85% of electricity by 2050 to combat the dire effects of climate change.

The good news? Embracing renewable energy is becoming easier on the wallet. Most renewable energy sources are becoming cheaper and quicker to produce, and it’s speeding up widespread adoption.

| Cost of electricity per energy source ($ per KWh) | 2010 | 2017 |

|---|---|---|

| Concentrating solar power | $0.33 | $0.22 |

| Offshore wind | $0.17 | $0.14 |

| Solar photovoltaic | $0.36 | $0.10 |

| Biomass | $0.07 | $0.07 |

| Geothermal | $0.05 | $0.07 |

| Onshore wind | $0.08 | $0.06 |

| Hydro | $0.04 | $0.05 |

The price of solar photovoltaic cells are projected to dip dramatically over this seven-year period, as solar panel infrastructure moves away from being an experimental technology, and into a trusted energy source easily replicated at scale. Solar also received the most new investment by energy type in 2017, up 18% from the previous year.

Of course, it won’t happen overnight. Even as the world continues to electrify, coal will still make up almost one-third of the world’s energy mix in 2040, while renewables will only be at 25%.

Nevertheless, concentrated efforts to curb our reliance on coal are signals that the fossil fuel is on its way out, and new investment in green energy sources is on the rise in most regions.

The Renewables Race

It’s perhaps not surprising that China is leading the change in renewable growth. The nation tops the list of spenders, spending more on green energy than the United States and Europe combined.

| New Investment by Region | 2016 ($ billion) | 2017 ($ billion) | % Change |

|---|---|---|---|

| China | $96.9 | $126.6 | 31% |

| Europe | $64.1 | $40.9 | -36% |

| United States | $43.1 | $40.5 | -6% |

| Other Asia and Oceania | $35.7 | $31.4 | -12% |

| Other Americas | $6 | $13.4 | 124% |

| Middle East & Africa | $9 | $10.1 | 11% |

| India | $13.7 | $10.9 | -20% |

| Brazil | $5.6 | $6 | 8% |

| Total | $274 | $279.8 | 2% |

In places where a consistent and reliable source of energy is hard to come by, people are looking to clean energy as a way to leapfrog ahead of using the carbon-intensive electricity grid entirely.

Take Ethiopia for example: the $4 billion Grand Ethiopian Renaissance Dam (GERD) project along the Nile River will help meet the area’s rising energy demands. Once completed, it will be the largest dam on the continent and generate around 6,450 MW of power.

This trifecta of innovation, investment, and falling costs could be the answer to bolstering renewable energy infrastructure for decades to come – and it will be interesting to see the ultimate pace at which green energy supply comes online, and what that means for the world.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium4 days ago

Lithium4 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees